Escolar Documentos

Profissional Documentos

Cultura Documentos

ITC Sales and Distribution Network

Enviado por

Saurabh DixitDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ITC Sales and Distribution Network

Enviado por

Saurabh DixitDireitos autorais:

Formatos disponíveis

Understanding Sales and Distribution

of ITC Ltd.

Introduction

Fast moving consumer goods

(FMCG)

Hotels

Paperboards & Packaging

Agri Business

Information Technology

Indian conglomerate

headquartered in Kolkata

Established in 1910

Annual turnover of US$ 8.31

billion and a market

capitalization of US$ 45 billion

in 2012-13

Employs over 25,000 people at

more than 60 locations across

India

Part of Forbes 2000 list

Business Segments About the Company

FMCG Categories

FMCG Business

Cigarettes & Cigars Personal Care Foods

W.D. & H.O.

Wills

Gold Flake

Navy cut

Insignia

Classic

Bristol

Aashirwad

Sunfeast

Bingo

Kitchens of

India

Mint-O

Candyman

Essenza Di

Wills

Vivel

Fiama Di Wills

Engage

Superia

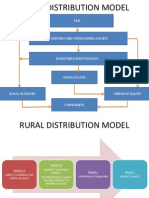

Distribution Channel

ITC

Distributor

Retailer Wholesaler

Retailer

Stockist

Retailer

Distributor

Profile

Exclusive distributor (carries no other brand); exclusive territory for each distributor

Carries all ITC FMCG products

IT system of ITC in place - contains classification of retailer & wholesaler

Selection criteria: Investment capability, market reputation and ability to service the

market

Economics

Margin for food and personal care products for a distributor is 3% while that for

Cigarettes is 1.45%

Average ROI for a distributor is 25-30%

No credit is extended to distributor by ITC however distributor offers credit to

wholesalers and retailers

Distribution expenses like salaries of the sales persons, fuel costs of the vans, etc. are

initially borne by distributor which are then reimbursed by the company subsequently

Key Responsibilities

Supplying to Retailers, Wholesalers & Stockists

Achieving annual targets received from Assistant Sales Manager

Wholesaler

Profile

Independent wholesalers - free to sell various product lines of different brands

No exclusivity multiple wholesalers in a particular area

Wholesaler serves to increase the penetration of ITC products

Economics

Gets all categories of products Personal care, Food and Cigarettes from ITC

distributors at a price which is 1% lower than the price at what the distributor sells to

the retailer

Selling price of the wholesaler is not fixed & hence they can sell at any price (even

below his purchase price Loss leader)

Credit terms if any offered to the wholesaler may depend on the distributor serving

him and he may or may not pass that credit facility to the retailers

Key Responsibilities

Supplying products to retailers, however wholesaler being independent and non

exclusive has no obligation to achieve a certain level of sales (targets)

Sales at the wholesaler level is more due to the pull of the products

Profile

Beedi shops, mom-n-pop stores, etc.

Minimum purchase value per month for a retailer to be serviced by a distributor

Economics

Gross margins range from 9-15% depending on the product category

Promotional schemes, display schemes for retailers

Key Responsibilities

Maintaining correct inventory levels, proper display of ITC products, product

knowledge to the end customer

Stockist & Retailer

Profile

Independent (can carry multiple brands) & exclusive territory, generally assigned to a

geographical area which has a population of 30,000 to 50,000

Economics

Margin for food and personal care products is 4% while that for Cigarettes is 2.45%

Key Responsibilities

Serving maximum number of retailers in his area

Stockist

Retailer

Sales Force Structure

Branch Manager

ASM

(specific for a

product

category)

Area Executive

(4-5 per product

category)

Distributors

(6-7 in number)

Sales Executives

ASM

(specific for a

product category

Area Executive

(4-5 per product

category)

Distributors

(6-7 in number

Sales Executives

Rationale for the structure

Separate sales team within ITC works

according to the product categories

This helps in implementing the

various decisions and objectives of a

particular product category at the

ground level

ITCs objective is to cover maximum

retail outlets directly through

distributors so that maximum product

push can be achieved

To meet this objective ITC reimburses

the sales and distribution costs to

distributors

However ITC decides which retail

outlet to be covered through

distributor so that it can keep a check

on its overall costs

Sales Force Structure

Compensation & Performance evaluation of sales force

Average salary of sales person per month 5k to 11k

Dual Reporting to Area executives and distributor

ITC runs incentives schemes on parameters like lines cut, bills per day,

bill value etc.

