Escolar Documentos

Profissional Documentos

Cultura Documentos

Swap Revised

Enviado por

rigilcolacoDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Swap Revised

Enviado por

rigilcolacoDireitos autorais:

Formatos disponíveis

2011 Dorling Kindersley (India) Pvt.

Ltd

Swaps

Chapter 10

2011 Dorling Kindersley (India) Pvt. Ltd

Objectives of the Chapter

What are swaps?

What is an interest rate swap?

What is a currency swap?

What is an equity swap?

What is a commodity swap?

What is the rationale for swaps?

2011 Dorling Kindersley (India) Pvt. Ltd

What are swaps?

A swap is a private agreement between two parties to exchange

one stream of cash flows for another stream of cash flows in

accordance with a pre-arranged formula

Agreement will provide details of how cash flows will be

calculated, and dates on which cash flows will be exchanged

At least one party will be exposed to an uncertain variable such

as interest rate, exchange rate, equity price, or commodity price

The other partys cash flow would be based on a fixed payment

or determined on the basis of another variable

2011 Dorling Kindersley (India) Pvt. Ltd

Types of Swaps

An interest rate swap is one in which one party

agrees to exchange interest payments based on

a fixed rate with another party based on a floating

rate

A currency swap is one in which one party agrees

to exchange payments based on one currency

with another party based on another currency

A commodity swap is one in which variable

market prices are exchanged for a fixed price

over a period of time

An equity swap is one in which one party agrees

to exchange payments based on an equity

portfolio for payment based on a floating rate

2011 Dorling Kindersley (India) Pvt. Ltd

The Terminology of Swaps

Swap: an agreement to exchange cash flows over a

fixed period of time

Counterparties: the two parties in a swap contract

Notional principal: a monetary figure used as a part of

the calculation to determine payment amounts

Tenor: The length of time for which payments will be

exchanged, also known as term, maturity, or

expiration of swap

Swap facilitators: specialists who help clients to

design swaps

Swap brokers: bring counterparties together for a

swap transaction

Swap dealers: can enter into swap agreements as

one of the counterparties

2011 Dorling Kindersley (India) Pvt. Ltd

Interest Rate Swap

A fixed interest rate loan is exchanged for a floating

interest rate loan

Party A will borrow in the market at a fixed rate; Party

B will borrow in the market at a floating rate; interest

payments will be swapped at every reset period of the

floating-rate loan

The rate at which party A will pay interest to party B

and vice versa are known as swap rates, which are

determined in the market

Principal will not be exchanged, and interest amount

will be calculated on notional principal

Designing a Swap

Microsoft has arranged to borrow a 100 million loan at

floating rate of LIBOR+.10. The same amount of

money has been borrowed by Intel at a fixed rate of

5.2% . They entered into a swap agreement where

Microsoft will pay a fixed interest @5% to Intel where

will pay Microsoft at LIBOR. Show the flow chart of

Swap and describe the cash flow of the Swap

arrangement.

Ford motor owns $100 million bond providing a fixed

interest of 4.7% and Hyundai motors owns $100

million bond getting interest at floating interest rate of

LIBOR-.30.They entered into a swap arrangement

where Ford Motor will pay 5% fixed rate to Hyundai

against the receipt of LIBOR from them. Show the flow

chart of Swap and describe the cash flow of the Swap

arrangement

2011 Dorling Kindersley (India) Pvt. Ltd

Forward Swaps

A forward swap is a swap that will commence at some

future time

Fixed interest rates will be fixed at the time the contract is

entered into

The floating rate is determined at the first period of the

agreement when the swap comes into effect

Useful when investment or borrowing will take place at a

future time

One major challenge is to find the fixed rate for the forward

swap: the implied forward rate from the current yield curve

is usually used

2011 Dorling Kindersley (India) Pvt. Ltd

Uses of the Interest Rate Swap

Hedging interest rate

Reduce funding costs

Manage the duration gap by banks

Speculating on interest rate movements

Swap arrangement

Two companies AAA Corp and BBB Corp both wish to

borrow 10 million for five years and have been offered

the following rates . BBB corp wants to borrow at a

fixed rate and AAA corp wants to borrow at floating

rate. Following are the offered rates :

