Escolar Documentos

Profissional Documentos

Cultura Documentos

Reporting Intercorporate Investments in Common Stock: Irwin/Mcgraw-Hill

Enviado por

ulfaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Reporting Intercorporate Investments in Common Stock: Irwin/Mcgraw-Hill

Enviado por

ulfaDireitos autorais:

Formatos disponíveis

1

Baker / Lembke / King

Reporting

Intercorporate

Investments in

Common Stock

Irwin/McGraw-

The McGraw-Hill

The McGraw-Hill

Companies,

Inc., 1999

Companies,

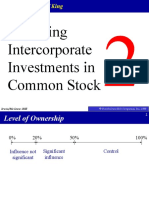

Level of Ownership

0%

20%

Influence not

significant

Irwin/McGraw-

50%

Significant

influence

100%

Control

The McGraw-Hill Companies, Inc., 1999

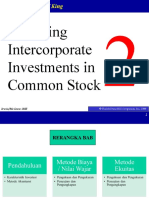

Level of Ownership

0%

20%

Influence not

significant

Cost

Method

Irwin/McGraw-

50%

100%

Significant

influence

Control

Equity

Method

Consolidation

The McGraw-Hill Companies, Inc., 1999

The Cost Method

ABC

ABCCompany

Companypurchases

purchases20

20percent

percentof

ofXYZ

XYZCompanys

Companys

common

commonstock

stockfor

for$100,000

$100,000at

atthe

thebeginning

beginningof

ofthe

theyear.

year.

Influence determined to

be not significant

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

The Cost Method

ABC

ABCCompany

Companypurchases

purchases20

20percent

percentof

ofXYZ

XYZCompanys

Companys

common

commonstock

stockfor

for$100,000

$100,000at

atthe

thebeginning

beginningof

ofthe

theyear.

year.

During

Duringthe

theyear,

year,XYZ

XYZhas

hasnet

netincome

incomeof

of$50,000

$50,000and

andpays

pays

dividends

dividendsof

of$20,000.

$20,000.

Cash

Dividend Income

4,000

4,000

20% of $20,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Liquidating Dividends

Investor

InvestorCompany

Companyowns

owns10

10percent

percentof

ofInvestee

Investee

Companys

Companyscommon

commonstock.

stock. By

Bythe

theend

endof

ofthe

thesecond

second

year,

year,net

netincome

incometotals

totals$200,000

$200,000and

anddividends

dividendsdeclared

declared

total

total$190,000.

$190,000. In

Inthe

thethird

thirdyear,

year,Investees

Investeesnet

netincome

incomeisis

$100,000

$100,000and

anddividends

dividendsare

are$120,000.

$120,000.

Cash

Investment in Investee Company Stock

Dividend Income

12,000

1,000

11,000

10% of

$120,000

Irwin/McGraw-

10% of

$110,000

The McGraw-Hill Companies, Inc., 1999

Liquidating Dividends

Investor

InvestorCompany

Companyowns

owns10

10percent

percentof

ofInvestee

Investee

Companys

Companyscommon

commonstock.

stock. By

Bythe

theend

endof

ofthe

thesecond

second

year,

year,net

netincome

incometotals

totals$200,000

$200,000and

anddividends

dividendsdeclared

declared

total

total$190,000.

$190,000. In

Inthe

thethird

thirdyear,

year,Investees

Investeesnet

netincome

incomeisis

$100,000

$100,000and

anddividends

dividendsare

are$120,000.

$120,000.

Cash

Investment in Investee Company Stock

Dividend Income

12,000

1,000

11,000

($310,000 - $300,000) x 10%

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Equity Method

APB

APB18

18requires

requiresthat

thatthe

theequity

equity

method

methodbe

beused

usedfor

forreporting

reporting

investments,

investments,other

otherthan

than

temporary,

temporary,in

incommon

commonstock...

stock...

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Equity Method

...of

...ofthe

the

following:

following:

Corporate joint ventures.