Sales Force Size

Determined using workload method

Average no of calls per day by Salesman 25 to 30

Calling frequency Once per week

A salesman covers approx. 180 210 retail outlets

Issues

&

Recommendations

Realisation of lower ROI by distributors

ROI generally obtained 20% or less against the Expected ROI of 25-30%

Approximate Cost of capital 12 to 14%

pressure from the retailers to offer lower prices

To meet targets often distributor has to offer the products at lower prices

Lenient credit terms increases his investment in working capital

Territory conflict between distributors

Recommendations

Ensuring better control over distributors so that they cater to their own territory only

Ensuring the faster collection of damaged and expired goods from the distributor and

crediting the amount as quickly as possible to the distributors account

Slabs for the volume based schemes should not be large and these should be tightly

monitored and controlled so that few distributors do not have an unfair advantage

Implementation Issues and Solutions

Monitoring territories is a problem as the number of retail outlets is very large; this can

be ensured by effectively using the IT systems

Currently no module in the IT system at distributors end to take care of damaged goods

that are taken back; as such an IT module to be added to the existing IT system

Impact due to emergence of the modern trade format

Delhi NCR has a high dominance of modern trade channels they drop prices of certain

products quite low

Retailers demand lower prices from the distributors in order to compete with modern

trade channels

Distributors are not able to meet sales targets due to the emergence of the modern

trade channels

Recommendations

Effectively monitor the modern trade channels ensuring that they do not drop the

prices below a certain level

Company should ensure that the additional benefits given to modern trade stores like

liquidation budget should be used only when it is absolutely necessary

In order the avoid the channel conflict ITC should come up with some SKUs specific to

certain store formats

Implementation Issues and Solutions

Detailed monitoring of schemes like liquidation budget , promotional budget etc. is

difficult; as such ITC can utilize its IT systems effectively for monitoring the behavior of

Modern trade channels

Issues with Personal Care Category

The personal care category does not enjoy similar market reception like cigarettes and

foods

Persistent pressure from the company on channel members to meet their targets

Lack of branding support by the company as informed by distributors and retailers

Company reduces prices to push products in this category but this causes some retailers

with old unsold stock to bear losses to match prices with other retailers

Recommendations

The company should maintain the prices steady in this category as frequent price

fluctuations hamper every channel members performance

Instead of pushing the products in this category efforts should be concentrated towards

creating a pull for the products

Selective stocking of products should be done according to the category of the retailer

Implementation Issues and Solutions

Categorization of retailers for selective stocking is a major challenge

Database of the retailers to be utilized in selection of retailers for selective stocking of

the personal care products

Rate cutting due to emergence of parallel channels

Parallel channels in terms of cash and carry stores and distributors both offering

similar products to the retailers this results in price cutting done by both the

channel members

However these channels differ in offering services to the retailer such as pick-

up, credit terms, returns etc.

Recommendations

Effectively monitor the prices and the services which the cash and carry stores

offer to the retailers

In order the avoid the channel conflict ITC should come up with some SKUs

specific to certain store formats

Implementation Issues and Solutions

Monitoring of the prices and services poses a challenge

Technology systems to be used for better and effective monitoring

Frequent new product launches

ITC launches new products very frequently in the market to remain competitive. At

times these new products are not well accepted by the market and hence a lot of capital

of channel members is blocked

Recommendations

Additional incentives like extended credit period or additional margins to be provided

for limited periods until the product is well accepted in the market

ITC should spend on increasing the visibility during the new product launches

Focus should be on creating pull for the new products rather than focusing on push

Implementation Issues and Solutions

Providing special credit for new products is a bit challenging as ITC deals with

distributors on advance payment terms. IT systems located at the distributors to be used

for implementing the credit policy. Benefits of promotional schemes to be passed in the

same manner as sales and distribution costs

Third party merchandisers to be employed for managing the in store visibility during the

new product launches

References

Kunal Shah Assistant Sales Manager, ITC Ltd.

