Escolar Documentos

Profissional Documentos

Cultura Documentos

Morning Update 3 Mar 10

Enviado por

AndysTechnicalsDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Morning Update 3 Mar 10

Enviado por

AndysTechnicalsDireitos autorais:

Formatos disponíveis

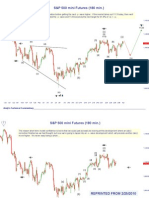

S&P 500 mini Futures (180 min.

)

(Z) We were looking for some resistance into the 1125 to 1129 zone. What we’re seeing doesn’t classify as a

“c” “reversal,” but the market is respecting this area as buying pressure has slowed down. The -y- structure from

1084.5 is very difficult to categorize at this point. It’s NOT an impulsive move--that’s all I know for sure. Which

means that it must be a correction of some kind. It resembles one of those “unorthodox” diametric (bowtie)

patterns that we’ve discussed before. I’m looking for some sort of reversal lower within the next 24 hours.

-y-

1129

-w-

(c)

[5]

All of this previous support 1113

should now be considered

resistance: 11251129 [3]

(b)

[4]

(a)

[1] 1084.5

(c)

[2] -x-

The move lower from the highs was clearly

“corrective” in nature and not an “impulse.” (a)

Can you legitimately see five waves down

from the peak?

(b)

Many people are attempting to call the move up from 1440.5 an “impulse,”

but it’s very difficult to make that case because of how the move began.

1440.5 The mess of corrective congestion that kicked it off does not fit as a 1-2

a

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (Daily)

This feels like a “triangle” in

development.

One of the things that has surprise me this year is how “persistent”

sentiment can remain stuck either bullish or bearish with respect to

currencies. Remember in the final weeks of the Dollar move (dashed -a-

y -c-?

z of “d”

blue box) how extremely bearish sentiment was? And yet, that market

kept “grinding” lower. In similar way, sentiment and bullish bets on the

-g-

80.68

Dollar are extremely high, but the DXY continues to congest/grind

higher.

-b-?

-e- 79.53

KEY SUPPORT

w -c- x2

-c-

-f-

-d-

-a-

-b-

76.60

-a-

x1

-b-

My target has been 81.70 for a 61.8% of “b” = “d”. When the market was

rushing higher a few weeks ago, I thought it would slice through that level

easily. It’s difficult to know exactly where this “d” wave might end, but it has

certainly SLOWED way down in front of the 81.70 objective. In terms of

duration, this wave “should” last a few more weeks.

Andy’s Technical Commentary__________________________________________________________________________________________________

Copper - 60 Minute

There’s a lesson to be learned from this chart. Sometimes

you don’t need to know much about Wave Analysis or

technicals in order to make a “call.” Yesterday we identified

the move down as “corrective” and were dealing with a

perfect “gap fill” accompanied by a bullish candle at the

bottom. One didn’t need to be a rocket scientist to realize a

bounce was coming….

Where we go from here is anyone’s guess--an 8.8

Earthquake in a major producing center will “disrupt” the

short/medium term wave count a little bit.

Andy’s Technical Commentary__________________________________________________________________________________________________

Copper - 60 Minute

Yesterday’s market action was a bit of a disappointment for both bears and bulls.

The bulls had to have that sinking feeling facing a shooting star top on the daily

candles AFTER a major supply disruption. Bears are disappointed with the

“corrective’ move lower that merely “filled the gap.” The market ended up holding

It looks like we get another push higher

the important support point that we identified yesterday at $3.28.

GAPS Get Filled

REPRINTED 3/2/10

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

Você também pode gostar

- Morning View 5mar2010Documento7 páginasMorning View 5mar2010AndysTechnicalsAinda não há avaliações

- S&P Futures 3 March 10 EveningDocumento2 páginasS&P Futures 3 March 10 EveningAndysTechnicalsAinda não há avaliações

- Morning View 29jan2010Documento5 páginasMorning View 29jan2010AndysTechnicalsAinda não há avaliações

- Morning Update 2 Mar 10Documento4 páginasMorning Update 2 Mar 10AndysTechnicalsAinda não há avaliações

- Morning View 21jan2010Documento6 páginasMorning View 21jan2010AndysTechnicalsAinda não há avaliações

- Morning View 28jan2010Documento7 páginasMorning View 28jan2010AndysTechnicalsAinda não há avaliações

- Wednesday Update 10 March 2010Documento6 páginasWednesday Update 10 March 2010AndysTechnicalsAinda não há avaliações

- Morning View 26jan2010Documento8 páginasMorning View 26jan2010AndysTechnicalsAinda não há avaliações

- S&P 500 (Daily) - Sniffed Out Some Support .Documento4 páginasS&P 500 (Daily) - Sniffed Out Some Support .AndysTechnicalsAinda não há avaliações