Companies in which the

investors voting stock interest

gives the investor the ability to

exercise significant influence

over operating and financial

policies of that company.

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Equity Method

10

But,

But, what

what isis

significant

significant

influence?

influence?

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

11

Equity Method

APB

APB 18

18 states,

states, An

An investment

investment (direct

(direct or

or

indirect)

indirect) of

of 20%

20% or

or more

more of

of the

the voting

voting

stock

stock of

of an

an investee

investee should

should lead

lead to

to the

the

presumption

presumption that

that in

in the

the absence

absence of

of

evidence

evidence to

to the

the contrary

contrary an

an investor

investor has

has

the

the ability

ability to

to exercise

exercise significant

significant

influence

influence over

over an

an investor.

investor.

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

12

Equity Method

ABC

ABCCompany

Companyacquires

acquiressignificant

significantinfluence

influenceover

overXYZ

XYZ

Company

Companyby

bypurchasing

purchasing20

20percent

percentof

ofthe

thecommon

common

stock

stockof

ofXYZ

XYZat

atthe

thebeginning

beginningof

ofthe

theyear.

year.

XYZ

XYZreports

reportsnet

netincome

incomeof

of$60,000.

$60,000.

Investment in XYZ Common Stock

Income from Investee

12,000

12,000

20% x $60,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

13

Equity Method

ABC

ABCCompany

Companyacquires

acquiressignificant

significantinfluence

influenceover

overXYZ

XYZ

Company

Companyby

bypurchasing

purchasing20

20percent

percentof

ofthe

thecommon

common

stock

stockof

ofXYZ

XYZat

atthe

thebeginning

beginningof

ofthe

theyear.

year.

XYZ

XYZdeclares

declaresand

andpays

paysaa$20,000

$20,000dividend.

dividend.

Cash

Investment in XYZ Company Stock

4,000

4,000

20% x $20,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Equity Method--Cost Exceeds Book Value

14

Ajax

AjaxCorporation

Corporationpurchases

purchases40

40percent

percentof

ofthe

thecommon

common

stock

stockof

ofBarclay

BarclayCompany

Companyon

onJanuary

January1,1,19X1,

19X1,for

for

$200,000.

$200,000. Barclay

Barclayhas

hasnet

netassets

assetswith

withaabook

bookvalue

value

of

of$400,000

$400,000and

andaafair

fairvalue

valueof

of$465,000.

$465,000.

Cost of investment to Ajax

Book value of Ajaxs share of Barclays net

assets (.40 x $400,000)

Differential

Irwin/McGraw-

$200,000

(160,000)

$ 40,000

The McGraw-Hill Companies, Inc., 1999

Equity Method--Cost Exceeds Book Value

15

Barclay

Barclayreports

reportsnet

netincome

incomeof

of$80,000

$80,000in

in19X1.

19X1.

Investment in Barclay Stock

Income from Investee

32,000

32,000

40% x $80,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Equity Method--Cost Exceeds Book Value

16

Barclay

Barclayreports

reportsnet

netincome

incomeof

of$80,000

$80,000in

in19X1.

19X1.

Investment in Barclay Stock

Income from Investee

32,000

32,000

Barclay

Barclaydeclares

declaresaadividend

dividendof

of$20,000

$20,000in

in19X1.

19X1.

Cash

Investment in Barclay Stock

8,000

8,000

40% x $20,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Equity Method--Cost Exceeds Book Value

17

The

The$40,000

$40,000excess

excesspaid

paidby

byAjax

Ajaxisisassigned

assignedto

toLand,

Land,$6,000,

$6,000,

Equipment,

Equipment,$20,000,

$20,000,and

andGoodwill,

Goodwill,$14,000.

$14,000. Because

Becauseland

land

has

hasunlimited

unlimitedlife,

life,only

onlyequipment

equipmentand

andgoodwill

goodwillare

areamortized.

amortized.

