Escolar Documentos

Profissional Documentos

Cultura Documentos

NNR

Enviado por

Rajpurohit Ramesh0 notas0% acharam este documento útil (0 voto)

62 visualizações13 páginasfbdhmgfdgrdgmhhgj

Título original

Nnr

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PPT, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentofbdhmgfdgrdgmhhgj

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

62 visualizações13 páginasNNR

Enviado por

Rajpurohit Rameshfbdhmgfdgrdgmhhgj

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

Você está na página 1de 13

Ayesha Neeha M Tonse

Neeraja Banapur

Sachin kumar Reddy

The Shops and Establishment Act is a state

legislation act and each state has framed

its own rules for the Act. The object of this

Act is to provide statutory obligation and

rights to employees and employers in the

unauthorized sector of employment, i.e.,

shops and establishments. This Act is

applicable to all persons employed in an

establishment with or without wages,

except the members of the employers

family.

2

To

provide statutory obligation and rights to employees

and employers in the unorganized sector of employment,

i.e., shops and establishments.

To regulate the conditions of work and employment in

shops, commercial establishments, residential hotels,

restaurants, eating houses, theatres and other places of

public entertainment.

A state

legislation; each state has framed its own rules for

the Act.

Applicable to all persons employed in an establishment

with or without wages, except the members of the

employer's family.

State government can exempt, either permanently or for a

specified period, any establishments from all or any

provisions of this Act.

Compulsory

registration of shop/establishment within thirty days

of commencement of work.

Communications of closure of the establishment within 15 days

from the closing of the establishment.

Lays down the hours of work per day and week.

Lays down guidelines for spread-over, rest interval, opening and

closing hours, closed days, national and religious holidays,

overtime work.

Rules

for employment of children, young persons and women

Lays down the minimum wages to be paid.

Rules

for annual leave, maternity leave, sickness

and casual leave, etc.

Rules for employment and termination of service.

Maintenance of registers and records and display

of notices.

Obligations of employers.

Obligations of employees.

This Act lays down the following rules:

Working hours per day and week.

Guidelines for spread-over, rest interval,

opening and closing hours, closed days,

national and religious holidays, overtime work.

Employment of children, young persons and

women.

Rules for annual leave, maternity leave,

sickness and casual leave, etc.

Rules for employment and termination of

service.

7

Opening

and closing time prescribed under the act are as

followsShops dealing wholly in milks, vegetables, fruits, fish,

bread etc

Opening : NBF 5.00am Closing: NLT 8.30 pm

Shops

dealing in goods other than those prescribed above

Opening : NBF 7.00am Closing: NLT 11.00pm

Commercial

Establishments

Opening : NBF 8.30am Closing: NLT 8.30pm

Customer

who is being served r waiting to be served at

closing time may be served within 15 min.

No employee is allowed to work MT 9hrs in a day or for

48 hrs in a week

An employee may be allowed to work upto 3 hrs a week

over and above this limit and upto 26 hrs or NMT 6 days

in a year for purposes of making of accounts, stock taking

settlements or prescribed occasions.

No employee is allowed to work for more than 5 hrs at a

stretch unless he is given rest for half an hour if in case of

commercial establishment engaged in manufacturing

process, and 1 hr in any other cases.

The spread over of an employee in shop d not exceed 11

hrs on any day.

Every shop or commercial establishment d remain

closed on any one day of the week. The list of

closing days d be notified to the Inspector and

displayed in the premises of the establishment.

A shop or establishment may remain open on the

notified closing day provided it remains closed on

any other day of the week and this change d be

notified to the Inspector atleast a week in advance.

Pharmacists, Chemists and Druggists shops are

exempted from these provisions relating to closing

day.

10

The provisions of payment of Wages Act, 1936 and

the Workmens compensation Act, 1932 are

applicable regarding the payment of wages of

employees.

The wages payment period d be fixed by every

employer and d not exceed one month.

All wages d be paid in cash within 7 days of expiry

of the wage day.

Due wages of an employee terminated by an

employer d be paid within a day of the termination.

11

Following deductions are allowed from the wages of

the employees

Absence from duty

Fines

Advance or overpayment of wages

House accommodation and other amnesties & services

provided by the employer

Loss or damage of goods due to negligence of employee

Deductions to an insurance scheme appointed by the Govt

or for payment of Cooperative society.

Income tax deduction

Deduction required to be made by an order of court or any

other competent agency

12

13

Você também pode gostar

- An Assignment As A Part of Requirement For The Programme of inDocumento1 páginaAn Assignment As A Part of Requirement For The Programme of inRajpurohit RameshAinda não há avaliações

- An Assignment As A Part of Requirement For The Programme of inDocumento1 páginaAn Assignment As A Part of Requirement For The Programme of inRajpurohit RameshAinda não há avaliações

- Presentation On Meetings: Presented By:-Yusuf Ali Gheewala Hardik Parekh Ramesh RajpurohitDocumento22 páginasPresentation On Meetings: Presented By:-Yusuf Ali Gheewala Hardik Parekh Ramesh RajpurohitRajpurohit RameshAinda não há avaliações

- Presentation On Meetings: Presented ByDocumento16 páginasPresentation On Meetings: Presented ByRajpurohit RameshAinda não há avaliações