Contact No.- 9501106856

Leela Krishna Ahuja

Shri Ram Sales Corporation (ITC Distributor) 08826777888

Shop No- 4-5/ 24, Basai Road, Near Bhuteshwar Temple, Gurgaon

Dilip Kumar (Salesman)

Contact No. 8802256951

Gurgaon Sector 14 and Sector 17 retailers covered

(The above mentioned persons were contacted in person and information collected

from them)

www.itcportal.com

Thank You

Você também pode gostar

- Gemini PPT 1Documento21 páginasGemini PPT 1Bhanu NirwanAinda não há avaliações

- Sales N Distribution of BritaniaDocumento10 páginasSales N Distribution of BritaniaAnshul67% (9)

- Syndicate8 - YP56A - Arcadian Microarray Techmologies IncDocumento10 páginasSyndicate8 - YP56A - Arcadian Microarray Techmologies InctuviejaprroAinda não há avaliações

- ITC Channel Analysis ReportDocumento45 páginasITC Channel Analysis ReportSuresh KumarAinda não há avaliações

- Sales and Distribution ManagementDocumento39 páginasSales and Distribution ManagementPrateek ChauhanAinda não há avaliações

- Sales and Distribution Channel of ITC CigarettesDocumento17 páginasSales and Distribution Channel of ITC CigarettesChandan Singh50% (4)

- An Irate Distributor: Presented By: Prashant Kumar 160103099Documento7 páginasAn Irate Distributor: Presented By: Prashant Kumar 160103099PrashantAinda não há avaliações

- Market Structure ConfluenceDocumento7 páginasMarket Structure ConfluenceSagar BhandariAinda não há avaliações

- Study of Sales and Distribution Channel of MaricoDocumento22 páginasStudy of Sales and Distribution Channel of MaricoVikram Agarwal67% (3)

- CEAT Tyres Distribution Channel and ManagementDocumento25 páginasCEAT Tyres Distribution Channel and ManagementSachi Gupta83% (6)

- The Irate DistributorDocumento29 páginasThe Irate DistributorSnehashish Chowdhary100% (7)

- ITC DiversificationDocumento21 páginasITC Diversificationankit yadav100% (1)

- Sales and Distribution of HULDocumento17 páginasSales and Distribution of HULAnkit Patodia100% (1)

- ITC Sales & Distribution Management ProjectDocumento31 páginasITC Sales & Distribution Management Projectafsal100% (3)

- Shoppers Stop Supply ChainDocumento46 páginasShoppers Stop Supply ChainBeingAbhishek Rupawate100% (2)

- ItcDocumento67 páginasItcShubham Grover79% (14)

- ITCDocumento57 páginasITCSurvivor Sidharrth100% (1)

- Distribution BritanniaDocumento5 páginasDistribution Britanniaarun0% (1)

- ItcDocumento19 páginasItcakshay chothe100% (2)

- PPT On ITCDocumento23 páginasPPT On ITCMukut Zubaer Khandker100% (1)

- COMPARATIVE STUDY AND DISTRIBUTION CHANNEL OF HUL & ITC Research Report NewkhjDocumento96 páginasCOMPARATIVE STUDY AND DISTRIBUTION CHANNEL OF HUL & ITC Research Report Newkhjlokesh_04590% (10)

- Itc ReportDocumento39 páginasItc Reportrashmi100% (1)

- ITC Distribution ChannelDocumento16 páginasITC Distribution ChannelMadhusudan Partani60% (5)

- Flipkart - Transitioning To A Marketplace ModelDocumento13 páginasFlipkart - Transitioning To A Marketplace ModelShambhawi Sinha50% (2)

- ITC Sales and Distribution NetworkDocumento17 páginasITC Sales and Distribution NetworkSurbhî GuptaAinda não há avaliações

- ITC Distribution Channel ObjectivesDocumento6 páginasITC Distribution Channel ObjectiveshemangokuAinda não há avaliações

- Sales Force Structure of ITCDocumento2 páginasSales Force Structure of ITCMohit Narayan100% (2)

- ITC Sales and Distribution ProcessDocumento22 páginasITC Sales and Distribution ProcessAmol ShelarAinda não há avaliações

- Itc Sales and DistributionDocumento19 páginasItc Sales and Distributionvenkateshmba100% (3)

- ITC LIMITED-Distribution Network ModelDocumento12 páginasITC LIMITED-Distribution Network Modelrameshsh100% (1)

