Escolar Documentos

Profissional Documentos

Cultura Documentos

PA-233-01 Feb. 03, 2010 Dax Bahr Rizelle Pecson Nicole Garcia Ronalyne Agpaoa

Enviado por

yume740 notas0% acharam este documento útil (0 voto)

32 visualizações22 páginasThis document discusses economic regulation and antitrust laws. It provides examples of industries that are subject to economic regulation at both the state and federal level, such as electric, gas, telephone and banking companies. It also summarizes the purpose of antitrust laws in prohibiting restrictive trade practices and protecting competition. The document then examines different perspectives on the goals of antitrust laws and how the guidelines for evaluating mergers have changed over time in response to increasing globalization and competition.

Descrição original:

Título original

PA233 Final

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PPTX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThis document discusses economic regulation and antitrust laws. It provides examples of industries that are subject to economic regulation at both the state and federal level, such as electric, gas, telephone and banking companies. It also summarizes the purpose of antitrust laws in prohibiting restrictive trade practices and protecting competition. The document then examines different perspectives on the goals of antitrust laws and how the guidelines for evaluating mergers have changed over time in response to increasing globalization and competition.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PPTX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

32 visualizações22 páginasPA-233-01 Feb. 03, 2010 Dax Bahr Rizelle Pecson Nicole Garcia Ronalyne Agpaoa

Enviado por

yume74This document discusses economic regulation and antitrust laws. It provides examples of industries that are subject to economic regulation at both the state and federal level, such as electric, gas, telephone and banking companies. It also summarizes the purpose of antitrust laws in prohibiting restrictive trade practices and protecting competition. The document then examines different perspectives on the goals of antitrust laws and how the guidelines for evaluating mergers have changed over time in response to increasing globalization and competition.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PPTX, PDF, TXT ou leia online no Scribd

Você está na página 1de 22

PA-233-01

Feb. 03, 2010

Group Members:

Dax Bahr

Rizelle Pecson

Nicole Garcia

Ronalyne Agpaoa

•Economic Regulation is a form of government

intervention designed to influence the behavior of firms

and individuals in the private sector. Defined as the

imposition of rules by a government backed by the use of

penalties attended to modify economic behavior.

•Antitrust Laws, Prohibits the practice of restricting free

trade and/or Competition between businesses. It also

prohibits abusive actions by firms such as price gouging,

refusal to deal, and predatory pricing. And is supervises

mergers of companies, to prevent actions that would harm

competition.

•State Level (most common) include, electric, gas,

telephone, and local cable television companies.

•Federal Level Control includes interstate air

transportation through Federal Aviation Administration,

interstate telephone rates/ broadcasting licenses through

Federal Communication Commissions, certain types of

banks through the Federal Reserve System, and

securities by Securities and Exchange Commissions.

•Electric Companies Began in the late 1870s as a street lighting and

electric railway business.

•Where given service territories and exclusive rights to sell

electricity within the territories.

•Vertically integrated, generation, transmission, and distribution.

•Federal government sells electric power as a by-product of

irrigation and flood-control projects. Aka dams.

•Federal government provides loans and grants for new state and

district power agencies and municipal electric systems.

•Mostly rate of return on investment regulated.

•One of the states regulatory commissions most

important functions is to determine the proper level of

return on investments, profit.

•To protect consumers against exorbitant charges.

•To set rates for services at levels that will afford the

companies an opportunity to earn a fair and reasonable

rate of return.

•Rate of return is the amount of money gained or lost

on an investment relative to the amount invested.

•Allowing varying rates within a price cap.

•Earnings Deadband, allowing companies to keep

profits it earned within a range “deadband”. In return

for a moratorium on initiating new rate adjustment

cases.

•Increased rates for additional earnings sharing.

•Rate freezing and profit sharing.