- SDMCET HR&FDocumento1 páginaSDMCET HR&FRajpurohit RameshAinda não há avaliações

- Sdmcet Exam Dec 2016 PDFDocumento1 páginaSdmcet Exam Dec 2016 PDFRajpurohit RameshAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

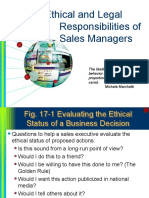

- Ethical and Legal Responsibilities of Sales ManagersDocumento4 páginasEthical and Legal Responsibilities of Sales ManagersBharathi RajuAinda não há avaliações

- Lxeb 1122 Assignment: Semester II 2015/2016Documento15 páginasLxeb 1122 Assignment: Semester II 2015/2016Jiana NasirAinda não há avaliações

- 003 Chapter Three Trade 2Documento14 páginas003 Chapter Three Trade 2Annette FlemingAinda não há avaliações

- VITUG Vs CA 183 SCRA 755 GDocumento2 páginasVITUG Vs CA 183 SCRA 755 GAlexandraSoledadAinda não há avaliações

- Release, Waiver and Quitclaim - Del Mundo, MGDocumento1 páginaRelease, Waiver and Quitclaim - Del Mundo, MGGracey Pascual100% (2)

- MCQ Lawof TortsDocumento38 páginasMCQ Lawof TortsNymphadora TonksAinda não há avaliações

- Property Outline Final-3Documento35 páginasProperty Outline Final-3Santosh Reddy Somi ReddyAinda não há avaliações

- Lecture 16 - Discharge - by Agreement and PerformanceDocumento5 páginasLecture 16 - Discharge - by Agreement and PerformanceBrett SmithAinda não há avaliações

- A13 - MumbaiDocumento4 páginasA13 - MumbaiVbs ReddyAinda não há avaliações

- Indian Partnership Act-1932Documento26 páginasIndian Partnership Act-1932harrygauravAinda não há avaliações

- Sales: San Beda College of LawDocumento42 páginasSales: San Beda College of LawLorry Fe A. SargentoAinda não há avaliações

- Sem1 Lecture 10 - Employer's LiabilityDocumento24 páginasSem1 Lecture 10 - Employer's Liabilityworld130108Ainda não há avaliações

- Chua Guan Vs Samahang MagsasakaDocumento12 páginasChua Guan Vs Samahang MagsasakaDexter CircaAinda não há avaliações

- G.R. No.183204, G.R. No. 209969, G.R. Nos. 198729-30Documento2 páginasG.R. No.183204, G.R. No. 209969, G.R. Nos. 198729-30MACAinda não há avaliações

- How To Start Your Asphalt Paving BusinessDocumento3 páginasHow To Start Your Asphalt Paving BusinessDennis MbegabolaweAinda não há avaliações

- 13.a.full Reyes Vs MauricioDocumento15 páginas13.a.full Reyes Vs MauricioWhoopi Jane MagdozaAinda não há avaliações

- Sandejas V LinaDocumento2 páginasSandejas V LinavalkyriorAinda não há avaliações

- Deed-Of-Donation-And-Acceptance Sub OfficeDocumento4 páginasDeed-Of-Donation-And-Acceptance Sub OfficeRohj EbreoAinda não há avaliações

- Test Bank For Financial Management Principles and Applications 11th Edition TitmanDocumento20 páginasTest Bank For Financial Management Principles and Applications 11th Edition TitmanIda Penza100% (36)

- Torts Exam NotesDocumento9 páginasTorts Exam NotesSara Darmenia100% (2)

- New Delhi Municipal Council Vs M-S Prominent Hotels Limited On 11 September, 2015Documento84 páginasNew Delhi Municipal Council Vs M-S Prominent Hotels Limited On 11 September, 2015Deepak SharmaAinda não há avaliações

- Evelyn Ruiz Vs Bernardo Dimailig (G.R. No. 204280 November 9, 2016) TOPIC: Real Estate Mortgage PONENTE: Del Castillo, JDocumento2 páginasEvelyn Ruiz Vs Bernardo Dimailig (G.R. No. 204280 November 9, 2016) TOPIC: Real Estate Mortgage PONENTE: Del Castillo, Jneil peirceAinda não há avaliações

- Pulumbirt, Sr. v. Ca, GR No. 153745-46Documento2 páginasPulumbirt, Sr. v. Ca, GR No. 153745-46AmicahAinda não há avaliações

- Aratea V Suico (Agas)Documento2 páginasAratea V Suico (Agas)Junsi AgasAinda não há avaliações

- Warranty Booklet 1902020 1110Documento17 páginasWarranty Booklet 1902020 1110Hoque AnamulAinda não há avaliações

- Duty of Care and Skill of Company DirectorsDocumento7 páginasDuty of Care and Skill of Company Directorsarchit malhotra100% (2)

- NY Custody PetitionDocumento6 páginasNY Custody PetitionNY Criminal LawyerAinda não há avaliações

- Article 1195-1198Documento3 páginasArticle 1195-1198Elai RubssAinda não há avaliações

- Transfer Pag Ibig Loan2Documento2 páginasTransfer Pag Ibig Loan2Christopher LaputAinda não há avaliações

- Tiu V ArriesgadoDocumento17 páginasTiu V ArriesgadoPatricia Anne GonzalesAinda não há avaliações