Escolar Documentos

Profissional Documentos

Cultura Documentos

Where We Left Off : - in GAA, I Pursued A Sector-Specific Long-Short Strategy

Enviado por

SriniTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Where We Left Off : - in GAA, I Pursued A Sector-Specific Long-Short Strategy

Enviado por

SriniDireitos autorais:

Formatos disponíveis

Where we left off

In GAA, I pursued a sector-specific long-short strategy:

Targeted market-neutrality

Industry-specific long and short baskets were identified on a

monthly basis through a screen of targeted factors

Results were mixed

Factors provided attractive In-Sample results but were less

compelling Out-of-Sample

While less volatile over-all and market neutral, the strategy did

not outperform the benchmark on an absolute basis

Next Steps#1,#2,#3

Model Improvement:

1) Fix the Factors: Test additional screening

criteria to develop a better model

2) Optimize: First-cut model employed

subjective scoring for multivariate screens.

Optimization provides a more robust

approach to weighting factors

3)Dynamic Weighting: Explore the benefits of

time-varying factor weights to incorporate

information from macroeconomic events

Next Steps#4

Tailor the Implementation:

4) Make the strategy deployable at a small scale:

Not an asset manager by trade, so adjust application

so I can use this knowledge for personal fun and profit

Limit trading: Valuation Screen as a fundamental overlay to

reduce number of securities traded

Less Rebalancing: Extend rebalancing period and assess

impact to returns

#1 Fix the Factors

Original:

Short Interest - total short positions currently open for a given equity as

a percentage of total shares

Fundamental Debt Factor - incorporates information about cost of debt

and leverage ratio

Change in Consensus Percent change in EPS estimate

Revised:

Prospective Earnings Yield provides a primary fundamental

measure and is expectational in nature

3 month revision rate indicates direction of most recent information

observe by market analysts

36 mo MA 60 mo MA technical factor to indicate momentum and

trends

Outcome: Better Screen, Better Results

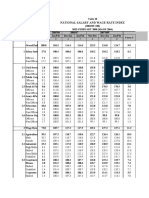

3 month Revision

Portfolios - equal weighted

-1- -2- -3- -4- -5-

Alpha

145.7 145.7 140.7 156.1 157.1

6.00 113.9 122.5 126.9 119.5 123.4

90.2 91.6 92.8 96.8 86.9

119.7 124.7 118.2 114.5 115.5

5.00 111.6 116.1 123.3 125.9 132.1

122.3 123.7 124.7 128.8 126.5

116.7 119.0 117.8 109.4 120.8

4.00 120.5 120.9 123.5 114.0 119.9

100.8 100.4 101.3 93.2 100.5

108.9 113.7 111.5 110.7 109.0

3.00

132.9 128.3 126.5 136.3 127.8

116.0 115.4 122.8 119.9 118.1

142.5 152.8 147.3 155.9 154.8

2.00

111.3 106.6 110.4 112.2 112.2

113.0 83.1 110.3 110.0 99.0

104.6 90.8 95.7 106.6 112.4

1.00

103.8 108.9 96.2 109.2 94.9

69.9 75.9 80.2 81.6 93.0

- 144.0 143.2 133.1 140.7 146.0

1 2 3 4 5 109.4 113.2 107.2 105.3 115.2

Average relative performance

3.8 3.1 2.7 2.7 2.7

36 mo Moving Avg 60 mo Moving Avg

Portfolios - equal weighted

-1- -2- -3- -4- -5-

Alpha 145.7 145.7 140.7 156.1 157.1

8.00

113.9 122.5 126.9 119.5 123.4

90.2 91.6 92.8 96.8 86.9

119.7 124.7 118.2 114.5 115.5

6.00

111.6 116.1 123.3 125.9 132.1

122.3 123.7 124.7 128.8 126.5

116.7 119.0 117.8 109.4 120.8

4.00

120.5 120.9 123.5 114.0 119.9

100.8 100.4 101.3 93.2 100.5

108.9 113.7 111.5 110.7 109.0

2.00

132.9 128.3 126.5 136.3 127.8

116.0 115.4 122.8 119.9 118.1

142.5 152.8 147.3 155.9 154.8

111.3 106.6 110.4 112.2 112.2

-

1 2 3 4 5 113.0 83.1 110.3 110.0 99.0

104.6 90.8 95.7 106.6 112.4

(2.00)