•Setting rates for specific categories; difficult

to both companies and regulatory agencies

• Suggestion for change- peak load rate

•Electricity pricing

•Invert the rates

•Electric utility industry restructured by legislative,

regulatory, organizational changes

•Competition in same markets

•Build and operate power plants

•Late 1990’s, California was facing retail electricity

prices

•“Perfect storm”- mid 2000

•Deregulation or bad luck

Competition is fundamental to a market system

and to the private enterprise activity.

Without vigorous competition, the private

enterprise system would not attract and maintain

enough support for its continuance.

In order to promote that objective, Congress

enacted three key antitrust statutes to outlaw

attempts at monopoly and agreements on the part

of private firms.

The term antitrust derives from a form of

business organization (the trust) that was

popular in the latter part of the nineteenth

century. The trust was a device for pyramiding

control over several operating companies.

Key examples: the sugar trust; the tobacco trust

and the best known oil trust (standard oil)

The grandfather of antitrust law in the United

States is the Sherman Act, passed in 1890.

The Sherman Act is enforced by the

Department of Justice, which initiates lawsuits

against alleged violators.

The real contribution of the Sherman Act has

turned to restraint trade and monopolization

into offenses against the federal government and

to require enforcement by federal officials.

Clayton Act is the second major antitrust law,

passed in 1914.

The Clayton Act is enforced by the Department of

Justice through direct court litigation or by the

Federal Trade Commission (FTC) through

investigative and hearing procedures.

It is illegal to engage in several important types of

business policies or conduct that may be conducive to

monopolization or restraint of competition.

oThese prohibited actions include price discrimination,

exclusive and typing contracts, and interlocking boards

of directors

The efficiency approach claims that the only

legitimate goal of antitrust is consumer welfare,

which is equivalent to economic efficiency.

The proponents of competitive approach believe the

intent of the Sherman Act is to establish the right for

buyers to pay no more than the competitive price.

Improved economic efficiency resulting from a

merger will result in either lower prices and increased

profits or if market power is enhanced in the process,

higher prices and small cost savings.

The objective of antitrust is to maintain

markets sufficiently to regulate themselves.

With varying degrees of enthusiasm, they

support laws controlling mergers and

attempts to monopolize, increasingly

questioning their need and effectiveness.

They defend internal growth results are in a more

concentrated market structure.

Some studies tend to show that profits related

closely to market share than to degree of

concentration of the market.

Large companies are increasing because they are

effective at meeting customers’ desires, not due to

accomplishments but by ripping off consumers.

Many structuralists believe that if companies grow

too large, they no longer subject the discipline of

competition.

The structuralists contend that large companies not

only produce adverse economic consequences but

exercise excessive social and political power.

Some of the structuralist economists find that the

large firms in concentrated industries earn higher

rates of return on investment.

From the structuralist’s point of view, antitrust

enforcement is not controlling the adverse effects of

concentrated industries.

• In 1982, the Antitrust Division of the Justice

Department introduced the Herfindahl Index.

•a measure of the size of firms in relation to the industry

and an indicator of the amount of competition among

them.

• A merger would be allowed if an industry with

• 4 equally sized competitors controlled 60% of the

market and the other 40 controlled 1% each.

• 1984 the Justice Dept revised its merger guidelines

• efficiency claims, imports, barriers to new entrants and the

problem of declining industries.

• 1992 DOJ and FTC issued a modest, revised Horizontal Merger

Guidelines of the ‘84 version.

• biggest change: reduce the chance that an agency would challenge

a proposed merger that is unlikely to injure competitions.

• In 1996 FTC objected a lot of proposed mergers, like Staples and

Office Depot

• the combinations would lead to higher prices for consumers.

• Late 90’s mergers hit it big because the companies were

working in the same sector. The largest merger was AOL and

Time Warner in a $156 billion deal.

· competition is encouraged by the knowledge of that potential

new entrants can match the positions of well-established

companies.

Entry is free and exit is costless. No business is perfectly

contestable.

· Strong consensus: horizontal price fixing is anti-competitive and

horizontal mergers in concentrated industries, protected by fringe

competitors, should be viewed with suspicion.

