Escolar Documentos

Profissional Documentos

Cultura Documentos

Money & Money Supply

Enviado por

Manjunath ShettigarDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Money & Money Supply

Enviado por

Manjunath ShettigarDireitos autorais:

Formatos disponíveis

MONEY AND

MONEY SUPPLY

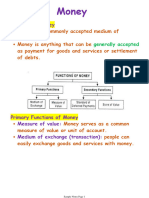

What is Money?

Some of the widely accepted definitions:

Money is what money does.

Anything which the state declared as money is money.

The means of valuation and of payment; as both the unit

of account and the generally acceptable medium of

exchange.

Currency and demand deposits, and its most important

function is to act as a medium of exchange.

It is the sum of currency plus all adjusted deposits in

commercial banks.

Any asset capable of serving as a temporary abode of

purchasing power.

Money is anything that is generally accepted in

Payment for goods and services and in

settlement of debt obligations.

The main functions of money are:

Unit of account/measure of value

Medium of exchange

Store of value

Transfer of value

Money supply

Stock of money held by the public in a spendable form

Aggregate stock of domestic money owned by the

public in the country

Total stock and supply of money in circulation at any

moment

Total money supply in a country comprises:

i) currency money- metallic coins and paper notes

issued by the central bank or Central Govt. and

circulating in the country

ii) demand/time deposits held by the public with the

commercial banks

Money stock measures in India are classified as:

M1 = currency with the public + deposit money of the public

(demand deposits with banks + other

deposits with RBI)

M2 = M1 + Post office savings deposits

M3 = M1 + Time deposits with banks

M4 = M3 + Total post office deposits

M1 is the narrow money and M3 is the broad money

Is computed by the aggregation of net bank credit to

govt., Bank credit to commercial banks, net foreign

exchange assets of the banking sector and Govt.

currency liabilities to the public less non-monetary

liabilities of the banking sector

Measures of money

Primarily there are three money

creating institutions in a country

i) Treasury

ii) Commercial banks

iii)Central bank

Changes in the money supply are

due to actions of these institutions

The demand for money

Two different concepts of demand for money:

Medium of exchange concept of the demand for

money-CLASSICAL VIEW

Store of value concept of the demand for money-

MODERN VIEW

CLASSICAL VIEW

Money is not demanded for its own sake

Demand arises on account of exchange transactions,

from the demand for goods and services

Depends upon the supply of exchangeable goods and

services available in the market which is not constant

So is demand for money which varies from time to time

and determined exclusively by objective factors such

as volume of exchange transactions

Equation of Exchange is MV=PT

M=total quantity of money, V=velocity of circulation

P=price level, T= total amount of goods and services

exchanged for money

Velocity of circulation of money

A unit of money may be spent several times during

given period of time

Average number of times money is transferred from

one person to another in a given period of time is

known as velocity of circulation of money

Hence total supply of money in a given period is

total amount of money in circulation multiplied by its

velocity of circulation

MODERN VIEW also known as Keynes view

Demand for money means the demand to hold

money or cash balances

Also known as liquidity preference which is the

demand for liquidity or cash, desire to hold

assets in cash

Sources of demand for money:

1. Transactions motive

2. Precautionary motive

3. Speculative motive

Motives behind liquidity preference

Transaction motive/demand

is the need of cash for the current transactions of

personal and business exchange

Further split as

i) business motive : to bridge the interval between the time of incurring business

costs and receipt of sale proceeds- transaction motives of businessmen,

industrialists, traders, merchants, etc. who require certain amount of money in

order to carry on their day-to-day business

ii) income motive: to bridge the interval between the receipt of income and its

disbursement- transaction motive of the consumers who require cash

balances to make day-to-day purchases of goods and services for

consumption

Transaction demand for money is directly proportional and

positive function of the level of income.

Depends on two things: i)on the business turnover ii) on

the timing and size of personal incomes

Precautionary motive/demand

Desire to provide for contingencies requiring sudden

expenditure and for unforeseen opportunities of

advantageous purchases

Both individuals and businessmen keep cash in

reserve to meet unexpected needs

Represents the store of value function of money

Depends on uncertainty of future

Depends upon:

level of income

business activity

opportunities for unexpected profitable deals

availability of cash

cost of holding liquid assets

Speculative motive/demand

A liquid store of value which can be invested at

an opportune moment in interest bearing bonds

and securities

Objective is for speculative purposes with a view

to earn income

Uncertainty of future rate of interest causes

demand for money for the speculative motive

A decreasing function of rate of interest higher

the rate, lower the demand for money and lower

the interest, higher the demand for money

Is highly volatile depending upon the behaviour

of interest rates

Total demand for money

According to Keynes,

Transaction motive and precautionary motive is

primarily a function of level of income, while the

speculative demand is the function of rate of

interest

Thus total demand for money is a function of

both income and interest rates.

