Escolar Documentos

Profissional Documentos

Cultura Documentos

Profit and Loss Account

Enviado por

Tahir Saeed0 notas0% acharam este documento útil (0 voto)

11 visualizações10 páginaschem

Título original

Lect-41

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PPT, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentochem

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

11 visualizações10 páginasProfit and Loss Account

Enviado por

Tahir Saeedchem

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

Você está na página 1de 10

Financial Accounting

Lecture 41

Profit and Loss Account

Shows profit earned or loss sustained from the

operations of the business during the period.

Balance Sheet

Shows the financial position of the business on a specific

date.

Cash Flow Statement

Shows the sources and utilization of cash during the

period.

NOTE: All points to appear simultaneously

Financial Accounting

Lecture 41

Cash Flow Statement

Cash

Flow Statement shows the sources and utilization of

cash during the period.

Financial Accounting

Lecture 41

Difference Between Profit and Cash

Example

A person starts a small business with Rs. 10,000.

He purchases goods worth Rs. 20,000.

Rs.10,000 is paid in cash and balance is payable at the end

of the month.

Same day all the goods are sold on credit of two months for

Rs. 30,000.

Sales Cost = Profit

30,000 20,000 = 10,000

Although the trader earned Rs. 10,000 profit but he does not

have any cash at the end of first month to repay the creditor.

Financial Accounting

Lecture 41

Liquidity

Liquidity

Liquidity means that a business has sufficient funds (cash

and cash equivalents) to repay its liabilities in time.

Cash

Cash includes cash in hand and bank balances.

Cash Equivalents

Cash equivalents are those short term investments that

can be readily converted into cash.

NOTE: All points to appear simultaneously

Financial Accounting

Lecture 41

Components OF Cash Flow Statement

Cash flow statement is divided into three components

Cash Flow from Operating Activities

Cash Flow from Investing Activities

Cash Flow from Financing Activities

NOTE: All points to appear simultaneously

Financial Accounting

Lecture 41

Operating Activities

Cash Flow from Operating Activities means cash generated

from daily operations of the organization.

Examples of cash flows from operating activities are:

Cash receipt from sale of goods and rendering of

services.

Cash

receipts from fees, commission and other

revenues.

Cash payments to suppliers for goods and services.

Cash payments to and on behalf of the employees.

Cash payments or refunds of income taxes.

Financial Accounting

Lecture 41

Cash Flow from Investing Activities

Cash

Flow from Investing Activities include cash receipts

and payments from fixed and long term assets of the

organization.

Examples of cash flows from investing activities are:

Cash payments to acquire property plant and equipment.

Cash receipts from sale of property plant and equipment.

Cash payments and receipts from acquisition and

disposal of other long term assets e.g.

Shares,

Debentures, TFC, Long Term Advances etc.

Financial Accounting

Lecture 41

Cash Flow from Financing Activities

Cash

Flow from Financing Activities include cash receipts

and payments that arise from owners of the business and

other long term liabilities of the organization.

Examples of cash flows from financing activities are:

Cash received from owners i.e. share issue in case of

company and capital invested by sole proprietor or

partners.

Cash payments to owners i.e. dividend, drawings etc.

Cash receipts and payments for other long term loans

and borrowings.

