Escolar Documentos

Profissional Documentos

Cultura Documentos

Topic 5a - Procurement and Inventory Control

Enviado por

faz143Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Topic 5a - Procurement and Inventory Control

Enviado por

faz143Direitos autorais:

Formatos disponíveis

10/15/2014 1

Operations

Management

Topic 5 Procurement

and Inventory Control

10/15/2014 2

Outline

Functions of Inventory

Types of Inventory

Inventory Management

ABC Analysis

Record Accuracy

Cycle Counting

Control of Service Inventories

Inventory Models

Independent vs. Dependent Demand

Holding, Ordering, and Setup Costs

10/15/2014 NY- KJP 585 2009 3

Outline Continued

Inventory Models for Independent

Demand

The Basic Economic Order Quantity

(EOQ) Model

Minimizing Costs

Reorder Points

Quantity Discount Models

Safety Stock

10/15/2014 NY- KJP 585 2009 4

Learning Objectives

When you complete this chapter you

should be able to:

1. Conduct an ABC analysis

2. Explain and use cycle counting

3. Explain and use the EOQ model for

independent inventory demand

4. Compute a reorder point and safety

stock

5. Explain and use the quantity

discount model

10/15/2014 NY- KJP 585 2009 5

Inventory

One of the most expensive assets

of many companies representing as

much as 50% of total invested

capital

Operations managers must balance

inventory investment and customer

service

10/15/2014 NY- KJP 585 2009 6

Functions of Inventory

1. To decouple or separate various

parts of the production process

2. To decouple the firm from

fluctuations in demand and

provide a stock of goods that will

provide a selection for customers

3. To take advantage of quantity

discounts

4. To hedge against inflation

10/15/2014 NY- KJP 585 2009 7

Types of Inventory

Raw material

Purchased but not processed

Work-in-process

Undergone some change but not completed

A function of cycle time for a product

Maintenance/repair/operating (MRO)

Necessary to keep machinery and processes

productive

Finished goods

Completed product awaiting shipment

10/15/2014 NY- KJP 585 2009 8

The Material Flow Cycle

Figure 12.1

Input Wait for Wait to Move Wait in queue Setup Run Output

inspection be moved time for operator time time

Cycle time

95% 5%

10/15/2014 NY- KJP 585 2009 9

Inventory Management

How inventory items can be

classified

How accurate inventory records

can be maintained

10/15/2014 10

ABC Analysis

Divides inventory into three classes

based on annual dollar volume

Class A - high annual dollar volume

Class B - medium annual dollar

volume

Class C - low annual dollar volume

Used to establish policies that focus

on the few critical parts and not the

many trivial ones not realistic to monitor

inexpensive items with the same intensity as very expensive items

10/15/2014 NY- KJP 585 2009 11

ABC Analysis

A Items

B Items

C Items

P

e

r

c

e

n

t

o

f

a

n

n

u

a

l

d

o

l

l

a

r

u

s

a

g

e

80

70

60

50

40

30

20

10

0

| | | | | | | | | |

10 20 30 40 50 60 70 80 90 100

Percent of inventory items

Figure 12.2

To determine annual dollar volume for ABC analysis

Annual Demand of

each inventory items x Cost per unit

10/15/2014 12

Example of ABC Analysis

Item

Stock

Number

Percent of

Number of

Items

Stocked

Annual

Volume

(units) x

Unit

Cost =

Annual

Dollar

Volume

Percent of

Annual

Dollar

Volume Class

#10286 20% 1,000 $ 90.00 $ 90,000 38.8% A

#11526 500 154.00 77,000 33.2% A

#12760 1,550 17.00 26,350 11.3% B

#10867 30% 350 42.86 15,001 6.4% B

#10500 1,000 12.50 12,500 5.4% B

72%

23%

Silicon Chips, Inc., maker of superfast DRAM chips, wants to categorize its

10 major inventory items using ABC analysis.