- Morning View 12feb2010Documento8 páginasMorning View 12feb2010AndysTechnicalsAinda não há avaliações

- Morning View 20jan2010Documento8 páginasMorning View 20jan2010AndysTechnicalsAinda não há avaliações

- Market Discussion 19 Dec 10Documento6 páginasMarket Discussion 19 Dec 10AndysTechnicalsAinda não há avaliações

- Morning View 10feb2010Documento8 páginasMorning View 10feb2010AndysTechnicalsAinda não há avaliações

- Dollar Index (180 Minute) "Unorthodox Model"Documento6 páginasDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsAinda não há avaliações

- Market Update 21 Nov 10Documento10 páginasMarket Update 21 Nov 10AndysTechnicalsAinda não há avaliações

- S&P 500 Update 1 Nov 09Documento7 páginasS&P 500 Update 1 Nov 09AndysTechnicalsAinda não há avaliações

- Market Discussion 5 Dec 10Documento9 páginasMarket Discussion 5 Dec 10AndysTechnicalsAinda não há avaliações

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocumento8 páginasREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsAinda não há avaliações

- S& P 500 Update 2 May 10Documento9 páginasS& P 500 Update 2 May 10AndysTechnicalsAinda não há avaliações

- Morning View 27jan2010Documento6 páginasMorning View 27jan2010AndysTechnicals100% (1)

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Documento7 páginasS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsAinda não há avaliações

- Morning View 3feb2010 - S&P GoldDocumento6 páginasMorning View 3feb2010 - S&P GoldAndysTechnicalsAinda não há avaliações

- Crude Oil 31 October 2010Documento8 páginasCrude Oil 31 October 2010AndysTechnicalsAinda não há avaliações

- Morning View 19 Feb 10Documento4 páginasMorning View 19 Feb 10AndysTechnicalsAinda não há avaliações

- Morning View 25jan2010Documento5 páginasMorning View 25jan2010AndysTechnicalsAinda não há avaliações

- SP500 Update 13 June 10Documento9 páginasSP500 Update 13 June 10AndysTechnicalsAinda não há avaliações

- S&P 500 Update 16 Jan 10Documento8 páginasS&P 500 Update 16 Jan 10AndysTechnicalsAinda não há avaliações

- Morning View 23 Feb 10Documento6 páginasMorning View 23 Feb 10AndysTechnicalsAinda não há avaliações

- Morning View 24 Feb 10Documento4 páginasMorning View 24 Feb 10AndysTechnicalsAinda não há avaliações

- General Growth Properties 7 Jan 09Documento4 páginasGeneral Growth Properties 7 Jan 09AndysTechnicalsAinda não há avaliações

- Market Discussion 23 Jan 11Documento10 páginasMarket Discussion 23 Jan 11AndysTechnicalsAinda não há avaliações

- Morning View 17 Feb 10Documento10 páginasMorning View 17 Feb 10AndysTechnicalsAinda não há avaliações

- Market Commentary 27mar11Documento10 páginasMarket Commentary 27mar11AndysTechnicalsAinda não há avaliações

- S&P 500 Update 4 Apr 10Documento10 páginasS&P 500 Update 4 Apr 10AndysTechnicalsAinda não há avaliações

- Market Discussion 12 Dec 10Documento9 páginasMarket Discussion 12 Dec 10AndysTechnicalsAinda não há avaliações

- SP500 Update 24apr11Documento7 páginasSP500 Update 24apr11AndysTechnicalsAinda não há avaliações

- Market Commentary 21feb11Documento10 páginasMarket Commentary 21feb11AndysTechnicalsAinda não há avaliações

- S&P 500 Update 2 Jan 10Documento8 páginasS&P 500 Update 2 Jan 10AndysTechnicalsAinda não há avaliações

- Baidu (BIDU) Daily Linear ScaleDocumento6 páginasBaidu (BIDU) Daily Linear ScaleAndysTechnicals100% (1)

- S&P 500 Update 9 Nov 09Documento6 páginasS&P 500 Update 9 Nov 09AndysTechnicalsAinda não há avaliações

- Gold Report 29 Nov 2009Documento11 páginasGold Report 29 Nov 2009AndysTechnicalsAinda não há avaliações

- S&P 500 Update 4 Nov 09Documento6 páginasS&P 500 Update 4 Nov 09AndysTechnicalsAinda não há avaliações

- Sunday Night Views 28 Feb 10Documento5 páginasSunday Night Views 28 Feb 10AndysTechnicalsAinda não há avaliações

- S&P 500 Update 20 Dec 09Documento10 páginasS&P 500 Update 20 Dec 09AndysTechnicalsAinda não há avaliações

- Jim 1000 RC 3Documento33 páginasJim 1000 RC 3singingblueeAinda não há avaliações

