Escolar Documentos

Profissional Documentos

Cultura Documentos

Ratele Financiare

Enviado por

Claudiu Andrei MDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ratele Financiare

Enviado por

Claudiu Andrei MDireitos autorais:

Formatos disponíveis

Principalele ratii financiare

MAIN FINANCIAL RATIOS

Ratios

Ratios related

to equity and

debt

Ratios related

to current

assets

Ratios related

to profitability

and efficiency

Equity ratio

Net financial debt to Total Net Worth

Net financial debt to EBITDA

Interest coverage

Current liquidity

Quick liquidity (quick test)

Receivables collection period

Accounts payables payment period

Inventory turnover period

Return on assets (ROA)

Return on Equity (ROE)

Return on Investments (ROI)

2

MAIN FINANCIAL RATIOS: RATIOS RELATED TO EQUITY AND DEBT

DEFINITION AND MEANING (1/4)

Ratio

Synthetic definition

Meaning

Key for interpretation

Total Net

Equity Intangible assets

Shows the level of

If intangibles are

owners funds

adjusted by applying a

nil value to the

intangible assets

Worth (TNW)

Equity ratio

Total Net Worth

Total

assets

significant then a

further analysis of their

value is necessary

Shows the extent to

A high ratio is

which a company uses

its own funds to

finance its operations

Shows level of

dependence on

financial institutions

preferred

Low ratio may

indicate high

dependence on third

parties and may signal

financial solidity

problems

MAIN FINANCIAL RATIOS: RATIOS RELATED TO EQUITY AND DEBT

DEFINITION AND MEANING (2/4)

Ratio

Synthetic definition

Net Financial

(Short term and Long Term Overall total of

financial liabilities

financial borrowing

- Monetary funds (*))

net of the companys

liquidity

Shows companys

level of indebtedness

Debt

Net gearing

Net Financial Debt

Total Net

Worth

Meaning

Shows the

relationship between

external financing &

owners equity

(*) It means cash and liquid assets

4

Key for interpretation

A low value is

preferable, though

adequate levels

depends on the type of

company

A low ratio is

preferable as it shows

an adequate asset

structure

A high ratio indicates

over dependence on

third parties

MAIN FINANCIAL RATIOS: RATIOS RELATED TO EQUITY AND DEBT

DEFINITION AND MEANING (3/4)

Ratio

Synthetic definition

Meaning

Key for interpretation

EBITDA

Earnings before

interest, taxes,

depreciation and

amortization

It is the gross operating

income derived from

core business activity

Represents the

companys ability to

generate revenues from

its operations

It is not influenced by

accounting policies (as

amortisation,

depreciation and

provisions)

expected as a sign of

profitability, while a

negative value may

signal inability to

control costs

Net Financial

Net Financial Debt

Shows the capacity to meet

A lower ratio, hence a

Debt to

EBITDA

EBITDA

the financial obligations with

the operating gross income.

In other words, the number of

years that would take to cover

the net financial obligations

with gross operating income.

5

A positive value is

higher coverage, is a

potential sign of a

firms adequacy in

meeting its financial

obligations

MAIN FINANCIAL RATIOS: RATIOS RELATED TO EQUITY AND DEBT

DEFINITION AND MEANING (4/4)

Ratio

Synthetic definition

EBIT

Earnings before

interest and taxes

Interest

coverage

EBIT

Interest paid and other

financial charges

Meaning

Key for interpretation

Gross operating

A positive value is

(current) income net

of depreciation &

amortization

provisions

Represents the

wealth generated by

the company after

sustaining external

costs and internal

production factors

expected as an indicator

of profitability

a negative value may

signal inability to control

operating costs

A negative EBIT against a

positive EBITDA may

mean high depreciation

expenses due to high

level of technical assets

or forecast of devaluation

of items

Shows the capacity

of a company to

cover its interest

expenses & other

financial charges

with operating profit

6

A high ratio indicates a

companys ability to meet

the cost of financial

liabilities hence good

financial situation.