2011 Dorling Kindersley (India) Pvt. Ltd

Company Fixed Floating

AAA Corp 10% LIBOR+.3%

BBB Corp 11.20% LIBOR+1%

The two companies tried to arrange a swap agreement in such way that

they are benefitted equally out of the swap agreement. Show the flow

diagram how they will arrange their swap and explain the cash flows. Use

the concept of Comparative Advantage concept to solve the case.

Answer:

Swap arrangement :

BBB Corp will pay to AAA corp at 9.95% and AAA

corp will pay at LIBOR to BBB Corp.

2011 Dorling Kindersley (India) Pvt. Ltd

Swap Arrangement

Company A and B was offered the following rates

2011 Dorling Kindersley (India) Pvt. Ltd

Company Fixed Floating

AAA Corp 12% LIBOR+.1%

BBB Corp 13.4% LIBOR+.6%

Company A requires a floating rate loan and company B

requires a a fixed rate loan. Design a swap that will give

both the parties equal benefit after providing a net to a

bank of .10% for acting as intermediary.

Swap arrangement:

Answer :- A will receive from bank at 12 . 3% and

will pay at Libor to Bank and B will receive at

LIBOR and pay to Bank at 12.4%.

2011 Dorling Kindersley (India) Pvt. Ltd

2011 Dorling Kindersley (India) Pvt. Ltd

Interest Rate Swaps: An Example

A can borrow at either LIBOR + 70 points, or at a fixed rate

of 9%

B can borrow at either LIBOR + 20 points, or at a fixed rate

of 8.2%

Both can have a lower cost of funding if A borrows at

LIBOR + 70, and B borrows at a fixed rate of 8.2%, and

they swap

Swap rates are fixed at 8.2%, and the floating rate at

LIBOR + 5

Net cost for A will be 8.85% fixed, and for B will be LIBOR

+ 5 points

Both save an interest rate of 0.15%

2011 Dorling Kindersley (India) Pvt. Ltd

Swaptions

This is an option to enter into a swap

A party will enter into a swap only when it is

advantageous to do so; otherwise the option will

not be undertaken

Used to:

Bring a swap into place when hedging is necessary;

Removing an existing swap when it is no longer

attractive;

Enhance yield with an underlying position by selling

a swaption;

Obtain access to a swap when uncertainty of when

funding will be required persists

Assignment 1

Company A can borrow at a fixed rate of 8% or

at a floating rate of MIBOR + 150 basis points.

Company B can borrow at a fixed rate of 9%

or at a floating rate of MIBOR + 50 basis

points. Show that these two companies can

improve their position through an interest rate

swap. What would be the gain to the two

parties?

2011 Dorling Kindersley (India) Pvt. Ltd

Assignment 2

ABC Corporation can borrow at 6% fixed rate

or at a floating rate of LIBOR + 50 basis

points. GH Corporation can borrow at 8%

fixed rate or at a floating rate of LIBOR + 100

basis points. Show that these two

corporations can be better off by entering into

an interest rate swap. Assume that the

comparative advantage is equally shared by

the two parties.

2011 Dorling Kindersley (India) Pvt. Ltd

2011 Dorling Kindersley (India) Pvt. Ltd

Currency Swap

Party A borrows in one currency, e.g. INR, and

party B borrows in another currency, e.g. USD:

the loan is swapped so that party A pays the

interest in USD, and party B pays the interest in

INR

In a currency swap, cash flows are exchanged in

two different currencies

Notional principals are the same based on current

exchange rate, which are also exchanged

2011 Dorling Kindersley (India) Pvt. Ltd

The Structure of a Currency

Swap

Party A Party B

Pay fixed in USD Pay fixed in INR

Pay floating in USD Pay fixed in INR

Pay fixed in USD Pay floating in INR

Pay floating in USD Pay floating in INR

2011 Dorling Kindersley (India) Pvt. Ltd

The Operation of a Currency

Swap

Initial exchange of a notional principal

Periodic exchange of coupon payments

Final exchange of notional principal at initial

exchange rate

10-21

An Example of a Currency Swap

Suppose a U.S. MNC wants to finance a

10,000,000 expansion of a British plant.

