Escolar Documentos

Profissional Documentos

Cultura Documentos

Builder Meet

Enviado por

Suranjit Baral0 notas0% acharam este documento útil (0 voto)

37 visualizações22 páginaspresentation on builder meeting

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PPT, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentopresentation on builder meeting

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

37 visualizações22 páginasBuilder Meet

Enviado por

Suranjit Baralpresentation on builder meeting

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

Você está na página 1de 22

To be among the TOP 5 Nationalized Banks in

terms

of

Business

Profitability with

Volumes

and

Sustained

Global Recognition guided by

High Standards of Governance and Ethics; and

emerge

as

the

MOST

PREFERRED

BANKING

PARTNER to unlock value to all its Stakeholders

Total Business: Rs 5,00,000 Crores

Net Profit: Rs 5,000 Crores

Chairman & M.D: Sri M Narendra

Have 3010 Branches & 2100 ATMs

ISO certified in-house I.T Department

The Bank has sponsored 3 Regional Rural Banks i.e. Puri

Gramya Bank, Pandyan Grama Bank, Dhenkanal Gramya

Bank

Indian Overseas Bank ( IOB ) was founded by Shri M.Ct.M.

Chidambaram in 1937 with 3 branches at Karaikudi,

Chennai and Rangoon in Burma (presently Myanmar)

IOB was the first Bank to venture into Personal Loan

Scheme in 1960.

In 1964, IOB started Computerisation in the areas of

inter-branch reconciliation and provident fund accounts.

In 1999, IOB had the distinction of being the first Bank

in Banking Industry to obtain ISO 9001 Certification

for its Computer Policy and Planning Department.

In 2000, IOB issued Initial Public Offering (IPO)

In 2012, IOB Crossed the Business of 3,00,000 Crs

In 2013, IOB opened 3000th Branches and 2000th ATM

National Award 2012 for outstanding

performance for implementing PMEGP in

South Zone

National Award for Excellence in MSE lending

during the year Second Rank

Agricultural Advances First Rank

Fund + Non Fund Based

*

*

*

* Includes Non Priority Housing Loans

(Rs in Crs)

District

Rural

SemiUrban

Urban

Total

Krishna

11

16

Guntur

18

Prakasam

West

Godavari

10

Total

13

13

23

49

Ring Road(Near Benz Circle)

Andhra Loyola College (Near ALC Campus)

Gandhi Nagar (In VUDA Campus)

Governorpet (Near Court)

Seetarampuram (Near Seetarampuram Junction)

Mid Corporate (Labbipet)

Krishna Nagar (Near AutoNagar Checkpost)

Vijayawada Main (Park Road - 1 Town)

Bhavanipuram (Crombay Road)

Ramavarapadu (Near Ramavarapadu Junction)

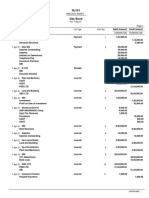

Parameter

Actual as on 30.09.2013

Total Business Mix

5307.88 Crs

Total Deposits

1310.72 Crs

Total Advances

3997.16 Crs

Profits

126.01 Crs

PURPOSE

Term

Loan

for

Development

of

Projects

(Apartments, Malls, Shopping Complex, Hotel etc).

MARGIN - 30% of cost of construction or amenities in case of

layout etc.

SECURITY - The security will be in the form of land & building

in the name of the borrower. In addition, collateral securities

in the form of any other land and building, NSCs, term

deposits may be obtained.

REPAYMENT PERIOD 36 months*.

RATE OF INTEREST - (Base Rate + 5%) = 15.25%

PURPOSE - Term Loan for Acquisition/ Construction of new flat/

house, Purchase of old house/ flat (not exceeding 25 years old).

TARGET GROUP - Individuals who have regular and independent

source of income from Agriculture/ Profession/ Trade/ Business

etc and through employment including NRIs.

QUANTUM OF FINANCE Upto 90%* of the cost of house.

Rate of Interest (Base Rate + 0%) = 10.25% (At Present)

PURPOSE

To provide advance against the rent receivables.

ELIGIBILITY Owners who let out their property

to reputed companies/PSUs/MNCs/Banks

Commercial Organizations/Individuals.

QUANTUM OF LOAN Maximum of 70% of rentals for unexpired lease

period and rental advance, if any.

SECURITY Mortgage of Same property or other property

valued 150% of Loan Amount.

REPAYMENT PERIOD Maximum of 10 Years ( i.e. 120 EMI)

PURPOSE

For purchase of both new as well as used cars.

For purchase of new two wheelers

ELIGIBILITY - Individuals in employment, business, self-employed

professionals both.

QUANTUM 0F LOAN For new cars/2 wheeler - 90% of the cost of car.

For used cars - 75% of the market value of the car.

SECURITY - Hypothecation of vehicle purchased.

