Escolar Documentos

Profissional Documentos

Cultura Documentos

Consolidation As of The Date of Acquisition: Irwin/Mcgraw-Hill

Enviado por

ulfaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Consolidation As of The Date of Acquisition: Irwin/Mcgraw-Hill

Enviado por

ulfaDireitos autorais:

Formatos disponíveis

1

Baker / Lembke / King

Consolidation

as of the Date

of Acquisition

Irwin/McGraw-

The McGraw-Hill

The McGraw-Hill

Companies,

Inc., 1999

Companies,

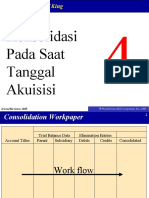

Consolidation Workpaper

Account Titles

Trial Balance Data

Parent

Subsidiary

Elimination Entries

Debits

Credits

Consolidated

Work flow

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Balance Sheets Before Combination

Assets

Cash

Accounts Receivable

Inventory

Land

Buildings and Equipment

Accumulated Depreciation

Total Assets

Liabilities and Stockholders Equity

Accounts Payable

Bonds Payable

Common Stock

Retained Earnings

Total Liabilities and Stockholders Equity

Irwin/McGraw-

$ 350,000

75,000

100,000

175,000

800,000

(400,000)

$ 50,000

50,000

60,000

40,000

600,000

(300,000)

$1,100,000

$500,000

$ 100,000

200,000

500,000

300,000

$1,100,000

$100,000

100,000

200,000

100,000

$500,000

The McGraw-Hill Companies, Inc., 1999

Balance Sheets Before Combination

Assets

Cash

$ 350,000

$ 50,000

Accounts Receivable

75,000

50,000

Investment cost

$300,00060,000

Inventory

100,000

Land Book value:

175,000

40,000

BuildingsCommon

and Equipment

800,000

600,000

stock--Special Foods $200,000

Accumulated

Depreciation

(400,000)

(300,000)

Retained

earnings--Special Foods 100,000

$300,000

Total Assets

$1,100,000

$500,000

Peerlesss

share Equity

x 1.00 (300,000)

Liabilities and

Stockholders

Difference

Accounts

Payablebetween cost and

$ 100,000

$100,000

book value

$

-0Bonds Payable

200,000

100,000

Common Stock

500,000

200,000

Retained Earnings

300,000

100,000

Total Liabilities and Stockholders Equity

$1,100,000

$500,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Balance Sheets After Combination

Assets

Cash

Accounts Receivable

Inventory

Land

Buildings and Equipment

Accumulated Depreciation

Investment in Special Foods Stock

Total Assets

Liabilities and Stockholders Equity

Accounts Payable

Bonds Payable

Common Stock

Retained Earnings

Total Liabilities and Stockholders Equity

Irwin/McGraw-

50,000

75,000

100,000

175,000

800,000

(400,000)

300,000

$1,100,000

$ 50,000

50,000

60,000

40,000

600,000

(300,000)

$500,000

$ 100,000

200,000

500,000

300,000

$1,100,000

$100,000

100,000

200,000

100,000

$500,000

The McGraw-Hill Companies, Inc., 1999

Purchase at Book Value

Account Titles

Trial Balance Data

Peerless

Spec. Fd.

Elimination Entries

Debits

Credits

Consolidated

Cash

50,000

Accounts Rec.

75,000

Inventory

l00,000

Land

175,000

Bldg. and Equip. 800,000

Inv. in Sp. Foods 300,000

Total Debits

1,500,000

50,000

50,000

60,000

40,000

600,000

100,000

125,000

160,000

215,000

1,400,000

800,000

2,000,000

Accum. Depr.

400,000

Accounts Payable 100,000

Bonds Payable

200,000

Common Stock

500,000

Retained Earn.

300,000

Total Credits

1,500,000

300,000

100,000

100,000

200,000

100,000

800,000

700,000

200,000

300,000

500,000

300,000

2,000,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Purchase at Book Value

Account Titles

Trial Balance Data

Peerless

Spec. Fd.

Elimination Entries

Debits

Credits

Consolidated

Cash

50,000

Accounts Rec.