Equipment ($20,000/5 years)

Goodwill ($14,000/7 years)

Total Amortization

Income from Investee

Investment in Barclay Stock

Irwin/McGraw-

$4,000

2,000

$6,000

6,000

6,000

The McGraw-Hill Companies, Inc., 1999

Equity Method--Purchase Additional Shares

18

ABC

ABCCompany

Companypurchases

purchases20

20percent

percentof

ofXYZs

XYZscommon

commonstock

stock

on

onJanuary

January2,2,19X1,

19X1,and

andanother

another10

10percent

percenton

onJuly

July1,1,19X1,

19X1,

and

andthe

thestock

stockpurchases

purchasesare

areat

atbook

bookvalue.

value.

XYZ

XYZCompany

Companyearns

earnsincome

incomeof

of$20,000

$20,000from

fromJanuary

January22

to

toJune

June30

30and

andearns

earns$30,000

$30,000from

fromJuly

July11to

toDecember

December31.

31.

Income, January 2 to June 30: $20,000 x .20

Income, July 1 to December 31: $30,000 x .30

Income from Investment, 19X1

Irwin/McGraw-

$ 4,000

9,000

$13,000

The McGraw-Hill Companies, Inc., 1999

Equity Method--Purchase Additional Shares

19

XYZ

XYZdeclares

declaresand

andpays

paysaa$10,000

$10,000dividend

dividendon

onJanuary

January15

15

and

andagain

againon

onJuly

July15.

15.

January 15 dividend: $10,000 x .20

July 15 dividend: $10,000 x .30

Reduction in Investment, 19X1

$2,000

3,000

$5,000

January 15, 19X1

Cash

Investment in XYZ Stock

2,000

July 15, 19X1

Cash

Investment in XYZ Stock

3,000

Irwin/McGraw-

2,000

3,000

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

20

Recorded amount of investment

at date of acquisition.

Cost

CostMethod

Method

Original cost

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

21

Recorded amount of investment

at date of acquisition.

Equity

EquityMethod

Method

Original cost

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

22

Usual carrying amount of

investment subsequent to acquisition

Cost

CostMethod

Method

Original cost

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

23

Usual carrying amount of

investment subsequent to acquisition

Equity

EquityMethod

Method

Original cost increased (decreased) by investors share of

investee's income (loss) and decreased by investors share of

investees dividends and by amortization of the differential.

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

24

Differential

Cost

CostMethod

Method

Not amortized

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

25

Differential

Equity

EquityMethod

Method

Amortized if related to limited-life or

intangible assets of investee

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

26

Income recognized by investor

Cost

CostMethod

Method

Investors share of investees dividends

declared from earnings since acquisition

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

27

Income recognized by investor

Equity

EquityMethod

Method

Investors share of investees earnings since

acquisition, whether distributed or not,

reduced by any amortization of the

differential

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

28

Investee dividends from earnings

since acquisition by investor

Cost

CostMethod

Method

Income

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

29

Investee dividends from earnings

since acquisition by investor

Equity

EquityMethod

Method

Reduction of investment

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

30

Investee dividends in excess of

earnings since acquisition by investor

Cost

CostMethod

Method

Reduction of investment

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Cost and Equity Methods Compared

31

Investee dividends in excess of

earnings since acquisition by investor

Equity

EquityMethod

Method

Reduction of investment

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

FASB Interpretation No. 35

32

Evidence that an investor is unable to exercise significant

influence over the investee:

Opposition

Opposition by

by the

the investee

investee

Investor

Investor and

and investee

investee sign

sign an

an agreement

agreement under

under

which

which the

the investor

investor surrenders

surrenders significant

significant rights

rights

as

as aa shareholder

shareholder

Investor

Investor tries

tries and

and fails

fails to

to obtain

obtain more

more financial

financial

information

information than

than available

available to

to other

other

shareholders

shareholders

Investor

Investor tries

tries and

and fails

fails to

to obtain

obtain representation

representation

on

on the

the investees

investeesboard

board of

of directors

directors

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

33

Chapter Two

The

The

End

End

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Você também pode gostar

- Reporting Intercorporate Investments in Common Stock: Irwin/Mcgraw-HillDocumento33 páginasReporting Intercorporate Investments in Common Stock: Irwin/Mcgraw-HillSofyan AliAinda não há avaliações

