Escolar Documentos

Profissional Documentos

Cultura Documentos

Special Journals: Sales and Cash Receipts: College Accounting: A Practical Approach

Enviado por

fa2heemTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Special Journals: Sales and Cash Receipts: College Accounting: A Practical Approach

Enviado por

fa2heemDireitos autorais:

Formatos disponíveis

9 - 1 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Special Journals:

Sales and Cash Receipts

Chapter 9

9 - 2 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Objective 1

Journalizing sales on

account in a sales journal.

9 - 3 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-1 (Sellers View

of a Merchandise Company)

Gross sales

= Amount of units sold

Sales price per unit

Amount is credited to

the Revenue account.

Normal balance is a credit.

9 - 4 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-1 (Sellers View

of a Merchandise Company)

Assume that Chous Toy

Shop had $3,000 in sales.

$1,800 were cash sales

and $1,200 were charges.

A customer received a $10 price

reduction for defective merchandise.

How can these transactions be recorded?

9 - 5 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-1 (Sellers View

of a Merchandise Company)

Accounts Affected Category Rules

Cash Asset Dr. 1,800

Accounts Receivable Asset Dr. 1,200

Sales Revenue Cr. 3,000

July 18

Cash 1,800

Accounts Receivable 1,200

Sales 3,000

To record sales for July 18

9 - 6 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-1 (Sellers View

of a Merchandise Company)

Sales returns and allowances =

Amount allowed for defective merchandise

Amount is debited in the journal entry.

Normal balance is a debit.

9 - 7 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-1 (Sellers View

of a Merchandise Company)

Accounts Affected Category Rules

Sales Returns and Contra- Dr. 10

Allowances revenue

Accounts Receivable, Asset Cr. 10

Michelle Reese

Accounts Receivable

1,200 10

9 - 8 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-1 (Sellers View

of a Merchandise Company)

What is a sales discount?

It is a percent decrease in the amount

collected from a credit customer.

9 - 9 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-1 (Sellers View

of a Merchandise Company)

What is the meaning of the term 2/10, n/30?

It means a customer will be granted a 2%

discount if the account is paid in 10 days.

Otherwise, the full amount (n = net)

is to be paid in 30 days.

9 - 10 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

July 24

Cash 39.20

Sales Discount .80

Accounts Receivable, Michelle Reese 40.00

Learning Unit 9-1 (Sellers View

of a Merchandise Company)

9 - 11 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-1 (Sellers View

of a Merchandise Company)

What is sales tax payable?

It is a percent multiplied times the gross

amount of the sale collected from customers.

The business has a liability to the taxing

authority for the amounts collected.

9 - 12 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Objectives

2 and 3

Posting from a sales journal

to the general ledger.

Recording to the accounts

receivable subsidiary ledger

from a sales journal.

9 - 13 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

The sales journal records sales of

merchandise on account.

The cash receipts journal records

receiving cash from any source.

Learning Unit 9-2

(Special Journals)

The purchases journal records buying

merchandise or other items on account.

The cash payments journal records payments.

9 - 14 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-2

(Special Journals)

Subsidiary Ledger

A separate record for each credit

customer must be set up.

9 - 15 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-2

(Special Journals)

Recorded sales are posted in total to the Sales

account and the Accounts Receivable account.

They are also recorded as debits

to individual customer accounts.

9 - 16 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-2

(Special Journals)

Sales Returns

and Allowances

Sales Discounts

Sales

Inventory

Accounts

Receivable

Cash

Partial General Ledger

Roe Company

Mels Dept. Store

Hals Clothing

Bevans

Company

Accounts Receivable

Subsidiary Ledger

9 - 17 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Objective 4

Preparing, journalizing,

recording, and posting

a credit memorandum.

9 - 18 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-3

(The Credit Memorandum)

What is a credit memorandum?

It shows amounts that were deducted

from the balance the customer owes.

They are contra-revenue accounts

with a normal debit balance.

These are recorded in the general journal

and posted to a subsidiary ledger.

9 - 19 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-3

(The Credit Memorandum)

Sales Returns and

Credit Account PR Allowances Dr.

Date Memo No. Credited Accts. Rec. Cr.

200x

April 12 1 Bevans 600.00

9 - 20 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Objective 5

Journalizing and posting

transactions using a cash

receipts journal, as well

as recording to the accounts

receivable subsidiary ledger.

9 - 21 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-4

(Cash Receipts Journal)

The cash receipts journal records

the receipt of cash from any source.

The number of columns

varies with each business.