MAIN FINANCIAL RATIOS: RATIOS RELATED TO CURRENT ASSETS

DEFINITION AND MEANING (1/3)

Ratio

Current

liquidity

Quick

liquidity

(quick

test)

Synthetic definition

Current assets

Short term

liabilities

(Current assets stocks)

(S/T liabilities Advances

from customers)

Meaning

Key for interpretation

Measures the ability

A high ratio is preferable

Too high a ratio may

of a firm to meets

its short term

liabilities through

current assets

Expresses the

capacity to meet

short term liabilities

with only readily

saleable assets

however indicate poor

management of current

assets (stocks,

receivables)

A high ratio is a good

indicator of short term

liquidity

It is important to analyze

the impact of the

inventory valuation

method used

MAIN FINANCIAL RATIOS: RATIOS RELATED TO CURRENT ASSETS

DEFINITION AND MEANING (2/3)

Ratio

Receivables

collection

period

Synthetic definition

Short and long

term receivables

x 360

Net sales

Account

payables

payment

period

Short and long

term payables

(Cost of materials +

Value of goods and

materials sold

+ Cost for hired

services)

Meaning

Key for interpretation

Shows average

A high increase may mean

days of payment

delay allowed to

customers

Average days

x 360

of payment

delay obtained

from suppliers

deteriorating customer base

in terms of credit quality

and/or deteriorating credit

policies

Implications: higher cash

outflows, or possibility of a

write down

High may signal dependence

on suppliers for financing but

may also detect financial

difficulties; to the contrary it may

mean that the company enjoys

good commercial credit

Low means that a firm is not

exploiting the implicit financing

of its operations by suppliers:

this implies higher cash outflows

MAIN FINANCIAL RATIOS: RATIOS RELATED TO CURRENT ASSETS

DEFINITION AND MEANING (3/3)

Ratio

Inventory

turnover

period

Synthetic definition

(Stock

advances to

suppliers)

Net

Sales

x 360

Meaning

Key for interpretation

Average time

Preferable high turnover and

that stocks

spend in the

company before

being sold

implies efficient use of cash.

However an increase in

turnover may mean a loss in

sales due to shortage.

Low turnover may signal

cash tied up in stocks & also

probability of a write down

MAIN FINANCIAL RATIOS: RATIOS RELATED TO PROFITABILITY AND EFFICIENCY

DEFINITION AND MEANING (1/2)

Ratio

Return on

asset (ROA)

Synthetic definition

(EBIT + Financial

incomes)

Total

Assets

Return on

Net profit or loss

Equity

(ROE)

Equity

Meaning

Key for interpretation

Measures the firms

A high ROA is preferred as

capacity to generate

revenues from its

current activity and its

financial activity & its

level of efficiency

it indicates high efficiency

of a firms operations

Depends on the type of

activity: for example, an

industrial company may

have a low ROA due to its

high level of assets but not

necessarily mean

inefficiency

Ratio of net earnings

the overall expression of

to shareholders equity

Measures the firms

efficiency in

employing owners

capital

the efficiency of the choices

made by the company and

thus of the capabilities of

the top management

It is affected by

extraordinary and financial

management

10

MAIN FINANCIAL RATIOS: RATIOS RELATED TO PROFITABILITY AND EFFICIENCY

DEFINITION AND MEANING (2/2)

Ratio

Synthetic definition

Meaning

Key for interpretation

Return on

(Net profit or loss +

Interests paid and other

financial expenses)

Return on invested

A high ratio is a good

Investments

(ROI)

(Equity (gross of

payout)

+ Long and Short term

financial liabilities)

capital

Measures a

companys capacity to

remunerate all the

sources financing

11

indicator of a

companys efficiency &

profitability of all

financial resources

utilized in the

companys operations

Você também pode gostar

- Business Metrics and Tools; Reference for Professionals and StudentsNo EverandBusiness Metrics and Tools; Reference for Professionals and StudentsAinda não há avaliações

- Financial Statement Analysis Financial Statement Analysis Is A Systematic Process of Identifying The Financial Strengths andDocumento7 páginasFinancial Statement Analysis Financial Statement Analysis Is A Systematic Process of Identifying The Financial Strengths andrajivkingofspadesAinda não há avaliações