- Reporting Intercorporate Investments in Common Stock: Irwin/Mcgraw-HillDocumento59 páginasReporting Intercorporate Investments in Common Stock: Irwin/Mcgraw-HillPutri MutiraAinda não há avaliações

- Quiz 1:: Case #1: As Consideration For The Business Combination, SMUTTY Co. Transferred 8,000Documento2 páginasQuiz 1:: Case #1: As Consideration For The Business Combination, SMUTTY Co. Transferred 8,000Andrew wigginAinda não há avaliações

- Issuing Securities To The Public: Mcgraw-Hill/Irwin Corporate Finance, 7/EDocumento27 páginasIssuing Securities To The Public: Mcgraw-Hill/Irwin Corporate Finance, 7/ERazzARazaAinda não há avaliações

- Reporting Intercorporate Investments in Common Stock: Douglas CloudDocumento31 páginasReporting Intercorporate Investments in Common Stock: Douglas CloudYudhi SutanaAinda não há avaliações

- Consolidation Following Acquisition: Irwin/Mcgraw-HillDocumento26 páginasConsolidation Following Acquisition: Irwin/Mcgraw-HillAmir ImraniAinda não há avaliações

- The Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillDocumento36 páginasThe Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillJumma KhanAinda não há avaliações

- Year Earnings: 20x1 20x2 20x3 20x4 20x5 Total 13,800,000Documento1 páginaYear Earnings: 20x1 20x2 20x3 20x4 20x5 Total 13,800,000ellieAinda não há avaliações

- Chapter 09 Indirect and Mutual HoldingsDocumento12 páginasChapter 09 Indirect and Mutual HoldingsNicolas ErnestoAinda não há avaliações

- Consolidation Ownership Issues: Irwin/Mcgraw-HillDocumento25 páginasConsolidation Ownership Issues: Irwin/Mcgraw-HillSofyan AliAinda não há avaliações

- Class 1 NotesDocumento57 páginasClass 1 Notesbenny1011Ainda não há avaliações

- Eagle Ridge Inc Was in The Final Phase of Completing: Unlock Answers Here Solutiondone - OnlineDocumento1 páginaEagle Ridge Inc Was in The Final Phase of Completing: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghAinda não há avaliações

- 13 Business Combination Pt3Documento1 página13 Business Combination Pt3Riselle Ann Sanchez50% (2)

- Intercompany Transfers of Services and Noncurrent Assets: AnswerDocumento34 páginasIntercompany Transfers of Services and Noncurrent Assets: AnswerIzzy B100% (1)

- CH 09Documento83 páginasCH 09JesussAinda não há avaliações

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocumento14 páginasIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldNovita AnggrainyAinda não há avaliações

- Intercorporate Transfers: Noncurrent Assets: Irwin/Mcgraw-HillDocumento32 páginasIntercorporate Transfers: Noncurrent Assets: Irwin/Mcgraw-HillSofyan AliAinda não há avaliações

- Intercompany Indebtedness: Irwin/Mcgraw-HillDocumento24 páginasIntercompany Indebtedness: Irwin/Mcgraw-HillSofyan AliAinda não há avaliações

- Chapter 15 Questions V1Documento6 páginasChapter 15 Questions V1coffeedanceAinda não há avaliações

- CH 09Documento98 páginasCH 09Ismadth2918388100% (1)

- Business Combi and Conso FSDocumento56 páginasBusiness Combi and Conso FSlachimolaluv chim50% (12)

- InvesmentDocumento5 páginasInvesmentMaricar San AntonioAinda não há avaliações

- Akuntansi DagangDocumento89 páginasAkuntansi DagangGIOVANNI SANTOSAAinda não há avaliações