The cash receipt journal

speeds up the posting process.

9 - 22 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

Learning Unit 9-4

(Cash Receipts Journal)

Debit Column

Cash

Sales Discount

Credit Column

Accounts Receivable

Sales

Sundry

9 - 23 2004 Prentice Hall Business Publishing, College Accounting: A Practical Approach, 9e by Slater

End of Chapter 9

Você também pode gostar

- Photomaker MedDocumento21 páginasPhotomaker Medfa2heemAinda não há avaliações

- This Slide Show Is Automatically Timed With The Song. Don't Click To Change Slides, Just Let It PlayDocumento11 páginasThis Slide Show Is Automatically Timed With The Song. Don't Click To Change Slides, Just Let It Playfa2heemAinda não há avaliações

- Funny Things Kids SayDocumento11 páginasFunny Things Kids Sayfa2heemAinda não há avaliações

- ATMcard Under Your Skin LoDocumento17 páginasATMcard Under Your Skin Lofa2heemAinda não há avaliações

- Turn On Your Speakers!: Click To Advance SlidesDocumento13 páginasTurn On Your Speakers!: Click To Advance Slidesfa2heemAinda não há avaliações

- Turn On Your Speakers: Click To Advance SlidesDocumento14 páginasTurn On Your Speakers: Click To Advance Slidesfa2heemAinda não há avaliações

- Pride and Self RighteousnessDocumento12 páginasPride and Self Righteousnessaudioactivated.orgAinda não há avaliações

- No Profit Hi - PpsDocumento13 páginasNo Profit Hi - Ppsfa2heemAinda não há avaliações

- Turn On Your Speakers!: Click To Advance SlidesDocumento11 páginasTurn On Your Speakers!: Click To Advance Slidesfa2heemAinda não há avaliações

- Tumbling BarrelDocumento7 páginasTumbling Barrelfa2heemAinda não há avaliações

- Pharisee and PublicanDocumento14 páginasPharisee and Publicanaudioactivated.orgAinda não há avaliações

- This Slide Show Is Automatically Timed With The Song. Don't Click To Change Slides, Just Let It PlayDocumento25 páginasThis Slide Show Is Automatically Timed With The Song. Don't Click To Change Slides, Just Let It Playfa2heemAinda não há avaliações

- Trust God AnyhowDocumento9 páginasTrust God Anyhowfa2heemAinda não há avaliações

- Power To ForgiveDocumento12 páginasPower To Forgivefa2heemAinda não há avaliações

- Storm Clouds LoDocumento8 páginasStorm Clouds Lofa2heemAinda não há avaliações

- Turn On Your Speakers: Click To Advance SlidesDocumento12 páginasTurn On Your Speakers: Click To Advance Slidesfa2heemAinda não há avaliações

- Feeling Negative LoDocumento17 páginasFeeling Negative Lofa2heemAinda não há avaliações

- Gods WaysDocumento14 páginasGods Waysfa2heemAinda não há avaliações

- Gods FormulaDocumento11 páginasGods Formulafa2heemAinda não há avaliações

- No Profit Hi - PpsDocumento13 páginasNo Profit Hi - Ppsfa2heemAinda não há avaliações

- Chase The LionDocumento13 páginasChase The Lionfa2heem100% (4)

- Turn On Your Speakers: Click To Advance SlidesDocumento10 páginasTurn On Your Speakers: Click To Advance Slidesfa2heemAinda não há avaliações

- ATMcard Under Your Skin LoDocumento17 páginasATMcard Under Your Skin Lofa2heemAinda não há avaliações

- Defy The Impossible LoDocumento15 páginasDefy The Impossible Lofa2heemAinda não há avaliações

- Words of Wisdom: A Potpourri of Inspirational Thoughts On Several TopicsDocumento6 páginasWords of Wisdom: A Potpourri of Inspirational Thoughts On Several TopicsMarkKevinAngtudAinda não há avaliações

- Worldchanger LoDocumento10 páginasWorldchanger Lofa2heemAinda não há avaliações

- Turn On Your Speakers!: Click To Advance SlidesDocumento11 páginasTurn On Your Speakers!: Click To Advance Slidesfa2heemAinda não há avaliações

- 7 Wonders of The World - PpsDocumento16 páginas7 Wonders of The World - Ppsfa2heemAinda não há avaliações

- Words of Wisdom 2Documento6 páginasWords of Wisdom 2fa2heemAinda não há avaliações