- FM PPT Ratio AnalysisDocumento12 páginasFM PPT Ratio AnalysisHarsh ManotAinda não há avaliações

- Liquidity RatiosDocumento7 páginasLiquidity RatiosChirrelyn Necesario SunioAinda não há avaliações

- RATIO AnalysisDocumento89 páginasRATIO Analysisjain2547100% (1)

- The Language of BusinessDocumento41 páginasThe Language of Businessrowealyn fabreAinda não há avaliações

- Credit Evaluation ProcessDocumento73 páginasCredit Evaluation ProcessNeeRaz Kunwar100% (2)

- Analysis of Financial Statements: BY Rana Asghar AliDocumento31 páginasAnalysis of Financial Statements: BY Rana Asghar AliMaxhar AbbaxAinda não há avaliações

- Ratio AnalysisDocumento23 páginasRatio AnalysishbijoyAinda não há avaliações

- Fatema NusratDocumento10 páginasFatema NusratFatema NusratAinda não há avaliações

- Break Even Analysis and Ratio AnalysisDocumento63 páginasBreak Even Analysis and Ratio AnalysisJaywanti Akshra Gurbani100% (1)

- Cost and Financial Accounting Session 5 NotesDocumento4 páginasCost and Financial Accounting Session 5 NotesDreadshadeAinda não há avaliações

- Financial Ratio AnalysisDocumento41 páginasFinancial Ratio Analysismbapriti100% (2)

- Ratio Analysis TheoryDocumento22 páginasRatio Analysis TheoryTarun Sukhija100% (1)

- Analysis and Interpretation of Financial StatementsDocumento25 páginasAnalysis and Interpretation of Financial StatementsAnim SaniAinda não há avaliações

- CH 2Documento53 páginasCH 2malo baAinda não há avaliações

- Analysis of Financial StatementDocumento4 páginasAnalysis of Financial StatementShardautdAinda não há avaliações

- Analysis and Interpretation of Financial StatementDocumento7 páginasAnalysis and Interpretation of Financial StatementshubhcplAinda não há avaliações

- Ratios Used in Credit Analysis: August 10, 2012Documento3 páginasRatios Used in Credit Analysis: August 10, 2012Moaaz AhmedAinda não há avaliações

- Module 1 - Financial AnalysisDocumento10 páginasModule 1 - Financial Analysistinakhanna15Ainda não há avaliações

- Accounting Chapter 3Documento4 páginasAccounting Chapter 3DEVASHYA KHATIKAinda não há avaliações

- Ratio Analysis PresentationDocumento39 páginasRatio Analysis PresentationJeevan PrasadAinda não há avaliações

- Financial AnalysisDocumento14 páginasFinancial AnalysisTusharAinda não há avaliações

- Ratio Analysis: Theory and ProblemsDocumento51 páginasRatio Analysis: Theory and ProblemsAnit Jacob Philip100% (1)

- Fin Financial Statement AnalysisDocumento8 páginasFin Financial Statement AnalysisshajiAinda não há avaliações

- Financial LeverageDocumento7 páginasFinancial LeverageGeanelleRicanorEsperonAinda não há avaliações

- Financials RatiosDocumento25 páginasFinancials RatiosSayan DattaAinda não há avaliações

- ABSTRACT Ratio AnalysisDocumento13 páginasABSTRACT Ratio AnalysisDiwakar SrivastavaAinda não há avaliações

- Financial Statement Analysis For MBA StudentsDocumento72 páginasFinancial Statement Analysis For MBA StudentsMikaela Seminiano100% (1)

- 58 Ratio Analysis Techniques PDFDocumento8 páginas58 Ratio Analysis Techniques PDF9raahuulAinda não há avaliações

- Ratio AnalysisDocumento48 páginasRatio AnalysisAnuranjanSinha100% (9)

- Financial Statement Analysis-IIDocumento45 páginasFinancial Statement Analysis-IINeelisetty Satya SaiAinda não há avaliações

