Escolar Documentos

Profissional Documentos

Cultura Documentos

Pre ClassPPT 6

Enviado por

Arjun SainiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Pre ClassPPT 6

Enviado por

Arjun SainiDireitos autorais:

Formatos disponíveis

Interest Rate Risk-2

Objective

In this session ,we will comprehend the following two

variants of interest rate risk.

Basis Risk

Yield curve Risk

Basis Risk

We assume that changes in interest rates equally affect both the assets and

liabilities.

But in reality, the extent of change in interest rate on re-pricing will depend

upon the specific asset/liability subject to re-pricing.

The risk of different groups of banks assets and liabilities being based on

different interest rate basis (like MIBOR, treasury bill rates etc.)which change by

varying degrees (in response to a given change in the key interest rates in the

market )is called Basis Risk.

Changes in deposit interest typically lag behind loan rates.

The complex linkages between interest rates in different segments of the market

(Call,Repos,CDs,Interbank term money etc.) contribute to basis risk.

Whatever be the underlying reasons, bank's net interest income will be

impacted by basis risk.

Typically, in a falling interest rate scenario, it is possible that interest rates on

assets may be lowered generally while the deposits may continue at the

contacted higher interest rates.

Basis Risk

The following illustration will make the concept of

Basis risk clear.

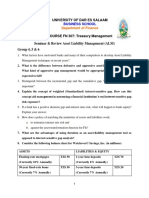

The Bharat Bank Limited

(Interest Sensitivity Gap Position 1-30 days Bucket)

Liabilities Assets

Call Money 50 Treasury Bills 30

Repo 50 Advances 120

Deposits 100

Total 200 Total 150

Basis Risk

If interest rate rises by 1%,bank will lose 0.5crore per

year assuming that the rise in interest will be uniformly

applicable to all the items of assets and liabilities.

But in reality, interest rates on assets and liabilities do

not change in the same proportions. Let us assume the

following changes in interest rates.

1. Call money rate may go ,up by 1%

2. Repo by 0.5%

3. Deposits by 0.25%

4. Treasury bills by 1.0%

5. Advances by 0.75%

Basis Risk

The impact of changes will be as follows:

Interest on liability/Asset

Call 50 0.01 % high 0.5

Repo 50 0.005 % high 0.25

Deposits 100 0.0025 0.25

Treasury Bills 30 0.01 0.3

Advances 120 0.0075 0.9

Net impact

on NII

0.20

YIELD CURVE RISK

On account of volatility in interest rates, the yield

curve unpredictability and often substantially

changes in shape.

If the interest rates on assets and liabilities are

pegged to the bench mark rates (like treasury bills

cut-off rates ),there is the risk that the interest

spread may decrease as term spread narrows

down.

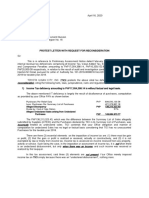

YIELD CURVE RISK

Illustration

Assume that the bank has raised a floating rate deposit which will be repriced

1% above the 91 day Treasury Bills cut-off and invested the amount in a

floating rate loan of the same re-pricing interval but at a spread of 2% above

364 Day Treasury Bills cut-off .The following table shows the Yield curve Risk

involved, as the spread between the two maturities of treasury bills

narrowed.

Period 91 Day TB 364 Day TB Term

Spread

Interest spread

between deposit

& loan.

April1999 8.75% 10.07% 1.32% 2.32%

June1999 9.24% 10.32% 1.08% 2.08%

August 1999 9.46% 10.28% 0.82% 1.82%

March2000 9.16% 9.93% 0.77% 1.77%

Feb.20002 6.25% 6.42% 0.17% 1.17%

Você também pode gostar

- Management of Interest Rate Risk in BanksDocumento6 páginasManagement of Interest Rate Risk in BanksPratik NayakAinda não há avaliações

- Financial Institutions Management - Solutions - Chap008Documento19 páginasFinancial Institutions Management - Solutions - Chap008duncan01234Ainda não há avaliações

- CB Chapter 7 AnswerDocumento4 páginasCB Chapter 7 AnswerSim Pei Ying100% (1)

- Questions, Anwers Chapter 22Documento3 páginasQuestions, Anwers Chapter 22basit111Ainda não há avaliações

- Chapter Seven Risks of Financial IntermediationDocumento15 páginasChapter Seven Risks of Financial IntermediationOsan JewelAinda não há avaliações

