Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter 03

Enviado por

simmi33Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chapter 03

Enviado por

simmi33Direitos autorais:

Formatos disponíveis

Excel Books

3 1

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Chapt

er

3

New Issue Market

Excel Books

3 2

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

An Initial Public Offer (IPO) is the selling of securities to the public in the

primary market. This Initial Public Offering can be made through the fixed

price method, book-building method or a combination of both. The new

issue market deals with the new securities, which were not previously

available to the investing public. The new issue market encompasses all

institution dealing in fresh claim.

Excel Books

3 3

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Distinctions between new issue market and stock

exchange

The distinction between new issue market and stock exchange can be

made on three grounds.

1. Functional difference

2. Organisational difference

3. Nature of contribution to industrial finance

Excel Books

3 4

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Functions of new issue market

The main function of new issue market is to facilitate transfer resources from

savers to the users. The savers are individuals, commercial banks,

insurance company etc. the users are public limited companies and the

government. The new issue market plays an important role in mobilizing the

funds from the savers and transferring them to borrowers for production

purposes, an important requisite of economic growth. It is not only a platform

for raising finance to establish new enterprises, but also for

expansion/diversification/modernizations of existing units. On this basis, the

new market can be classified as:

1. A market where firms go to the public for the first time through initial

public offering (IPO).

Cont.

Excel Books

3 5

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

2. A market where firms which are already trade raise additional

capital through seasoned equity offering (SEO).

The main function of new issue market can be divided into three service

functions:

1. Origination

2. Underwriting

3. Distribution

Excel Books

3 6

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Methods of floating new issues

The various methods which are used in the floating of securities in the

new issue market are:

Public issues

Offer for sale

Placement

Rights issues

Excel Books

3 7

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Kinds of Offer Documents

An offer document covers all the relevant information to help an investor

in making wise investment decisions.

Draft Prospectus

Draft Letter of Offer

Prospectus

Abridged Prospectus

Shelf Prospectus

Information Memorandum

Red-Herring Prospectus

Excel Books

3 8

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Disadvantages of Floatation

The disadvantages of floatation include the following:

There are considerable costs in floatation and listing.

It takes lot of management's time, before and after floatation

and listing.

The company must comply with the stringent stock exchange

regulations.

It will be necessary to meet the regulatory requirements for

disclosure of information, including details of managerial

remuneration.

A dilution of management control will result from the widely

held shares of the company.

Cont.

Excel Books

3 9

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

The affairs of the company are subject to public scrutiny and

fluctuations in share price may some time cause adverse image in the

public.

Since the costs of floatation are higher, other ways of rising

finance would reduce the cost of funds.

Listed company status will put additional burden on the managerial

staff.

The buying and selling of shares by the directors and other

related persons might attract the provisions of 'insider trading'.

There will always be pressure from shareholders to declare

dividends, which may not be in the interests of the company.

Cont.

Excel Books

3 10

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

The adverse campaigns against the company may drive down the

share price; it is technically called 'bear raids'.

The investors always expect a raise in the share price. The

company's growth and profitability may not afford the increase in

share price always.

Excel Books

3 11

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Promoters

A 'promoter' has been defined as a person or group of persons who are

instrumental in formation of the company, who enable the company to start

its commercial operations by bringing in the necessary funds required for

the concern. The promoters are in the overall control of the company, whose

names are mentioned in the offer document.

'Promoter group' includes promoter, an immediate relative of the

promoter (i.e. any spouse of that person, or any parent, brother, sister

or child of the person or of the spouse).

In case, promoter is a company, a subsidiary or holding company of

that company.

Cont.

Excel Books

3 12

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Any company in which the promoter holds 10% or more of the

equity capital or which holds 10% or more of the equity capital of

the promoter.

Any company in which a group of individuals or companies or

combinations thereof who holds 20% or more of the equity

capital in that company also holds 20% or more of the equity

capital in that company also holds 20% or more of the equity

capital of the issuer company.

In case, the promoter is an individual, any company in which

10% or more of the share capital is held by the promoter or an

immediate relative of the promoter or a firm or HUF in which the

promoter or any one or more of his immediate relative is a member.