- Kimmel Acct 7e Ch09 Reporting and Analyzing Long Lived AssetsDocumento79 páginasKimmel Acct 7e Ch09 Reporting and Analyzing Long Lived AssetsElectronAinda não há avaliações

- Business Combination ActivityDocumento5 páginasBusiness Combination ActivityAndy LaluAinda não há avaliações

- Payout Policy: Fundamentals of Corporate FinanceDocumento24 páginasPayout Policy: Fundamentals of Corporate FinanceMuh BilalAinda não há avaliações

- Intermediate Accounting: Seventeenth EditionDocumento50 páginasIntermediate Accounting: Seventeenth Editionxuân huấn bùiAinda não há avaliações

- ExcelDocumento7 páginasExcellorrynorryAinda não há avaliações

- Sixth Edition: UpdatedDocumento41 páginasSixth Edition: UpdatedwarbaasAinda não há avaliações

- Intangible AssetsDocumento7 páginasIntangible Assetssammeracobre-7155Ainda não há avaliações

- M ABC 5 CopiesDocumento6 páginasM ABC 5 CopiesChloe CataluñaAinda não há avaliações

- Chapter Nineteen: Dividends and Other PayoutsDocumento37 páginasChapter Nineteen: Dividends and Other PayoutsiisrasyidiAinda não há avaliações

- Chapter 13Documento59 páginasChapter 13Asad AbbasAinda não há avaliações

- Quiz 2 SolutionsDocumento5 páginasQuiz 2 Solutions820090150% (2)

- Chapter 7 ProblemsDocumento4 páginasChapter 7 ProblemsZyraAinda não há avaliações

- Chapter 09 Indirect and Mutual HoldingsDocumento22 páginasChapter 09 Indirect and Mutual HoldingsKukuh HariyadiAinda não há avaliações

- Ch06 ShortDocumento46 páginasCh06 ShortThai Anh HoAinda não há avaliações

- Laporan Keuangan KonsolidasiDocumento49 páginasLaporan Keuangan KonsolidasiMuhammad Tamul FikriAinda não há avaliações

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDocumento2 páginasAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeAinda não há avaliações

- Chapter 06 - Intercompany Profit Transactions - Plant AssetsDocumento28 páginasChapter 06 - Intercompany Profit Transactions - Plant AssetsTina Lundstrom100% (1)

- CH 06Documento72 páginasCH 06Lenny FransiskaAinda não há avaliações

- Reporting Intercorporate InterestDocumento21 páginasReporting Intercorporate Interestwahyu dirosoAinda não há avaliações

- Intermediate: AccountingDocumento63 páginasIntermediate: AccountingPhạm Lê Thùy LinhAinda não há avaliações

- Dividends and Other PayoutsDocumento29 páginasDividends and Other PayoutsArif AlamgirAinda não há avaliações

- ch06 Beams10e TBDocumento28 páginasch06 Beams10e TBKenneth Jay AcideraAinda não há avaliações

- Answers Ans 1Documento11 páginasAnswers Ans 1Patrick Panlilio RetuyaAinda não há avaliações

- Finance - Exam 3Documento15 páginasFinance - Exam 3Neeta Joshi50% (6)

- Quiz Chapter 1 Business Combinations Part 1Documento6 páginasQuiz Chapter 1 Business Combinations Part 1Kaye L. Dela CruzAinda não há avaliações

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocumento5 páginasBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Module 5.3 Advanced Financial ReportingDocumento31 páginasModule 5.3 Advanced Financial ReportingRonaly Nario DagohoyAinda não há avaliações

- CH 09Documento101 páginasCH 09Armand Muhammad100% (1)

- Blue Corporation Holds 70 Percent of Black Companys Voting Common Stock On - 8375222Documento21 páginasBlue Corporation Holds 70 Percent of Black Companys Voting Common Stock On - 8375222Muhammad SatrioAinda não há avaliações