103.8 108.9 96.2 109.2 94.9

69.9 75.9 80.2 81.6 93.0

144.0 143.2 133.1 140.7 146.0

109.4 113.2 107.2 105.3 115.2

(4.00)

Average relative performance

3.8 3.1 2.7 2.7 2.7

Earnings Yield

Portfolios - equal weighted

-1- -2- -3- -4- -5-

Alpha

135.0 148.3 143.7 171.5 167.9

14.00

111.3 107.3 96.4 108.2 111.5

79.5 82.2 89.6 95.0 83.3

12.00

109.4 110.8 119.0 122.0 123.4

102.8 113.3 116.2 111.2 109.4

10.00

105.3 113.8 100.7 123.1 117.2

123.8 118.6 125.3 140.8 144.5

8.00

123.6 137.2 137.3 143.0 164.3

89.3 91.5 99.0 99.8 107.3

6.00

103.1 101.0 113.0 113.1 116.5

120.9 131.0 133.5 153.4 172.3

4.00

121.1 119.0 128.9 128.9 140.0

151.7 150.8 166.4 171.5 159.6

2.00

115.5 91.0 93.4 85.0 80.0

93.6 102.7 100.1 88.4 106.3

-

80.8 109.8 115.0 130.9 164.9

1 2 3 4 5

109.7 107.7 115.3 109.6 124.5

(2.00)

77.4 78.8 84.1 87.3 83.7

164.3 144.4 147.2 155.3 167.8

(4.00)

108.2 103.5 109.0 108.3 115.2

Average relative performance

4.1 3.9 2.9 2.1 1.9

#2 Optimize

Matrix for Correlation

Use optimization (as Factor 1

3m Rev

Factor 2

3mv-5mv

Factor 3

EY

opposed to subjective Factor 1

Factor 2

Factor 3

1.00

0.07

(0.22)

0.07

1.00

(0.10)

(0.22)

(0.10)

1.00

scoring to build multi- Matrix for Covariance

Factor 1 Factor 2 Factor 3

variant screen 3m Rev

2.48%

3mv-5mv

3.74%

EY

3.73%

2.48% 0.06% 0.01% -0.02%

Target different 3.74%

3.73%

0.01%

-0.02%

0.14%

-0.01%

-0.01%

0.14%

Matrix for (X i )(X j )(Cor ij )( s i )( s j ) --which is the same as (X i )(X j )(Cov ij )

acceptable level of Factor 1

3m Rev

Factor 2

3mv-5mv

Factor 3

EY

Weights (Xn) -75% 71% 105%

volatility (sensitivity

analysis)