10/15/2014 NY- KJP 585 2009 13

Example of ABC Analysis

Item

Stock

Number

Percent of

Number of

Items

Stocked

Annual

Volume

(units) x

Unit

Cost =

Annual

Dollar

Volume

Percent of

Annual

Dollar

Volume Class

#12572 600 $ 14.17 $ 8,502 3.7% C

#14075 2,000 .60 1,200 .5% C

#01036 50% 100 8.50 850 .4% C

#01307 1,200 .42 504 .2% C

#10572 250 .60 150 .1% C

8,550 $232,057 100.0%

5%

10/15/2014 NY- KJP 585 2009 14

ABC Analysis

Other criteria than annual dollar

volume may be used

Anticipated engineering changes

Delivery problems

Quality problems

High unit cost

10/15/2014 NY- KJP 585 2009 15

ABC Analysis

Policies employed may include

More emphasis on supplier

development for A items

Tighter physical inventory control for

A items

More care in forecasting A items

10/15/2014 NY- KJP 585 2009 16

Record Accuracy

Accurate records are a critical ingredient in

production and inventory systems

Allows organization to focus on what is

needed

Necessary to make precise decisions about

ordering, scheduling, and shipping

Incoming and outgoing record keeping must

be accurate

Stockrooms should be secure

10/15/2014 NY- KJP 585 2009 17

Cycle Counting

Items are counted and records updated on a

periodic basis

Often used with ABC analysis

to determine cycle

Has several advantages

Eliminates shutdowns and interruptions

Eliminates annual inventory adjustment

Trained personnel audit inventory accuracy

Allows causes of errors to be identified and

corrected

Maintains accurate inventory records

10/15/2014 NY- KJP 585 2009 18

Cycle Counting Example

5,000 items in inventory, 500 A items, 1,750 B items, 2,750 C

items

Policy is to count A items every month (20 working days), B

items every quarter (60 days), and C items every six months

(120 days)

Item

Class Quantity Cycle Counting Policy

Number of Items

Counted per Day

A 500 Each month 500/20 = 25/day

B 1,750 Each quarter 1,750/60 = 29/day

C 2,750 Every 6 months 2,750/120 = 23/day

77/day

10/15/2014 NY- KJP 585 2009 19

Control of Service Inventories

Can be a critical component

of profitability

Losses may come from

shrinkage or pilferage

Applicable techniques include

1. Good personnel selection, training, and

discipline

2. Tight control on incoming shipments

3. Effective control on all goods leaving

facility

10/15/2014 NY- KJP 585 2009 20

Independent Versus

Dependent Demand

Independent demand - the demand for

item is independent of the demand for any other item in

inventory

Demand for items used by external customers

Cars, appliances, computers, and houses are examples of

independent demand inventory

Dependent demand - the demand for

item is dependent upon the demand for some other item

in the inventory

Demand for items used to produce final products

Tires for autos are a dependent demand item

10/15/2014 NY- KJP 585 2009 21

Holding, Ordering, and Setup

Costs

Holding costs - the costs of holding

or carrying inventory over time

Ordering costs - the costs of

placing an order and receiving

goods

Setup costs - cost to prepare a

machine or process for

manufacturing an order

10/15/2014 NY- KJP 585 2009 22

Holding Costs

Category

Cost (and range) as

a Percent of

Inventory Value

Housing costs (building rent or depreciation,

operating costs, taxes, insurance)

6% (3 - 10%)

Material handling costs (equipment lease or

depreciation, power, operating cost)

3% (1 - 3.5%)

Labor cost 3% (3 - 5%)

Investment costs (borrowing costs, taxes, and

insurance on inventory)

11% (6 - 24%)

Pilferage, space, and obsolescence 3% (2 - 5%)

Overall carrying cost 26%

Table 12.1

10/15/2014 NY- KJP 585 2009 23

Holding Costs

Category

Cost (and range) as

a Percent of

Inventory Value

Housing costs (building rent or depreciation,

operating costs, taxes, insurance)

6% (3 - 10%)

Material handling costs (equipment lease or

depreciation, power, operating cost)

3% (1 - 3.5%)

Labor cost 3% (3 - 5%)

Investment costs (borrowing costs, taxes, and

insurance on inventory)

11% (6 - 24%)

Pilferage, space, and obsolescence 3% (2 - 5%)

Overall carrying cost 26%

Table 12.1

10/15/2014 NY- KJP 585 2009 24

Inventory Models for

Independent Demand

Basic economic order quantity

(EOQ)

Production order quantity

Quantity discount model

Need to determine when and how

much to order

10/15/2014 NY- KJP 585 2009 25

Basic EOQ Model

1. Demand is known, constant, and

independent

2. Lead time is known and constant

3. Receipt of inventory is instantaneous and

complete

4. Quantity discounts are not possible

5. Only variable costs are setup and holding

6. Stockouts can be completely avoided

Important assumptions

10/15/2014 NY- KJP 585 2009 26

Inventory Usage Over Time

Figure 12.3

Order

quantity = Q

(maximum

inventory

level)