They could borrow dollars in the U.S. where they

are well known and exchange for dollars for

pounds.

This will give them exchange rate risk: financing a

sterling project with dollars.

They could borrow pounds in the international

bond market, but pay a lot since they are not as

well known abroad.

10-22

An Example of a Currency Swap

If they can find a British MNC with a mirror-image

financing need they may both benefit from a

swap.

If the exchange rate is S

0

($/) = $1.60/, the U.S.

firm needs to find a British firm wanting to finance

dollar borrowing in the amount of $16,000,000.

10-23

An Example of a Currency Swap

Consider two firms A and B: firm A is a U.S.based

multinational and firm B is a U.K.based

multinational.

Both firms wish to finance a project in each others

country of the same size. Their borrowing

opportunities are given in the table below.

$

Company A 8.0% 11.6%

Company B 10.0% 12.0%

10-24

A is the more credit-worthy of the two firms.

Comparative Advantage

as the Basis for Swaps

$

Company A 8.0% 11.6%

Company B 10.0% 12.0%

A has a comparative advantage in borrowing in dollars.

B has a comparative advantage in borrowing in pounds.

A pays 2% less to borrow in dollars than B

A pays .4% less to borrow in pounds than B:

10-25

B has a comparative advantage in borrowing in .

Comparative Advantage

as the Basis for Swaps

$

Company A 8.0% 11.6%

Company B 10.0% 12.0%

B pays 2% more to borrow in dollars than A

B pays only .4% more to borrow in pounds than A:

A has a comparative advantage in borrowing in dollars.

B has a comparative advantage in borrowing in pounds.

If they borrow according to their comparative advantage

and then swap, there will be gains for both parties.

Comparative Advantage

as the Basis for Swaps

10-27

An Example of a Currency Swap

Company

A

Swap

Bank

$8%

12%

$8%

11%

12%

$9.4%

$

Company A 8.0% 11.6%

Company B 10.0% 12.0%

Company

B

10-28

An Example of a Currency Swap

Company

A

Swap

Bank

$8%

12%

$8%

11%

12%

$9.4%

$

Company A 8.0% 11.6%

Company B 10.0% 12.0%

Company

B

As net position is to borrow at 11%

A saves .6%

10-29

An Example of a Currency Swap

Company

A

Swap

Bank

$8%

12%

$8%

11%

12%

$9.4%

$

Company A 8.0% 11.6%

Company B 10.0% 12.0%

Company

B

Bs net position is to borrow at $9.4%

B saves $.6%

10-30

An Example of a Currency Swap

Company

A

Swap

Bank

$8%

12%

$8%

11%

12%

$9.4%

$

Company A 8.0% 11.6%

Company B 10.0% 12.0%

Company

B

The swap bank makes

money too:

At S

0

($/) = $1.60/, that

is a gain of $64,000 per

year for 5 years.

The swap bank

faces exchange rate

risk, but maybe

they can lay it off

in another swap.

1.4% of $16 million

financed with 1% of 10

million per year for 5

years.

Assignment 3

BHP, Australia, can borrow at 8% fixed rate in

Australia and at 9% fixed rate in India. Tata

Steel can borrow at a fixed rate of 7% in India

and at a fixed rate of 11% in Australia. The

current exchange rate is AUD 1 = INR 36.

Explain how the two companies can engage in

a five-year currency swap with payments

every six months. Assume Swap rate is BHP

pays 8.5% in INR, and Tata Steel pays 9% in

AUD draw the flow chart and calculate the net

cost.

