Escolar Documentos

Profissional Documentos

Cultura Documentos

Presentation On Umpqua Bank

Enviado por

PujaSinghTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Presentation On Umpqua Bank

Enviado por

PujaSinghDireitos autorais:

Formatos disponíveis

Submitted by :

Abhishek Nayyer

Bhuvneshwar

Ravi Yadav

Rajeev

Suhani

INTRODUCTION

Founded : Roseburg, Oregon, United States (1953)

Headquarters :Portland, Oregon, United States

Umpqua Bank with more than 90 branches and $5 billion in

assets is creating and maintaining corporate culture that provide

excellent customer care services

Proper training is been provided by to every employee to do all

kind of task

Umpqua employees are empowered to satisfy customers

needs

Umpqua banks believes that it needs to continually measure

and reward customer service on a departmental level as

they command it as return on quality

Umpqua acquires banks that have had vastly different

cultures and personnel who do not share Umpquas

customer care philosophy

A key component of its strategy is universal associate

program

UNIVERSAL ASSOCIATE PROGRAM

Every employee is trained to perform every task.

The benefit of this program is that the employee

turnover is half of the industry average.

The another benefit is that the employee boredom is

reduced because they have to perform multiple task

each day.

According to this program, an employees workday

varies based on which department are slow and busy.

There is no its not my job mentality because every

person has to do every work.

Their main work is to provide every work with best

quality

STRENGTHS

Individualized customer service at the branch level (not

centralized)

Localized loan services allow better understanding of

qualifications and specialized needs of borrowers. This

is especially an advantage in the small/medium markets

that Umpqua is concentrated in.

Unique retail environment/merchandising strategy for

branches is appealing to many consumers. Umpqua-

branded coffee, music & other items strengthen brand

awareness and image, which Umpqua is effectively

marketing.

CONTD..

Able to successfully integrate acquisitions into

company and made diverse background into

universal culture

Have gone beyond to satisfy their customers

WEAKNESS

Economic strength of region (Pacific)Northwest/I-5

corridor) has been weaker than that of U.S. in

general (though improving).

Growth through acquisitions is currently expensive

(investor expectations are high).

Mortgage business falling significantly due to

reduction in refinancing activity

Large competitors can offer larger lending limits

and offer state-/nation-wide facilities and services

CONTD..

Because Umpqua largely uses purchased SW, IT

often can't implement desired improvements, so

they must push vendors to innovate on their behalf

(which vendors can then sell to other banks)

OPPORTUNITIES

Few regional banks left in the area (most have

been consolidated into national banks)

Few regional banks left in the area (most have

been consolidated into national banks)

Many consumers are becoming disenchanted with

deteriorating service at national banks

Well-run banks are candidates for take-over by

larger rivals (this could be an opportunity or a

threat, depending on your point of view).

THREATS

1.Credit unions:

- untaxed, allowing them to offer better rates.

- have fewer lending regulations, reducing their

costs.

- field of membership rules are being relaxed,

allowing more people to join.

2.New community banks are being formed in

response to consolidation.

CONTD..

3. On-line banks can offer better rates due to lower

overhead.

4. Interest rate risk a substantial amount of

Umpquas earnings are from the spread between

interest on deposits & loans, which could

deteriorate if deposit rates increase faster than loan

rates

Q1.Discuss the pros and cons of Umpqua bank

universal associate program perspective of the

bank management ?

Pros :

Reduced temporary staff required for coverage from

illness, vacations, etc.

Reduced cost for training employees

Reduced number of Branch employees

Increased cross sell ratio

Improved employee satisfaction scores

Improved employee retention

Improved Customer satisfaction scores

Improved staff ability to handle more complex

transactions

CONS

"The training provided for anyone other than a Universal

Associate is terrible

Lack of leadership in some areas and upper

management feels that middle managers are

responsible for leading without support.

The bank force feeds its "culture" to its employees. It's

very cultish, and advancement depends heavily on how

well you talk the talk

Way too much work put on shoulders of employees with

embarrassing pay rate and nonexistent promotions.

Politics decides who gets what not how hard you work

QUESTION NO 2

Discuss the pros and cons of Umpqua bank

universal associate program perspective of

the bank employee?

PROS:

Higher employee satisfaction

Proper work life balance

Less conflict

Developing up of new skills in employees

Low employee attrition

CONS

As there is universal associate program then it may

happen that all employees are not trained as they

need to be for their personal development

Organizational objective is placed more importance

then personal objectives

despite the integration activities going on, there is a

lot of overwork anyways and a lot of people do not

feel they are paid fairly for the amount of hours that

they put in

Way too much work put on shoulders of employees

with embarrassing pay rate and nonexistent

promotions

Q3. Is a tall or flat organization most

appropriate for Umpqua? Explain your

answer

.

Its a flat organization structure because

There is a clarity in decisions.

Narrow span of control is there.

Providing more opportunities to employees to grow

through multi tasking thing.

More flexible in nature.

Due to its culture people are ready to adapt new

changes.

Q4. Develop a goal oriented job

description for an Umpqua teller.

Responsible for handling customer transactions at banks,

including taking deposits, disbursing cash, opening

accounts, and investigating fees.