#2 Optimized Heat Map Portfolios - equal weighted

-1- -2- -3- -4- -5-

Alpha 1985 152.2 147.9 153.4 143.0 145.9

1986 116.0 128.7 125.1 109.7 117.1

7.00 1987 87.8 89.6 94.4 92.4 90.8

1988 125.5 122.8 116.9 115.3 106.2

6.00 1989 119.8 116.8 119.6 119.5 123.3

1990 138.6 116.7 121.3 130.0 121.2

1991 124.9 113.9 122.6 114.1 113.2

5.00

1992 126.1 125.9 112.3 119.1 115.8

1993 104.5 105.8 93.3 93.6 88.7

4.00 1994 124.3 111.5 113.1 107.4 107.6

1995 138.3 135.3 137.4 127.2 131.0

3.00

1996 117.9 119.5 120.8 113.1 117.5

1997 146.6 147.6 151.4 151.4 146.8

1998 117.9 105.9 107.9 112.7 91.8

2.00

1999 120.9 101.7 100.6 99.1 95.5

2000 97.5 98.6 122.5 105.4 106.4

1.00

Hold -out / Out of Sample

-

1 2 3 4 5 2001 111.8 112.6 100.0 101.8 86.5

2002 76.2 75.0 88.5 84.6 80.9

2003 147.7 143.0 144.8 134.2 137.6

2004 110.3 109.7 108.3 113.4 110.4

Outcome: Better Screen, Better Results

#2 Optimize

Excel Printouts: Comparison on frontier

#3 Dynamic Factors

Strategy Returns in Periods with Interacting with Yield Curve Slope

Flattening Yield Curves

Changes in Weighting when 10 yr

Nov 88 Jun 90

yield less 6 mo yield is less than 1%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 New Optimization delivers different

weightings

Nov 97 Feb 01 Minor change in performance

1st Episode = 0.045%/month

advantage

1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 2nd Episode = (0.017%)/month

Interacted for Dynamic weighting Not Compelling as Executed

Static Weighting

#4 Scale Down

Implementation is Difficult at small scale:

With scoring screen limiting to 250 securities, still long 50 and

short 50

Monthly rebalancing prohibitive

Solution:

Automate a fundament sort of the long-short basket to further

reduce holdings

Explore rebalance at 6 / 12 month intervals

#4 Valuation Screen

Goal: apply an objective criteria to narrow the total population

of the identified long and short baskets

Process:

Attain consensus forecasts for stocks in long and short basket

Apply mechanical valuation, building and explicit valuation forecast for each

security in in the 1st and 5th fractile

Assume consensus performance and a 15 yr linear ramp-down to

performance at their cost of capital

Compare mechanical valuation to market price select top 10 undervalued

longs and top 10 overvalued shorts

Results:

Painful to apply (manual data entry, requires a more elegant execution)

Potential for information gaps (i.e. lack of forecast, not all securities

covered)

Sacrifices returns (on average), spikes volatility

Disclaimer: more rigorous back-testing necessary

#4 Valuation Screen

Excel Printouts: Structure of inputs and sort

on valuation information

#4 Rebalance Period

Goal: assess trade-off in expected return from longer

rebalancing 7.00

6.00

5.00

Return SD Sharpe 4.00

3.00

1 month: 8.5% .11 .78

2.00

1.00

-

1 2 3 4 5

7.00

6.00

5.00

4.00

3.00

2.00

6 month: 7.0% .08 .85

1.00

(1.00) 1 2 3 4 5

9.00

8.00

7.00

6.00

5.00

4.00

3.00

12 month: 8.7% .15 .60 2.00

1.00

-

1 2 3 4 5

Conclusion: Small sacrifice for longer rebalance

Conclusions

Optimization beats Subjective

Dynamic Factoring must be refined

Long-Short can be scaled down, but risk

obviously increases

A little bit of knowledge can be dangerous

Você também pode gostar

- BMI ChartDocumento24 páginasBMI ChartMerlinda PacquiaoAinda não há avaliações

- Sebelum Senam Sesudah SenamDocumento12 páginasSebelum Senam Sesudah SenamKlinik Cempaka PutihAinda não há avaliações

- Export Unit Value & Volume Indices (2010 100), November 2022Documento6 páginasExport Unit Value & Volume Indices (2010 100), November 2022Fauzan SyahmiAinda não há avaliações

- Gerongan-Es-Endline-Ns 22-23Documento83 páginasGerongan-Es-Endline-Ns 22-23JANET ALMENANAAinda não há avaliações

- Rumus ' S ' Curve (Version 1)Documento7 páginasRumus ' S ' Curve (Version 1)Najib MuhammadAinda não há avaliações

- ANALYSIS OF EMPLOYEE PERFORMANCE, MOTIVATION, ORGANIZATIONAL CLIMATE AND COMMUNICATION VARIABLESDocumento5 páginasANALYSIS OF EMPLOYEE PERFORMANCE, MOTIVATION, ORGANIZATIONAL CLIMATE AND COMMUNICATION VARIABLESAguswan FurwendoAinda não há avaliações

- Sincua PS NS Endline 2022 2023Documento79 páginasSincua PS NS Endline 2022 2023JANET ALMENANAAinda não há avaliações