Usage rate

Average

inventory

on hand

Q

2

Minimum

inventory

I

n

v

e

n

t

o

r

y

l

e

v

e

l

Time

0

10/15/2014 NY- KJP 585 2009 27

Minimizing Costs

Objective is to minimize total costs

Table 11.5

A

n

n

u

a

l

c

o

s

t

Order quantity

Curve for total

cost of holding

and setup

Holding cost

curve

Setup (or order)

cost curve

Minimum

total cost

Optimal order

quantity (Q*)

10/15/2014 28

The EOQ Model

Q = Number of pieces per order

Q* = Optimal number of pieces per order (EOQ)

D = Annual demand in units for the inventory item

S = Setup or ordering cost for each order

H = Holding or carrying cost per unit per year

Annual setup cost = (Number of orders placed per year)

x (Setup or order cost per order)

Annual demand

Number of units in each order

Setup or order

cost per order

=

Annual setup cost = S

D

Q

= (S)

D

Q

10/15/2014 NY- KJP 585 2009 29

The EOQ Model

Q = Number of pieces per order

Q* = Optimal number of pieces per order (EOQ)

D = Annual demand in units for the inventory item

S = Setup or ordering cost for each order

H = Holding or carrying cost per unit per year

Annual holding cost = (Average inventory level)

x (Holding cost per unit per year)

Order quantity

2

= (Holding cost per unit per year)

= (H)

Q

2

Annual setup cost = S

D

Q

Annual holding cost = H

Q

2

30

The EOQ Model

Optimal order quantity, Q* is found when annual setup

cost equals annual holding cost

Annual setup cost = S

D

Q

Annual holding cost = H

Q

2

D

Q

S = H

Q

2

Solving for Q*

2DS = Q

2

H

Q

2

= 2DS/H

Q* = 2DS/H

Total annual inventory cost = annual setup cost + annual holding cost

TC =

D

Q

S + H

Q

2

TC may also be written to include the actual cost of the material purchased.

where P is the unit purchase

price of the material.

A company that markets a type of needles to

hospitals would like to reduce its inventory cost by

determining the optimal number of needles to obtain

per order. The annual demand is 1,000 units; the set-

up or ordering cost is RM10 per order; and the

holding cost per unit per year is RM0.50.

i. Calculate the optimal number of units per order.

ii. Assuming a 250-day working year, find N and T.

iii.Determine the Total annual inventory cost.

10/15/2014 31

An EOQ Example

10/15/2014 NY- KJP 585 2009 32

An EOQ Example

i) Determine optimal number of needles to order, Q*

D = 1,000 units

S = $10 per order

H = $.50 per unit per year

Q* =

2DS

H

Q* =

2(1,000)(10)

0.50

= 40,000 = 200 units

10/15/2014 NY- KJP 585 2009 33

An EOQ Example

ii) Determine expected number of orders, N

D = 1,000 units Q* = 200 units

S = $10 per order

H = $.50 per unit per year

= N = =

Expected

number of

orders

Demand

Order quantity

D

Q*

N = = 5 orders per year

1,000

200

10/15/2014 NY- KJP 585 2009 34

An EOQ Example

ii) Determine expected time between orders, T

D = 1,000 units Q* = 200 units

S = $10 per order N = 5 orders per year

H = $.50 per unit per year

= T =

Expected

time between

orders

Number of working

days per year

N

T = = 50 days between orders

250

5

10/15/2014 NY- KJP 585 2009 35

An EOQ Example

iii) Determine total annual inventory cost, TC

D = 1,000 units Q* = 200 units

S = $10 per order N = 5 orders per year

H = $.50 per unit per year T = 50 days

Total annual cost = Setup cost + Holding cost

TC = S + H

D

Q

Q

2

TC = ($10) + ($.50)

1,000

200

200

2

TC = (5)($10) + (100)($.50) = $50 + $50 = $100

10/15/2014 NY- KJP 585 2009 36

Robust Model

The EOQ model is robust

It works even if all parameters

and assumptions are not met

The total cost curve is relatively

flat in the area of the EOQ

10/15/2014 NY- KJP 585 2009 37

An EOQ Example

Management underestimated demand by 50%

D = 1,000 units Q* = 200 units

S = $10 per order N = 5 orders per year

H = $.50 per unit per year T = 50 days

TC = S + H

D

Q

Q

2

TC = ($10) + ($.50) = $75 + $50 = $125

1,500

200

200

2

1,500 units

Total annual cost increases by only 25%

10/15/2014 NY- KJP 585 2009 38

An EOQ Example

Actual EOQ for new demand is 244.9 units

D = 1,000 units Q* = 244.9 units

S = $10 per order N = 5 orders per year

H = $.50 per unit per year T = 50 days

TC = S + H

D

Q

Q

2

TC = ($10) + ($.50)

