Escolar Documentos

Profissional Documentos

Cultura Documentos

George Soros & The Commodities

Enviado por

Iwan Siauw100%(1)100% acharam este documento útil (1 voto)

755 visualizações20 páginasTítulo original

George Soros & the Commodities

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PPT, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

100%(1)100% acharam este documento útil (1 voto)

755 visualizações20 páginasGeorge Soros & The Commodities

Enviado por

Iwan SiauwDireitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

Você está na página 1de 20

Greats & Great Reads

George Soros & the Commodities

Corp. Gang

Overview

George Soros & Stanley Druckenmiller

The Commodities Corp. Gang

Martin Schwartz: The Champion Trader

Ed Seykota & the Trading Tribe

Michael Marcus

Bruce Kovner

Paul Tudor Jones II

George Soros

Born: Aug. 12, 1930 in Hungary

Manager of the Quantum Fund

Open Society Institute

Macro trader extraordinaire

British Pound coup in 1992

“It is not whether you are right or

wrong that's important, but how

much money you make when you're

right and how much you lose when

you're wrong”

Stanley Druckenmiller

Former right hand

man of George Soros

142 on the Forbes list

“It takes courage to

be a pig.”

“Just keep hitting

homeruns &

preserving capital”

The Alchemy of Finance

By George Soros

Macroeconomic

analysis bible

Market Wizards”

Also, the “New Market

Wizards” and “Stock

Market Wizards”

By Jack Schwager

Interviews with Top

Traders

Commodities Corp.

Founded in 1969 by Amos Hostetter

“They are free to trade any way they want,

and to come and go as they please.”

“Any theory is good as long as it makes

money”

“Never bucked a trend in prices”

"Never mind the cheese….let me out of

the trap."

And these are their stories…..

Marty Schwartz:

The Champion Trader

$40, 000 to $20M with never more

than 3% drawdown.

“Not to go against the moving

averages, it’s self-destructive”

“Know the amount you are willing

to lose”

“Don’t break the rules”

“The most important thing is

money management,

money management,

money management.”

“Let your gains run”

Pit Bull

Pit Bull: Lessons from

Wall Street’s

Champion Day Trader

By Marty Schwartz

With actual trading

tips and lessons~!!

Ed Seykota & the Trading Tribe

250 000% return in 16

years (‘70s ~ ‘80s)

79% annualized –

60% after fees (‘90s)

“Everybody gets what

they want out of the

market”

Trend follower

Math & Psychology

www.seykota.com

The Trading Tribe

www.seykota.com

“To avoid whipsaw losses, stop trading”

“It can be very expensive to try to convince

the markets you are right.”

The Toronto Tribe: Jason Russell

jason@hedgehogcapital.com

But now, to a book, then his best

student….

Trend Following

Trend Following: How Great

Traders Make Millions in Up

or Down Markets

By Michael Covel

Endorsed by Ed Seykota

How to become the owner of the Redsox~!!

Commodities Corp.

Michael Marcus

John Hopkins grad, at the top of his class.

Student of Ed Seykota

Formerly the largest futures trader in the US

“Cutting down the number of trades you make”

“The best trades are the ones in which you have

all 3 things going for you”

Fundamentals

Technicals

Market Tone

Bruce Kovner

106 on the Forbes list

Harvard Poli Sci. Prof.

“Place my stop..that is

too far or too difficult to

reach easily”

“If you personalize your

losses, you can’t trade.

“The price for a market on any given day is the

correct price, then I try to figure out what

changes are occurring that will alter that price.”

John Murphy

Former head of research

at Merrill Lynch

“Technical Analysis of the

Financial Markets”

“Intermarket Analysis”

Bond to currency to

commodities to stock.

Paul Tudor Jones

“Don’t be a hero. Don’t

have an ego.”

“Don’t EVER average

losers”

“Decrease your trading

volume when you are

trading poorly”

“Always thinking about

Left Comm. Corp. at 1980 losing money as opposed

5 straight years of 100%+ to making money.”

Never had a down year .

30% annually

What the Wizards Read…

Reminiscence of a Stock

Operator

By Edwin Lefvre

The story of Jesse Livermore

Frank discussion of his

investment methods

Author followed Livermore

around for 3 years

So who is Livermore…

Greatest investor in the early

20th century

“The Great Bear of Wall

Street”

Netted $100 million at the day

of the 1929 crash.

Summary

Don’t predict the future

But do react quickly

Cut your losses

Only make the good trades

Any Questions ~ ???