- Bets Remaining Win/Loss Kelly Bankroll Alternative Bankroll Win %Documento8 páginasBets Remaining Win/Loss Kelly Bankroll Alternative Bankroll Win %sandip_exlAinda não há avaliações

- Height-For-Age GIRLS: 5 To 19 Years (Z-Scores)Documento7 páginasHeight-For-Age GIRLS: 5 To 19 Years (Z-Scores)krisyantotigadaraAinda não há avaliações

- Realannualcommoditybasedexchangerates 1Documento22 páginasRealannualcommoditybasedexchangerates 1luizcorradini10Ainda não há avaliações

- Hfa Boys 5 19years ZDocumento7 páginasHfa Boys 5 19years ZYessy AndikaAinda não há avaliações

- Load Oriented Manufacturing Control (LOMC) Tugas Pertemuan 6Documento3 páginasLoad Oriented Manufacturing Control (LOMC) Tugas Pertemuan 6SEBRIELLA AULIA SIREGARAinda não há avaliações

- Nutritional Status - Five 2018Documento130 páginasNutritional Status - Five 2018icy clorionAinda não há avaliações

- Base plate capacity tables for column designDocumento7 páginasBase plate capacity tables for column designvtalexAinda não há avaliações

- National Salary and Wage Rate Index TrendsDocumento4 páginasNational Salary and Wage Rate Index TrendsMadhav BaralAinda não há avaliações

- SO2 Gas - Sulphur Burner Outlet Analysis Chart PDFDocumento2 páginasSO2 Gas - Sulphur Burner Outlet Analysis Chart PDFYalamati SatyanarayanaAinda não há avaliações

- Bmi g12 EmeraldDocumento487 páginasBmi g12 EmeraldGladzangel LoricabvAinda não há avaliações

- Descriptive Statistics: The Farthest Most People Ever GetDocumento53 páginasDescriptive Statistics: The Farthest Most People Ever GetpalanivelAinda não há avaliações

- Bmiwhf - Marj (Grade 7,8,9)Documento151 páginasBmiwhf - Marj (Grade 7,8,9)Beth PangilinanAinda não há avaliações

- Frequency TableDocumento6 páginasFrequency TableLê Hoàng VyAinda não há avaliações

- Tabela Psicométrica PDFDocumento4 páginasTabela Psicométrica PDFsoliveira_149796Ainda não há avaliações

- QC glucose analysis reportDocumento3 páginasQC glucose analysis reportPutri LendaAinda não há avaliações

- BMI 2022-2023 (1)Documento784 páginasBMI 2022-2023 (1)florriza bombioAinda não há avaliações

- BMI W HFA 15 Sec (5-29-17)Documento384 páginasBMI W HFA 15 Sec (5-29-17)Dang-dang QueAinda não há avaliações

- Nutritional Status EndlineDocumento108 páginasNutritional Status Endlineethel mae gabrielAinda não há avaliações

- NOTE-combined Analysis and Conclusion at The End : Year Item Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov DecDocumento9 páginasNOTE-combined Analysis and Conclusion at The End : Year Item Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov DecShreya TalujaAinda não há avaliações

- LJ Chart Electrolytes Dec 2022 - NewDocumento49 páginasLJ Chart Electrolytes Dec 2022 - NewKoton RoyAinda não há avaliações

- How to use the School Nutrition ProgramDocumento484 páginasHow to use the School Nutrition ProgramLorremae ArponAinda não há avaliações

- Nutritional Status FormDocumento529 páginasNutritional Status FormKaren Lozano ManqueriaAinda não há avaliações

- Pemetaan Daerah Resiko JenepontoDocumento2 páginasPemetaan Daerah Resiko JenepontoBayu KhonjoAinda não há avaliações

- Bmi Hfa Old FormsDocumento44 páginasBmi Hfa Old FormsPASDA ELEMAinda não há avaliações

- How to use the School Nutrition ProgramDocumento512 páginasHow to use the School Nutrition Programlyra mae maravillaAinda não há avaliações