· Ex: Airline Market. Carriers could shift their equipment from one

airport to another. But, landing slots are limited so they would have

to buy a slot from an existing holder. Meaning, a firm can enter a

air-travel market only by obtaining a company that’s already in the

market.

• Competitive reality: larger U.S. firms are competing against

overseas giants as well as against smaller domestic companies.

• 1992-1997, pressure of increasing competition grew, the efficiency

of a firm’s operations assumes new weight as a reason for mergers

and other actions that are likely to result in demonstrated savings in

cost.

• Foreign competitions are no longer a part of the antitrust equation

because the imports are counted with the total of foreign firms’

share of the US.

• Antitrust agencies are undercut by three factors: the

internalization of production, the increased cross-border flows of

info, money, and technology, and the resultant rise of the

transnational enterprise.

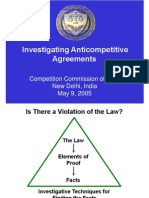

• In 1994, the antitrust division has stepped up its trials on

international antitrust cases w/ foreign defendants and overseas

violations of the laws. Foreign govts think that it is unjustified

extraterritorial enforcement of the domestic laws of the US.

• Conflicts rises because individual nations have different types

of orders & may interpret them in various ways.

• US antitrust authorities said that the merger would have been

precompetitive and yet useful to consumers. The EU and the US

differed fundamentally: one focused on the effects on

consumers, the other on the effects on other companies in the

industry.

Você também pode gostar

- Competition Act, 2002Documento47 páginasCompetition Act, 2002themeditator100% (1)

- A2 Markets MergersDocumento8 páginasA2 Markets MergersTamani MoyoAinda não há avaliações

- Sample Solution Manual For Mergers Acquisitions and Other Restructuring Activities 9th Edition by Donald DePamphilisDocumento39 páginasSample Solution Manual For Mergers Acquisitions and Other Restructuring Activities 9th Edition by Donald DePamphilisSammy Dalie Soto BernaolaAinda não há avaliações

- Us and Eu Competition Law 2011Documento63 páginasUs and Eu Competition Law 2011SanchitSinghalAinda não há avaliações

- Economic Costs of Imperfect CompetitionDocumento15 páginasEconomic Costs of Imperfect Competitionsszr88Ainda não há avaliações

- 4277 Competition IssueDocumento17 páginas4277 Competition Issuenabila ulfaAinda não há avaliações

- Anti-Compettive PracticesDocumento5 páginasAnti-Compettive PracticesMFCAinda não há avaliações

- CSR Social Responsibility Towards The CompetitorsDocumento20 páginasCSR Social Responsibility Towards The CompetitorsErica Dizon86% (7)

- Notes On LawsDocumento7 páginasNotes On LawsSasikumar ParanjothiAinda não há avaliações

- Privatisation: (Vickers & Yarrow, Privatisation: An Economic Analysis)Documento15 páginasPrivatisation: (Vickers & Yarrow, Privatisation: An Economic Analysis)Lev IsmailAinda não há avaliações

- AgendaDocumento11 páginasAgendapramodshukla1Ainda não há avaliações

- An Introduction To Competition LAW: Submitted byDocumento19 páginasAn Introduction To Competition LAW: Submitted byKareen BaucanAinda não há avaliações

- Caribbean Competition Policy and LawDocumento20 páginasCaribbean Competition Policy and LawJ'Moul A. Francis100% (1)

- Why Is Competition Important?Documento4 páginasWhy Is Competition Important?CJVAinda não há avaliações

- Business Law Groupwork: EMBA11 - Group 2 Stanelle, Tari, Estep, Nguyen, MildrenDocumento44 páginasBusiness Law Groupwork: EMBA11 - Group 2 Stanelle, Tari, Estep, Nguyen, MildrenAmmar KhanAinda não há avaliações

- MANAGERIAL ECONOMICS NOTES & REVIEWER (Finals 1st Sem)Documento4 páginasMANAGERIAL ECONOMICS NOTES & REVIEWER (Finals 1st Sem)Princess Delos SantosAinda não há avaliações