Financial Accounting

Lecture 41

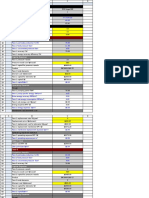

Form of Cash Flow Statement

Name of the Entity

Cash Flow Statement for the Period Ending ----Net Profit Before Tax

XYZ

Add: Adjustment for Non-Cash Items

Depreciation for the Year

XYZ

Provision for Doubtful Debts

XYZ

Exchange Gain / Loss

XYZ

Gain / Loss on Disposal of Assets

XYZ

Return on Investments

XYZ

Mark-up on Loans

XYZ

XYZ

Operating Profit Before Working Capital Changes

XYZ

Working Capital Changes

Add: Decrease in Current Assets

XYZ

Less: Increase in Current Assets

XYZ

Add: Increase in Current Liabilities

XYZ

Less: Decrease in Current Liabilities

XYZ

XYZ

Cash Generated From Operations

XYZ

Z

O

O

M

1

Z

O

O

M

2

Financial Accounting

Lecture 41

Form of Cash Flow Statement

Cash Generated From Operations

XYZ

Less: Markup paid on loans

XYZ

Less: Taxes Paid

XYZ

Net Cash Flow from Operating Activities

XYZ

Cash Flow from Investing Activities

Add: Disposal of Fixed Asset and Long Term Investments

XYZ

Less: Acquisition of Fixed Assets and Long Term Investments

XYZ

Add: Dividend Received / Returns on Investment Received

XYZ

Net Cash Flow from Investing Activities

XYZ

Cash Flow from Financing Activities

Add: Shares Issued / Capital Invested

XYZ

Less: Dividend Paid / Drawings

XYZ

Add: Increase in Long Term Borrowings

XYZ

Net Cash Flow from Financing Activities

XYZ

Net Increase / Decrease in Cash and Cash Equivalents

XYZ

Add: Opening Balance of Cash and Cash Equivalents

XYZ

Closing Balance of Cash and Cash Equivalents

XYZ

10

Double

underlin

e

Z

O

O

M

1

Z

O

O

M

2

Você também pode gostar

- Unit 4 Cash Flow StatementDocumento26 páginasUnit 4 Cash Flow Statementjatin4verma-2Ainda não há avaliações

- Deshare Explore Search You Slideshare Upload Login Signup Search Submit Search Home Explore Sharelikesave Next SlidesharesDocumento6 páginasDeshare Explore Search You Slideshare Upload Login Signup Search Submit Search Home Explore Sharelikesave Next SlidesharesGrowing BiznizAinda não há avaliações

- Statement of Changes in Financial Position: Cash Flow StatementDocumento25 páginasStatement of Changes in Financial Position: Cash Flow StatementCharu Arora100% (1)

- Cash Flow StatementsDocumento19 páginasCash Flow Statementsyow jing peiAinda não há avaliações

- 21 Ch. 21 - Statement of Cash Flows - S2015Documento27 páginas21 Ch. 21 - Statement of Cash Flows - S2015zhouzhu211100% (1)

- FRA-NewDocumento31 páginasFRA-NewAbhishek DograAinda não há avaliações

- Introduction To Financial Statements and Other Financial ReportingDocumento24 páginasIntroduction To Financial Statements and Other Financial ReportingAlina ZubairAinda não há avaliações

- How to Analyze Cash Flows and Financial PlanningDocumento68 páginasHow to Analyze Cash Flows and Financial Planninghunkie71% (7)

- Chapter 06: Understanding Cash Flow StatementsDocumento23 páginasChapter 06: Understanding Cash Flow StatementsSadia RahmanAinda não há avaliações

- Chapter 13 PowerPointDocumento89 páginasChapter 13 PowerPointcheuleee100% (1)

- Cash Flow AnalysisDocumento75 páginasCash Flow AnalysisBalasingam PrahalathanAinda não há avaliações

- Seminar Week 9 (Lecture Slides Chapter 7)Documento27 páginasSeminar Week 9 (Lecture Slides Chapter 7)palekingyeAinda não há avaliações

- Cash Flow StatementDocumento19 páginasCash Flow StatementGokul KulAinda não há avaliações

- Ias 3Documento21 páginasIas 3JyotiAinda não há avaliações

- Financial Accounting - Information For Decisions - Session 9 - Chapter 11 PPT HmugGnI6jbDocumento41 páginasFinancial Accounting - Information For Decisions - Session 9 - Chapter 11 PPT HmugGnI6jbmukul3087_305865623Ainda não há avaliações

- Lecture 5 - Cash Flow StatementDocumento60 páginasLecture 5 - Cash Flow StatementMutesa Chris100% (1)