- Free!: Program Features and Some Tips!Documento50 páginasFree!: Program Features and Some Tips!Analyn PenarandaAinda não há avaliações

- How to use the School Nutrition ProgramDocumento50 páginasHow to use the School Nutrition ProgramAnalyn PenarandaAinda não há avaliações

- Nutritional Status Bmi 2022 2023 BaselineDocumento781 páginasNutritional Status Bmi 2022 2023 BaselineAdelo MagnayeAinda não há avaliações

- Bmi Sy 2022-23 SoftDocumento996 páginasBmi Sy 2022-23 SoftRichdel TulabingAinda não há avaliações

- Nutritional Status Bmi 2022 2023 Baseline g10 DiscernmentDocumento781 páginasNutritional Status Bmi 2022 2023 Baseline g10 DiscernmentAdelo MagnayeAinda não há avaliações

- Ns - Software.elem With Grade 3Documento105 páginasNs - Software.elem With Grade 3ARLENE AQUINOAinda não há avaliações

- Nutritional Status EMERALDDocumento90 páginasNutritional Status EMERALDMaureen SantosAinda não há avaliações

- Free!: Program Features and Some Tips!Documento489 páginasFree!: Program Features and Some Tips!Yna Graciela BarcelonaAinda não há avaliações

- BMIWHF1Documento790 páginasBMIWHF1ELEANOR ERMITANIOAinda não há avaliações

- Grade 1 NSDocumento47 páginasGrade 1 NSMary Jennifer SoteloAinda não há avaliações

- BMI TVL NDocumento785 páginasBMI TVL NShiela Mie Malasaga BallonAinda não há avaliações

- How to use the School Nutrition ProgramDocumento97 páginasHow to use the School Nutrition ProgramBryan Landor TamayoAinda não há avaliações

- Miramar Nutritional Status 2021 2022 1Documento63 páginasMiramar Nutritional Status 2021 2022 1Yom KiroAinda não há avaliações

- Bmi VenusDocumento489 páginasBmi VenusLea SantueleAinda não há avaliações

- Grade 1 and 2Documento746 páginasGrade 1 and 2Romilyn QuiñoAinda não há avaliações

- Bmi Sy 2022-23 SoftDocumento996 páginasBmi Sy 2022-23 SoftRichdel TulabingAinda não há avaliações

- BMI W HFA 2018Documento996 páginasBMI W HFA 2018joshua doradoAinda não há avaliações

- Nutritional Status Ates 22 23 EndlineDocumento783 páginasNutritional Status Ates 22 23 EndlineLoreli AtesAinda não há avaliações

- Long BMI W HFA 215 Sec (4-15-2017)Documento996 páginasLong BMI W HFA 215 Sec (4-15-2017)Mary Rose ArengaAinda não há avaliações

- Bmi G9 Boyle Sy2023 2024Documento736 páginasBmi G9 Boyle Sy2023 2024Renalyn CastigadorAinda não há avaliações

- Rose Nutritional-Status 19-20 PostDocumento92 páginasRose Nutritional-Status 19-20 PostHaydee Fay GomezAinda não há avaliações

- Nutritional StatusDocumento44 páginasNutritional StatusEljhie AllabaAinda não há avaliações

- How to use this school nutrition programDocumento151 páginasHow to use this school nutrition programMarvelous Villafania100% (3)

- Auto Nutritional Status EndlineDocumento98 páginasAuto Nutritional Status EndlinearisuAinda não há avaliações

- BMI W HFA Validated 60 Sec (5!16!2017)Documento151 páginasBMI W HFA Validated 60 Sec (5!16!2017)Sheena San GabrielAinda não há avaliações

- Abby-Post BmiDocumento151 páginasAbby-Post BmiAbigael Abac RiveraAinda não há avaliações

- STUDENT PROJECT SabarishDocumento7 páginasSTUDENT PROJECT SabarishSriniAinda não há avaliações

- Heat Power Lab ManualDocumento68 páginasHeat Power Lab ManualRaghu KrishnanAinda não há avaliações