1,500

244.9

244.9

2

1,500 units

TC = $61.24 + $61.24 = $122.48

Only 2% less

than the total

cost of $125

when the

order quantity

was 200

10/15/2014 39

Reorder Points

EOQ answers the how much question

The reorder point (ROP) tells when to

order (inventory level (point) at which action is taken to replenish the stocked item )

ROP =

Lead time for a

new order in days

Demand

per day

= d x L

d =

D

Number of working days in a year

Where as;

40

Reorder Point Curve

Q*

ROP

(units)

I

n

v

e

n

t

o

r

y

l

e

v

e

l

(

u

n

i

t

s

)

Time (days)

Figure 12.5

Lead time =L

Slope =units/day =d

* Note that the Lead time (L) in diagram is the length of

time between the time an order is placed and the time

the stock is arrived or received.

Note that earlier, it was assumed that a firm will place

an order when the inventory level for a particular item

reaches 0 and that it will receive the ordered item

immediately.

However, usually some amount of time is needed

between placement and receipt of an order. This is

called lead time or delivery time and can be as short

as a few hours or as long as months.

An apple distributor has a demand of

8,000 iPods per year. The firm operates

a 250-day working year. On average,

delivery of an order takes 3 working

days. Find RoP.

10/15/2014 NY- KJP 585 2009 41

Reorder Point Example

10/15/2014

42

Reorder Point Example

Demand = 8,000 iPods per year

250 working day year

Lead time for orders is 3 working days

ROP = d x L

d =

D

Number of working days in a year

= 8,000/250 = 32 units

= 32 units per day x 3 days = 96 units

i.e. When stock drops to 96, an order should be placed. And the order

will arrive 3 days later just as the firms stock is depleted.

10/15/2014 43

Quantity Discount Models

Reduced prices are often available when

larger quantities are purchased

Trade-off is between reduced product cost

and increased holding cost

Total cost = Setup cost + Holding cost + Product cost

TC = S + H + PD

D

Q

Q

2

In order to lower TC, we need to balance between

reduced product cost (as a result of increasing the order

quantity to make use of the available discounts) and increased

holding cost (more order quantity will result in more inventory)

10/15/2014 NY- KJP 585 2009 44

Quantity Discount Models

If holding cost is given as a percentage of the unit price, we

have H = I x P where P = unit price and I = % of unit price

Then,

Note that with Quantity Discount, EOQ may not be the best

order size.

After finding Q*, we need to keep on trying at lower price

breaks until the quantity that results in the lowest TC is

found.

Q* =

2DS

IP

10/15/2014 NY- KJP 585 2009 45

Quantity Discount Models

Discount

Number Discount Quantity Discount (%)

Discount

Price (P)

1 0 to 999 no discount $5.00

2 1,000 to 1,999 4 $4.80

3 2,000 and over 5 $4.75

Table 12.2

A typical quantity discount schedule

10/15/2014 NY- KJP 585 2009 46

Quantity Discount Models

1. For each discount, calculate Q*

2. If Q* for a discount doesnt qualify,

choose the smallest possible order size

to get the discount

3. Compute the total cost for each Q* or

adjusted value from Step 2

4. Select the Q* that gives the lowest total

cost

Steps in analyzing a quantity discount

10/15/2014 NY- KJP 585 2009 47

Quantity Discount Models

1,000 2,000

T

o

t

a

l

c

o

s

t

$

0

Order quantity

Q* for discount 2 is below the allowable range at point a

and must be adjusted upward to 1,000 units at point b

a

b

1st price

break

2nd price

break

Total cost

curve for

discount 1

Total cost curve for discount 2

Total cost curve for discount 3

Figure 12.7

Wohls Discount Store stocks toy race car. Recently, the

store has been given a quantity discount schedule for

these cars. This quantity schedule was shown below.

Ordering cost is $49.00 per order, annual demand is

5,000 race cars, and inventory carrying charge, as a

percent of cost is, I, is 20% or 0.2.