Cont.

Excel Books

3 13

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Promoters Contribution

Promoters' contribution in any public issue shall be in accordance with the

following provisions under SEBI's DIP Guidelines:

Unlisted companies

Offers for sale

Listed companies

Composite issues of listed companies

Excel Books

3 14

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Free Pricing of Issues

The basis of issue price is disclosed in the offer document where the issuer

discloses in detail about the qualitative and quantitative factors justifying

the issue price.

Advantages of Free Pricing

The free pricing of capital issues will bring in the following advantages:

The fixation of price is based on the influence of market forces, and it

tends to be a fair price of share. This would lead to healthy

transactions in the market place.

This would boost the government policies as regards globalisation and

liberalization.

Cont.

Excel Books

3 15

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

It helps in development of efficient capital markets with efficient

information.

There would be more flow of funds into the capital market, thereby

development of the economy and faster growth in industrialisation.

Disadvantages of Free Pricing

The free pricing system of public issues is subject to the following

drawbacks:

Even though it appears that the price is fixed freely, it may happen to

be an unrealistic price fixed by the company in consultation with the

lead manager to the issue.

For a developing country like India, absolute freedom from regulations

will lead to unethical practices in the capital market.

In an unregulated market, the risk exposure to the investor is more, and

hence the regulatory mechanism should continue.

Excel Books

3 16

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Lock-in Period

'Lock- in' indicates the freeze on transfer of shares. Lock-in of Minimum

Specified Promoters Contribution in Public Issues

In case of any issue of capital to the public the minimum promoter

contribution shall be locked in for a period of three years.

The lock-in shall start from the date of allotment in the proposed public

issue and the last date of the lock-in shall be reckoned as three years

from the date of commencement of commercial production or the date of

allotment in the public issue, whichever is later.

"The date of commencement of commercial production" means the last

date of the month in which commercial production in a manufacturing

company is expected to commence as stated in the offer document.

Excel Books

3 17

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Qualified Institutional Buyers (QIBs)

Qualified Institutional Buyers are those institutional investors who are

generally perceived to possess expertise and the financial muscle to

evaluate and invest in the capital market. As per the SEBI guidelines,

QIBs shall mean the following:

Public Financial Institution as defined in Section 4A of the

Companies Act, 1956

Scheduled Commercial Banks

Mutual Funds

Foreign Institutional Investors registered with SEBI

Multilateral and bilateral development financial institutions

Cont.

Excel Books

3 18

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Venture capital funds registered with SEBI

Foreign venture capital investors registered with SEBI

State Industrial Development Corporations

Insurance companies registered with the Insurance Regulatory and

Development Authority (IRDA)

Provident Funds with a minimum corpus of Rs. 25 crores

Pension Funds with minimum corpus of Rs. 25 crores.

Excel Books

3 19

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Placement

Under this method, the issue houses or brokers buy the securities outright

with the intention of placing them with their clients afterwards. Here, the

brokers act as almost wholesalers selling them in retail to the public. The

brokers would make profit in the process of reselling to the public. The

issue houses or brokers maintain their own list of client and through

customer contact sell the securities.

Excel Books

3 20

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Book-Building About Book Building

Book-building is basically a capital issuance process used in Initial Public

Offer (IPO), aiding price and demand discovery. It is a process used for

marketing a public offer of equity shares of a company. It is a mechanism

wherein, during the period for which the book for the IPO is open, bids are

collected from investors at various prices, which are above or equal to the

floor price. The process aims at tapping both wholesale and retail

investors. The offer/issue price is then determined after the bid closing

date based on certain evaluation criteria.

Excel Books

3 21

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

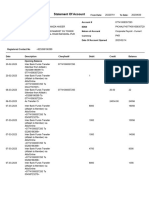

BSE's Book-Building System

Features Fixed Price process Book Building process

Pricing The price at which the securities are

offered/allotted is known in advance to the

investor.

The price at which securities will be offered/allotted

is not known in advance to the investor. Only an

indicative price range is known.

Demand Demand for the securities offered is known

only after the closure of the issue.

Demand for the securities offered can be known

everyday as the book is built.