- Gas Turbines PDFDocumento3 páginasGas Turbines PDFSriniAinda não há avaliações

- Me6404 - Thermal EngineeringDocumento195 páginasMe6404 - Thermal EngineeringSasidharan MadhavikrishnankuttyAinda não há avaliações

- NEET 2017 Answer KeyDocumento21 páginasNEET 2017 Answer KeySriniAinda não há avaliações

- Effect of Speed On Boundary Friction ForceDocumento39 páginasEffect of Speed On Boundary Friction ForceSriniAinda não há avaliações

- Transmission Design Course MaterialDocumento116 páginasTransmission Design Course Materialharishankarnadar0% (1)

- TE Lab PDFDocumento79 páginasTE Lab PDFrkaruppasamyAinda não há avaliações

- Allen: Neet-2017 Test Paper With Answer & Solutions (Held On Sunday 07 MAY, 2017)Documento7 páginasAllen: Neet-2017 Test Paper With Answer & Solutions (Held On Sunday 07 MAY, 2017)Anurag LaddhaAinda não há avaliações

- Part A - AnswersDocumento7 páginasPart A - AnswersSriniAinda não há avaliações

- Thermal NotesDocumento192 páginasThermal NotesSriniAinda não há avaliações

- Gas TurbinesDocumento3 páginasGas TurbinesSriniAinda não há avaliações

- Chrompet VaishnavaDocumento2 páginasChrompet VaishnavaSriniAinda não há avaliações

- Morse Test On Multi Cylinder Petrol EngineDocumento4 páginasMorse Test On Multi Cylinder Petrol EnginealagurmAinda não há avaliações

- Solar Water Purifier 1Documento40 páginasSolar Water Purifier 1Srini0% (1)

- RPDocumento10 páginasRPpatilsspAinda não há avaliações

- Em QBDocumento24 páginasEm QBSriniAinda não há avaliações

- Rapid Prototyping NotesDocumento37 páginasRapid Prototyping NotesSriniAinda não há avaliações

- Graphics November - December 2011Documento2 páginasGraphics November - December 2011Dmj Anbu RajAinda não há avaliações

- Scanned by CamscannerDocumento4 páginasScanned by CamscannerSriniAinda não há avaliações

- 3yr 1sem Mech Thermal Engineering Lab ManualDocumento85 páginas3yr 1sem Mech Thermal Engineering Lab Manualrahulmahesh3A6Ainda não há avaliações

- Scanned by CamscannerDocumento4 páginasScanned by CamscannerSriniAinda não há avaliações

- Conduction and Heat ExchangersDocumento1 páginaConduction and Heat ExchangersSriniAinda não há avaliações

- Unit - IDocumento19 páginasUnit - ISriniAinda não há avaliações

- Gate Model Test 1Documento3 páginasGate Model Test 1SriniAinda não há avaliações

- FMM Cycle Test 3Documento2 páginasFMM Cycle Test 3SriniAinda não há avaliações

- Mech 32 HT Lab ManualDocumento74 páginasMech 32 HT Lab Manualalp_alp100% (1)

- HMT5Documento9 páginasHMT5SriniAinda não há avaliações

- AUT R2010 SyllabusDocumento1 páginaAUT R2010 SyllabusSriniAinda não há avaliações

- Low rank tensor product smooths for GAMMsDocumento24 páginasLow rank tensor product smooths for GAMMsDiego SotoAinda não há avaliações

- WaidhanDocumento86 páginasWaidhanPatel Nitesh OadAinda não há avaliações

- Listening Script 11Documento11 páginasListening Script 11harshkumarbhallaAinda não há avaliações

- List of SDAsDocumento4 páginasList of SDAsAthouba SagolsemAinda não há avaliações

- Azura Amid (Eds.) - Recombinant Enzymes - From Basic Science To Commercialization-Springer International Publishing (2015) PDFDocumento191 páginasAzura Amid (Eds.) - Recombinant Enzymes - From Basic Science To Commercialization-Springer International Publishing (2015) PDFnurul qAinda não há avaliações