What order quantity will minimize

the total inventory cost?

10/15/2014 48

Quantity Discount Example

10/15/2014 NY- KJP 585 2009 49

Quantity Discount Example

Calculate Q* for every discount

Q* =

2DS

IP

Q

1

* = = 700 cars/order

2(5,000)(49)

(.2)(5.00)

Q

2

* = = 714 cars/order

2(5,000)(49)

(.2)(4.80)

Q

3

* = = 718 cars/order

2(5,000)(49)

(.2)(4.75)

10/15/2014 NY- KJP 585 2009 50

Quantity Discount Example

Calculate Q* for every discount

Q* =

2DS

IP

Q

1

* = = 700 cars/order

2(5,000)(49)

(.2)(5.00)

Q

2

* = = 714 cars/order

2(5,000)(49)

(.2)(4.80)

Q

3

* = = 718 cars/order

2(5,000)(49)

(.2)(4.75)

1,000 adjusted

2,000 adjusted

10/15/2014 51

Quantity Discount Example

Discount

Number

Unit

Price

Order

Quantity

Annual

Product

Cost

Annual

Ordering

Cost

Annual

Holding

Cost Total

1 $5.00 700 $25,000 $350 $350 $25,700

2 $4.80 1,000 $24,000 $245 $480 $24,725

3 $4.75 2,000 $23.750 $122.50 $950 $24,822.50

Table 12.3

Choose the price and quantity that gives

the lowest total cost

Buy 1,000 units at $4.80 per unit

10/15/2014 NY- KJP 585 2009 52

Probabilistic Models and Safety

Stock

Used when demand is not constant or

certain

Use safety stock to achieve a desired

service level and avoid stockouts

ROP = d x L + ss

Annual stockout costs = the sum of the units short

x the probability x the stockout cost/unit

x the number of orders per year

10/15/2014 NY- KJP 585 2009 53

Safety Stock Example

Number of Units Probability

30 .2

40 .2

ROP 50 .3

60 .2

70 .1

1.0

ROP = 50 units Stockout cost = $40 per frame

Orders per year = 6 Carrying cost = $5 per frame per year

10/15/2014 NY- KJP 585 2009 54

Safety Stock Example

ROP = 50 units Stockout cost = $40 per frame

Orders per year = 6 Carrying cost = $5 per frame per year

Safety

Stock

Additional

Holding Cost Stockout Cost

Total

Cost

20 (20)($5) = $100 $0 $100

10 (10)($5) = $ 50 (10)(.1)($40)(6) = $240 $290

0 $ 0 (10)(.2)($40)(6) + (20)(.1)($40)(6) = $960 $960

A safety stock of 20 frames gives the lowest total cost

ROP = 50 + 20 = 70 frames

Você também pode gostar

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesAinda não há avaliações

- Inventory MGMTDocumento77 páginasInventory MGMTKalavathi KalyanaramanAinda não há avaliações

- Practical Guide To Production Planning & Control [Revised Edition]No EverandPractical Guide To Production Planning & Control [Revised Edition]Nota: 1 de 5 estrelas1/5 (1)

- OPM101Chapter12 000Documento51 páginasOPM101Chapter12 000N Satish MohanAinda não há avaliações

- Chapter 7 - Inventory ManagementDocumento52 páginasChapter 7 - Inventory ManagementTrey Holton100% (2)

- Earned Value Project Management (Fourth Edition)No EverandEarned Value Project Management (Fourth Edition)Nota: 1 de 5 estrelas1/5 (2)

- OMch 12Documento19 páginasOMch 12Javier AlvarezAinda não há avaliações

- Inventory Management: Anoop P. SDocumento45 páginasInventory Management: Anoop P. Sgowthamam0809Ainda não há avaliações

- Inventory Management PPT at BEC DOMSDocumento51 páginasInventory Management PPT at BEC DOMSBabasab Patil (Karrisatte)0% (1)

- 7.0 Inventory ManagementDocumento24 páginas7.0 Inventory Managementrohanfyaz00Ainda não há avaliações

- EOQDocumento20 páginasEOQPavanAinda não há avaliações

- Inventory Management - Lecture 15.04.2015Documento56 páginasInventory Management - Lecture 15.04.2015Asia Oleśków SzłapkaAinda não há avaliações

- Supply Chain Management: Indian Institute of Management LucknowDocumento28 páginasSupply Chain Management: Indian Institute of Management LucknowParidhi VarmaAinda não há avaliações