Payment Payment if made at the time of subscription

whereas refund is given after allocation.

Payment only after allocation.

Excel Books

3 22

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Safety Net

Safety net is a scheme under which a person or a company (generally a

finance company) undertakes to buy shares issued and allotted in a new

issue from the allottees at a stipulated price This is an agreement in

relation to an issue of equity shares. The main feature of the safety net is

to provide the equity investors safety of their investments from fall of the

share price below the issue price.

Excel Books

3 23

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Stockinvest

The stockinvest is a non-negotiable bank instrument issued by the bank in

different denominations. The investor who has a savings or current account

with the bank will obtain the stockinvest in required denominations and will

have to enclose it with the share/debenture application.

Excel Books

3 24

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Rights Issues

If an existing company intends to raise additional funds, it can do so by

borrowing or by issuing new shares. One of the most common methods for a

public company to use is to offer existing shareholders the opportunity to

subscribe further shares. This mode of raising finance is called 'Rights Issues'.

Reasons for a Rights Issue

In times of inflation, the replacement costs of assets will be high; unless

the company can retain cash from substantial profits, the only alternative

is to raise cash from a fresh issue of shares.

For funding expansion projects, a company may make a rights issue.

If a company has a proportion of interest-bearing loan capital, it can

suffer from a squeeze on profits. The company can improve its capital

structure position by obtaining extra share capital.

At a time when the share prices were relatively high, companies found it

easy to persuade their shareholders to subscribe cash for new issues

with a view to expansion by takeover.

Excel Books

3 25

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Long-dated Rights

The long-dated rights are a dilutive anti-takeover device in which rights

are automatically distributed to existing stockholders during hostile

takeover. These 'poison pills' are automatically exercised when during a

hostile takeover, a company or an investor acquires a certain percentage

of shares, thereby diluting the takeover.

Cont.

Excel Books

3 26

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Non-voting Shares

Non-voting shares (NVS) are an innovative instrument for raising funds,

although prevalent in many developed countries for years. The non-voting

shares are closely akin to preference shares that do not carry any voting

rights nor is the dividend payable pre-determined. However, unlike

preference capital, non-voting shares do not carry a pre-determined

dividend. The payoff to the investor for the assumption of higher risk levels

and the compensation for loss of control is the high rate of dividends

payable to them. Companies that are shy of exposure over leveraged

companies, new companies and closely held companies can find NVS

useful. It may find favour with small investors, non-resident Indians,

overseas corporate bodies, mutual funds etc. The investor gains in terms of

higher dividends, purchase at advantageous low price, liquidity and capital

appreciation.

Excel Books

3 27

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT Sudhindra Bhat

Copyright 2008, Sudhindra Bhat

Part I : The Investment Environment

C3

New Issue Market

Bought Out Deal

Bought Out Deal (BOD) is a process of investment by a sponsor or a

syndicate of investors/ sponsors directly in a company. Such direct

investment is being made with an understanding between the company and

the sponsor to go for public offering in a mutually agreed time. Bought out

deal, as the very name suggests, is a type of wholesale of equities by a

company. A company allots shares in full or in lots to sponsors at a price

negotiated between the company and the sponsor(s). After a particular

period of agreed upon between the sponsor and the company the shares

are issued to the public by the sponsor with a premium. The holding cost of

such shares by the sponsor may either be reimbursed by the company, or

the sponsor may absorb the profit in part or full as per the agreement,

arising out of the public offering at a premium. After the public offering, the

shares are listed in one or more stock exchanges.