Você também pode gostar

- MEED GCC Captive InsuranceDocumento44 páginasMEED GCC Captive InsurancemacoceanAinda não há avaliações

- MoneyDocumento38 páginasMoneyAnurag SanjayAinda não há avaliações

- Convertible Promissory Note Template 1Documento6 páginasConvertible Promissory Note Template 1David Jay Mor100% (5)

- Money and Banking Explained: Functions, Demand and SupplyDocumento53 páginasMoney and Banking Explained: Functions, Demand and SupplySamruddhi PatilAinda não há avaliações

- Mergers, Acquisitions & AlliancesDocumento28 páginasMergers, Acquisitions & AlliancesManjunath ShettigarAinda não há avaliações

- Money and Monetarism: Unit HighlightsDocumento18 páginasMoney and Monetarism: Unit HighlightsprabodhAinda não há avaliações

- Self-Esteem: Dr. M Manjunath ShettigarDocumento23 páginasSelf-Esteem: Dr. M Manjunath ShettigarManjunath ShettigarAinda não há avaliações

- Chapter 22 FinalDocumento15 páginasChapter 22 FinalMichael HuAinda não há avaliações

- Money Demand and SupplyDocumento22 páginasMoney Demand and SupplyHarsh Shah100% (1)

- SBIDocumento6 páginasSBIkavitha nagarajuAinda não há avaliações

- Money and Banking - 10&11 PDFDocumento8 páginasMoney and Banking - 10&11 PDFDebabrattaAinda não há avaliações

- REYNOSO MBBA507 Final AssessmentDocumento7 páginasREYNOSO MBBA507 Final AssessmentGianne Denise ReynosoAinda não há avaliações

- Money and BankingDocumento26 páginasMoney and BankingutkarshAinda não há avaliações

- UNIT IV - The Accommodation Product Notes PDFDocumento16 páginasUNIT IV - The Accommodation Product Notes PDFKiran audinaAinda não há avaliações

- Lecture 10money and Monetary PolicyDocumento15 páginasLecture 10money and Monetary PolicyashwanisonkarAinda não há avaliações

- Demand and Supply of MoneyDocumento55 páginasDemand and Supply of MoneyKaran Desai100% (1)

- Demand and Supply of MoneyDocumento55 páginasDemand and Supply of MoneyMayurRawoolAinda não há avaliações

- MONEYDocumento5 páginasMONEYShazia SadhikaliAinda não há avaliações

- Demand for Money ExplainedDocumento10 páginasDemand for Money ExplainedM ManjunathAinda não há avaliações

- CCCDBEE (2019-20) Handout-07 Money Market and Monetary PolicyDocumento4 páginasCCCDBEE (2019-20) Handout-07 Money Market and Monetary PolicyLAVISH DHINGRAAinda não há avaliações

- AEC 501 Question BankDocumento15 páginasAEC 501 Question BankAnanda PreethiAinda não há avaliações

- Money & BankingDocumento33 páginasMoney & BankingGeeta GhaiAinda não há avaliações

- Unit 4 MoneyDocumento39 páginasUnit 4 MoneyTARAL PATELAinda não há avaliações

- Business Economics Presentation On Money and Its MultiplierDocumento15 páginasBusiness Economics Presentation On Money and Its MultiplierAnshAinda não há avaliações

- Money and Banking 22-23Documento17 páginasMoney and Banking 22-23larissa nazarethAinda não há avaliações

- 4 Week GEHon Economics IInd Semeter Introductory MacroeconomicsDocumento14 páginas4 Week GEHon Economics IInd Semeter Introductory Macroeconomicskasturisahoo20Ainda não há avaliações

- Chapter 3 (Unit 1)Documento21 páginasChapter 3 (Unit 1)GiriAinda não há avaliações

- Lecture 7 Banking, Money and Monetary PolicyDocumento36 páginasLecture 7 Banking, Money and Monetary PolicyAvinash PrashadAinda não há avaliações