- SDM ItcDocumento25 páginasSDM ItcSumit KakkarAinda não há avaliações

- BULK DEAL IN BAGRI MARKET - CASE STUDY Group - 9Documento8 páginasBULK DEAL IN BAGRI MARKET - CASE STUDY Group - 9trisanka banik0% (1)

- Hul Distribution ModelDocumento5 páginasHul Distribution ModelBhavik LodhaAinda não há avaliações

- Spice RushDocumento3 páginasSpice RushNavpreet Singh RandhawaAinda não há avaliações

- Market Analysis of Nimyle: by Anandu P ShajiDocumento13 páginasMarket Analysis of Nimyle: by Anandu P ShajiDaily Journal100% (1)

- Distribution Network For BritanniaDocumento5 páginasDistribution Network For BritanniaSaba Dabir100% (3)

- Case Analysis Apple Food Products AFPDocumento3 páginasCase Analysis Apple Food Products AFPAnonymous 0JhO3KdjAinda não há avaliações

- HUL (Supply Chain)Documento19 páginasHUL (Supply Chain)rohan_jangid8100% (4)

- VijetaDocumento2 páginasVijetaPandharinath Rameshrao Chidrawar100% (1)

- ItcDocumento46 páginasItcabhi_vicky007Ainda não há avaliações

- Group4 SecD UniGlobe'SDilemmaDocumento3 páginasGroup4 SecD UniGlobe'SDilemmasantosh sahu100% (1)

- India's Thirst For Rural MarketDocumento19 páginasIndia's Thirst For Rural MarketVedant VarshneyAinda não há avaliações

- Tata Steel's Efficient Distribution NetworkDocumento7 páginasTata Steel's Efficient Distribution NetworkHrithik SinghAinda não há avaliações

- Rural Marketing of ParleDocumento58 páginasRural Marketing of ParleSagar KapoorAinda não há avaliações

- ITC QuestionnaireDocumento2 páginasITC QuestionnaireRohit Sharma100% (1)

- BCG Matrix of Itc LTD On The FMCGDocumento11 páginasBCG Matrix of Itc LTD On The FMCGSubhranil GuhaAinda não há avaliações

- Supply Chain Nanagement of HULDocumento11 páginasSupply Chain Nanagement of HULsalil1235650% (4)

- ITC CigarettesDocumento14 páginasITC CigarettesRavi TejaAinda não há avaliações

- Hero Honda in Rural MarketDocumento27 páginasHero Honda in Rural MarketManoj Yadav90% (10)

- Business Strategy MaricoDocumento20 páginasBusiness Strategy MaricoLokendra Bains100% (1)

- MARICO'S Growth Strategies and Brand PortfolioDocumento36 páginasMARICO'S Growth Strategies and Brand PortfolioNivedita Chatterji0% (1)

- Marketing Channel at TitanDocumento8 páginasMarketing Channel at TitanRAHUL MOHATA0% (1)

- ITC Org StructDocumento21 páginasITC Org StructAparna Sarojini100% (3)

- ITC Company ProfileDocumento41 páginasITC Company ProfileABHISHEK CHAKRABORTY83% (23)

- Distribution Management and The Marketing MixDocumento36 páginasDistribution Management and The Marketing MixMics MarianoAinda não há avaliações

- Distributionmanagementmarketingmix 130718101133 Phpapp02Documento27 páginasDistributionmanagementmarketingmix 130718101133 Phpapp02anishgowdaAinda não há avaliações

- F 0 F 0 e RetailingDocumento28 páginasF 0 F 0 e RetailingRubina ParwezAinda não há avaliações

- Distribution StrategiesDocumento34 páginasDistribution StrategiesShivani SharmaAinda não há avaliações

- SDM G1 PresentationDocumento16 páginasSDM G1 Presentationmohit rajputAinda não há avaliações

- B2B Marketing Unit III - Part 2Documento34 páginasB2B Marketing Unit III - Part 2Egorov ZangiefAinda não há avaliações

- Amity School of Business: BBA V Semester Sales and Distribution ManagementDocumento50 páginasAmity School of Business: BBA V Semester Sales and Distribution Managementpoojapanwar1_2587726Ainda não há avaliações

- CUSTOMER CENTRICITY & GLOBALISATION: PROJECT MANAGEMENT: MANUFACTURING & IT SERVICESNo EverandCUSTOMER CENTRICITY & GLOBALISATION: PROJECT MANAGEMENT: MANUFACTURING & IT SERVICESAinda não há avaliações