75,000

Inventory

l00,000

Land

175,000

Bldg. and Equip. 800,000

Inv. in Sp. Foods 300,000

Total Debits

1,500,000

50,000

50,000

60,000

40,000

600,000

800,000

2,000,000

Accum. Depr.

400,000

Accounts Payable 100,000

Bonds Payable

200,000

Common Stock

500,000

Retained Earn.

300,000

Total Credits

1,500,000

300,000

100,000

100,000

200,000

100,000

800,000

700,000

200,000

300,000

500,000

300,000

2,000,000

Irwin/McGraw-

100,000

125,000

160,000

215,000

1,400,000

300,000

200,000

100,000

300,000

300,000

The McGraw-Hill Companies, Inc., 1999

Purchase at Book Value

Account Titles

Trial Balance Data

Peerless

Spec. Fd.

Elimination Entries

Debits

Credits

Consolidated

Cash

50,000

Accounts Rec.

75,000

Inventory

l00,000

Land

175,000

Bldg. and Equip. 800,000

Inv. in Sp. Foods 300,000

Total Debits

1,500,000

50,000

50,000

60,000

40,000

600,000

800,000

2,000,000

Accum. Depr.

400,000

Accounts Payable 100,000

Bonds Payable

200,000

Common Stock

500,000

Retained Earn.

300,000

Total Credits

1,500,000

300,000

100,000

100,000

200,000

100,000

800,000

700,000

200,000

300,000

500,000

300,000

2,000,000

Irwin/McGraw-

100,000

125,000

160,000

215,000

1,400,000

300,000

200,000

100,000

300,000

300,000

The McGraw-Hill Companies, Inc., 1999

Purchase at Book Value

Common Stock--Special Foods 200,000

Retained Earnings

100,000

Investment in Special Foods

Stock

300,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Purchase At More Than Book Value

10

Investment

$340,000

Investmentcost

cost

$340,000

Book

Bookvalue:

value:

Common

Commonstock--Special

stock--SpecialFoods

Foods $200,000

$200,000

Retained

Retainedearnings--Special

earnings--SpecialFoods

Foods 100,000

100,000

$300,000

$300,000

Peerlesss

xx 1.00

Peerlesssshare

share

1.00 (300,000)

(300,000)

Difference

Differencebetween

betweencost

costand

and

book

$$ 40,000

bookvalue

value

40,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Purchase At More Than Book Value

11

Reasons the purchase price of a companys stock

might exceed the stocks book value...

Errors or omissions on the books of the

subsidiary

Excess of fair value over the book value

of the subsidiarys net identifiable assets

Existence of goodwill

Other reasons

Irwin/McGraw-

This

This one

one

should

should be

be

rare

rare

The McGraw-Hill Companies, Inc., 1999

Purchase At More Than Book Value

Account Titles

Trial Balance Data

Peerless

Spec. Fd.

Elimination Entries

Debits

Credits

12

Consolidated

Cash

10,000

Accounts Rec.

75,000

Inventory

l00,000

Land

175,000

Bldg. and Equip. 800,000

Inv. in Sp. Foods 340,000

Differential

Total Debits

1,500,000

50,000

50,000

60,000

40,000

600,000

800,000

2,000,000

Accum. Depr.

400,000

Accounts Payable 100,000

Bonds Payable

200,000

Common Stock

500,000

Retained Earn.

300,000

Total Credits

1,500,000

300,000

100,000

100,000

200,000

100,000

800,000

700,000

200,000

300,000

500,000

300,000

Irwin/McGraw-

60,000

125,000

160,000

255,000

1,400,000

40,000

40,000

200,000

100,000

340,000

40,000

The McGraw-Hill Companies, Inc., 1999

Purchase At More Than Book Value

Account Titles

Trial Balance Data

Peerless

Spec. Fd.

Elimination Entries

Debits

Credits

13

Consolidated

Cash

10,000

Accounts Rec.

75,000

Inventory

l00,000

Land

175,000

Bldg. and Equip. 800,000

Inv. in Sp. Foods 340,000

Differential

Total Debits

1,500,000

50,000

50,000

60,000

40,000

600,000

800,000

2,000,000

Accum. Depr.