Você também pode gostar

- Executive SummaryDocumento55 páginasExecutive SummaryTilak SalianAinda não há avaliações

- Equity Markets With Controlling Shareholders: Sidharth Sinha W.P. No. 2011-04-02Documento22 páginasEquity Markets With Controlling Shareholders: Sidharth Sinha W.P. No. 2011-04-02ankitleo18Ainda não há avaliações

- Senior Analyst-FMS Finance MagazineDocumento47 páginasSenior Analyst-FMS Finance MagazineShas RockstoneAinda não há avaliações

- Unit 8 Capital Market I NEW Issues Market: 8.0 ObjectivesDocumento14 páginasUnit 8 Capital Market I NEW Issues Market: 8.0 Objectivesmaria_rajeshiitAinda não há avaliações

- Role of Clearing Corporation in Indian Financial Market DevelopmentDocumento6 páginasRole of Clearing Corporation in Indian Financial Market DevelopmentSanjeev Gupta100% (1)

- Investopedia ExplainsDocumento28 páginasInvestopedia ExplainsPankaj JoshiAinda não há avaliações

- SME Exchange v1Documento8 páginasSME Exchange v1prateekbhandari123Ainda não há avaliações

- Unit 3 Primary MarketDocumento29 páginasUnit 3 Primary MarkettiwariaradAinda não há avaliações

- Stock Maket Direct Listing Management SystemDocumento17 páginasStock Maket Direct Listing Management SystemZig Kapingiri LuijAinda não há avaliações

- Finance of CompanyDocumento16 páginasFinance of CompanyshikhaAinda não há avaliações

- Recent Trend in New Issue MarketDocumento14 páginasRecent Trend in New Issue MarketAbhi SinhaAinda não há avaliações

- Solution Manual For Essentials of Investments 11th by BodieDocumento6 páginasSolution Manual For Essentials of Investments 11th by BodieLandon Bryant100% (35)

- Capital MarketsDocumento12 páginasCapital MarketsSanoj Kumar YadavAinda não há avaliações

- Solution Manual For Essentials of Investments 11th by BodieDocumento21 páginasSolution Manual For Essentials of Investments 11th by Bodievarisse.aphides5aj4tp100% (48)

- Internet Stock Trading and Market Research for the Small InvestorNo EverandInternet Stock Trading and Market Research for the Small InvestorAinda não há avaliações

- Chapter-1: Portfolio Management Services - A StudyDocumento67 páginasChapter-1: Portfolio Management Services - A StudyalbinpalakkaranAinda não há avaliações

- Equity ResearchDocumento7 páginasEquity Researchmohammadhamza563Ainda não há avaliações

- Equity ResearchDocumento7 páginasEquity Researchmohammadhamza563Ainda não há avaliações

- Equity ResearchDocumento14 páginasEquity ResearchMohit ModiAinda não há avaliações

- IntermedariesDocumento27 páginasIntermedariessimmi33Ainda não há avaliações

- Firoz ProjectDocumento104 páginasFiroz ProjectRishi GoyalAinda não há avaliações

- A Synopsis On: Manpreet KaurDocumento18 páginasA Synopsis On: Manpreet Kaurferoz khanAinda não há avaliações

- IPO (Initial Public Offer) : Advantages of Going PublicDocumento67 páginasIPO (Initial Public Offer) : Advantages of Going PublicIsmath FatimaAinda não há avaliações

- A Project Report On Ratio Analysis at Il&Fs Invest Smart Mba Project FinanceDocumento88 páginasA Project Report On Ratio Analysis at Il&Fs Invest Smart Mba Project Financesatish pawarAinda não há avaliações

- What Is 'Fundamental Analysis': Intrinsic Value Macroeconomic Factors Current PriceDocumento9 páginasWhat Is 'Fundamental Analysis': Intrinsic Value Macroeconomic Factors Current Pricedhwani100% (1)

- Next 4Documento10 páginasNext 4Nurhasanah Asyari100% (1)

- Basic Concepts: Mba Iii SemesterDocumento11 páginasBasic Concepts: Mba Iii SemesterDrDhananjhay GangineniAinda não há avaliações

- Project 2 - Securities Law 1Documento16 páginasProject 2 - Securities Law 1Zaii ZaiAinda não há avaliações

- Listing and DelistingDocumento20 páginasListing and DelistingTarun Lohar50% (2)

- Equity Research On Paint and FMCG SectorDocumento47 páginasEquity Research On Paint and FMCG SectornehagadgeAinda não há avaliações

- On-Line Chapter 3Documento16 páginasOn-Line Chapter 3X TriphersAinda não há avaliações