- (Before Acquisition) (After Acquisition) : Conjunction Co. Combined EntityDocumento2 páginas(Before Acquisition) (After Acquisition) : Conjunction Co. Combined Entityellie100% (1)

- ch11 Beams10e TBDocumento28 páginasch11 Beams10e TBK. CustodioAinda não há avaliações

- Fin ManDocumento3 páginasFin ManDonna Mae HernandezAinda não há avaliações

- Accounting Principles: Plant Assets, Natural Resources, and Intangible AssetsDocumento79 páginasAccounting Principles: Plant Assets, Natural Resources, and Intangible AssetsThế VinhAinda não há avaliações

- The Teenage Investor: How to Start Early, Invest Often & Build WealthNo EverandThe Teenage Investor: How to Start Early, Invest Often & Build WealthNota: 2.5 de 5 estrelas2.5/5 (2)

- Investing in Fixer-Uppers: A Complete Guide to Buying Low, Fixing Smart, Adding Value, and Selling (or Renting) HighNo EverandInvesting in Fixer-Uppers: A Complete Guide to Buying Low, Fixing Smart, Adding Value, and Selling (or Renting) HighNota: 5 de 5 estrelas5/5 (1)

- Analisis Laporan Keuangan (ALK)Documento40 páginasAnalisis Laporan Keuangan (ALK)Farid MuhammadAinda não há avaliações

- Chapter 7 - Cash Flow AnalysisDocumento18 páginasChapter 7 - Cash Flow AnalysisulfaAinda não há avaliações

- Consolidation As of The Date of Acquisition: Irwin/Mcgraw-HillDocumento23 páginasConsolidation As of The Date of Acquisition: Irwin/Mcgraw-HillulfaAinda não há avaliações

- Presentation TADocumento28 páginasPresentation TAulfaAinda não há avaliações

- Chap 01Documento20 páginasChap 01ulfaAinda não há avaliações

- Chap 03Documento29 páginasChap 03ulfaAinda não há avaliações

- CH 07Documento20 páginasCH 07ulfaAinda não há avaliações

- Accounting Information Systems: 9 EditionDocumento49 páginasAccounting Information Systems: 9 Editionjeff4509Ainda não há avaliações

- AIS01Documento49 páginasAIS01Fitriyah Az-zahraaAinda não há avaliações

- Chapter 7 - Cash Flow AnalysisDocumento18 páginasChapter 7 - Cash Flow AnalysisulfaAinda não há avaliações

- Pacoac - Acctg For Corporation, Financial Reporting - Analysis, and Intro To CostaccDocumento12 páginasPacoac - Acctg For Corporation, Financial Reporting - Analysis, and Intro To CostaccJaysonAinda não há avaliações

- Comprehensive Guide To Real Estate InvestmentDocumento156 páginasComprehensive Guide To Real Estate Investmentpllssdsd100% (2)

- Cadbury Schweppes DF 2006Documento1 páginaCadbury Schweppes DF 2006JORGEAinda não há avaliações

- Finex Ppt1 (MBA)Documento45 páginasFinex Ppt1 (MBA)DowlathAhmedAinda não há avaliações

- 2014 - The Effects of Harmonization and Convergence With IFRS On The Timelines of Earnings Reported Under Chinese GAApDocumento12 páginas2014 - The Effects of Harmonization and Convergence With IFRS On The Timelines of Earnings Reported Under Chinese GAApDiny SulisAinda não há avaliações

- Deprival Value Lecture NotesDocumento7 páginasDeprival Value Lecture NotesTosin YusufAinda não há avaliações

- Etd 2009 8 8Documento16 páginasEtd 2009 8 8harsh0520Ainda não há avaliações

- Proposed California Wildfire Risk Legislation Is Credit Positive But Questions Remain 7 10 19Documento6 páginasProposed California Wildfire Risk Legislation Is Credit Positive But Questions Remain 7 10 19Rob NikolewskiAinda não há avaliações