- Gold Report 15 Nov 2009Documento11 páginasGold Report 15 Nov 2009AndysTechnicalsAinda não há avaliações

- Sugar Report Nov 06 2009Documento6 páginasSugar Report Nov 06 2009AndysTechnicalsAinda não há avaliações

- S&P 500 Update 18 Apr 10Documento10 páginasS&P 500 Update 18 Apr 10AndysTechnicalsAinda não há avaliações

- Sales and Other Dispositions of Capital AssetsDocumento2 páginasSales and Other Dispositions of Capital AssetsIleana ColettaAinda não há avaliações

- Market Update 18 July 10Documento10 páginasMarket Update 18 July 10AndysTechnicalsAinda não há avaliações

- Morning View 18 Feb 10Documento6 páginasMorning View 18 Feb 10AndysTechnicalsAinda não há avaliações

- Economy RC 1Documento80 páginasEconomy RC 1Yến ĐỗAinda não há avaliações

- test 01 (economy) - đọcDocumento27 páginastest 01 (economy) - đọcThuyhuyen VoAinda não há avaliações

- S&P 500 Update 30 Nov 09Documento8 páginasS&P 500 Update 30 Nov 09AndysTechnicalsAinda não há avaliações

- Gains and Losses From Section 1256 Contracts and Straddles: A B C D (A) Identification of Account (B) (Loss) (C) GainDocumento4 páginasGains and Losses From Section 1256 Contracts and Straddles: A B C D (A) Identification of Account (B) (Loss) (C) GainGaro OhanogluAinda não há avaliações

- Sales and Other Dispositions of Capital Assets: Go To WWW - Irs.gov/form8949 For Instructions and The Latest InformationDocumento2 páginasSales and Other Dispositions of Capital Assets: Go To WWW - Irs.gov/form8949 For Instructions and The Latest InformationJessica NulphAinda não há avaliações

- Sales and Other Dispositions of Capital Assets: Go To WWW - Irs.gov/form8949 For Instructions and The Latest InformationDocumento2 páginasSales and Other Dispositions of Capital Assets: Go To WWW - Irs.gov/form8949 For Instructions and The Latest InformationJessica NulphAinda não há avaliações

- Form 6781Documento4 páginasForm 6781MarkAinda não há avaliações

- 09 Ec4t4r PDFDocumento26 páginas09 Ec4t4r PDFณัฐกรานต์ ไชยหาวงศ์Ainda não há avaliações

- Market Commentary 17JUN12Documento7 páginasMarket Commentary 17JUN12AndysTechnicalsAinda não há avaliações

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocumento6 páginasS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 22JUL12Documento6 páginasMarket Commentary 22JUL12AndysTechnicalsAinda não há avaliações

- Market Commentary 5aug12Documento7 páginasMarket Commentary 5aug12AndysTechnicalsAinda não há avaliações

- Market Commentary 1JUL12Documento8 páginasMarket Commentary 1JUL12AndysTechnicalsAinda não há avaliações

- Market Commentary 10JUN12Documento7 páginasMarket Commentary 10JUN12AndysTechnicalsAinda não há avaliações

- Market Commentary 1apr12Documento8 páginasMarket Commentary 1apr12AndysTechnicalsAinda não há avaliações

- Market Commentary 25mar12Documento8 páginasMarket Commentary 25mar12AndysTechnicalsAinda não há avaliações

- Market Commentary 29apr12Documento6 páginasMarket Commentary 29apr12AndysTechnicalsAinda não há avaliações

- Market Commentary 18mar12Documento8 páginasMarket Commentary 18mar12AndysTechnicalsAinda não há avaliações

- Market Commentary 16jan12Documento7 páginasMarket Commentary 16jan12AndysTechnicalsAinda não há avaliações

- Market Commentary 6NOVT11Documento4 páginasMarket Commentary 6NOVT11AndysTechnicalsAinda não há avaliações

- Dollar Index (DXY) Daily ContinuationDocumento6 páginasDollar Index (DXY) Daily ContinuationAndysTechnicalsAinda não há avaliações

- Copper Commentary 11dec11Documento6 páginasCopper Commentary 11dec11AndysTechnicalsAinda não há avaliações

- Market Commentary 27NOV11Documento5 páginasMarket Commentary 27NOV11AndysTechnicalsAinda não há avaliações

- Market Commentary 11mar12Documento7 páginasMarket Commentary 11mar12AndysTechnicalsAinda não há avaliações

- Market Commentary 19DEC11Documento9 páginasMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 30OCT11Documento6 páginasMarket Commentary 30OCT11AndysTechnicalsAinda não há avaliações

- Market Commentary 20NOV11Documento7 páginasMarket Commentary 20NOV11AndysTechnicalsAinda não há avaliações

