Escolar Documentos

Profissional Documentos

Cultura Documentos

Mudra Bank

Enviado por

nagallanraoDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Mudra Bank

Enviado por

nagallanraoDireitos autorais:

Formatos disponíveis

Why Savings are needed?

Drawbacks of

Cash at Home

Future Emergencies

Large Expenses

Needs

With savings, in the futureUnexpected Expenses like To meet larger expenses

you can buy what you can Illness, accident, death

like purchasing a house, marriage, Unsafe

not buy today education Money can be stolen or lost

due to natural calamities

Why Bank is needed?

Secure

Money

Loss of Growth

Avoid risk

Opportunity

of chit Inculca

funds, te Loss of Interest Income

sahukars habit

of

Bank

Saving

Earn

Loans

Interes

t No Credit

Remittances using Cheque Eligibility

Demand Draft Deposits in Bank

creates Credit Eligibility

Documents for Opening of Bank Account

In case of no

official

documents

Passport Pan Card Driving License Small Accounts can

be opened by submitting

recent photograph and

putting signature or

thumb impression in the

presence of Bank Official

Aadhar Card Voter Id Card Photograph

Manrega Card

Banking Products

Recurring Saving Fixed Educatio

Overdrafts

Account Account Deposit n Loans

Monthly savings. Normal transaction, Fixed deposit Pursuing Excess money

Interest paid higher flexibility for deposit for 7 days to 10 Higher/Vocational withdrawal over

than savings bank and withdraws, years, higher studies in India balance in accounts

account. passbook and cheque interest. maximum 10 lakhs on basis of eligibility

book,etc and abroad 20 lakhs.

Banking Service Delivery Channel

Bank Mitra

AT

with Micro

M

Cash Withdrawal Account Opening, Cash

through ATM / ATM

Withdrawal / Deposit, Fund

RuPay Debit Card Transfer

Branc Point of Sale

All Banking Purchasing

h

Services and limited

cash

withdrawal

Mobile Interne

Bankin t

Fund Transfer ,

g

Fund Bankin

Bill payment,

Transfer , Bill

payment onlinegshopping

,ticket

Mobile

wallets

Mobile based

virtual wallet, National Electronic

Real Time Gross

preloaded

amount for online

Fund Transfer (NEFT)

Settlement (RTGS)

and offline Inter-Bank Transfer of Inter-Bank Transfer of

spends any amount Rs 2 lac and above.

Você também pode gostar

- Accounting Concepts & PrinciplesDocumento29 páginasAccounting Concepts & PrinciplesnagallanraoAinda não há avaliações

- Anti Money Laundering Policy 2016-17Documento30 páginasAnti Money Laundering Policy 2016-17nagallanraoAinda não há avaliações

- Settlement of Claims for Deceased DepositorsDocumento33 páginasSettlement of Claims for Deceased DepositorsnagallanraoAinda não há avaliações

- Profit and Loss Acccount Study MaterialDocumento103 páginasProfit and Loss Acccount Study MaterialnagallanraoAinda não há avaliações

- TDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsDocumento10 páginasTDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsnagallanraoAinda não há avaliações

- D1 Explanatory NotesDocumento11 páginasD1 Explanatory NotesnagallanraoAinda não há avaliações

- Payment and Settlement System1Documento6 páginasPayment and Settlement System1nagallanraoAinda não há avaliações

- Capital Expenditure & Revenue ExpenditureDocumento5 páginasCapital Expenditure & Revenue ExpenditurenagallanraoAinda não há avaliações

- PML Act 2002Documento8 páginasPML Act 2002nagallanraoAinda não há avaliações

- Anti Money Laundering Policy 2016-17Documento30 páginasAnti Money Laundering Policy 2016-17nagallanraoAinda não há avaliações

- Financing and Supporting Producer OrganisationsDocumento12 páginasFinancing and Supporting Producer OrganisationsnagallanraoAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- PFRS 9Documento1 páginaPFRS 9Ella MaeAinda não há avaliações

- GTP Ew230524a 2Documento1 páginaGTP Ew230524a 2pcm-indo techAinda não há avaliações