- BRM Session 8 Interest Rate RiskDocumento31 páginasBRM Session 8 Interest Rate RiskSrinita MishraAinda não há avaliações

- Seminar Risk ManagementDocumento9 páginasSeminar Risk ManagementDương Nguyễn TùngAinda não há avaliações

- Problem & SolutionDocumento19 páginasProblem & Solutionfanuel kijojiAinda não há avaliações

- CH 8Documento9 páginasCH 8realsimplemusicAinda não há avaliações

- FI - M Lecture 5-How Do Risk - Term Structure Affect Interest Rates - CompleteDocumento71 páginasFI - M Lecture 5-How Do Risk - Term Structure Affect Interest Rates - CompleteMoazzam ShahAinda não há avaliações

- Lesson 11Documento44 páginasLesson 11Devica UditramAinda não há avaliações

- Financial Institutions Management - Chapter 5 Solutions PDFDocumento6 páginasFinancial Institutions Management - Chapter 5 Solutions PDFJarrod RodriguesAinda não há avaliações

- Term Structure of Interest RatesDocumento44 páginasTerm Structure of Interest RatesmasatiAinda não há avaliações

- RM in BanksDocumento60 páginasRM in BanksDeepak TandonAinda não há avaliações

- Seminar Questions Set II-1Documento4 páginasSeminar Questions Set II-1fanuel kijojiAinda não há avaliações

- Chapter 008Documento25 páginasChapter 008Muhammad Bilal TariqAinda não há avaliações

- Bond Valuation Fall 2012Documento74 páginasBond Valuation Fall 2012Suvam Roy ChowdhuriAinda não há avaliações

- Lighthouse - Bond Bulletin - 2017-05Documento23 páginasLighthouse - Bond Bulletin - 2017-05Alexander GloyAinda não há avaliações

- Microprudential InstrumentsDocumento5 páginasMicroprudential InstrumentsMaria GarciaAinda não há avaliações

- Solutions For End-of-Chapter Questions and Problems: Chapter EightDocumento25 páginasSolutions For End-of-Chapter Questions and Problems: Chapter EightSam MAinda não há avaliações

- Chapter 4. ALM ManagementDocumento33 páginasChapter 4. ALM ManagementĐoàn Trần Ngọc AnhAinda não há avaliações

- Interest Rates and Bond Valuation Chapter 6Documento29 páginasInterest Rates and Bond Valuation Chapter 6Mariana MuñozAinda não há avaliações

- Lecture Notes - Econ B&F Lecture 3-12Documento64 páginasLecture Notes - Econ B&F Lecture 3-12Qoirunisa AynaAinda não há avaliações

- Chap 008Documento6 páginasChap 008Haris JavedAinda não há avaliações

- Interest Rate and BondDocumento87 páginasInterest Rate and BondLee ChiaAinda não há avaliações

- Brief Content - Excercises - Chapter 2Documento5 páginasBrief Content - Excercises - Chapter 2Chi BongAinda não há avaliações

- FIN 4003 FWA Problem Solving Revision 2020 10 Key Answers1Documento6 páginasFIN 4003 FWA Problem Solving Revision 2020 10 Key Answers1Nourhan KhaterAinda não há avaliações

- Fixed Income Securities Macaulay'sDocumento47 páginasFixed Income Securities Macaulay'sUbaid DarAinda não há avaliações

- Interest Rate Risk Management: Learning OutcomesDocumento16 páginasInterest Rate Risk Management: Learning OutcomesAnil ReddyAinda não há avaliações

- Financial Institutions Management - Chap017Documento11 páginasFinancial Institutions Management - Chap017Abhilash PattanaikAinda não há avaliações

- Introduction To Monetary PolicyDocumento21 páginasIntroduction To Monetary PolicyHisham JawharAinda não há avaliações

- Basis RiskDocumento2 páginasBasis RiskRocking LadAinda não há avaliações

- BFMDocumento17 páginasBFMsaurabhasdfAinda não há avaliações

- EOC08 EdittedDocumento12 páginasEOC08 EdittedFilip velico100% (1)

- Carcillar, Maclaine Joyce R.Documento29 páginasCarcillar, Maclaine Joyce R.Venus Salgado SupremoAinda não há avaliações

- Lecture Slides Real and Nominal IrDocumento17 páginasLecture Slides Real and Nominal IrNik Nur Najwa AzharAinda não há avaliações

- Interest Rate RiskDocumento58 páginasInterest Rate RiskStevan PknAinda não há avaliações