- Introducing The Phenomenon To Be Discussed: Stating Your OpinionDocumento8 páginasIntroducing The Phenomenon To Be Discussed: Stating Your OpinionRam RaghuwanshiAinda não há avaliações

- A Study To Assess The Effectiveness of PDocumento9 páginasA Study To Assess The Effectiveness of PKamal JindalAinda não há avaliações

- AI Berkeley Solution PDFDocumento9 páginasAI Berkeley Solution PDFPrathamGuptaAinda não há avaliações

- Sensor Guide: Standard Triaxial Geophones Specialty Triaxial Geophones Standard Overpressure MicrophonesDocumento1 páginaSensor Guide: Standard Triaxial Geophones Specialty Triaxial Geophones Standard Overpressure MicrophonesDennis Elias TaipeAinda não há avaliações

- Graffiti Model Lesson PlanDocumento9 páginasGraffiti Model Lesson Planapi-286619177100% (1)

- Configure NTP, OSPF, logging and SSH on routers R1, R2 and R3Documento2 páginasConfigure NTP, OSPF, logging and SSH on routers R1, R2 and R3Lars Rembrandt50% (2)

- 6907 6 52 0040Documento35 páginas6907 6 52 0040amitkumar8946Ainda não há avaliações

- Frame Fit Specs SramDocumento22 páginasFrame Fit Specs SramJanekAinda não há avaliações

- Toolbox Meeting Or, TBT (Toolbox TalkDocumento10 páginasToolbox Meeting Or, TBT (Toolbox TalkHarold PonceAinda não há avaliações

- Vehicle Tracker Offer SheetDocumento1 páginaVehicle Tracker Offer SheetBihun PandaAinda não há avaliações

- Capacitor BanksDocumento49 páginasCapacitor BanksAmal P RaviAinda não há avaliações

- Test 420001 PDFDocumento13 páginasTest 420001 PDFmaria100% (1)

- Obeid Specialized Hospital - Riyadh: Inpatient DeptsDocumento4 páginasObeid Specialized Hospital - Riyadh: Inpatient DeptsLovelydePerioAinda não há avaliações

- Adiabatic Production of Acetic AnhydrideDocumento7 páginasAdiabatic Production of Acetic AnhydrideSunilParjapatiAinda não há avaliações

- Katja Kruckeberg, Wolfgang Amann, Mike Green-Leadership and Personal Development - A Toolbox For The 21st Century Professional-Information Age Publishing (2011)Documento383 páginasKatja Kruckeberg, Wolfgang Amann, Mike Green-Leadership and Personal Development - A Toolbox For The 21st Century Professional-Information Age Publishing (2011)MariaIoanaTelecan100% (1)

- 10 ExtSpringsDocumento27 páginas10 ExtSpringsresh27Ainda não há avaliações

- Schippers and Bendrup - Ethnomusicology Ecology and SustainabilityDocumento12 páginasSchippers and Bendrup - Ethnomusicology Ecology and SustainabilityLuca GambirasioAinda não há avaliações

- Marginal Field Development Concepts (Compatibility Mode)Documento17 páginasMarginal Field Development Concepts (Compatibility Mode)nallay1705100% (1)

- CH - 1Documento4 páginasCH - 1Phantom GamingAinda não há avaliações

- Air Cooled Screw Chiller Performance SpecificationDocumento2 páginasAir Cooled Screw Chiller Performance SpecificationDajuko Butarbutar100% (1)

- Methanol Technical Data Sheet FactsDocumento1 páginaMethanol Technical Data Sheet FactsmkgmotleyAinda não há avaliações

- An Introduction to Heisenberg Groups in Analysis and GeometryDocumento7 páginasAn Introduction to Heisenberg Groups in Analysis and Geometrynitrosc16703Ainda não há avaliações

- Fire InsuranceDocumento108 páginasFire Insurancem_dattaias88% (8)

- Overview On Image Captioning TechniquesDocumento6 páginasOverview On Image Captioning TechniquesWARSE JournalsAinda não há avaliações

- Electronics Today 1977 10Documento84 páginasElectronics Today 1977 10cornel_24100% (3)