- The Role of The ACCCDocumento28 páginasThe Role of The ACCChdgh3Ainda não há avaliações

- Government PoliciesDocumento8 páginasGovernment Policieser_ankurpareekAinda não há avaliações

- Econ202 Chapter 22Documento11 páginasEcon202 Chapter 22Wassup WasabiAinda não há avaliações

- Competition Policy: George Symeonidis University of EssexDocumento3 páginasCompetition Policy: George Symeonidis University of EssexRunaway ShujiAinda não há avaliações

- Unit 2Documento8 páginasUnit 2martalebronvillenAinda não há avaliações

- Competition Act 2002Documento35 páginasCompetition Act 2002sanyodental100% (1)

- Mergers Acquisitions and Other Restructuring Activities 9th Edition Depamphilis Solutions ManualDocumento39 páginasMergers Acquisitions and Other Restructuring Activities 9th Edition Depamphilis Solutions ManualAnirban BhowmikAinda não há avaliações

- Investihgyhggating Anticompetitive Agreements-2Documento20 páginasInvestihgyhggating Anticompetitive Agreements-2Kritika JainAinda não há avaliações

- Competition ActDocumento22 páginasCompetition ActRahim MardhaniAinda não há avaliações

- Understanding Antitrust LawsDocumento10 páginasUnderstanding Antitrust Lawsselozok1Ainda não há avaliações

- L02 The Impact of Law (Competition Law & Data Protection)Documento31 páginasL02 The Impact of Law (Competition Law & Data Protection)Amna SajidAinda não há avaliações

- Merger and AcquisitionDocumento7 páginasMerger and AcquisitionNishant JainAinda não há avaliações

- Managerial Economics Notes & Reviewer (Finals 1st Sem)Documento19 páginasManagerial Economics Notes & Reviewer (Finals 1st Sem)Princess Delos SantosAinda não há avaliações

- ANSWER 1 (A)Documento4 páginasANSWER 1 (A)RIJu KuNAinda não há avaliações

- Econ SG Chap17Documento12 páginasEcon SG Chap17Mohamed MadyAinda não há avaliações

- Legal Tech and Digital Transformation: Competitive Positioning and Business Models of Law FirmsNo EverandLegal Tech and Digital Transformation: Competitive Positioning and Business Models of Law FirmsAinda não há avaliações

- 3.3.11 Why Does The Government Intervene in Markets To Maintain CompetitionDocumento8 páginas3.3.11 Why Does The Government Intervene in Markets To Maintain CompetitionHelen Amanda NaizghiAinda não há avaliações

- 26 Investigating Anticomp Agre 9may05 20080410184531Documento20 páginas26 Investigating Anticomp Agre 9may05 20080410184531mmeghwaniAinda não há avaliações

- Ingredients of CartelisationDocumento2 páginasIngredients of CartelisationahmadhnluAinda não há avaliações

- Monopolies and The Market Economy Vladutiu Adrian Cosmin Gr.2 Anul 2 ECTSDocumento7 páginasMonopolies and The Market Economy Vladutiu Adrian Cosmin Gr.2 Anul 2 ECTSVladutiu AdrianAinda não há avaliações

- Big Data and Competition Policy China Presentation 2019Documento20 páginasBig Data and Competition Policy China Presentation 2019wakilidorothykAinda não há avaliações

- UNIT 2 UK Competition LegislationsDocumento25 páginasUNIT 2 UK Competition LegislationsDEEPANJALI K SAinda não há avaliações

- Handelsrecht 7Documento25 páginasHandelsrecht 7KiewrAinda não há avaliações

- Internationl MarketingDocumento17 páginasInternationl Marketingarchana yadavAinda não há avaliações

- Case Study CartelDocumento7 páginasCase Study CartelMark Ericson Matias Muldong100% (1)