2011 Dorling Kindersley (India) Pvt. Ltd

Assignment 4

Rajesh wants to borrow Singapore dollar (SGD)

20,000,000 at a fixed interest rate for 5 years.

Rakesh wants to borrow INR 560,000,000 in India

for five years at a fixed interest. Investment

Bankers were approached for the same to have

the likely borrowing rates for Rajesh and Rakesh.

The borrowing rate for Rajesh was 12% in

Singapore and 8% in India and the borrowing rate

for Rakesh was 9% both in Singapore and India.

Find a suitable swap strategy between Rajesh

and Rakesh considering their comparative

advantage .

Also find the net cost for them and payment

process.

Assume spot rat SGD 1 = INR 28. Swap rate

Rajesh to pay rakesh @10% SGD and Rakesh to

Rajesh @8% INR.

2011 Dorling Kindersley (India) Pvt. Ltd

Currency Risk in Currency Swap

As periodic coupon and final exchange of notional

principal are in different currencies, currency risk

can arise from this

If a company has cash inflow in the swap

currency, the periodic payments can be paid

without converting local currencycurrency risk

is thus avoided

If a company has no cash inflow in the swap

currency, currency risk exists

2011 Dorling Kindersley (India) Pvt. Ltd

The Uses of a Currency Swap

1. To hedge currency risk; and

2. To reduce funding costs

2011 Dorling Kindersley (India) Pvt. Ltd

Equity Swap

This is a transaction in which one party agrees to

make a series of payments determined by the

return on a stock to another party for a cash flow

based either on fixed rate, floating rate, or return

on another portfolio of stocks

E.g. one party receives a return on the BSE

Sensex Index in return for paying a 9% fixed

interest rate

2011 Dorling Kindersley (India) Pvt. Ltd

Commodity Swap

Used to hedge risk associated with prices of input

resources

Involves exchange of payments between two parties

at set time periods

One leg of payment is based on commodity price

The other leg usually involves a fixed rate

Usually average price over a set period of time is

used as settlement price

Você também pode gostar

- Introduction To Public IssueDocumento15 páginasIntroduction To Public IssuePappu ChoudharyAinda não há avaliações

- 9 MCQ On Third Party Products With Ans.Documento4 páginas9 MCQ On Third Party Products With Ans.Nitin MalikAinda não há avaliações

- Your Results For - Multiple ChoiceDocumento3 páginasYour Results For - Multiple ChoiceSeema KujurAinda não há avaliações

- Question Bank Business LawDocumento2 páginasQuestion Bank Business LawNeha BhatiaAinda não há avaliações

- Vouching of Building N Bill PayableDocumento10 páginasVouching of Building N Bill PayableMohammed BilalAinda não há avaliações

- Operations Research MCQ PDFDocumento17 páginasOperations Research MCQ PDFDipak Mahalik100% (1)

- Inflation AccountingDocumento34 páginasInflation AccountingUnbeatable 9503Ainda não há avaliações

- BWRR3143 - Chapter 4 - Ins ContractsDocumento32 páginasBWRR3143 - Chapter 4 - Ins ContractsWingFatt KhooAinda não há avaliações

- Companies Act 1956 Notes PDFDocumento73 páginasCompanies Act 1956 Notes PDFsanresAinda não há avaliações

- Corporate Law Case StudiesDocumento2 páginasCorporate Law Case Studiesshaurya Jain100% (1)

- 23 Issue, Forfeiture and Reissue of Shares PDFDocumento13 páginas23 Issue, Forfeiture and Reissue of Shares PDFsureshdevidasAinda não há avaliações

- Ext 601 TheoryDocumento40 páginasExt 601 Theorysandeep gp100% (1)

- REDEMPTION OF SHARES & DEBENTURES MCQsDocumento7 páginasREDEMPTION OF SHARES & DEBENTURES MCQsChetan StoresAinda não há avaliações

- Business Regulatory Framework Set 2Documento2 páginasBusiness Regulatory Framework Set 2Titus Clement100% (1)