RATE OF INTEREST - (Base Rate + 0.50%) = 10.75% (At Present)

Você também pode gostar

- Jaiib Moduled MCQDocumento20 páginasJaiib Moduled MCQHarsh MehtaAinda não há avaliações

- Ensure Proper Security and Vigilance at Bank BranchesDocumento9 páginasEnsure Proper Security and Vigilance at Bank BranchesSuranjit BaralAinda não há avaliações

- Managing People For Service Advantage: Slide ©2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/EDocumento83 páginasManaging People For Service Advantage: Slide ©2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/ESuranjit BaralAinda não há avaliações

- Jaiib PPT Downloaded From IibfDocumento42 páginasJaiib PPT Downloaded From IibfSuranjit BaralAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Globalization Becomes Truly Global: Lessons Learned at LenovoDocumento9 páginasGlobalization Becomes Truly Global: Lessons Learned at LenovormvffrankenbergAinda não há avaliações

- JD & MainDocumento2 páginasJD & MainSourabh Sharma100% (1)

- AccountingDocumento4 páginasAccountinganca9004Ainda não há avaliações

- Question BankDocumento7 páginasQuestion BankJahnavi GoelAinda não há avaliações

- Withholding Tax in MalaysiaDocumento4 páginasWithholding Tax in MalaysiaYana Zakaria100% (1)

- Review of Literature-Car FinancingDocumento5 páginasReview of Literature-Car FinancingRaj Kumar50% (4)

- MCQDocumento4 páginasMCQAjaySharmaAinda não há avaliações

- International Accounting Standards, Harmonization and Financial ReportingDocumento2 páginasInternational Accounting Standards, Harmonization and Financial ReportingDevi PrasadAinda não há avaliações

- Clinical Audit: A Process for Improving Patient Care and OutcomesDocumento8 páginasClinical Audit: A Process for Improving Patient Care and OutcomesAranaya DevAinda não há avaliações

- NP Profile 2014Documento2 páginasNP Profile 2014JCI100% (1)

- Rural TourismDocumento30 páginasRural TourismWaleed Abdalla El SayedAinda não há avaliações

- AR Gapura Angkasa 2018Documento222 páginasAR Gapura Angkasa 2018Alexius SPAinda não há avaliações

- Bill Ackman's Letter On General GrowthDocumento8 páginasBill Ackman's Letter On General GrowthZoe GallandAinda não há avaliações

- Transnational Crimes and Malaysia's Domestic LawsDocumento5 páginasTransnational Crimes and Malaysia's Domestic LawsGlorious El DomineAinda não há avaliações

- Telebrands Corp V Martfive - DJ ComplaintDocumento37 páginasTelebrands Corp V Martfive - DJ ComplaintSarah BursteinAinda não há avaliações

- Day Book 2Documento2 páginasDay Book 2The ShiningAinda não há avaliações

- Suit for Specific Performance of Flat Sale AgreementDocumento13 páginasSuit for Specific Performance of Flat Sale Agreementyash50% (6)

- Cayetano vs. Monsod - G.R. No. 100113 September 3, 1991Documento21 páginasCayetano vs. Monsod - G.R. No. 100113 September 3, 1991Cyna Marie A. Franco100% (2)

- Andersen violated auditing standards in Enron auditDocumento2 páginasAndersen violated auditing standards in Enron auditJanelAlajasLeeAinda não há avaliações

- Lecture 2 OrganizationalcommunicationDocumento12 páginasLecture 2 OrganizationalcommunicationAdilaAnbreenAinda não há avaliações

- PSMDocumento62 páginasPSMzamijakaAinda não há avaliações

- Praktikum Akuntansi Biaya 2021 VEA - Template KerjaDocumento228 páginasPraktikum Akuntansi Biaya 2021 VEA - Template KerjaHendy Prastyo W0% (2)

- AIOU Development Planning Checklist Spring 2019Documento7 páginasAIOU Development Planning Checklist Spring 2019thorkhan42Ainda não há avaliações

- Prelim Que. Paper - EEFM 23-24Documento4 páginasPrelim Que. Paper - EEFM 23-24ffqueen179Ainda não há avaliações

- Top IT and Non-IT Skills Staffing and Consulting Firms in ChennaiDocumento10 páginasTop IT and Non-IT Skills Staffing and Consulting Firms in ChennaiBanuMadivananAinda não há avaliações

- Long-Term Rating Grades Mapping TableDocumento1 páginaLong-Term Rating Grades Mapping TableSidrah ShaikhAinda não há avaliações

- PR and The Party - The Truth About Media Relations in ChinaDocumento11 páginasPR and The Party - The Truth About Media Relations in ChinaMSLAinda não há avaliações

- IATF Internal Auditor 2019Documento1 páginaIATF Internal Auditor 2019Prakash kumarTripathiAinda não há avaliações

- 28 Books To 100K by Michelle KulpDocumento99 páginas28 Books To 100K by Michelle KulpAditya Joshi100% (3)

- About ATA CarnetDocumento4 páginasAbout ATA CarnetRohan NakasheAinda não há avaliações