- Inventory Control ModelsDocumento55 páginasInventory Control ModelsShweta SinghAinda não há avaliações

- Inventory ManagementDocumento30 páginasInventory ManagementAbhayVarunKesharwaniAinda não há avaliações

- ch05 PPTDocumento23 páginasch05 PPThusnainttsAinda não há avaliações

- Inventory ManagementDocumento52 páginasInventory Managementsatyamchoudhary2004Ainda não há avaliações

- 157 - 25225 - EA435 - 2013 - 1 - 2 - 1 - CHAPTER - 2 Inventory MangementDocumento59 páginas157 - 25225 - EA435 - 2013 - 1 - 2 - 1 - CHAPTER - 2 Inventory MangementKarthickKrishnaAinda não há avaliações

- Inventory ControlDocumento34 páginasInventory ControlsantoshskpurAinda não há avaliações

- Unit 4. Inventory Analysis and ControlDocumento57 páginasUnit 4. Inventory Analysis and Controlskannanmec100% (1)

- Inventory ManagementDocumento27 páginasInventory ManagementNandini SuriAinda não há avaliações

- Independent Demand Inventory Management: by 3 Edition © Wiley 2007 Powerpoint Presentation by R.B. Clough - UnhDocumento49 páginasIndependent Demand Inventory Management: by 3 Edition © Wiley 2007 Powerpoint Presentation by R.B. Clough - Unhprasanth_raj_2Ainda não há avaliações

- Chap 06 Inventory Control ModelsDocumento112 páginasChap 06 Inventory Control ModelsFatma El TayebAinda não há avaliações

- Inventory ControlDocumento36 páginasInventory ControlAnkur YashAinda não há avaliações

- Introduction To Inventory ManagementDocumento71 páginasIntroduction To Inventory ManagementJane LobAinda não há avaliações

- NIT Hamirpur: Inventory Management Inventory ManagementDocumento58 páginasNIT Hamirpur: Inventory Management Inventory Managementabhinav.v9Ainda não há avaliações

- CH09 InventoryDocumento31 páginasCH09 InventoryRahul GhosaleAinda não há avaliações

- Inventory ControlDocumento35 páginasInventory ControlSamis NoAinda não há avaliações

- InventoryDocumento36 páginasInventorynidhi_friend1020032748Ainda não há avaliações

- Independent Demand Inventory Management: by 2 Edition © Wiley 2005 Powerpoint Presentation by R.B. Clough - UnhDocumento38 páginasIndependent Demand Inventory Management: by 2 Edition © Wiley 2005 Powerpoint Presentation by R.B. Clough - Unhnaveed_nawabAinda não há avaliações

- Inventory ControlDocumento30 páginasInventory Controlchintu_thakkar9Ainda não há avaliações

- Inventory ControlDocumento26 páginasInventory ControlAmu CoolAinda não há avaliações

- Inventory Management (Complete)Documento71 páginasInventory Management (Complete)ANCHETA, Yuri Mark Christian N.Ainda não há avaliações

- EBC6230 Inventory ManagementDocumento26 páginasEBC6230 Inventory ManagementMorvarid KardanAinda não há avaliações

- Gestión de Compras Y ProveedoresDocumento49 páginasGestión de Compras Y ProveedoresJavier Holgado RiveraAinda não há avaliações

- 021 Maint Spare Parts Management 31 01 08Documento49 páginas021 Maint Spare Parts Management 31 01 08makinistmoru100% (1)

- Chap015.ppt Independent-Demand InventoryDocumento44 páginasChap015.ppt Independent-Demand InventorySaad Khadur Eilyes100% (1)

- CH 15 Inventory ManagementDocumento21 páginasCH 15 Inventory ManagementAshwin MishraAinda não há avaliações

- 306 CH 12Documento38 páginas306 CH 12Mahendra ThengAinda não há avaliações

- Chapter 17. Inventory Control: Inventory Is The Stock of Any Item or Resource Used in AnDocumento21 páginasChapter 17. Inventory Control: Inventory Is The Stock of Any Item or Resource Used in AnHassan SalamaAinda não há avaliações

- Inventory Management-Dante v. AriñezDocumento41 páginasInventory Management-Dante v. AriñezJaypee FazoliAinda não há avaliações

- Chapter 10 - Inventory Decision MakingDocumento84 páginasChapter 10 - Inventory Decision MakingArman100% (1)