- Chapter 1 - Capital Market in India: IntroductionDocumento56 páginasChapter 1 - Capital Market in India: IntroductionshivtyAinda não há avaliações

- Primarymarket Vs SecondarymarketDocumento18 páginasPrimarymarket Vs SecondarymarketAbhishek Singh100% (1)

- SSRN Id2980791Documento6 páginasSSRN Id2980791rafachidazAinda não há avaliações

- Assignment On Capital Market Prepared ForDocumento8 páginasAssignment On Capital Market Prepared ForRazwana AishyAinda não há avaliações

- Evaluation Chapter 1 (Page 10-11)Documento6 páginasEvaluation Chapter 1 (Page 10-11)inter 14Ainda não há avaliações

- Evaluation of Stock Market Efficiency: A Case Study of Chittagong Stock Exchange (CSE)Documento19 páginasEvaluation of Stock Market Efficiency: A Case Study of Chittagong Stock Exchange (CSE)Pranit AutiAinda não há avaliações

- Investment ManagementDocumento12 páginasInvestment ManagementRamiEssoAinda não há avaliações

- Overview of Indian Securities Market: Chapter-1Documento100 páginasOverview of Indian Securities Market: Chapter-1tamangargAinda não há avaliações

- Business Plan Report On Stock Market IndustryDocumento6 páginasBusiness Plan Report On Stock Market IndustryNikhilkumar TejaniAinda não há avaliações

- Relationship of New Issue Market and Stock Exchange-Skill TestDocumento26 páginasRelationship of New Issue Market and Stock Exchange-Skill TestbhavanabhuratAinda não há avaliações

- Unit 2 BankingDocumento9 páginasUnit 2 BankingSakshi BorkarAinda não há avaliações

- Current Stock Market Scenario-Delisting OffersDocumento4 páginasCurrent Stock Market Scenario-Delisting OffersSAinda não há avaliações

- Ijrfm Volume 2, Issue 5 (May 2012) (ISSN 2231-5985) A Study On Market Performance of Selected Telecommunication Companies in IndiaDocumento19 páginasIjrfm Volume 2, Issue 5 (May 2012) (ISSN 2231-5985) A Study On Market Performance of Selected Telecommunication Companies in IndiaShubham GuptaAinda não há avaliações

- Capital MarketDocumento56 páginasCapital Marketsaurabh khatate100% (2)

- Wealth Management of India Info LineDocumento68 páginasWealth Management of India Info LineHarrish KumarAinda não há avaliações

- Chapter 1 - Capital Market in India: IntroductionDocumento53 páginasChapter 1 - Capital Market in India: IntroductionHitesh PaliwalAinda não há avaliações

- IpoDocumento71 páginasIpoBhumi GhoriAinda não há avaliações

- Krishna G. Palepu, Paul M. Healy, Erik Peek - Business Analysis and Valuation - IFRS Edition-Cengage Learning (2013) - Chapter 1 PDFDocumento42 páginasKrishna G. Palepu, Paul M. Healy, Erik Peek - Business Analysis and Valuation - IFRS Edition-Cengage Learning (2013) - Chapter 1 PDFTrần Beta100% (1)

- Investment CH 05Documento10 páginasInvestment CH 05tesfaAinda não há avaliações

- Investors Attitude Towards Primary Market - BrijenderDocumento56 páginasInvestors Attitude Towards Primary Market - BrijenderGaurav GuptaAinda não há avaliações

- Role of Capital Market in Developing Economy: Sakshi TomarDocumento18 páginasRole of Capital Market in Developing Economy: Sakshi Tomarsakshi tomarAinda não há avaliações

- In TermsDocumento5 páginasIn TermsVibhu BabbarAinda não há avaliações

- Ipo Guide PDFDocumento9 páginasIpo Guide PDFahmedAinda não há avaliações

- 8915 - FinanceDocumento11 páginas8915 - FinanceAhmed AwaisAinda não há avaliações

- BBA 3005 Corporate Finance (Assignment)Documento17 páginasBBA 3005 Corporate Finance (Assignment)VentusAinda não há avaliações

- Equity Research On Ultratech CementDocumento17 páginasEquity Research On Ultratech CementViral GalaAinda não há avaliações