- Chapter 9: Legal Challenges of Entrepreneurial Ventures: True/FalseDocumento6 páginasChapter 9: Legal Challenges of Entrepreneurial Ventures: True/Falseelizabeth bernalesAinda não há avaliações

- Business Law BBA: 206-B Bba 4 SEM Question Bank: Unit-1Documento2 páginasBusiness Law BBA: 206-B Bba 4 SEM Question Bank: Unit-1monikaAinda não há avaliações

- IPCC - 33e - Differences & True or False Statements in Indian Contract ActDocumento58 páginasIPCC - 33e - Differences & True or False Statements in Indian Contract Actmohan100% (3)

- Tandon Committee Report On Working CapitalDocumento4 páginasTandon Committee Report On Working CapitalMohitAhujaAinda não há avaliações

- The Empirical School or The Management by Customs SchoolDocumento3 páginasThe Empirical School or The Management by Customs SchoolMaeve AguerroAinda não há avaliações

- Business OrganisationDocumento87 páginasBusiness OrganisationVictor Boateng100% (2)

- AFS MCQsDocumento43 páginasAFS MCQsNayab KhanAinda não há avaliações

- RIMT University: Part-A (Question-1) (MCQ) (All Questions Are Compulsory) 01 12 12 MarksDocumento3 páginasRIMT University: Part-A (Question-1) (MCQ) (All Questions Are Compulsory) 01 12 12 MarksharpominderAinda não há avaliações

- Entrepreneurship and Small Business Management Multiple Choice QuestionsDocumento54 páginasEntrepreneurship and Small Business Management Multiple Choice QuestionsANDUALEM MENGISTEAinda não há avaliações

- BUSINESS LAW and EthicsDocumento2 páginasBUSINESS LAW and EthicsSowjanya TalapakaAinda não há avaliações

- 01 Philosophical FoundationsDocumento21 páginas01 Philosophical FoundationsSharifah Amrina100% (2)

- Business Law McqsDocumento2 páginasBusiness Law McqsHaseeb ShaikhAinda não há avaliações

- Funds Flow Statement MCQs Schedule of Changes in Financial Position Multiple Choice Questions and AnDocumento7 páginasFunds Flow Statement MCQs Schedule of Changes in Financial Position Multiple Choice Questions and Anshuhal Ahmed33% (3)

- PPC Model Exam Question PaperDocumento2 páginasPPC Model Exam Question PapertharunAinda não há avaliações

- Financial Management Mcqs With AnswersDocumento53 páginasFinancial Management Mcqs With Answersviveksharma51Ainda não há avaliações

- Section 2 (4) Section 4 (2) Section 3 (1) Section 1 (3) A-CDocumento5 páginasSection 2 (4) Section 4 (2) Section 3 (1) Section 1 (3) A-CNaqeeb Ur RehmanAinda não há avaliações

- Retail Mcqs 19 20 Batch PDFDocumento26 páginasRetail Mcqs 19 20 Batch PDFShailendra JoshiAinda não há avaliações

- Collective Bargaining Process: Megha .U S3 MbaDocumento8 páginasCollective Bargaining Process: Megha .U S3 MbaMegha UnniAinda não há avaliações

- 17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingDocumento4 páginas17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingSimon JosephAinda não há avaliações

- Unit 3 HRM Recruitment Selection MCQDocumento2 páginasUnit 3 HRM Recruitment Selection MCQguddan prajapatiAinda não há avaliações

- Merchant Banking and Financial Services Question PaperDocumento248 páginasMerchant Banking and Financial Services Question Paperexecutivesenthilkumar100% (1)

- MCQ 464Documento10 páginasMCQ 464Tonmoy MajumderAinda não há avaliações

- FD MCQ 2Documento2 páginasFD MCQ 2ruchi agrawal100% (1)

- Define The Term SecurityDocumento8 páginasDefine The Term SecurityMahaboob PashaAinda não há avaliações