400,000

Accounts Payable 100,000

Bonds Payable

200,000

Common Stock

500,000

Retained Earn.

300,000

Total Credits

1,500,000

300,000

100,000

100,000

200,000

100,000

800,000

700,000

200,000

300,000

500,000

300,000

2,000,000

Irwin/McGraw-

60,000

125,000

160,000

255,000

1,400,000

40,000

40,000

200,000

100,000

380,000

340,000

40,000

380,000

The McGraw-Hill Companies, Inc., 1999

Purchase At More Than Book Value

Account Titles

Trial Balance Data

Peerless

Spec. Fd.

Elimination Entries

Debits

Credits

14

Consolidated

Cash

10,000

Accounts Rec.

75,000

Inventory

l00,000

Land

175,000

Bldg. and Equip. 800,000

Inv. in Sp. Foods 340,000

Differential

Total Debits

1,500,000

50,000

50,000

60,000

40,000

600,000

800,000

2,000,000

Accum. Depr.

400,000

Accounts Payable 100,000

Bonds Payable

200,000

Common Stock

500,000

Retained Earn.

300,000

Total Credits

1,500,000

300,000

100,000

100,000

200,000

100,000

800,000

700,000

200,000

300,000

500,000

300,000

2,000,000

Irwin/McGraw-

60,000

125,000

160,000

255,000

1,400,000

40,000

40,000

200,000

100,000

380,000

340,000

40,000

380,000

The McGraw-Hill Companies, Inc., 1999

Purchase At More Than Book Value

15

Common Stock--Special Foods 200,000

Retained Earnings

100,000

Differential

40,000

Investment in Special Foods

Stock

340,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Purchase At More Than Book Value

Land

Differential

Irwin/McGraw-

16

40,000

40,000

The McGraw-Hill Companies, Inc., 1999

Purchase At More Than Book Value

Account Titles

Trial Balance Data

Peerless

Spec. Fd.

Elimination Entries

Debits

Credits

17

Consolidated

Cash

10,000

Accounts Rec.

75,000

Inventory

l00,000

Land

175,000

Bldg. and Equip. 800,000

Inv. in Sp. Foods 340,000

Differential

Total Debits

1,500,000

50,000

50,000

60,000

40,000

600,000

800,000

2,000,000

Accum. Depr.

400,000

Accounts Payable 100,000

Bonds Payable

200,000

Common Stock

500,000

Retained Earn.

300,000

Total Credits

1,500,000

300,000

100,000

100,000

200,000

100,000

800,000

700,000

200,000

300,000

500,000

300,000

2,000,000

Irwin/McGraw-

60,000

125,000

160,000

255,000

1,400,000

40,000

40,000

200,000

100,000

380,000

340,000

40,000

380,000

The McGraw-Hill Companies, Inc., 1999

80 Percent Purchase at Book Value

18

Investment

$240,000

Investmentcost

cost

$240,000

Book

Bookvalue:

value:

Common

Commonstock--Special

stock--SpecialFoods

Foods $200,000

$200,000

Retained

Retainedearnings--Special

earnings--SpecialFoods

Foods 100,000

100,000

$300,000

$300,000

Peerlesss

xx .80

Peerlesssshare

share

.80 (240,000)

(240,000)

Differential

$$

-0Differential

-0-

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

80 Percent Purchase at Book Value

Account Titles

Trial Balance Data

Peerless

Spec. Fd.

Cash

110,000

Accounts Rec.

75,000

Inventory

l00,000

Land

175,000

Bldg. and Equip. 800,000

Inv. in Sp. Foods 240,000

Total Debits

1,500,000

50,000

50,000

60,000

40,000

600,000

Accum. Depr.

Accounts Payable

Bonds Payable

Common Stock

Retained Earn.

300,000

100,000

100,000

200,000

100,000

Total Credits

Irwin/McGraw-

400,000

100,000

200,000

500,000

300,000

1,500,000

Elimination Entries

Debits

Credits

19

Consolidated

240,000

800,000

800,000

200,000

100,000

300,000

60,000

300,000

The McGraw-Hill Companies, Inc., 1999

80 Percent Purchase at Book Value

Account Titles

Trial Balance Data

Peerless

Spec. Fd.