- AS-3 Cash Flow StatementDocumento26 páginasAS-3 Cash Flow StatementJonathan BarretoAinda não há avaliações

- Far Chapter 5Documento5 páginasFar Chapter 5Pedro CorreiaAinda não há avaliações

- Cash Flow Statement Wit SumDocumento27 páginasCash Flow Statement Wit SumSunay KhaireAinda não há avaliações

- Purpose of The Statement of Cash FlowsDocumento6 páginasPurpose of The Statement of Cash FlowsZebedee TaltalAinda não há avaliações

- Finance Primer - 2016Documento26 páginasFinance Primer - 2016Gurram Sarath KumarAinda não há avaliações

- Cash Flow StatementDocumento17 páginasCash Flow StatementJohn Adriansyah ZainAinda não há avaliações

- 2022 Sem 1 ACC10007 Topic 3Documento45 páginas2022 Sem 1 ACC10007 Topic 3JordanAinda não há avaliações

- Accounting Equation and Financial Statements ExplainedDocumento12 páginasAccounting Equation and Financial Statements ExplainedAishah Rafat Abdussattar100% (1)

- Accounting and Financial Management in LogisticsDocumento23 páginasAccounting and Financial Management in LogisticsWah KhaingAinda não há avaliações

- CASH FLOW StudentsDocumento14 páginasCASH FLOW StudentsJirehJohnG.ArafolAinda não há avaliações

- Chapter 12Documento8 páginasChapter 12Hareem Zoya WarsiAinda não há avaliações

- Statement of Cash Flows: Tenth Canadian EditionDocumento39 páginasStatement of Cash Flows: Tenth Canadian EditionEli SaAinda não há avaliações

- How to analyze a cash flow statementDocumento20 páginasHow to analyze a cash flow statementMidsy De la Cruz100% (1)

- Cash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareDocumento135 páginasCash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareMariel de Lara100% (2)

- MA 6.1-Cash Flow 16.4.2013Documento42 páginasMA 6.1-Cash Flow 16.4.2013vini2710Ainda não há avaliações

- CH 11Documento128 páginasCH 11gimmedemdocs100% (1)

- Cash Flow Statement ExplainedDocumento3 páginasCash Flow Statement ExplainedAkshay JainAinda não há avaliações

- Fund Flow and Cash Flow AnalysisDocumento20 páginasFund Flow and Cash Flow AnalysisThirumanas Kottarathil K RAinda não há avaliações

- Unit 3Documento73 páginasUnit 3api-3698864100% (1)

- Cash Flow Statement ExplainedDocumento35 páginasCash Flow Statement ExplainedShiv Shankar Kumar100% (1)

- Atp 106 LPM Accounting - Topic 5 - Statement of Cash FlowsDocumento17 páginasAtp 106 LPM Accounting - Topic 5 - Statement of Cash FlowsTwain JonesAinda não há avaliações

- Basic AnalysisDocumento15 páginasBasic Analysiskgaseitsiwe0952Ainda não há avaliações

- Accounting Basics for Non-AccountantsDocumento129 páginasAccounting Basics for Non-Accountantsdesikan_r100% (7)

- Cash Flow Analysis PresentationDocumento44 páginasCash Flow Analysis Presentationkojo2kg100% (1)

- Cash Flow Statement-ShortDocumento33 páginasCash Flow Statement-Shortadam jamesAinda não há avaliações

- Chapter 6 Satatement of Cash FlowsDocumento28 páginasChapter 6 Satatement of Cash FlowsCabdiraxmaan GeeldoonAinda não há avaliações

- Financial Reporting and Analysis 21BAT-602: Master of Business AdministrationDocumento27 páginasFinancial Reporting and Analysis 21BAT-602: Master of Business AdministrationsanyaAinda não há avaliações

- Funds Flow AnalysisDocumento31 páginasFunds Flow Analysisadnan arshadAinda não há avaliações