- Lecture No.2 Financial Statements AnalysisDocumento17 páginasLecture No.2 Financial Statements AnalysisSokoine Hamad Denis100% (1)

- Module 2Documento27 páginasModule 2MADHURIAinda não há avaliações

- 4 Reasons Why Ratios and Proportions Are So ImportantDocumento8 páginas4 Reasons Why Ratios and Proportions Are So ImportantShaheer MehkariAinda não há avaliações

- Ratio AnalysisDocumento34 páginasRatio AnalysisavdhutshirsatAinda não há avaliações

- Management Accounting Assignment Topic:Ratio Analysis: Room 34Documento18 páginasManagement Accounting Assignment Topic:Ratio Analysis: Room 34nuttynehal17100% (1)

- Note On Financial Ratio AnalysisDocumento9 páginasNote On Financial Ratio Analysisabhilash831989Ainda não há avaliações

- Financial Ratio IntrepretationDocumento47 páginasFinancial Ratio IntrepretationRavi Singla100% (1)

- Analysis of Financial StatementsDocumento80 páginasAnalysis of Financial Statementsmano cherian mathew100% (1)

- Financial Statement AnalysisDocumento26 páginasFinancial Statement AnalysisRahul DewakarAinda não há avaliações

- Theoretical PerspectiveDocumento12 páginasTheoretical PerspectivepopliyogeshanilAinda não há avaliações

- Financial Statement AnalysisDocumento10 páginasFinancial Statement Analysisswayam anandAinda não há avaliações

- Net Profit Margin:: SignificanceDocumento7 páginasNet Profit Margin:: Significanceamisha kbAinda não há avaliações

- Ratio AnalysisDocumento38 páginasRatio AnalysismdalakotiAinda não há avaliações

- MCS Presentation Thermax Ratio AnalysisDocumento31 páginasMCS Presentation Thermax Ratio AnalysispatsjitAinda não há avaliações

- Fin & Acc For MGT - Interpretation of Accounts HandoutDocumento16 páginasFin & Acc For MGT - Interpretation of Accounts HandoutSvosvetAinda não há avaliações

- Course Code: COM-405 Course Title: Credit Hours: 3 (3-0) : Introduction To Business FinanceDocumento21 páginasCourse Code: COM-405 Course Title: Credit Hours: 3 (3-0) : Introduction To Business FinanceSajjad AhmadAinda não há avaliações

- Financial Statement & Ratio AnalysisDocumento30 páginasFinancial Statement & Ratio AnalysisA.m. selvamAinda não há avaliações

- Key Financial Performance IndicatorsDocumento19 páginasKey Financial Performance Indicatorsmariana.zamudio7aAinda não há avaliações

- Profitability RatiosDocumento8 páginasProfitability Ratiosbiplobsinhamats100% (1)

- Return On EquityDocumento6 páginasReturn On EquitySharathAinda não há avaliações

- Ratio Analysis Interview QuestionsDocumento4 páginasRatio Analysis Interview QuestionsMuskanDodejaAinda não há avaliações

- Pegasus Ratio Analysis1 (1) Final-1Documento38 páginasPegasus Ratio Analysis1 (1) Final-1Bella BellAinda não há avaliações

- HOD Assignment 2Documento15 páginasHOD Assignment 2KUMARAGURU PONRAJAinda não há avaliações

- Understanding Business Accounting For DummiesNo EverandUnderstanding Business Accounting For DummiesNota: 3.5 de 5 estrelas3.5/5 (8)

- Transparency in Financial Reporting: A concise comparison of IFRS and US GAAPNo EverandTransparency in Financial Reporting: A concise comparison of IFRS and US GAAPNota: 4.5 de 5 estrelas4.5/5 (3)

- What is Financial Accounting and BookkeepingNo EverandWhat is Financial Accounting and BookkeepingNota: 4 de 5 estrelas4/5 (10)

- IFDocumento15 páginasIFSuvarna KambleAinda não há avaliações

- Coursera Quiz 4Documento2 páginasCoursera Quiz 4Subodh Mayekar0% (3)