- MS 44Documento12 páginasMS 44Rajni KumariAinda não há avaliações

- Emerging FinTech: Understanding and Maximizing Their BenefitsNo EverandEmerging FinTech: Understanding and Maximizing Their BenefitsAinda não há avaliações

- Behavioural FinanceDocumento8 páginasBehavioural Financesimmi33Ainda não há avaliações

- Project FinancingDocumento3 páginasProject FinancingSimmi KhuranaAinda não há avaliações

- Capital BudgetingDocumento12 páginasCapital Budgetingsimmi33Ainda não há avaliações

- Project ImplementationDocumento8 páginasProject Implementationsimmi33Ainda não há avaliações

- Ch-6 Expected Utility As A Basis For Decision-Making The Evolution of TheoriesDocumento17 páginasCh-6 Expected Utility As A Basis For Decision-Making The Evolution of Theoriessimmi33100% (2)

- Tools and Techniques of Project ManagementDocumento4 páginasTools and Techniques of Project Managementsimmi33Ainda não há avaliações

- Demand ForecastingDocumento4 páginasDemand Forecastingsimmi33Ainda não há avaliações

- Behavioural FinanceDocumento8 páginasBehavioural Financesimmi33Ainda não há avaliações

- Capital StructureDocumento7 páginasCapital Structuresimmi33Ainda não há avaliações

- Banking and Indian Financialt200813 PDFDocumento425 páginasBanking and Indian Financialt200813 PDFsimmi33Ainda não há avaliações

- Foreign Direct InvestmentDocumento4 páginasForeign Direct Investmentsimmi33Ainda não há avaliações

- Case Studies of Cost and Works AccountingDocumento17 páginasCase Studies of Cost and Works AccountingShalini Srivastav50% (2)

- Forward Rate AgreementDocumento19 páginasForward Rate Agreementsimmi33Ainda não há avaliações

- Financial InstrumentsDocumento19 páginasFinancial InstrumentsRamswaroop ChoudharyAinda não há avaliações

- Ch-6 Expected Utility As A Basis For Decision-Making The Evolution of TheoriesDocumento17 páginasCh-6 Expected Utility As A Basis For Decision-Making The Evolution of Theoriessimmi33100% (2)

- Project OrganizationDocumento8 páginasProject Organizationsimmi33Ainda não há avaliações

- Elasticity of DemandDocumento41 páginasElasticity of Demandsimmi33Ainda não há avaliações

- Financial AnalysisDocumento5 páginasFinancial Analysissimmi33Ainda não há avaliações

- Project ImplementationDocumento8 páginasProject Implementationsimmi33Ainda não há avaliações

- Tools and Techniques of Project ManagementDocumento4 páginasTools and Techniques of Project Managementsimmi33Ainda não há avaliações

- Case Studies of Cost and Works AccountingDocumento17 páginasCase Studies of Cost and Works AccountingShalini Srivastav50% (2)

- SharesDocumento16 páginasSharessimmi33Ainda não há avaliações

- Case Study Punjab National BankDocumento3 páginasCase Study Punjab National BankHirenGandhiAinda não há avaliações

- Feasibility Study and Preparation of Feasibility ReportDocumento3 páginasFeasibility Study and Preparation of Feasibility Reportutcm77Ainda não há avaliações

- Responsibility AccountingDocumento12 páginasResponsibility Accountingsimmi33Ainda não há avaliações

- Sources of Long-Term FinanceDocumento26 páginasSources of Long-Term Financerrajsharmaa100% (2)

- Behavioural FinanceDocumento8 páginasBehavioural Financesimmi33Ainda não há avaliações

- Indian Banking SystemDocumento13 páginasIndian Banking Systemsimmi33Ainda não há avaliações

- Target CostingDocumento5 páginasTarget Costingsimmi33Ainda não há avaliações

- Life Cycle CostingDocumento14 páginasLife Cycle CostingMUNAWAR ALI87% (15)

- GDP and gnp1Documento18 páginasGDP and gnp1AakanshasoniAinda não há avaliações

- Site Rental 24 Dec 2021Documento16 páginasSite Rental 24 Dec 2021Wega BluemartAinda não há avaliações