- Econ Ch01 Chapter Test ADocumento3 páginasEcon Ch01 Chapter Test ATony DeCotisAinda não há avaliações

- The Global Economy: Lesson 2Documento4 páginasThe Global Economy: Lesson 2Reven Domasig TacordaAinda não há avaliações

- CH 9 Capital Asset Pricing ModelDocumento25 páginasCH 9 Capital Asset Pricing ModelShantanu ChoudhuryAinda não há avaliações

- L1R32 Annotated CalculatorDocumento33 páginasL1R32 Annotated CalculatorAlex PaulAinda não há avaliações

- Micro & Macro EconomicsDocumento8 páginasMicro & Macro Economicsadnantariq_2004100% (1)

- Ecocomy at WarDocumento40 páginasEcocomy at Wargion trisaptoAinda não há avaliações

- Booth School Problem Set 2 Fixed IncomeDocumento2 páginasBooth School Problem Set 2 Fixed IncomeelsaifymAinda não há avaliações

- Keystone College Module Explores GlobalizationDocumento15 páginasKeystone College Module Explores GlobalizationJherick TacderasAinda não há avaliações

- Chapter 29Documento26 páginasChapter 29ENG ZI QINGAinda não há avaliações

- DPDS R4a Batangas PalingowakES 107623 August 2022Documento66 páginasDPDS R4a Batangas PalingowakES 107623 August 2022May Anne AlmarioAinda não há avaliações

- SSRN Id3040422 PDFDocumento51 páginasSSRN Id3040422 PDFAnonymous jlWeHpTJzMAinda não há avaliações

- Module 5 Policy Lesson PresentationDocumento74 páginasModule 5 Policy Lesson PresentationFranzAinda não há avaliações

- Seminar Assignments Multiple Choice Questions City Size Growth PDFDocumento4 páginasSeminar Assignments Multiple Choice Questions City Size Growth PDFminlwintheinAinda não há avaliações

- Eco 2009 Het Final Exam QuestionsDocumento4 páginasEco 2009 Het Final Exam QuestionsAslı Yaren K.Ainda não há avaliações

- Roadshow Beiersdorf / Société Générale: Paris, June 11th, 2009Documento17 páginasRoadshow Beiersdorf / Société Générale: Paris, June 11th, 2009Gc DmAinda não há avaliações

- Introduction To Mutual Fund and Its Various AspectsDocumento7 páginasIntroduction To Mutual Fund and Its Various AspectsUzairKhanAinda não há avaliações

- Marble IndustryDocumento6 páginasMarble IndustryPrateek ShuklaAinda não há avaliações

- 898 Ch15ARQDocumento2 páginas898 Ch15ARQNga BuiAinda não há avaliações

- Updated Date Sheet of Odd Semesters (12 Feb) - 2Documento126 páginasUpdated Date Sheet of Odd Semesters (12 Feb) - 2Gaming with Shivangi and aadityaAinda não há avaliações

- Cabanyss Et Al. (2014) - Preliminary Market Analysis and Plant CapacityDocumento5 páginasCabanyss Et Al. (2014) - Preliminary Market Analysis and Plant Capacityvazzoleralex6884Ainda não há avaliações

- Public ChoiceDocumento39 páginasPublic ChoiceRoberta DGAinda não há avaliações

- EC501-Fall 2021-PS3Documento2 páginasEC501-Fall 2021-PS3Tayhan OzenAinda não há avaliações

- The Clorox Company-MarketingDocumento6 páginasThe Clorox Company-MarketingRehan AliAinda não há avaliações

- Ancient Times 1904 1960-1975: Push PullDocumento43 páginasAncient Times 1904 1960-1975: Push PullAshley ClarkAinda não há avaliações

- RP - CF1 - Time Value of MoneyDocumento28 páginasRP - CF1 - Time Value of MoneySamyu KAinda não há avaliações

- 8.capital BudgetingDocumento82 páginas8.capital BudgetingOblivion OblivionAinda não há avaliações

- This Paper Is Not To Be Removed From The Examination HallsDocumento55 páginasThis Paper Is Not To Be Removed From The Examination Halls陈红玉Ainda não há avaliações

- URBN218 Analysis 9Documento4 páginasURBN218 Analysis 9Liwro NacotnaAinda não há avaliações