- Credit Transactions Digests (Mutuum)Documento6 páginasCredit Transactions Digests (Mutuum)Stan AileronAinda não há avaliações

- MATERIALDocumento23 páginasMATERIALPocari OnceAinda não há avaliações

- Egret Printing and Publishing CompanyDocumento19 páginasEgret Printing and Publishing CompanySiddhartha ChhetriAinda não há avaliações

- The Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedDocumento3 páginasThe Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedMohd AqdasAinda não há avaliações

- Sas#22-Acc115 - QuizDocumento7 páginasSas#22-Acc115 - QuizLouisse Marie CatipayAinda não há avaliações

- Project On Cash Flow and Ratio Analysis of CompanyDocumento85 páginasProject On Cash Flow and Ratio Analysis of Companysomyajit SahooAinda não há avaliações

- IIBF Banking and FinanceDocumento16 páginasIIBF Banking and FinanceLakshay Singh0% (1)

- Thirteen Foundation 2015Documento25 páginasThirteen Foundation 2015cmf8926Ainda não há avaliações

- Accounting September Memo 2016Documento18 páginasAccounting September Memo 2016Jester LabanAinda não há avaliações

- Petroflo Trading Company: Cash Payment VoucherDocumento10 páginasPetroflo Trading Company: Cash Payment Vouchermuhammad ihtishamAinda não há avaliações

- HW2 ch12bDocumento10 páginasHW2 ch12bBAurAinda não há avaliações

- Project PresentationDocumento17 páginasProject Presentationdivya gambhirAinda não há avaliações

- Agricultural Business ManagementDocumento5 páginasAgricultural Business ManagementAreicra NutAinda não há avaliações

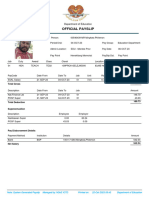

- Official Payslip: Department of EducationDocumento1 páginaOfficial Payslip: Department of Educationphillmingkwa2017Ainda não há avaliações

- For Student - Animation - Environment and MarketDocumento69 páginasFor Student - Animation - Environment and MarketJaylord MagpantayAinda não há avaliações

- Socio 101 Notes. Midterm TopicsDocumento25 páginasSocio 101 Notes. Midterm TopicsAsherAinda não há avaliações

- Finance Lease Agreement Mathematics Soluation: SolutionDocumento2 páginasFinance Lease Agreement Mathematics Soluation: SolutionMd. Shahbub AlamAinda não há avaliações

- 3rd Cases-Labor-Ft PDFDocumento42 páginas3rd Cases-Labor-Ft PDF001nooneAinda não há avaliações

- Banking Regulation Act 1949Documento13 páginasBanking Regulation Act 1949jhumli0% (1)

- Hill Country CaseDocumento5 páginasHill Country CaseDeepansh Kakkar100% (1)

- V Imp Questions For Exams For Selected ChaptersDocumento132 páginasV Imp Questions For Exams For Selected ChaptersNkume Irene100% (1)

- Statements 7344Documento4 páginasStatements 7344Валентина ШвечиковаAinda não há avaliações

- Sir Osborne Smith 01-04-1935 To 30-06-1937Documento6 páginasSir Osborne Smith 01-04-1935 To 30-06-1937Chintan P. ModiAinda não há avaliações

- Security Analysis and Portfolio Management Questions and AnswersDocumento15 páginasSecurity Analysis and Portfolio Management Questions and AnswersPashminaDoshiAinda não há avaliações

- IMD Total Public Equity Asset Class Review: April 25, 2016Documento39 páginasIMD Total Public Equity Asset Class Review: April 25, 2016hAinda não há avaliações

- Credit Ratings Provide Insight Into Financial StrengthDocumento6 páginasCredit Ratings Provide Insight Into Financial StrengthvishAinda não há avaliações

- Exercise4 Adjusting 1Documento4 páginasExercise4 Adjusting 1ABIGAIL DAYOTAinda não há avaliações

- Angelo Chua 庄向志 PETA 1 Financial StatementsDocumento4 páginasAngelo Chua 庄向志 PETA 1 Financial Statements채문길Ainda não há avaliações