- Module 1-Review of Accounting ProcessDocumento49 páginasModule 1-Review of Accounting ProcessJenny Flor PeterosAinda não há avaliações

- Statement of Cash Flows ExplainedDocumento53 páginasStatement of Cash Flows ExplainedKaushik DwivediAinda não há avaliações

- Financial Accounting SeminarDocumento4 páginasFinancial Accounting SeminarIbrahimm Denis FofanahAinda não há avaliações

- Chapter-5: Statement of Cash FlowDocumento43 páginasChapter-5: Statement of Cash FlowBAM ZAHARDAinda não há avaliações

- Cash Flow Amr MehesenDocumento66 páginasCash Flow Amr Mehesenkarimhisham0% (1)

- Cima F1 Chapter 4Documento20 páginasCima F1 Chapter 4MichelaRosignoli100% (1)

- SOCFs: IAS 7 Statement of cash flowsDocumento46 páginasSOCFs: IAS 7 Statement of cash flowsK58 Nguyễn Hương GiangAinda não há avaliações

- Statement of Cash Flows Module 6Documento3 páginasStatement of Cash Flows Module 6rima riveraAinda não há avaliações

- Statement of Cash FlowsDocumento14 páginasStatement of Cash FlowsNiña Gloria Acuin ZaspaAinda não há avaliações

- Lecture 1 On Cash Flow StatementsDocumento21 páginasLecture 1 On Cash Flow StatementsERICK MLINGWAAinda não há avaliações

- Understanding Cash Flow Movements and AnalysisDocumento12 páginasUnderstanding Cash Flow Movements and AnalysisRozaimie Anzuar0% (1)

- Cahs Flow StatementDocumento18 páginasCahs Flow Statementtaniya17Ainda não há avaliações

- Financial Plan for SMEsDocumento31 páginasFinancial Plan for SMEsShirah CoolAinda não há avaliações

- IAS 7 Cash Flow Statement GuideDocumento17 páginasIAS 7 Cash Flow Statement GuideimtiazbulbulAinda não há avaliações

- Introduction To Finance (Profit & Loss, Working Capital) : Lesson 6Documento24 páginasIntroduction To Finance (Profit & Loss, Working Capital) : Lesson 6danaAinda não há avaliações

- Installation: Pressure Reducing Valves EuropressDocumento2 páginasInstallation: Pressure Reducing Valves EuropressTahir SaeedAinda não há avaliações

- Piping Drawings Guide: PFDs, P&IDs, Isometrics & GADsDocumento89 páginasPiping Drawings Guide: PFDs, P&IDs, Isometrics & GADsbey100% (2)

- ULMA Technical HandbookDocumento132 páginasULMA Technical HandbookcaponelyAinda não há avaliações

- ArsenicDocumento4 páginasArsenicTahir SaeedAinda não há avaliações

- RosaDocumento3 páginasRosaTahir SaeedAinda não há avaliações

- Understanding Process DrawingsDocumento25 páginasUnderstanding Process Drawingspippo2378793Ainda não há avaliações

- 4Ch7 PumpsDocumento117 páginas4Ch7 PumpsTahir SaeedAinda não há avaliações

- GacDocumento2 páginasGacTahir SaeedAinda não há avaliações

- Chemistry Density Problems SEODocumento5 páginasChemistry Density Problems SEOTahir SaeedAinda não há avaliações

- Reactor 1: Dust Collector Dust CollectorDocumento2 páginasReactor 1: Dust Collector Dust CollectorTahir SaeedAinda não há avaliações

- M TDocumento30 páginasM TTahir SaeedAinda não há avaliações

- DTL FormDocumento4 páginasDTL FormcuambyahooAinda não há avaliações

- DisplayDocumento2 páginasDisplayTahir SaeedAinda não há avaliações

- Grundfosliterature 146158Documento16 páginasGrundfosliterature 146158AddeNifiraAinda não há avaliações