- Market Commentary 25SEP11Documento8 páginasMarket Commentary 25SEP11AndysTechnicalsAinda não há avaliações

- Copper Commentary 2OCT11Documento8 páginasCopper Commentary 2OCT11AndysTechnicalsAinda não há avaliações

- Sp500 Update 23oct11Documento7 páginasSp500 Update 23oct11AndysTechnicalsAinda não há avaliações

- Sp500 Update 11sep11Documento6 páginasSp500 Update 11sep11AndysTechnicalsAinda não há avaliações

- Sp500 Update 5sep11Documento7 páginasSp500 Update 5sep11AndysTechnicalsAinda não há avaliações

- Gaudenzi Death Valley of InnovationDocumento23 páginasGaudenzi Death Valley of InnovationleemacaleAinda não há avaliações

- DmciDocumento87 páginasDmciqsurban7721Ainda não há avaliações

- Financial Accounting: Reference Books: Accountancy by D. K. Goel Rajesh Goel OR Double Entry Book Keeping by T. S. GrewalDocumento27 páginasFinancial Accounting: Reference Books: Accountancy by D. K. Goel Rajesh Goel OR Double Entry Book Keeping by T. S. GrewalBhawna SinghAinda não há avaliações

- Risk Management Plan V 4-7Documento2 páginasRisk Management Plan V 4-7nejineon50% (2)

- Francesco Giaretta - Changing Business Model PDFDocumento162 páginasFrancesco Giaretta - Changing Business Model PDFALEX ARTURO TURCIOS MENJIVARAinda não há avaliações

- CBBEDocumento23 páginasCBBECharuJagwaniAinda não há avaliações

- Tax CompiledDocumento379 páginasTax Compiledlayla scotAinda não há avaliações

- Tata Aig Invest Assure ApexDocumento7 páginasTata Aig Invest Assure ApexKrupa Karia ThakkarAinda não há avaliações

- GSIS v. CADocumento3 páginasGSIS v. CAKevin EvangelistaAinda não há avaliações

- Ac557 W3 HW HBDocumento2 páginasAc557 W3 HW HBHasan Barakat100% (2)

- Reviewer - ParCorDocumento13 páginasReviewer - ParCoramiAinda não há avaliações

- Annual-Report Eng 2010Documento48 páginasAnnual-Report Eng 2010AlezNgAinda não há avaliações

- WNG Capital LLC Case AnalysisDocumento8 páginasWNG Capital LLC Case AnalysisMMAinda não há avaliações

- Non Resident Ordy Rupee Nro AccountDocumento5 páginasNon Resident Ordy Rupee Nro AccountAmar SinhaAinda não há avaliações

- Litonjua V LitonjuaDocumento2 páginasLitonjua V LitonjuaFrancis Kyle Cagalingan SubidoAinda não há avaliações

- Name of Company "Splendor Jewels"Documento17 páginasName of Company "Splendor Jewels"Harsh BansalAinda não há avaliações

- Tourism Product DevelopmentDocumento9 páginasTourism Product DevelopmentJay-ar Pre100% (1)

- Intermediate Financial Accounting II 1 1Documento146 páginasIntermediate Financial Accounting II 1 1natinaelbahiru74Ainda não há avaliações

- World Class Motor MaintDocumento3 páginasWorld Class Motor MaintIshmael WoolooAinda não há avaliações

- Course Outline of Financial Statement AnalysisDocumento4 páginasCourse Outline of Financial Statement AnalysisJesin EstianaAinda não há avaliações

- Bit - Financial StatementsDocumento10 páginasBit - Financial StatementsAldrin ZolinaAinda não há avaliações

- HDFC Life Insurance ProjectDocumento18 páginasHDFC Life Insurance Projectshubham moonAinda não há avaliações

- McKinsey Model PortfolioDocumento3 páginasMcKinsey Model PortfolioAbhay SuryAinda não há avaliações

- Case Notes - Topic 7Documento2 páginasCase Notes - Topic 7meiling_1993Ainda não há avaliações

- Course of Financial AnalysisDocumento34 páginasCourse of Financial AnalysisSherlock HolmesAinda não há avaliações

- BogaziciDocumento106 páginasBogazicimanishjethva2009Ainda não há avaliações

- Portfolio Management Management 290Documento3 páginasPortfolio Management Management 290z_k_j_vAinda não há avaliações

- AnnuityDocumento1 páginaAnnuityRechie Jhon D. RelatorAinda não há avaliações

- PPC QuestionsDocumento4 páginasPPC Questionssumedhasajeewani100% (1)

- !barra Portfolio Manager Fact Sheet - April 2014Documento2 páginas!barra Portfolio Manager Fact Sheet - April 2014Jitka SamakAinda não há avaliações