- CH 10 SMDocumento17 páginasCH 10 SMapi-267019092Ainda não há avaliações

- Production Planning and Inventory ManagementDocumento31 páginasProduction Planning and Inventory ManagementChindu JosephAinda não há avaliações

- Lecture 3. Matching Supply With DemandDocumento42 páginasLecture 3. Matching Supply With DemandSamantha SiauAinda não há avaliações

- Production Planning and Inventory ManagementDocumento31 páginasProduction Planning and Inventory ManagementramakrishnaAinda não há avaliações

- Inventory ManagementDocumento27 páginasInventory ManagementsaloniAinda não há avaliações

- Ch08 - InventoryDocumento111 páginasCh08 - InventoryelakkiyaAinda não há avaliações

- Accounts ShareDocumento23 páginasAccounts ShareBharti GoyalAinda não há avaliações

- ABC Activity Based Costing: CA - Chandra Sekhar VeeraghantaDocumento34 páginasABC Activity Based Costing: CA - Chandra Sekhar VeeraghantaSameer KrishnaAinda não há avaliações

- Module 09Documento53 páginasModule 09samaanAinda não há avaliações

- Production Planning and Control Methods, Aggregate Planning, Capacity Planing, SchedulingDocumento51 páginasProduction Planning and Control Methods, Aggregate Planning, Capacity Planing, SchedulingkapilmantriAinda não há avaliações

- Material ManagementDocumento18 páginasMaterial Managementgayatri_vyas1Ainda não há avaliações

- Inventories in The Supply ChainDocumento36 páginasInventories in The Supply ChainPreeti AroraAinda não há avaliações

- Materials Management & Maintenance Slides 109 To 145Documento37 páginasMaterials Management & Maintenance Slides 109 To 145Kumar RajendranAinda não há avaliações

- Chapter 13 Inventory Management ReportDocumento22 páginasChapter 13 Inventory Management ReportJanine SalesAinda não há avaliações

- Lecture OutlineDocumento55 páginasLecture OutlineShweta ChaudharyAinda não há avaliações

- Inventory ManagementDocumento8 páginasInventory Managementsouhardya.research.1Ainda não há avaliações

- Chapter Seven (Materials Mangement)Documento46 páginasChapter Seven (Materials Mangement)temesgen yohannesAinda não há avaliações

- Study of Boiler Maintenance For Enhanced Reliability of System A ReviewDocumento8 páginasStudy of Boiler Maintenance For Enhanced Reliability of System A Reviewfaz143Ainda não há avaliações

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Planning of Operation & Maintenance Using Risk and Reliability Based MethodsDocumento8 páginasPlanning of Operation & Maintenance Using Risk and Reliability Based Methodsfaz143Ainda não há avaliações

- An Evaluation System of The Setting Up of Predictive Maintenance ProgrammesDocumento19 páginasAn Evaluation System of The Setting Up of Predictive Maintenance Programmesfaz143Ainda não há avaliações

- Industrial Management: Topic 1: Basic Concepts in Operation ManagementDocumento33 páginasIndustrial Management: Topic 1: Basic Concepts in Operation Managementfaz143Ainda não há avaliações

- Topic 7B-Short Term SchedulingDocumento22 páginasTopic 7B-Short Term Schedulingfaz143Ainda não há avaliações

- Operations Management: Topic 9 - Quality Management (TQM)Documento29 páginasOperations Management: Topic 9 - Quality Management (TQM)faz143Ainda não há avaliações

- Operations Management: Topic 7A - Production Planning and Control (Aggregate Planning)Documento51 páginasOperations Management: Topic 7A - Production Planning and Control (Aggregate Planning)faz143Ainda não há avaliações

- Operations Management: Topic 3 - Plant LayoutDocumento79 páginasOperations Management: Topic 3 - Plant Layoutfaz143Ainda não há avaliações

- Topic 2 - ForecastingDocumento49 páginasTopic 2 - Forecastingfaz143Ainda não há avaliações

- CAT T10 - 2010 - Dec - ADocumento9 páginasCAT T10 - 2010 - Dec - AHussain MeskinzadaAinda não há avaliações

- Management Accounting Notes1Documento170 páginasManagement Accounting Notes1Anish Gambhir100% (1)

- Fixed-OrderQuantity and Fixed-TimePeriod ExercisesDocumento1 páginaFixed-OrderQuantity and Fixed-TimePeriod ExercisesIris Descent0% (1)