- Ppts 35Documento62 páginasPpts 35Tahir SaeedAinda não há avaliações

- Do You Think Media Convergence Bring Positive Change in Today World or Not and Support Your Answer With Logical Arguments and Real-Time ExampleDocumento2 páginasDo You Think Media Convergence Bring Positive Change in Today World or Not and Support Your Answer With Logical Arguments and Real-Time ExampleTahir SaeedAinda não há avaliações

- Financial Accounting Lecture on Business Entities (31Documento20 páginasFinancial Accounting Lecture on Business Entities (31Tahir SaeedAinda não há avaliações

- BuildDocumento10 páginasBuildLuis Eduardo CaicedoAinda não há avaliações

- EquationsDocumento1 páginaEquationsTahir SaeedAinda não há avaliações

- Recruitment PolicyDocumento38 páginasRecruitment PolicyMuhammadRizwanAinda não há avaliações

- Physics Measurement WorksheetDocumento3 páginasPhysics Measurement WorksheetTahir SaeedAinda não há avaliações

- F044 ELT-37 General English Syllabus Design - v3Documento93 páginasF044 ELT-37 General English Syllabus Design - v3Cristina Rusu100% (1)

- Density Worksheet: Mass V MDocumento2 páginasDensity Worksheet: Mass V MTahir SaeedAinda não há avaliações

- MediaDocumento5 páginasMediaTahir SaeedAinda não há avaliações

- Q. Considering The Above Given NBC Standards For Television, Analyze A Private and Public TV Channel and State That Which One Follows These Standards in A Better Way? Discuss by Giving ExamplesDocumento2 páginasQ. Considering The Above Given NBC Standards For Television, Analyze A Private and Public TV Channel and State That Which One Follows These Standards in A Better Way? Discuss by Giving ExamplesTahir SaeedAinda não há avaliações

- Diffusion and Osmosis Worksheet ExplainedDocumento3 páginasDiffusion and Osmosis Worksheet ExplainedLuigi Battistini R.67% (3)

- Study Guide Year 10 Science: Chapter 13: The Hydrosphere Then and NowDocumento5 páginasStudy Guide Year 10 Science: Chapter 13: The Hydrosphere Then and NowTahir SaeedAinda não há avaliações

- CAESARII IntergraphUserConferenceDocumento42 páginasCAESARII IntergraphUserConferenceGiriAeroAinda não há avaliações

- MSE-Aspen Tech InstallationDocumento13 páginasMSE-Aspen Tech InstallationfunctionlakeAinda não há avaliações

- OECD-The Size and Sectoral Distribution of SOEs in OECD and Partner Countries-OECD Publishing (2014) - CópiaDocumento70 páginasOECD-The Size and Sectoral Distribution of SOEs in OECD and Partner Countries-OECD Publishing (2014) - CópiaFelipe QuintasAinda não há avaliações

- SapuraKencana Petroleum to be one of Malaysia's largest companiesDocumento12 páginasSapuraKencana Petroleum to be one of Malaysia's largest companiesRaymond ChungAinda não há avaliações

- Heller House Opportunity Fund - 2018 Q2 Letter - PublicDocumento23 páginasHeller House Opportunity Fund - 2018 Q2 Letter - PublichreinischAinda não há avaliações

- Conversion of Company Limited by Shares to GuaranteeDocumento12 páginasConversion of Company Limited by Shares to Guaranteeaugustine agyeiAinda não há avaliações

- Draft Letter of Offer For Equity Shareholders of The CompanyDocumento262 páginasDraft Letter of Offer For Equity Shareholders of The CompanysanjeeviramAinda não há avaliações

- EFE MatrixDocumento3 páginasEFE Matrixchandra_bhan9243Ainda não há avaliações

- Module - 4: Principles of Working Capital ManagementDocumento15 páginasModule - 4: Principles of Working Capital ManagementChander KumarAinda não há avaliações