Cash

110,000

Accounts Rec.

75,000

Inventory

l00,000

Land

175,000

Bldg. and Equip. 800,000

Inv. in Sp. Foods 240,000

Total Debits

1,500,000

50,000

50,000

60,000

40,000

600,000

Accum. Depr.

400,000

Accounts Payable 100,000

Bonds Payable

200,000

Common Stock

500,000

Retained Earn.

300,000

Noncont. Interest

Total Credits

1,500,000

300,000

100,000

100,000

200,000

100,000

Irwin/McGraw-

Elimination Entries

Debits

Credits

20

Consolidated

240,000

800,000

800,000

200,000

100,000

300,000

60,000

300,000

The McGraw-Hill Companies, Inc., 1999

80 Percent Purchase at Book Value

Account Titles

Trial Balance Data

Peerless

Spec. Fd.

Elimination Entries

Debits

Credits

21

Consolidated

Cash

110,000

Accounts Rec.

75,000

Inventory

l00,000

Land

175,000

Bldg. and Equip. 800,000

Inv. in Sp. Foods 240,000

Total Debits

1,500,000

50,000

50,000

60,000

40,000

600,000

800,000

2,060,000

Accum. Depr.

400,000

Accounts Payable 100,000

Bonds Payable

200,000

Common Stock

500,000

Retained Earn.

300,000

Noncont. Interest

Total Credits

1,500,000

300,000

100,000

100,000

200,000

100,000

700,000

200,000

300,000

500,000

300,000

60,000

2,060,000

Irwin/McGraw-

160,000

125,000

160,000

215,000

1,400,000

240,000

800,000

200,000

100,000

300,000

60,000

300,000

The McGraw-Hill Companies, Inc., 1999

80 Percent Purchase at Book Value

22

Common Stock--Special Foods 200,000

Retained Earnings

100,000

Investment in Special Foods

Stock

240,000

Noncontrolling Interest

60,000

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

23

Chapter Four

The

The

End

End

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Você também pode gostar

- Mergers, Acquisitions, Divestitures, and Other RestructuringsNo EverandMergers, Acquisitions, Divestitures, and Other RestructuringsAinda não há avaliações

- Konsolidasi Pada Saat Tanggal Akuisisi: Irwin/Mcgraw-HillDocumento23 páginasKonsolidasi Pada Saat Tanggal Akuisisi: Irwin/Mcgraw-HillAbraham Niel puteranataAinda não há avaliações

- Introduction To Accounting and BusinessDocumento54 páginasIntroduction To Accounting and BusinessAje AndiartaAinda não há avaliações

- Chapter 4. Financial Statements: Spring 2003Documento17 páginasChapter 4. Financial Statements: Spring 2003izzati adibahAinda não há avaliações

- Chap 002Documento17 páginasChap 002soso900Ainda não há avaliações

- CH01 Introduction To Accounting PDFDocumento40 páginasCH01 Introduction To Accounting PDFindra6rusadie100% (1)

- Chap 006 NotesDocumento69 páginasChap 006 Notesflower104Ainda não há avaliações

- MGT45 Fall 2013 HW#2 11AM SectionDocumento25 páginasMGT45 Fall 2013 HW#2 11AM SectionTrevor Allen HolleronAinda não há avaliações

- Introduction To Accounting and Business: Financial and Managerial Accounting 8th Edition Warren Reeve FessDocumento40 páginasIntroduction To Accounting and Business: Financial and Managerial Accounting 8th Edition Warren Reeve FessJuan VictorAinda não há avaliações

- Objectives: Introduction To Accounting and BusinessDocumento7 páginasObjectives: Introduction To Accounting and BusinessKetrineAinda não há avaliações

- Week 4-5 - ULOd-Lets Analyze and in A NutshellDocumento2 páginasWeek 4-5 - ULOd-Lets Analyze and in A Nutshellalmira garciaAinda não há avaliações

- Chapter 3 - OutlineDocumento7 páginasChapter 3 - OutlineBen YungAinda não há avaliações