- IB Pitchbook Valuation AnalysisDocumento3 páginasIB Pitchbook Valuation AnalysisSumeer BeriAinda não há avaliações

- The Cemex Way PDFDocumento21 páginasThe Cemex Way PDFLis Bueno Saavedra100% (1)

- Comparative Study of Mutual Fund Returns and Insurance ReturnsDocumento3 páginasComparative Study of Mutual Fund Returns and Insurance Returnskkdeepak sal0% (1)

- Should You Buy or Sell Tail Risk Hedges? A Filtered Bootstrap ApproachDocumento33 páginasShould You Buy or Sell Tail Risk Hedges? A Filtered Bootstrap ApproachRahul SheorainAinda não há avaliações

- 084.anthony Falasca With 'Lusan Pty LTD' and 'Kool Fun Toys (HK) Pty LTD': LinkedinDocumento5 páginas084.anthony Falasca With 'Lusan Pty LTD' and 'Kool Fun Toys (HK) Pty LTD': LinkedinFlinders TrusteesAinda não há avaliações

- Lumax Auto Technologies Limited: Illuminated PerformanceDocumento8 páginasLumax Auto Technologies Limited: Illuminated Performancemohammad shabuddinAinda não há avaliações

- SAPM - Risk AversionDocumento13 páginasSAPM - Risk Aversiongs_waiting_4_uAinda não há avaliações

- Investopedia - Financial Ratio TutorialDocumento55 páginasInvestopedia - Financial Ratio TutorialKoh See Hui RoxanneAinda não há avaliações

- JPM - Cap and FloorDocumento7 páginasJPM - Cap and FloorRR BakshAinda não há avaliações

- Mock Exam of Partnership AccountingDocumento12 páginasMock Exam of Partnership AccountingArcely Gundran100% (1)

- Chapter 14Documento29 páginasChapter 14Baby Khor100% (1)

- 2018 Integrated Report PDFDocumento290 páginas2018 Integrated Report PDFAndrea PalancaAinda não há avaliações

- Astro Electronics Corp. vs. Philippine Export and Foreign Loan Guarantee Corporation, G.R. No. 136729, September 23, 2003Documento3 páginasAstro Electronics Corp. vs. Philippine Export and Foreign Loan Guarantee Corporation, G.R. No. 136729, September 23, 2003Fides DamascoAinda não há avaliações

- Bahana Tbla Rated Oct 2016Documento22 páginasBahana Tbla Rated Oct 2016nikAinda não há avaliações

- Declaration by Trustees ExampleDocumento4 páginasDeclaration by Trustees ExamplePeter WatsonAinda não há avaliações

- Accounts Notes Ecom Final 409 PagesDocumento409 páginasAccounts Notes Ecom Final 409 PagesRajesh PrasadAinda não há avaliações

- The Cboe S&P 500 Putwrite Index (Put) : Month End Index Values, June 1988 To May 2007Documento13 páginasThe Cboe S&P 500 Putwrite Index (Put) : Month End Index Values, June 1988 To May 2007alexjones365Ainda não há avaliações

- Banking Project - Indian Financial SystemDocumento16 páginasBanking Project - Indian Financial SystemAayush VarmaAinda não há avaliações

- John Seckinger - Sophisticated Look at Pivot PointsDocumento5 páginasJohn Seckinger - Sophisticated Look at Pivot Pointsjackjensen2852Ainda não há avaliações

- Berkshire Hathaway Audit Committee Report On Trading in Lubrizol Corporation Shares by David L. SokolDocumento18 páginasBerkshire Hathaway Audit Committee Report On Trading in Lubrizol Corporation Shares by David L. SokolCNBCAinda não há avaliações

- Finance Ba 1 ExamDocumento48 páginasFinance Ba 1 ExamAniruddhaAinda não há avaliações

- Telenor ASA - 9 April 2019Documento19 páginasTelenor ASA - 9 April 2019Hoàng Tuấn LinhAinda não há avaliações