- Global Logistics and Supply Chain ManagementDocumento16 páginasGlobal Logistics and Supply Chain Managementshilpie10Ainda não há avaliações

- Operations Management II: Saurabh Chandra, IIM IndoreDocumento59 páginasOperations Management II: Saurabh Chandra, IIM IndoreSubhrodeep DasAinda não há avaliações

- Or Lectures 2011 - Part 2Documento191 páginasOr Lectures 2011 - Part 2Ahmed RamadanAinda não há avaliações

- Unit 2 Inventory Management: DR Rajkumari SoniDocumento19 páginasUnit 2 Inventory Management: DR Rajkumari SoniAlka PatelAinda não há avaliações

- Eoq PDFDocumento10 páginasEoq PDFविनय कुमार शर्माAinda não há avaliações

- Introduction To Logistic ManagementDocumento28 páginasIntroduction To Logistic ManagementRosalie RosalesAinda não há avaliações

- E.W. Taft: Maribbay - Masigan - Millora - Nocasa - OpanaDocumento37 páginasE.W. Taft: Maribbay - Masigan - Millora - Nocasa - OpanaMARIEL ANGELA SOROLLAAinda não há avaliações

- CH 13 Supply Chain ManagementDocumento66 páginasCH 13 Supply Chain ManagementCOVID RSHJAinda não há avaliações

- Chopra Scm6 Inppt 11Documento104 páginasChopra Scm6 Inppt 11Tonmoy RoyAinda não há avaliações

- Store KeepingDocumento60 páginasStore KeepingHaritha Mugunthan100% (2)

- Doc-20230713-Wa0012 230713 145439Documento33 páginasDoc-20230713-Wa0012 230713 145439Suraj KambleAinda não há avaliações

- AEC 4204-Agribusiness Management: Lecture 8: Agricultural Enterprise Selection and ManagementDocumento26 páginasAEC 4204-Agribusiness Management: Lecture 8: Agricultural Enterprise Selection and ManagementRogers Soyekwo KingAinda não há avaliações

- Bài Tập Mua Hàng và Cung Ứng Toàn CầuDocumento2 páginasBài Tập Mua Hàng và Cung Ứng Toàn Cầuhylieu.31211027735Ainda não há avaliações

- Materials ManagementDocumento52 páginasMaterials ManagementakulavarshiniAinda não há avaliações

- Cycle InventoryDocumento75 páginasCycle InventoryDeep DaveAinda não há avaliações

- Managing Inventories in Supply ChainDocumento26 páginasManaging Inventories in Supply Chaingeraldine bayno tumacasAinda não há avaliações

- HPC 4 Chapter 4Documento7 páginasHPC 4 Chapter 4Elaine PeraltaAinda não há avaliações

- EOQ, CSL, ESC, FR CalculationsDocumento4 páginasEOQ, CSL, ESC, FR CalculationsPrakhar GuptaAinda não há avaliações

- Inventory ManagementDocumento23 páginasInventory ManagementJulie ChanfranciscoAinda não há avaliações

- Inventory Control Practice Problems (To Be Submitted As Assignment On or Before 02-12-2019)Documento2 páginasInventory Control Practice Problems (To Be Submitted As Assignment On or Before 02-12-2019)syedqutub16Ainda não há avaliações

- Inventory 1Documento10 páginasInventory 1singarajusarathAinda não há avaliações

- 2,,working Capital ManagementDocumento19 páginas2,,working Capital ManagementKelvin mwaiAinda não há avaliações

- Inventory System For Independent DemandDocumento21 páginasInventory System For Independent DemandTawsif R ChoudhuryAinda não há avaliações

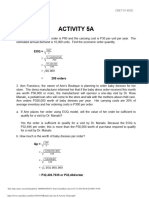

- Ramiro Jan Luis N. Activity 5A PDFDocumento7 páginasRamiro Jan Luis N. Activity 5A PDFAubrey Shaiyne OfianaAinda não há avaliações

- WCM PresentationDocumento52 páginasWCM PresentationJeffrey S. RequisoAinda não há avaliações

- Inventory ControlDocumento24 páginasInventory ControlAdityaAinda não há avaliações

- Chapter SixDocumento47 páginasChapter SixAshenafi ZelekeAinda não há avaliações

![Practical Guide To Production Planning & Control [Revised Edition]](https://imgv2-1-f.scribdassets.com/img/word_document/235162742/149x198/2a816df8c8/1709920378?v=1)