- The Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/IrwinDocumento45 páginasThe Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/IrwinSobia NasreenAinda não há avaliações

- Financial Statements and Accounting Concepts/PrinciplesDocumento30 páginasFinancial Statements and Accounting Concepts/PrinciplesdanterozaAinda não há avaliações

- Consolidations - Subsequent To The Date of AcquisitionDocumento42 páginasConsolidations - Subsequent To The Date of AcquisitionAla'aEQahwajiʚîɞAinda não há avaliações

- CH01Documento41 páginasCH01ahmad_habibi_70% (1)

- Chap 002Documento16 páginasChap 002species09Ainda não há avaliações

- Esops 101 (What/Why/How) : Robert E. BrownDocumento20 páginasEsops 101 (What/Why/How) : Robert E. Brownashwani7789Ainda não há avaliações

- Basic Facts About ESOPs2Documento20 páginasBasic Facts About ESOPs2Quant TradingAinda não há avaliações

- CHP 4 Financial Statement of Sole TraderDocumento6 páginasCHP 4 Financial Statement of Sole TraderKelvin PadmanAinda não há avaliações

- Chapter 1-4Documento20 páginasChapter 1-4BookDownAinda não há avaliações

- ACCT2020 Introduction To Accounting For Non-Business Majors Chapter 1Documento15 páginasACCT2020 Introduction To Accounting For Non-Business Majors Chapter 1H20-spoutAinda não há avaliações

- Financial Accounting PDFDocumento43 páginasFinancial Accounting PDFJaya SudhakarAinda não há avaliações

- Kohler Case Leo Final DraftDocumento16 páginasKohler Case Leo Final DraftLeo Ng Shee Zher67% (3)

- CHP 2 Double Entry Book Keeping and Books of Original EntryDocumento34 páginasCHP 2 Double Entry Book Keeping and Books of Original EntryKelvin PadmanAinda não há avaliações

- Vertical Analysis of A Balance SheetDocumento4 páginasVertical Analysis of A Balance SheetMary80% (5)

- Intercorporate Acquisitions and Investment in Other EntitiesDocumento21 páginasIntercorporate Acquisitions and Investment in Other Entitieswahyu dirosoAinda não há avaliações

- R13 - Lesson 3 - Investments in Business CombinationsDocumento12 páginasR13 - Lesson 3 - Investments in Business CombinationsDhar CHanAinda não há avaliações

- Chapter Five: The Financial Statements of Banks and Their Principal CompetitorsDocumento30 páginasChapter Five: The Financial Statements of Banks and Their Principal CompetitorsMaria ZakirAinda não há avaliações

- Chapter Exercise 2 (March 2022)Documento7 páginasChapter Exercise 2 (March 2022)Woo JohnsonAinda não há avaliações

- Financial and Managerial Accounting 11th Edition Warren Solutions ManualDocumento10 páginasFinancial and Managerial Accounting 11th Edition Warren Solutions Manualcharlesdrakejth100% (14)

- Session 2 Ma (9th May 2012)Documento31 páginasSession 2 Ma (9th May 2012)KamauWafulaWanyamaAinda não há avaliações

- Accounting Basics 1Documento75 páginasAccounting Basics 1allangreslyAinda não há avaliações

- Statement of Cash FlowsDocumento40 páginasStatement of Cash FlowsGaluh Boga KuswaraAinda não há avaliações

- Working Capital MGTDocumento12 páginasWorking Capital MGTssimi137Ainda não há avaliações

- Chapter 2 ProbelmsDocumento10 páginasChapter 2 Probelmsmorgan.bertoneAinda não há avaliações

- Essentials of Managerial Finance 14th Edition Besley Solutions ManualDocumento35 páginasEssentials of Managerial Finance 14th Edition Besley Solutions Manualbayedaidancerkobn8100% (30)

- Solution Manual For Financial Accounting 9th Edition by WeygandtDocumento22 páginasSolution Manual For Financial Accounting 9th Edition by Weygandta540142314100% (3)

- Lecture1 On Introduction To Company AccountsDocumento29 páginasLecture1 On Introduction To Company AccountsERICK MLINGWAAinda não há avaliações