- Econ W9+10Documento23 páginasEcon W9+10calinorthAinda não há avaliações

- A Guide For Divesting Government-Owned Enterprises: How To Guide No. 15 July 1996Documento16 páginasA Guide For Divesting Government-Owned Enterprises: How To Guide No. 15 July 1996reasonorgAinda não há avaliações

- Monopoli BisnisDocumento13 páginasMonopoli BisnisFajar MuhammadAinda não há avaliações

- Reading Material 1Documento26 páginasReading Material 1Zeeshan RafiqAinda não há avaliações

- DQ 4.4 EconomicDocumento1 páginaDQ 4.4 EconomicEhab ShabanAinda não há avaliações

- Deregulation: Deregulation Is The Removal or Simplification of Government Rules and Regulations That Constrain TheDocumento8 páginasDeregulation: Deregulation Is The Removal or Simplification of Government Rules and Regulations That Constrain TheEdyana_inaAinda não há avaliações

- Abuse of Dominance-OECDDocumento24 páginasAbuse of Dominance-OECDSuman sharmaAinda não há avaliações

- Good Governance Midterm Module 1 - Legal-Regulatory-and-Political-Issues-2022Documento8 páginasGood Governance Midterm Module 1 - Legal-Regulatory-and-Political-Issues-2022JM NavarretteAinda não há avaliações

- Competition and Antitrust LawDocumento2 páginasCompetition and Antitrust LawEmeka NkemAinda não há avaliações

- Swot Analysis InfosysDocumento17 páginasSwot Analysis InfosysAlia AkhtarAinda não há avaliações

- Micro L25Documento17 páginasMicro L25khanqsaraAinda não há avaliações

- Competition Law and PolicyDocumento264 páginasCompetition Law and PolicyKatherine Mae Leus GuicoAinda não há avaliações

- External Influences On Business Activity YR 13Documento82 páginasExternal Influences On Business Activity YR 13David KariukiAinda não há avaliações

- CH 03Documento21 páginasCH 03leisurelarry999100% (1)

- Government Regulation: Corporations Are Legal Entities Which Exist Only Because Governments Allow Them To ExistDocumento21 páginasGovernment Regulation: Corporations Are Legal Entities Which Exist Only Because Governments Allow Them To Existtanvir09Ainda não há avaliações

- Weekly Summary ReportDocumento7 páginasWeekly Summary Reportmd.educationaidsAinda não há avaliações

- Decision Making at The CentreDocumento24 páginasDecision Making at The CentreFacultatea Finanțe și Bănci 212Ainda não há avaliações

- Multinational Corporation: Market ImperfectionsDocumento32 páginasMultinational Corporation: Market ImperfectionsShyam LakhaniAinda não há avaliações

- CONTROLLING MERGERS AND MARKET POWER: A Program for Reviving Antitrust in AmericaNo EverandCONTROLLING MERGERS AND MARKET POWER: A Program for Reviving Antitrust in AmericaAinda não há avaliações

- Workbench Users Guide 15Documento294 páginasWorkbench Users Guide 15ppyim2012Ainda não há avaliações

- An Overview of Entertainment Law in NigeDocumento10 páginasAn Overview of Entertainment Law in NigeCasmir OkereAinda não há avaliações

- JWB Thesis 05 04 2006Documento70 páginasJWB Thesis 05 04 2006Street Vendor ProjectAinda não há avaliações

- Flag of Southeast Asian CountriesDocumento6 páginasFlag of Southeast Asian CountriesbaymaxAinda não há avaliações

- 2021-06-07 Yoe Suárez Case UpdateDocumento1 página2021-06-07 Yoe Suárez Case UpdateGlobal Liberty AllianceAinda não há avaliações

- Identifying Text Structure 1 PDFDocumento3 páginasIdentifying Text Structure 1 PDFUsaid BukhariAinda não há avaliações