PRIMARY RESPONSIBILITIES

Process routine account transactions.

Open accounts, including savings and checking.

Help customers fill out deposit and withdrawal slips.

Use adding machine.

Disburse money to customers.

Validate the deposit slip and stamp it by machine.

Check for photo identification.

Assist customers at the drive-through window.

Greet people warmly and direct them to appropriate bank

personnel.

Handle loan payments and cash checks.

Sell travelers checks and money orders.

Collect loan and utility payments.

Promote bank products.

Record all transactions.

Report suspicious activity to police.

Exchange foreign currency.

Count cash at beginning and end of shift.

Balance currency, cash and checks in cash drawer at

end of each shift.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Company ProfileDocumento2 páginasCompany ProfileMonika RockerAinda não há avaliações

- Changing Nature of Managerial WorkDocumento10 páginasChanging Nature of Managerial WorkakramAinda não há avaliações

- Types of Price Elasticity of DemandDocumento5 páginasTypes of Price Elasticity of DemandNelluri Surendhar ChowdaryAinda não há avaliações

- Social Marketing WASH and Community HygieneDocumento69 páginasSocial Marketing WASH and Community Hygienemy channelAinda não há avaliações

- BBGP4103 Consumer BehaviourDocumento6 páginasBBGP4103 Consumer Behaviournartina sadzilAinda não há avaliações

- Hierarchy & Product MAtrixDocumento19 páginasHierarchy & Product MAtrixManseerat KaurAinda não há avaliações

- Mekko Graphics Sample ChartsDocumento47 páginasMekko Graphics Sample ChartsluizacoditaAinda não há avaliações

- BUS 6140 PowerPoint Business Plan TemplateDocumento16 páginasBUS 6140 PowerPoint Business Plan TemplateWaleTaiwo0% (1)

- Opportunity in The Indian Commercial Kitchen Equipment Market - Feedback OTS - 2015Documento9 páginasOpportunity in The Indian Commercial Kitchen Equipment Market - Feedback OTS - 2015Feedback Business Consulting Services Pvt. Ltd.Ainda não há avaliações

- Marketing Metrics (Prof. Jithesh)Documento7 páginasMarketing Metrics (Prof. Jithesh)Vedantam GuptaAinda não há avaliações

- VSS Mani, Just Dial: QuotesDocumento9 páginasVSS Mani, Just Dial: QuotesPavel GuptaAinda não há avaliações

- Arpit Kohli-ResumeDocumento3 páginasArpit Kohli-ResumeTanish ChaudharyAinda não há avaliações

- Pricing Strategies of Two Cellular CompaniesDocumento44 páginasPricing Strategies of Two Cellular CompaniesInam Uddin100% (2)

- Variable and Absorption CostingDocumento3 páginasVariable and Absorption CostingAreeb Baqai100% (1)

- Qa ImpsDocumento2 páginasQa ImpsasifbhaiyatAinda não há avaliações

- Chapter 6 Financial StrategyDocumento5 páginasChapter 6 Financial StrategySweta KumariAinda não há avaliações

- Telenor CaseDocumento14 páginasTelenor Casemaheen0% (1)

- Navigate: The Book "5 Minute Business" NOW AVAILABLE Get MyDocumento11 páginasNavigate: The Book "5 Minute Business" NOW AVAILABLE Get MyMaria TwinAinda não há avaliações

- University of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 Semester Set-1Documento4 páginasUniversity of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 Semester Set-1Supriyo BiswasAinda não há avaliações

- Britannia Market AnalysisDocumento10 páginasBritannia Market Analysisurmi_patel22Ainda não há avaliações

- Resume SampleDocumento3 páginasResume SampleLeonard Alfred BadongAinda não há avaliações

- Youreka Amritsar CaseDocumento12 páginasYoureka Amritsar CaseKaushal RaiAinda não há avaliações

- Running Head: Pepsico'S Strategic Choices 1: Executive SummaryDocumento7 páginasRunning Head: Pepsico'S Strategic Choices 1: Executive Summarydelphine lugaliaAinda não há avaliações

- Towards A Dynamic Theory of StrategyDocumento39 páginasTowards A Dynamic Theory of StrategyGabriel LubenAinda não há avaliações

- Professional English: in UseDocumento7 páginasProfessional English: in Usee.akcetin71350% (2)

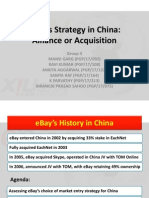

- EBay China Group3 IB-CDocumento27 páginasEBay China Group3 IB-CTamarai Selvi Arumugam50% (2)

- Opsonin Pharmaceutical LimitedDocumento30 páginasOpsonin Pharmaceutical LimitedNusrat Saragin NovaAinda não há avaliações

- REVISED Furniture Industry in Kenya PDFDocumento66 páginasREVISED Furniture Industry in Kenya PDFChike ChukudebeluAinda não há avaliações

- My Home Industries Limited (MHIL) Summer InternshipDocumento36 páginasMy Home Industries Limited (MHIL) Summer InternshipNaveen KumarAinda não há avaliações

- 09 Chapter2Documento38 páginas09 Chapter2Gaurav Singh RathoreAinda não há avaliações