- SC Eoc08Documento25 páginasSC Eoc08vanessagreco17Ainda não há avaliações

- Bond PortfolioDocumento36 páginasBond PortfoliomarcchamiehAinda não há avaliações

- Elements of Banking and Finance (FINA 1001) Semester I (2020/2021)Documento38 páginasElements of Banking and Finance (FINA 1001) Semester I (2020/2021)Tia WhoserAinda não há avaliações

- Week 8 Class ExercisesDocumento3 páginasWeek 8 Class ExercisesChinhoong Ong100% (1)

- Selected Tutorial Solutions - Week 8Documento4 páginasSelected Tutorial Solutions - Week 8qhayyumAinda não há avaliações

- Sovereign Loan PricingDocumento3 páginasSovereign Loan PricingWilliam LauAinda não há avaliações

- Finanical Management Ch5Documento43 páginasFinanical Management Ch5Chucky ChungAinda não há avaliações

- Week 11 - Tutorial QuestionsDocumento7 páginasWeek 11 - Tutorial QuestionsVuong Bao KhanhAinda não há avaliações

- Pre ClassPPT 7Documento7 páginasPre ClassPPT 7Arjun SainiAinda não há avaliações

- Irm201920 3Documento18 páginasIrm201920 3Prabhat SinghAinda não há avaliações

- Capital Adequacy in Banks: Chapter ThreeDocumento22 páginasCapital Adequacy in Banks: Chapter ThreeU A CAinda não há avaliações

- DRM 1Documento6 páginasDRM 1zarthchahalAinda não há avaliações

- MCB AssignmentDocumento13 páginasMCB AssignmentTushar DiwakarAinda não há avaliações

- FINS3630: UNSW Business SchoolDocumento32 páginasFINS3630: UNSW Business SchoolcarolinetsangAinda não há avaliações

- Risk ManagementDocumento19 páginasRisk ManagementamitAinda não há avaliações

- 03 - New Version. Interest Rate and BondDocumento89 páginas03 - New Version. Interest Rate and BondLee ChiaAinda não há avaliações

- March 22 ChapDocumento31 páginasMarch 22 ChapÁrni Davíð SkúlasonAinda não há avaliações

- Lecture 6 - Interest Rates and Bond ValuationDocumento56 páginasLecture 6 - Interest Rates and Bond Valuationabubaker janiAinda não há avaliações

- BFM Module B SnapshotDocumento17 páginasBFM Module B SnapshotVenkata Raman RedrowtuAinda não há avaliações

- Financial Risk Management: A Simple IntroductionNo EverandFinancial Risk Management: A Simple IntroductionNota: 4.5 de 5 estrelas4.5/5 (7)

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Ainda não há avaliações

- All MCQ of DBDocumento16 páginasAll MCQ of DBArjun SainiAinda não há avaliações

- Development of Banking in VillagesDocumento31 páginasDevelopment of Banking in VillagesArjun SainiAinda não há avaliações

- Pre ClassPPT 7Documento7 páginasPre ClassPPT 7Arjun SainiAinda não há avaliações

- Pre ClassPPT 1Documento16 páginasPre ClassPPT 1Arjun SainiAinda não há avaliações

- Credit Risk: Credit Risk Is Defined As "The Inability orDocumento10 páginasCredit Risk: Credit Risk Is Defined As "The Inability orArjun SainiAinda não há avaliações

- Pre ClassPPT 5Documento6 páginasPre ClassPPT 5Arjun SainiAinda não há avaliações

- Sensex at 100,000 by 2020!: by Varun Goel, Head PMS, KarvyDocumento4 páginasSensex at 100,000 by 2020!: by Varun Goel, Head PMS, KarvyArjun SainiAinda não há avaliações

- Governmentsponsored Industrial Growththe Jaipur Industrial Estate A Case StudyDocumento8 páginasGovernmentsponsored Industrial Growththe Jaipur Industrial Estate A Case StudyArjun SainiAinda não há avaliações

- Accounting Notes For StudentsDocumento14 páginasAccounting Notes For StudentsArjun SainiAinda não há avaliações

- Rights and Obligations of Beneficial Owner and Depository ParticipantDocumento4 páginasRights and Obligations of Beneficial Owner and Depository ParticipantddAinda não há avaliações

- BankersDocumento1 páginaBankersArjun SainiAinda não há avaliações

- For India? The Solution For Our Economic ProblemsDocumento1 páginaFor India? The Solution For Our Economic ProblemsArjun SainiAinda não há avaliações