- Lecture 7 Banking, Money and Monetary PolicyDocumento37 páginasLecture 7 Banking, Money and Monetary Policyshajea aliAinda não há avaliações

- Money and Banking: 1. Write A Short Note On Evolution of MoneyDocumento5 páginasMoney and Banking: 1. Write A Short Note On Evolution of MoneyShreyash HemromAinda não há avaliações

- Money DemandDocumento13 páginasMoney DemandqazplmAinda não há avaliações

- Monetary EconomicsDocumento12 páginasMonetary Economicsrealmadridramos1902Ainda não há avaliações

- Module 2Documento33 páginasModule 2DHWANI DEDHIAAinda não há avaliações

- Ecn 102 by WestminsterDocumento7 páginasEcn 102 by WestminsterTriggersingerAinda não há avaliações

- Monetary Mass in RMDocumento35 páginasMonetary Mass in RMLaurentiu SpinuAinda não há avaliações

- Money and Banking: Unit IIIDocumento69 páginasMoney and Banking: Unit IIIBharti SutharAinda não há avaliações

- Sample NotesDocumento20 páginasSample NotesKenpin EteAinda não há avaliações

- Chapter 3Documento41 páginasChapter 3nigusu deguAinda não há avaliações

- Meaning of MoneyDocumento4 páginasMeaning of MoneyRoyal WafersAinda não há avaliações

- Lecture No. 12 The Supply of MoneyDocumento11 páginasLecture No. 12 The Supply of MoneyMilind SomanAinda não há avaliações

- Money in A Modern Economy: By-Sanskriti Kesarwani Roll No. - 22/COM) 120Documento13 páginasMoney in A Modern Economy: By-Sanskriti Kesarwani Roll No. - 22/COM) 120SanskritiAinda não há avaliações

- Assessment 2 - Lesson Plan PPDocumento24 páginasAssessment 2 - Lesson Plan PPZaria TariqAinda não há avaliações

- Attachment Video 3 - Supply of Money Lyst9092 PDFDocumento30 páginasAttachment Video 3 - Supply of Money Lyst9092 PDFSaumyaAinda não há avaliações

- Banking Basics and Money CreationDocumento20 páginasBanking Basics and Money CreationsujithaAinda não há avaliações

- Money MattersDocumento34 páginasMoney MattersirsamAinda não há avaliações

- Money ManagementDocumento20 páginasMoney ManagementXen XeonAinda não há avaliações

- What Is The Most Important Thing in Your Life ?: What Are We Aspiring For ?Documento58 páginasWhat Is The Most Important Thing in Your Life ?: What Are We Aspiring For ?Shambhawi SinhaAinda não há avaliações

- MONEY Demand and Supply of MoneyDocumento63 páginasMONEY Demand and Supply of MoneySwagat MohantyAinda não há avaliações

- Week 3Documento44 páginasWeek 3Maqsood AhmadAinda não há avaliações

- Ch-5 MONEYDocumento6 páginasCh-5 MONEYYoshita ShahAinda não há avaliações

- Week 3 Money, Prices, Interest Rates and Monetary PoliciesDocumento32 páginasWeek 3 Money, Prices, Interest Rates and Monetary Policiesdaisyruyu2001Ainda não há avaliações

- Unit - 8: Monetary Theory Concept of Money SupplyDocumento10 páginasUnit - 8: Monetary Theory Concept of Money SupplySamin maharjanAinda não há avaliações

- 5money & BankingDocumento53 páginas5money & Bankingshikshita jainAinda não há avaliações

- Economic Project On MoneyDocumento14 páginasEconomic Project On MoneyAshutosh RathiAinda não há avaliações

- Money Supply and Credit CreationDocumento12 páginasMoney Supply and Credit CreationP Janaki RamanAinda não há avaliações

- Overview of The Study On Money, Banking and Financial MarketsDocumento36 páginasOverview of The Study On Money, Banking and Financial MarketsFarapple24Ainda não há avaliações

- Money Supply: Economics ProjectDocumento9 páginasMoney Supply: Economics ProjectabhimussoorieAinda não há avaliações

- International MacroeconomicDocumento63 páginasInternational MacroeconomicShu YuAinda não há avaliações

- Macroeconomics Class 12 Money and BankingDocumento11 páginasMacroeconomics Class 12 Money and BankingstudentAinda não há avaliações