- Short-Term Finance and Planning: © 2003 The Mcgraw-Hill Companies, Inc. All Rights ReservedDocumento59 páginasShort-Term Finance and Planning: © 2003 The Mcgraw-Hill Companies, Inc. All Rights ReservedKARISHMAATAinda não há avaliações

- Quiz 2 SolutionsDocumento5 páginasQuiz 2 Solutions820090150% (2)

- Ati Teas V Exam Ati Test of Essential Academic SkillsDocumento24 páginasAti Teas V Exam Ati Test of Essential Academic SkillsMelissaBeckMDdxtmo100% (50)

- Accounting For Business CombinationDocumento17 páginasAccounting For Business CombinationTrace ReyesAinda não há avaliações

- Importance of AccountingDocumento52 páginasImportance of AccountingLalithaAinda não há avaliações

- The Accounting Cycle:: Accruals and DeferralsDocumento41 páginasThe Accounting Cycle:: Accruals and DeferralsIrfan AliAinda não há avaliações

- Accounting Equation - Useful NotesDocumento19 páginasAccounting Equation - Useful Notessam guptAinda não há avaliações

- The Accounting Cycle: Accruals and Deferrals: Mcgraw-Hill/IrwinDocumento40 páginasThe Accounting Cycle: Accruals and Deferrals: Mcgraw-Hill/IrwinjawadzaheerAinda não há avaliações

- Excel 6Documento4 páginasExcel 6Eco FacileAinda não há avaliações

- Ch01 Beams12ge SMDocumento11 páginasCh01 Beams12ge SMWira MokiAinda não há avaliações

- Chapter 06 XLSolDocumento8 páginasChapter 06 XLSolZachary Thomas CarneyAinda não há avaliações

- Reporting and Analyzing Equity: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinDocumento58 páginasReporting and Analyzing Equity: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonAinda não há avaliações

- Chapter 10 - Business Combinations: Review QuestionsDocumento8 páginasChapter 10 - Business Combinations: Review QuestionsShek Kwun HeiAinda não há avaliações

- Chapter 03Documento12 páginasChapter 03Asim NazirAinda não há avaliações

- Chapter 5 ENTREP New BookDocumento23 páginasChapter 5 ENTREP New BookClaire Evann Villena EboraAinda não há avaliações

- Ifsa Chapter2Documento31 páginasIfsa Chapter2bingoAinda não há avaliações

- Analisis Laporan Keuangan (ALK)Documento40 páginasAnalisis Laporan Keuangan (ALK)Farid MuhammadAinda não há avaliações

- Chapter 7 - Cash Flow AnalysisDocumento18 páginasChapter 7 - Cash Flow AnalysisulfaAinda não há avaliações

- Chap 03Documento29 páginasChap 03ulfaAinda não há avaliações

- Presentation TADocumento28 páginasPresentation TAulfaAinda não há avaliações

- Chap 01Documento20 páginasChap 01ulfaAinda não há avaliações

- Reporting Intercorporate Investments in Common Stock: Irwin/Mcgraw-HillDocumento33 páginasReporting Intercorporate Investments in Common Stock: Irwin/Mcgraw-HillulfaAinda não há avaliações

- CH 07Documento20 páginasCH 07ulfaAinda não há avaliações

- Accounting Information Systems: 9 EditionDocumento49 páginasAccounting Information Systems: 9 Editionjeff4509Ainda não há avaliações

- AIS01Documento49 páginasAIS01Fitriyah Az-zahraaAinda não há avaliações

- Chapter 7 - Cash Flow AnalysisDocumento18 páginasChapter 7 - Cash Flow AnalysisulfaAinda não há avaliações

- Larcade Arcana LT 2.3 Module 2 The Development of World PoliticsDocumento2 páginasLarcade Arcana LT 2.3 Module 2 The Development of World PoliticsLarcade ArcanaAinda não há avaliações

- Activities KeyDocumento7 páginasActivities KeyCassandra Dianne Ferolino MacadoAinda não há avaliações