- Create An Internet Explorer Toolbar PluginDocumento19 páginasCreate An Internet Explorer Toolbar PluginArjun SainiAinda não há avaliações

- CIR Vs Sony PhilDocumento1 páginaCIR Vs Sony PhilJazem Ansama100% (3)

- The Accounting Cycle: Capturing Economic EventsDocumento55 páginasThe Accounting Cycle: Capturing Economic EventsK KAinda não há avaliações

- Company Law PDFDocumento276 páginasCompany Law PDFjesurajajosephAinda não há avaliações

- Chapter 11 - Computation of Taxable Income and TaxDocumento22 páginasChapter 11 - Computation of Taxable Income and TaxMichelle Tan100% (1)

- Team Based Compensation: Made By: Prashansa Madan Pragya SabharwalDocumento18 páginasTeam Based Compensation: Made By: Prashansa Madan Pragya SabharwalVijay AnandAinda não há avaliações

- Cost-Volume-Profit Analysis Lecture Notes With ProbsDocumento6 páginasCost-Volume-Profit Analysis Lecture Notes With ProbsShaika Haceena100% (1)

- ProtestLetter TICIDocumento4 páginasProtestLetter TICIdbircs100% (4)

- Organisation Study at Vijayamohini Mill TrivandrumDocumento42 páginasOrganisation Study at Vijayamohini Mill Trivandrumsarathvl100% (2)

- Sunbeam FS EvaluationDocumento5 páginasSunbeam FS EvaluationSaurav GhoshAinda não há avaliações

- Cir Vs de PrietoDocumento7 páginasCir Vs de PrietoG FAinda não há avaliações

- Cetking GK Shot Test - Feb 2019Documento213 páginasCetking GK Shot Test - Feb 2019harshit rajAinda não há avaliações

- Report Singue Revised4Documento11 páginasReport Singue Revised4EDINPETROL ESPINOZAAinda não há avaliações

- New Capex Plan of Nestle LTDDocumento13 páginasNew Capex Plan of Nestle LTDnandeeppatel5159Ainda não há avaliações

- Financial Position of The STCDocumento13 páginasFinancial Position of The STCSalwa AlbalawiAinda não há avaliações

- OPTCL-Fin-Bhw-12Documento51 páginasOPTCL-Fin-Bhw-12Bimal Kumar DashAinda não há avaliações

- TX10 - Other Percentage TaxDocumento15 páginasTX10 - Other Percentage TaxKatzkie Montemayor GodinezAinda não há avaliações

- Crc-Ace Review School: TAXATION (1-70)Documento10 páginasCrc-Ace Review School: TAXATION (1-70)LuisitoAinda não há avaliações

- AFAR Problem Solving 1Documento41 páginasAFAR Problem Solving 1Ricamae MendiolaAinda não há avaliações

- Top 200 The Rise of Corporate Global PowerDocumento17 páginasTop 200 The Rise of Corporate Global PowervalwexAinda não há avaliações

- Purefoods Financial Statements 2018-2021Documento8 páginasPurefoods Financial Statements 2018-2021Kyle Denise Castillo VelascoAinda não há avaliações

- Production N Cost AnalysisDocumento71 páginasProduction N Cost AnalysisAnubhav PatelAinda não há avaliações

- Take Home Quiz 2Documento2 páginasTake Home Quiz 2Ann SCAinda não há avaliações

- 2012 Annual Report AcerinoxDocumento142 páginas2012 Annual Report Acerinoxaniket_ghoseAinda não há avaliações

- Project Report of SIEMENS AurangabadDocumento58 páginasProject Report of SIEMENS AurangabadShahnawaz Aadil50% (2)

- Yangon Technological University Department of Civil EngineeringDocumento28 páginasYangon Technological University Department of Civil Engineeringthan zawAinda não há avaliações

- ABG ShipyardDocumento9 páginasABG ShipyardTejas MankarAinda não há avaliações

- Saln TemplateDocumento6 páginasSaln TemplateAllan TomasAinda não há avaliações

- Partnership OperationsDocumento12 páginasPartnership Operationsninny ragayAinda não há avaliações

- BIR Form 2316 Guide 2Documento1 páginaBIR Form 2316 Guide 2Nicole PriorAinda não há avaliações

- Corporate FarmingDocumento30 páginasCorporate FarmingKhurram S. Qazi100% (1)