- PE2-001 - Nigerian Labour Law (Regu)Documento7 páginasPE2-001 - Nigerian Labour Law (Regu)Tega Nesirosan100% (1)

- Note On Public IssueDocumento9 páginasNote On Public IssueKrish KalraAinda não há avaliações

- EOQ Is A Point Where: Select Correct Option: Ordering CostDocumento5 páginasEOQ Is A Point Where: Select Correct Option: Ordering CostKhurram NadeemAinda não há avaliações

- CT9 Business Awareness Module PDFDocumento4 páginasCT9 Business Awareness Module PDFVignesh SrinivasanAinda não há avaliações

- Audit MCQ by IcaiDocumento24 páginasAudit MCQ by IcaiRahulAinda não há avaliações

- Amalgamation, Absorption, Reconstruction, and General Insurance Company MCQDocumento17 páginasAmalgamation, Absorption, Reconstruction, and General Insurance Company MCQbharat wankhedeAinda não há avaliações

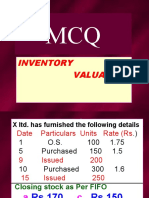

- MCQ Inventory Valuation LBSIMDocumento49 páginasMCQ Inventory Valuation LBSIMSumit SharmaAinda não há avaliações

- Principles of InsuranceDocumento2 páginasPrinciples of Insurancepsawant77Ainda não há avaliações

- Amalgamation, Absorption & External Reconstruction: Chapter-IDocumento9 páginasAmalgamation, Absorption & External Reconstruction: Chapter-Iayushi aggarwalAinda não há avaliações

- Legal Aspects of Business 2 MarksDocumento7 páginasLegal Aspects of Business 2 MarksSivagnanaAinda não há avaliações

- Chapter 26 MCQs On International TaxationDocumento26 páginasChapter 26 MCQs On International TaxationSuranjali Tiwari100% (1)

- Xii Mcqs CH - 6 Retirement of A PartnerDocumento6 páginasXii Mcqs CH - 6 Retirement of A PartnerJoanna GarciaAinda não há avaliações

- It MCQDocumento31 páginasIt MCQbigbulleye6078Ainda não há avaliações

- CRV Goodwill MCQDocumento9 páginasCRV Goodwill MCQMital ParmarAinda não há avaliações

- Debentures ProjectDocumento28 páginasDebentures ProjectMT RA100% (1)

- Questions Paper 399-406Documento8 páginasQuestions Paper 399-406s4sahithAinda não há avaliações

- MCQ'S (Multiple Choice Questions)Documento19 páginasMCQ'S (Multiple Choice Questions)Shubham SinghAinda não há avaliações

- MCQS 8Documento6 páginasMCQS 8Muhammad Usama KhanAinda não há avaliações

- LeasingDocumento6 páginasLeasingSamar MalikAinda não há avaliações

- MRO Procurement Solutions A Complete Guide - 2020 EditionNo EverandMRO Procurement Solutions A Complete Guide - 2020 EditionAinda não há avaliações

- 6 - SwapDocumento29 páginas6 - SwapPratik KhetanAinda não há avaliações

- 6 - SwapDocumento29 páginas6 - SwapnishantAinda não há avaliações

- The Philippine Society: Class StructureDocumento4 páginasThe Philippine Society: Class StructureJaymar Sardz VillarminoAinda não há avaliações

- Problem SetDocumento14 páginasProblem SetVin PheakdeyAinda não há avaliações

- Basic Economic Problem PDFDocumento3 páginasBasic Economic Problem PDFMarvin Angcay AmancioAinda não há avaliações

- Benihana of Tokyo Analysis of CaseDocumento3 páginasBenihana of Tokyo Analysis of CaseAli KhanAinda não há avaliações

- Complete Exhibit 3. Provide The Answers in A Table FormatDocumento5 páginasComplete Exhibit 3. Provide The Answers in A Table FormatSajan Jose100% (2)