- BS 1139-6-2005 Metal Scaffolding. Specification For Prefabricated Tower Scaffolds Outside The Scope of BS en 1004, But Utilizing Components From Such SystemsDocumento16 páginasBS 1139-6-2005 Metal Scaffolding. Specification For Prefabricated Tower Scaffolds Outside The Scope of BS en 1004, But Utilizing Components From Such SystemsHiệpBáAinda não há avaliações

- NIGIS PPP AgreementDocumento15 páginasNIGIS PPP AgreementNasiru Abdullahi BabatsofoAinda não há avaliações

- Nego Long Quiz 12 With Basis Midterms MCQDocumento6 páginasNego Long Quiz 12 With Basis Midterms MCQClephanie BuaquiñaAinda não há avaliações

- IRN - 18.07.2019 - Harshad Panchal - Revision-0 - Furnace Fabrica - JNK - PORVAIR - RIL PDFDocumento3 páginasIRN - 18.07.2019 - Harshad Panchal - Revision-0 - Furnace Fabrica - JNK - PORVAIR - RIL PDFsaptarshi jashAinda não há avaliações

- Martha Washington Based On A 1757 Portrait By: John WollastonDocumento1 páginaMartha Washington Based On A 1757 Portrait By: John WollastonroyjaydeyAinda não há avaliações

- Legal Basis of International RelationsDocumento22 páginasLegal Basis of International RelationsCyra ArquezAinda não há avaliações

- The Wall Street Journal - 19.09.2019Documento42 páginasThe Wall Street Journal - 19.09.2019Nadia BustosAinda não há avaliações

- LALON Mixed MathDocumento9 páginasLALON Mixed MathZia UddinAinda não há avaliações

- SPA Liability FormDocumento2 páginasSPA Liability FormfoxcitiesstarsAinda não há avaliações

- CIS-Client Information Sheet - TEMPLATEDocumento15 páginasCIS-Client Information Sheet - TEMPLATEPolat Muhasebe100% (1)

- Vistar - The Rural InitiativeDocumento14 páginasVistar - The Rural InitiativePRAPTI TIWARIAinda não há avaliações

- Hulle v. Orynge (The Case of Thorns)Documento3 páginasHulle v. Orynge (The Case of Thorns)Amber SmithAinda não há avaliações

- DiffusionDocumento15 páginasDiffusionRochie DiezAinda não há avaliações

- Civrev1 CasesDocumento264 páginasCivrev1 Casessamjuan1234Ainda não há avaliações

- St. Peter The Apostle Bulletin For The Week of 4-2-17Documento8 páginasSt. Peter The Apostle Bulletin For The Week of 4-2-17ElizabethAlejoSchoeterAinda não há avaliações

- Company PolicyDocumento58 páginasCompany PolicyChitresh BishtAinda não há avaliações

- Pangil, LagunaDocumento2 páginasPangil, LagunaSunStar Philippine NewsAinda não há avaliações

- DSSSB Je 801 22Documento2 páginasDSSSB Je 801 22suneetbansalAinda não há avaliações

- Asia Banking Vs Javier (GR No. 19051, April 1923)Documento2 páginasAsia Banking Vs Javier (GR No. 19051, April 1923)Thoughts and More ThoughtsAinda não há avaliações

- Twitter Thread By: History of RajputanaDocumento12 páginasTwitter Thread By: History of Rajputanafreetrial dontbanAinda não há avaliações

- Schlage Price Book July 2013Documento398 páginasSchlage Price Book July 2013Security Lock DistributorsAinda não há avaliações

- 24.02.27 - Section 14 - SuperFormDocumento4 páginas24.02.27 - Section 14 - SuperFormMichael NettoAinda não há avaliações

- Professional Ethics and EtiquetteDocumento14 páginasProfessional Ethics and EtiquetteArunshenbaga ManiAinda não há avaliações

- God'S Order For Family Life: 1. God Created Man (Male/Female) in His Own Image (Documento7 páginasGod'S Order For Family Life: 1. God Created Man (Male/Female) in His Own Image (Divino Henrique SantanaAinda não há avaliações