- PT Garudafood Putra Putri Jaya TBK - 31.12.2019Documento129 páginasPT Garudafood Putra Putri Jaya TBK - 31.12.2019Revandi DarmawanAinda não há avaliações

- NCR 071921Documento34 páginasNCR 071921Weavemanila Inc Ann HernandezAinda não há avaliações

- New Microsoft Word DocumentDocumento4 páginasNew Microsoft Word DocumentSajid IslamAinda não há avaliações

- Chapter 9Documento67 páginasChapter 9Nguyen NguyenAinda não há avaliações

- Banking Scams in IndiaDocumento3 páginasBanking Scams in IndiaMohit ChoudharyAinda não há avaliações

- Business ValuationDocumento5 páginasBusiness ValuationAppraiser PhilippinesAinda não há avaliações

- Dll.-Business-Finance Q2-Week-2Documento6 páginasDll.-Business-Finance Q2-Week-2Mariz Bolongaita AñiroAinda não há avaliações

- Banking Regulations in The PhilippinesDocumento36 páginasBanking Regulations in The PhilippinesEmerlyn Charlotte Fonte100% (1)

- Calculation Exchange RatioDocumento10 páginasCalculation Exchange Ratiomittalsakshi020692100% (1)

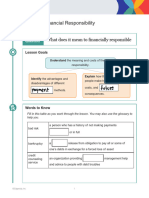

- 3108 13 06 FinancialResponsibility GN SEDocumento9 páginas3108 13 06 FinancialResponsibility GN SENEEVE SHETHAinda não há avaliações

- Understanding Credit Cards Note Taking Guide 2 6 3 l1Documento4 páginasUnderstanding Credit Cards Note Taking Guide 2 6 3 l1api-295404572Ainda não há avaliações

- Class XII Economics Set IDocumento3 páginasClass XII Economics Set IShivansh JaiswalAinda não há avaliações

- Product Disclosure Sheet: Export Credit Refinancing-IDocumento5 páginasProduct Disclosure Sheet: Export Credit Refinancing-IRandaZarkelAinda não há avaliações

- Receivables ProblemsDocumento43 páginasReceivables ProblemsxagocipAinda não há avaliações

- Bharti Airtel LTDDocumento7 páginasBharti Airtel LTDNanvinder SinghAinda não há avaliações

- Housing Development Finance Corporation: PrintDocumento2 páginasHousing Development Finance Corporation: PrintAbdul Khaliq ChoudharyAinda não há avaliações

- Practice Questions SheetDocumento4 páginasPractice Questions Sheetsaif hasanAinda não há avaliações

- Unit 4. Grammar and Vocabulary PracticeDocumento8 páginasUnit 4. Grammar and Vocabulary PracticeCristina RamónAinda não há avaliações

- Insta Loan On Card TCDocumento3 páginasInsta Loan On Card TCMANIKANDAN ANANTHARAJANAinda não há avaliações

- Security Valuation PriciplesDocumento69 páginasSecurity Valuation PriciplesvacinadAinda não há avaliações

- The Rise of The Goliath: A.K. Bhattacharya: Content ResearchDocumento3 páginasThe Rise of The Goliath: A.K. Bhattacharya: Content Researchakansha topaniAinda não há avaliações

- GenMath11 Q2 Mod-6Documento20 páginasGenMath11 Q2 Mod-6Nico Paolo L. BaltazarAinda não há avaliações

- Post Office SchemesDocumento14 páginasPost Office SchemesAbhishek KapoorAinda não há avaliações

- Electronic Money E Money InstitutionsDocumento20 páginasElectronic Money E Money Institutionsmohamed.khalidAinda não há avaliações

- Perez V CA 127 SCRA 636Documento2 páginasPerez V CA 127 SCRA 636Steven CasaisAinda não há avaliações

- Free Term Paper On EconomicsDocumento7 páginasFree Term Paper On Economicsfuzkxnwgf100% (1)

- Track 3.2 & 3.3Documento2 páginasTrack 3.2 & 3.3Hami DuongAinda não há avaliações

- 1 Cash and Cash EquivalentsDocumento6 páginas1 Cash and Cash Equivalentsanon_752939353100% (1)