- Leverage AnalysisDocumento16 páginasLeverage AnalysisVelmuruganKAinda não há avaliações

- Carceller vs. Court of Appeals DIGESTDocumento3 páginasCarceller vs. Court of Appeals DIGESTHortense VarelaAinda não há avaliações

- Intern Report (Final) - Financial Ratio AnalysisDocumento38 páginasIntern Report (Final) - Financial Ratio AnalysisangelAinda não há avaliações

- Multiple ChoiceDocumento21 páginasMultiple ChoiceXuân DuyênAinda não há avaliações

- Stores Ledger 20101012Documento36 páginasStores Ledger 20101012Rafeek Shaikh0% (2)

- Basic Accounting and PartnershipDocumento11 páginasBasic Accounting and PartnershipMichelle Chandria Bernardo-FordAinda não há avaliações

- Exhibit 4-5 Chan Audio Company: Current RatioDocumento35 páginasExhibit 4-5 Chan Audio Company: Current Ratiofokica840% (1)

- ch08 Solution Manual Managerial Accounting Tools For Business Decision Making PDFDocumento54 páginasch08 Solution Manual Managerial Accounting Tools For Business Decision Making PDFMunna Bhattacharjee100% (1)

- Analysis of Autoline Industries Ltd.Documento43 páginasAnalysis of Autoline Industries Ltd.Umang Katta0% (1)

- Debenhams Analyst ReportDocumento108 páginasDebenhams Analyst ReportFisher Black75% (4)

- The Merger and Acquisition of Nigerian Banks From 2007 Till Date by ARTICLES - Published: JUNE 11, 2013 The Merger and Acquisition of Nigerian Banks From 2007 Till DateDocumento7 páginasThe Merger and Acquisition of Nigerian Banks From 2007 Till Date by ARTICLES - Published: JUNE 11, 2013 The Merger and Acquisition of Nigerian Banks From 2007 Till Datefisayobabs11Ainda não há avaliações

- Aditya Birla Capital BudgetingDocumento54 páginasAditya Birla Capital BudgetingParul PrajapatiAinda não há avaliações

- McKinsey. Analytics Comes of Age. March 2018 PDFDocumento100 páginasMcKinsey. Analytics Comes of Age. March 2018 PDFgcvela100% (1)

- Virtual Stock Trading LessonsDocumento12 páginasVirtual Stock Trading Lessonslove meAinda não há avaliações

- Eckert Sandra Bachelor ThesisDocumento98 páginasEckert Sandra Bachelor ThesisNauman SaddiquiAinda não há avaliações

- IL&FS Preference Share: "Company"/ The "Issuer")Documento4 páginasIL&FS Preference Share: "Company"/ The "Issuer")GK LSAinda não há avaliações

- Inventories - TOADocumento19 páginasInventories - TOAYen86% (7)

- Tax Considerations and Structuring Options in Corporate AcquisitionsDocumento3 páginasTax Considerations and Structuring Options in Corporate Acquisitionspolobook3782Ainda não há avaliações

- Tax-Related Provisions of The IRR On The Tourism Act of 2009Documento4 páginasTax-Related Provisions of The IRR On The Tourism Act of 2009Dei GonzagaAinda não há avaliações

- Order Against Sameer S. Joshi Prop. Shreesurya Investments, Sub BrokerDocumento11 páginasOrder Against Sameer S. Joshi Prop. Shreesurya Investments, Sub BrokerShyam SunderAinda não há avaliações

- Bad Debts, Depreciation, Pre-Payments & Accruals: AS AccountancyDocumento35 páginasBad Debts, Depreciation, Pre-Payments & Accruals: AS AccountancySteve JonzieAinda não há avaliações

- Anglo Annual Report 2009Documento180 páginasAnglo Annual Report 2009grumpyfeckerAinda não há avaliações

- Ken GriffinDocumento7 páginasKen Griffinanandoiyer9Ainda não há avaliações