- Demand & Supply For Money: Presented By:-Ruhi MamDocumento28 páginasDemand & Supply For Money: Presented By:-Ruhi Mam9977425172Ainda não há avaliações

- Functions of MoneyDocumento7 páginasFunctions of MoneyShayan YasirAinda não há avaliações

- DEMAND FOR MONEY AND VALUE OF MONEYDocumento46 páginasDEMAND FOR MONEY AND VALUE OF MONEYAmanda RuthAinda não há avaliações

- Session 7 (Demand For Money)Documento14 páginasSession 7 (Demand For Money)Shishir SinghAinda não há avaliações

- IBE Module 6Documento84 páginasIBE Module 6Siddanagouda BiradarAinda não há avaliações

- Money & Banking NotesDocumento15 páginasMoney & Banking Noteslarissa nazarethAinda não há avaliações

- MoneyDocumento18 páginasMoneyAkshit KansalAinda não há avaliações

- Class 12 Macro Economics Chapter 3 - Revision NotesDocumento4 páginasClass 12 Macro Economics Chapter 3 - Revision NotesPappu BhatiyaAinda não há avaliações

- CSR - in India - Under Companies ActDocumento8 páginasCSR - in India - Under Companies ActManjunath ShettigarAinda não há avaliações

- How To Talk - Academic TalkDocumento60 páginasHow To Talk - Academic TalkManjunath ShettigarAinda não há avaliações

- Resume FormatDocumento5 páginasResume FormatManjunath ShettigarAinda não há avaliações

- (-) Marketing Management (BookFi) PDFDocumento3 páginas(-) Marketing Management (BookFi) PDFManjunath ShettigarAinda não há avaliações

- How To Give Academic Job TalksDocumento14 páginasHow To Give Academic Job Talkscharles_j_gomezAinda não há avaliações

- CEO Perspectives 2018 PDFDocumento36 páginasCEO Perspectives 2018 PDFManjunath ShettigarAinda não há avaliações

- Effective Teaching PDFDocumento105 páginasEffective Teaching PDFManjunath ShettigarAinda não há avaliações

- How To Give Academic Job TalksDocumento14 páginasHow To Give Academic Job Talkscharles_j_gomezAinda não há avaliações

- (-) Marketing Management (BookFi)Documento5 páginas(-) Marketing Management (BookFi)Manjunath ShettigarAinda não há avaliações

- Amazon Books: Foundations of International MacroeconomicsDocumento380 páginasAmazon Books: Foundations of International MacroeconomicshetsudoyaguiuAinda não há avaliações

- (-) Marketing Management (BookFi)Documento5 páginas(-) Marketing Management (BookFi)Manjunath ShettigarAinda não há avaliações

- A Monetary Policy PrimerDocumento96 páginasA Monetary Policy PrimerManjunath ShettigarAinda não há avaliações

- Implementing CSR in India - Issues ND ChallengesDocumento12 páginasImplementing CSR in India - Issues ND ChallengesManjunath ShettigarAinda não há avaliações

- ECONOMICS - Consumer Surplus & Producer SurplusDocumento12 páginasECONOMICS - Consumer Surplus & Producer SurplusManjunath ShettigarAinda não há avaliações

- Macreconomics Shcools of ThoughtDocumento16 páginasMacreconomics Shcools of ThoughtManjunath ShettigarAinda não há avaliações

- Market EQUILIBRIUM & Govt InterventionDocumento25 páginasMarket EQUILIBRIUM & Govt InterventionManjunath ShettigarAinda não há avaliações

- Corporate Governance TheoriesDocumento12 páginasCorporate Governance TheoriesManjunath ShettigarAinda não há avaliações

- ECONOMICS - Consumer Surplus & Producer SurplusDocumento12 páginasECONOMICS - Consumer Surplus & Producer SurplusManjunath Shettigar100% (1)

- Educational Leadership Roles & FunctionsDocumento31 páginasEducational Leadership Roles & FunctionsManjunath ShettigarAinda não há avaliações

- Market Equilibrium & Govt InterventionDocumento25 páginasMarket Equilibrium & Govt InterventionManjunath ShettigarAinda não há avaliações

- Money and Money Supply - Class1Documento84 páginasMoney and Money Supply - Class1Manjunath ShettigarAinda não há avaliações

- International Product Life CycleDocumento4 páginasInternational Product Life CycleManjunath Shettigar67% (3)