- Words of Wisdom: A Potpourri of Inspirational Thoughts On Several TopicsDocumento6 páginasWords of Wisdom: A Potpourri of Inspirational Thoughts On Several Topicsfa2heemAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Lecture Notes - Chapter 5 & 6Documento14 páginasLecture Notes - Chapter 5 & 6Nova Grace LatinaAinda não há avaliações

- Comprehensive Audit Problem (Julie&Angelo)Documento8 páginasComprehensive Audit Problem (Julie&Angelo)Julie Ann Pili100% (3)

- HFM Interview QuestionsDocumento7 páginasHFM Interview QuestionsUtsav MakwanaAinda não há avaliações

- CPWA CODE 101-150 (Guide Part 4) PDFDocumento15 páginasCPWA CODE 101-150 (Guide Part 4) PDFshekarj80% (5)

- CH06Documento26 páginasCH06Will TrầnAinda não há avaliações

- Auditing Theory - CabreraDocumento24 páginasAuditing Theory - CabreraKirsten Marie Exim100% (4)

- Statement of Account: State Bank of IndiaDocumento7 páginasStatement of Account: State Bank of IndiaARJUN RAWATAinda não há avaliações

- Sub Merchant AgreementDocumento11 páginasSub Merchant AgreementBasit XargarAinda não há avaliações

- Accounting All ChaptersDocumento155 páginasAccounting All ChaptersHasnain Ahmad KhanAinda não há avaliações

- ACT 3014 Tutorial 2Documento8 páginasACT 3014 Tutorial 2SHAFINA TUN NAJAH SUMUUIAinda não há avaliações

- AP5Documento5 páginasAP5Sweetcell Anne50% (2)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento28 páginasStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDhanraj KhatriAinda não há avaliações

- Gdhsjsiidbebrvrkld PDFDocumento19 páginasGdhsjsiidbebrvrkld PDFNuarin JJAinda não há avaliações

- MBA 533 Lecture 2 Introduction To Financial Accounting BasicsDocumento35 páginasMBA 533 Lecture 2 Introduction To Financial Accounting BasicsTrymore KondeAinda não há avaliações

- Soal Myob PT DinamikaDocumento5 páginasSoal Myob PT DinamikaRaden Andini AnggreaniAinda não há avaliações

- Oracle Financials Functional Consultant TrainingDocumento6 páginasOracle Financials Functional Consultant TrainingEbs FinancialsAinda não há avaliações

- Teaching Guide for Senior High School Fundamentals of Accountancy, Business, & Management 1Documento160 páginasTeaching Guide for Senior High School Fundamentals of Accountancy, Business, & Management 1angel myles baltazarAinda não há avaliações

- Finacle Book For Bank Auditors PDFDocumento54 páginasFinacle Book For Bank Auditors PDFGaurav jain100% (1)

- Trial Balance N Balance SheetDocumento2 páginasTrial Balance N Balance SheetMimi MyshaAinda não há avaliações

- IL - Accounting - Entries - Indian Localization UGDocumento27 páginasIL - Accounting - Entries - Indian Localization UGRamadoss VinayagamAinda não há avaliações

- Muthoot FinanceDocumento66 páginasMuthoot Financesheetalrahuldewan80% (5)

- MGT101 FinalTerm NotesDocumento127 páginasMGT101 FinalTerm Notesaafiah100% (1)

- Final Exam Afar 3 2022Documento10 páginasFinal Exam Afar 3 2022Cassie HowardAinda não há avaliações

- ACCTG A Final ExamDocumento2 páginasACCTG A Final ExamheyheyAinda não há avaliações

- School Accounting Journal Entries T-AccountsDocumento3 páginasSchool Accounting Journal Entries T-AccountsJemar AlipioAinda não há avaliações

- Audit ProgrammesDocumento11 páginasAudit ProgrammesSajjad CheemaAinda não há avaliações

- Fabm 1 LeapDocumento4 páginasFabm 1 Leapanna paulaAinda não há avaliações

- Uniform Ltd adjusting entriesDocumento11 páginasUniform Ltd adjusting entriesThi Van Anh VUAinda não há avaliações

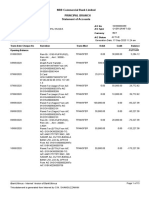

- NRB Commercial Bank Limited Principal Branch Statement of AccountsDocumento15 páginasNRB Commercial Bank Limited Principal Branch Statement of AccountsS.M. Shamsuzzaman SalimAinda não há avaliações

- Abm Final Group 4Documento7 páginasAbm Final Group 4Unfernie Christian Jhe PulveraAinda não há avaliações