- Gisella Cindy 115180047 JADocumento32 páginasGisella Cindy 115180047 JAYuyun AnitaAinda não há avaliações

- SIEMENS Analysis of Financial StatementDocumento16 páginasSIEMENS Analysis of Financial StatementNeelofar Saeed100% (1)

- Post Merger Integration Toolkit - Overview and ApproachDocumento30 páginasPost Merger Integration Toolkit - Overview and Approachrindergal0% (1)

- Tips For The Toppers ComDocumento55 páginasTips For The Toppers ComAkshat KumarAinda não há avaliações

- Simulation of A Sustainable Cement Supply Chain Proposal Model ReviewDocumento9 páginasSimulation of A Sustainable Cement Supply Chain Proposal Model Reviewbinaym tarikuAinda não há avaliações

- Functions of CSODocumento25 páginasFunctions of CSOS Sai KumarAinda não há avaliações

- Role of Financial Markets and InstitutionsDocumento8 páginasRole of Financial Markets and InstitutionsTabish HyderAinda não há avaliações

- Shape of The MEC CurveDocumento3 páginasShape of The MEC CurveYashas Mp100% (2)

- BarillaDocumento22 páginasBarillaAbhinav LuthraAinda não há avaliações

- Rich Dad, Poor Dad Summary at WikiSummaries, Free Book SummariesDocumento12 páginasRich Dad, Poor Dad Summary at WikiSummaries, Free Book SummariesKristian100% (1)

- 10 Axioms of FinManDocumento1 página10 Axioms of FinManNylan NylanAinda não há avaliações

- DMA Case-Tean Assignment-Group4 v1Documento8 páginasDMA Case-Tean Assignment-Group4 v1Aissam OuazaAinda não há avaliações

- Dodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033Documento1 páginaDodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033yamanura hAinda não há avaliações

- On The Role of Human Resource Intermediaries - Basic Concepts and Research PDFDocumento2 páginasOn The Role of Human Resource Intermediaries - Basic Concepts and Research PDFFredrik MarkgrenAinda não há avaliações

- Form PDF 927448140281220Documento7 páginasForm PDF 927448140281220Arvind KumarAinda não há avaliações

- DLP - Cot - 2 - Applied - Econ - 2022 FinalDocumento7 páginasDLP - Cot - 2 - Applied - Econ - 2022 FinalWenelyn Bautista50% (2)

- Townhall SustDocumento21 páginasTownhall Sustpritom173Ainda não há avaliações

- EduHubSpot ITTOs CheatSheetDocumento29 páginasEduHubSpot ITTOs CheatSheetVamshisirAinda não há avaliações

- Module 4Documento26 páginasModule 4Be Verly BalawenAinda não há avaliações

- Your Guide To Employing A Foreign Domestic Worker in QatarDocumento20 páginasYour Guide To Employing A Foreign Domestic Worker in QatarMigrantRightsOrg100% (1)

- FCT IPO - Investor PresentationDocumento21 páginasFCT IPO - Investor PresentationbandaliumAinda não há avaliações

- MACROECONOMICS For PHD (Dynamic, International, Modern, Public Project)Documento514 páginasMACROECONOMICS For PHD (Dynamic, International, Modern, Public Project)the.lord.of.twitter101Ainda não há avaliações

- Capital and Return On CapitalDocumento38 páginasCapital and Return On CapitalThái NguyễnAinda não há avaliações

- Skill Shortage Is A Crucial Social IssueDocumento21 páginasSkill Shortage Is A Crucial Social Issuead4w8rlAinda não há avaliações

- Quiz Chương Btap - HTRDocumento7 páginasQuiz Chương Btap - HTRDOAN NGUYEN TRAN THUCAinda não há avaliações

- Commandant, Sap 7Th Battalion Pay Slip Government of West BengalDocumento1 páginaCommandant, Sap 7Th Battalion Pay Slip Government of West Bengalkazi MasrurAinda não há avaliações

- Activity - Cultural Differences and HRMDocumento3 páginasActivity - Cultural Differences and HRMSaraKovačićAinda não há avaliações

- KaleeswariDocumento14 páginasKaleeswariRocks KiranAinda não há avaliações