- Educational Leadership Roles & FunctionsDocumento31 páginasEducational Leadership Roles & FunctionsManjunath ShettigarAinda não há avaliações

- Types of DemandDocumento34 páginasTypes of DemandManjunath ShettigarAinda não há avaliações

- Corporate Governance Overview - Key Concepts, Models, Failures & ReformsDocumento95 páginasCorporate Governance Overview - Key Concepts, Models, Failures & ReformsManjunath ShettigarAinda não há avaliações

- Attitude, Behavior & Job Satisfaction - ClassDocumento29 páginasAttitude, Behavior & Job Satisfaction - ClassManjunath Shettigar100% (1)

- C H A P T E R 8: Developing An Effective Ethics ProgramDocumento11 páginasC H A P T E R 8: Developing An Effective Ethics ProgramManjunath ShettigarAinda não há avaliações

- Production PossibilityDocumento33 páginasProduction PossibilityManjunath ShettigarAinda não há avaliações

- Section 4 - Other Structures For Rahn-Based Islamic Microcredit FacilityDocumento2 páginasSection 4 - Other Structures For Rahn-Based Islamic Microcredit FacilityFeisal RahmanAinda não há avaliações

- Model Question Set 1Documento2 páginasModel Question Set 1Destiny Tuition CentreAinda não há avaliações

- Business Ethics Activity 2Documento5 páginasBusiness Ethics Activity 2Divakara Reddy100% (3)

- Income Tax CircularDocumento6 páginasIncome Tax Circularu19n6735Ainda não há avaliações

- Mutual Fund FormateDocumento65 páginasMutual Fund Formatesurya prakashAinda não há avaliações

- Tax Return NotesDocumento16 páginasTax Return NotesDick WilliamsAinda não há avaliações

- Aditya Birla Capital scales Equentis ratingsDocumento2 páginasAditya Birla Capital scales Equentis ratingssayuj83Ainda não há avaliações

- Tally 9Documento18 páginasTally 9Romendro ThokchomAinda não há avaliações

- Reserve Bank of India: Systemically Important Core Investment CompaniesDocumento19 páginasReserve Bank of India: Systemically Important Core Investment CompaniesBhanu prasanna kumarAinda não há avaliações

- DerivativesDocumento8 páginasDerivativesSubrahmanyam RajuAinda não há avaliações

- Reaction Paper On GRP 12Documento2 páginasReaction Paper On GRP 12Ayen YambaoAinda não há avaliações

- Inside Job The Documentary That Cost 20 000 000 000 000 To ProduceDocumento30 páginasInside Job The Documentary That Cost 20 000 000 000 000 To ProducePedro José ZapataAinda não há avaliações

- Askri BankDocumento17 páginasAskri Bankanon_772670Ainda não há avaliações

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BDocumento5 páginasThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburAinda não há avaliações

- Literature ReviewDocumento5 páginasLiterature ReviewGourab MondalAinda não há avaliações

- Re: Full and Final Settlement - (Fairfield Colony) : 8 MessagesDocumento5 páginasRe: Full and Final Settlement - (Fairfield Colony) : 8 MessagesManoj kumarAinda não há avaliações

- Commercial Bank AssignmentDocumento7 páginasCommercial Bank Assignmentjayesh singhAinda não há avaliações

- Warrants & ConvertiblesDocumento12 páginasWarrants & ConvertiblesKshitij SharmaAinda não há avaliações

- Sreepur Textile Mills Financial AnalysisDocumento11 páginasSreepur Textile Mills Financial AnalysisZidan ZaifAinda não há avaliações

- City of Miami: Inter-Office MemorandumDocumento17 páginasCity of Miami: Inter-Office Memorandumal_crespoAinda não há avaliações

- Form A1.1Documento2 páginasForm A1.1Mritunjai SinghAinda não há avaliações

- 2584/2 Chotki Ghitti Hyd Rizwana: Acknowledgement Slip 114 (1) (Return of Income Filed Voluntarily For Complete Year)Documento4 páginas2584/2 Chotki Ghitti Hyd Rizwana: Acknowledgement Slip 114 (1) (Return of Income Filed Voluntarily For Complete Year)Mohsin Ali Shaikh vlogsAinda não há avaliações

- Bluk 145011 en PDFDocumento5 páginasBluk 145011 en PDFEmirjona LleshiAinda não há avaliações