- Portuguese Economic Performance 1250-2000Documento17 páginasPortuguese Economic Performance 1250-2000Paula Danielle SilvaAinda não há avaliações

- EU: Quicklime, Slaked Lime and Hydraulic Lime - Market Report. Analysis and Forecast To 2020Documento10 páginasEU: Quicklime, Slaked Lime and Hydraulic Lime - Market Report. Analysis and Forecast To 2020IndexBox MarketingAinda não há avaliações

- E-Marketing Plan For WalmartDocumento10 páginasE-Marketing Plan For WalmartAfrin Sumaiya100% (2)

- Lecture 9. ARIMA ModelsDocumento16 páginasLecture 9. ARIMA ModelsPrarthana PAinda não há avaliações

- Syllabi of B.voc. (Retail Management) 2014-15Documento38 páginasSyllabi of B.voc. (Retail Management) 2014-15Bikalpa BoraAinda não há avaliações

- Econ 2000 Exam 2Documento11 páginasEcon 2000 Exam 2Peyton LawrenceAinda não há avaliações

- The Wealth of NationsDocumento2 páginasThe Wealth of NationsJosé CAinda não há avaliações

- Salient Features of Keynes Theory of Income & EmploymentDocumento8 páginasSalient Features of Keynes Theory of Income & EmploymentHabib urrehmanAinda não há avaliações

- 6 Pricing Understanding and Capturing Customer ValueDocumento27 páginas6 Pricing Understanding and Capturing Customer ValueShadi JabbourAinda não há avaliações

- Design in Search of Roots An Indian Experience Uday AthavankarDocumento16 páginasDesign in Search of Roots An Indian Experience Uday AthavankarPriyanka MokkapatiAinda não há avaliações

- ICT London Kill ZoneDocumento3 páginasICT London Kill Zoneazhar500100% (3)

- REAL 4000 Ch3 HW SolutionsDocumento6 páginasREAL 4000 Ch3 HW SolutionsnunyabiznessAinda não há avaliações

- Eco Prakash PDFDocumento10 páginasEco Prakash PDFPanwar SurajAinda não há avaliações

- Term Paper-02 Business MathematicsDocumento8 páginasTerm Paper-02 Business MathematicsZamiar ShamsAinda não há avaliações

- ECO111 - Individual Assignment 03Documento3 páginasECO111 - Individual Assignment 03Khánh LyAinda não há avaliações

- 50 ArticleText 168 1 10 20200331Documento11 páginas50 ArticleText 168 1 10 20200331FajrinAinda não há avaliações

- Handout Porter's Diamond ModelDocumento2 páginasHandout Porter's Diamond ModelAbraham ZeusAinda não há avaliações

- UT Dallas Syllabus For Ob7300.001.07f Taught by Richard Harrison (Harrison)Documento5 páginasUT Dallas Syllabus For Ob7300.001.07f Taught by Richard Harrison (Harrison)UT Dallas Provost's Technology GroupAinda não há avaliações

- Case 5Documento4 páginasCase 5ad1gamer100% (1)

- Icmap Sma SyllabusDocumento2 páginasIcmap Sma SyllabusAdeel AbbasAinda não há avaliações

- Lecture 12 - Recap (Solutions)Documento19 páginasLecture 12 - Recap (Solutions)Stefano BottariAinda não há avaliações

- Topic 1 Introduction To Financial Markets: Universidad Carlos III Financial EconomicsDocumento19 páginasTopic 1 Introduction To Financial Markets: Universidad Carlos III Financial EconomicsalbroAinda não há avaliações

- CV Tarun Das For Monitoring and Evaluation Expert July 2016Documento9 páginasCV Tarun Das For Monitoring and Evaluation Expert July 2016Professor Tarun DasAinda não há avaliações

- Strategy Implementation at Functional LevelDocumento14 páginasStrategy Implementation at Functional Levelpopat vishal100% (1)

- J. Dimaampao Notes PDFDocumento42 páginasJ. Dimaampao Notes PDFAhmad Deedatt Kalbit100% (1)