- Creating Value Beyond The Deal: Financial Services: Maximise Success by Keeping An Intense Focus On Three Key ElementsDocumento24 páginasCreating Value Beyond The Deal: Financial Services: Maximise Success by Keeping An Intense Focus On Three Key ElementsNick HuAinda não há avaliações

- ESG Syllabus V3 16062021finalDocumento13 páginasESG Syllabus V3 16062021finalsaabiraAinda não há avaliações

- Star Founder Raveendran Broke Down in Tears As Crises Engulfed Byju'sDocumento14 páginasStar Founder Raveendran Broke Down in Tears As Crises Engulfed Byju'sGAPL International SalesAinda não há avaliações

- Negen Angel Fund FAQsDocumento8 páginasNegen Angel Fund FAQsAnil Kumar Reddy ChinthaAinda não há avaliações

- Chapter No. 2Documento46 páginasChapter No. 2Muhammad SalmanAinda não há avaliações

- AC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and CommentariesDocumento69 páginasAC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and Commentaries전민건Ainda não há avaliações

- Statement of AccountDocumento7 páginasStatement of AccountHamza CollectionAinda não há avaliações

- FenchelDocumento20 páginasFenchelgeertrui1234321100% (1)

- Q2 W1 General MathematicsDocumento39 páginasQ2 W1 General MathematicsSamantha ManibogAinda não há avaliações

- Quiz in ObligationDocumento8 páginasQuiz in ObligationSherilyn BunagAinda não há avaliações

- 21127, Ahmad, Assignment 5, IFDocumento5 páginas21127, Ahmad, Assignment 5, IFmuhammad ahmadAinda não há avaliações

- Sawsan Hassan Al SaffarDocumento3 páginasSawsan Hassan Al SaffarwaminoAinda não há avaliações

- The Karur Vysya Bank Limited Writeup Pankaj SinghDocumento40 páginasThe Karur Vysya Bank Limited Writeup Pankaj SinghPankaj Singh100% (2)

- Basic Details: Indian Oil Corporation Eprocurement PortalDocumento3 páginasBasic Details: Indian Oil Corporation Eprocurement PortalamitjustamitAinda não há avaliações

- List of Courses 20-21 - 1Documento19 páginasList of Courses 20-21 - 1Why WhyAinda não há avaliações

- SYBAF Project Guidelines: 1) AuditingDocumento6 páginasSYBAF Project Guidelines: 1) AuditingBhavya RatadiaAinda não há avaliações

- How To Understand Payment Industry in BrazilDocumento32 páginasHow To Understand Payment Industry in BrazilVictor SantosAinda não há avaliações

- Technical Indicators: - Stochastic Oscillator - Relative Strength Index - Moving Average Convergence-DivergenceDocumento32 páginasTechnical Indicators: - Stochastic Oscillator - Relative Strength Index - Moving Average Convergence-DivergenceChartSniperAinda não há avaliações

- Ipsas 24 BudgetDocumento2 páginasIpsas 24 Budgetritunath100% (1)

- Work PaystubDocumento1 páginaWork Paystubjoelryan2019Ainda não há avaliações

- LAON Recovery-management-Of Andhra BankDocumento87 páginasLAON Recovery-management-Of Andhra Banklakshmikanth100% (1)

- Cash Flow Statement 2016-2020Documento8 páginasCash Flow Statement 2016-2020yip manAinda não há avaliações

- 001I7D7441643896296Documento1 página001I7D7441643896296Shamantha ManiAinda não há avaliações

- Iskal ArnoDocumento37 páginasIskal ArnoRuan0% (1)

- Appendix FDocumento17 páginasAppendix FD3 Pajak 315Ainda não há avaliações

- Banking AwarenessDocumento130 páginasBanking AwarenessDAX LABORATORY100% (2)

- IBO 3 - 10yearsDocumento28 páginasIBO 3 - 10yearsManuAinda não há avaliações

- Partnership AccountDocumento9 páginasPartnership AccountBamidele AdegboyeAinda não há avaliações