Você também pode gostar

- PH Miracle Complete Whole Body Alkalizing Program-1201724Documento20 páginasPH Miracle Complete Whole Body Alkalizing Program-1201724joao carlos100% (1)

- Ken GriffinDocumento7 páginasKen Griffinanandoiyer9Ainda não há avaliações

- Why Trading Offers Low Risk and High Returns (35 charactersDocumento17 páginasWhy Trading Offers Low Risk and High Returns (35 charactersRitha Dhama C SAinda não há avaliações

- Story of A SpeculatorDocumento84 páginasStory of A Speculatortradingpithistory100% (5)

- Commodities Corp The Mike Marcus TapeDocumento10 páginasCommodities Corp The Mike Marcus TapeLonewolf99100% (2)

- SWOT AnalysisDocumento6 páginasSWOT Analysishananshahid96Ainda não há avaliações

- TurtleDocumento12 páginasTurtleanon-373190Ainda não há avaliações

- Words From the Wise - Ed Thorp InterviewDocumento22 páginasWords From the Wise - Ed Thorp Interviewfab62100% (1)

- Paul Tudor Jones InsightsDocumento2 páginasPaul Tudor Jones Insightslibertarian_trader100% (4)

- ONE-WAY POCKETS: The Book of Books on Wall Street SpeculationNo EverandONE-WAY POCKETS: The Book of Books on Wall Street SpeculationAinda não há avaliações

- Paul Tudor Jones The Great Liquidity RaceDocumento2 páginasPaul Tudor Jones The Great Liquidity RacePeter BullockAinda não há avaliações

- Tim Bourquin InterviewDocumento8 páginasTim Bourquin Interviewartus14Ainda não há avaliações

- The Little Book of Market Wizards Lessons FromDocumento4 páginasThe Little Book of Market Wizards Lessons FromForex Trading100% (1)

- Joe Ross - Spread Trading PDFDocumento79 páginasJoe Ross - Spread Trading PDFRazvanCristian100% (1)

- EcR - 1 Leading and Lagging IndicatorsDocumento10 páginasEcR - 1 Leading and Lagging IndicatorsMiloš ĐukićAinda não há avaliações

- Structural - Analysis - Skid A4401 PDFDocumento94 páginasStructural - Analysis - Skid A4401 PDFMohammed Saleem Syed Khader100% (1)

- Short SqueezeDocumento10 páginasShort Squeezealphatrends100% (1)

- Griffin Booklist PDFDocumento1 páginaGriffin Booklist PDFWill MunnyAinda não há avaliações

- Eckhardt TradingDocumento30 páginasEckhardt Tradingfredtag4393Ainda não há avaliações

- Decision-Making For Investors: Theory, Practice, and PitfallsDocumento20 páginasDecision-Making For Investors: Theory, Practice, and PitfallsGaurav JainAinda não há avaliações

- Preparing For The Next 'Black Swan'Documento5 páginasPreparing For The Next 'Black Swan'Edward Chai Ming HuaAinda não há avaliações

- Market Manipulation in the VIX. Are illiquid options regularly used to manipulate the cash settlement?No EverandMarket Manipulation in the VIX. Are illiquid options regularly used to manipulate the cash settlement?Ainda não há avaliações

- Wiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Documento2 páginasWiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Rushikesh Inamdar100% (1)

- The IB Business of Trading: Market Making, Arbitrage, Repo and Prime BrokerageDocumento78 páginasThe IB Business of Trading: Market Making, Arbitrage, Repo and Prime BrokerageNgọc Phan Thị BíchAinda não há avaliações

- Notes On Market Wizards IDocumento24 páginasNotes On Market Wizards IAdam HardyAinda não há avaliações

- Short SqueezeDocumento6 páginasShort Squeezealphatrends100% (1)

- Macro Ops Handbook V2 PDFDocumento90 páginasMacro Ops Handbook V2 PDFaksiitian100% (1)

- Technical Strategy Book DirectoryDocumento3 páginasTechnical Strategy Book DirectorybestniftyAinda não há avaliações

- Learn from Top FX Traders' StrategiesDocumento11 páginasLearn from Top FX Traders' StrategiesWayne Gonsalves100% (2)

- AXIA Futures The HERODocumento28 páginasAXIA Futures The HEROwedojif895Ainda não há avaliações

- O-L English - Model Paper - Colombo ZoneDocumento6 páginasO-L English - Model Paper - Colombo ZoneJAYANI JAYAWARDHANA100% (4)

- Money Management Controlling Risk and Capturing ProfitsDocumento20 páginasMoney Management Controlling Risk and Capturing ProfitsIan Moncrieffe100% (10)

- Marc Fabers The Gloom Boom Doom ReportDocumento20 páginasMarc Fabers The Gloom Boom Doom ReportMikle196950% (2)

- Don’t Trade Like Tony Montana: Adventures in FX TradingDocumento34 páginasDon’t Trade Like Tony Montana: Adventures in FX TradingLuciano SuarezAinda não há avaliações

- George Soros v2Documento47 páginasGeorge Soros v2Piaget ModelerAinda não há avaliações

- Day Trading PEG Red To Green SetupsDocumento5 páginasDay Trading PEG Red To Green Setupsarenaman0528Ainda não há avaliações

- Self Sabotage Reexamined: by Van K. Tharp, PH.DDocumento8 páginasSelf Sabotage Reexamined: by Van K. Tharp, PH.DYashkumar JainAinda não há avaliações

- Why Traders Plan But Don't Follow Their PlansDocumento3 páginasWhy Traders Plan But Don't Follow Their PlansSudath NiroshanAinda não há avaliações

- Jesse Livermore 01Documento5 páginasJesse Livermore 01ehemAinda não há avaliações

- Trading Wisdom QuotesDocumento69 páginasTrading Wisdom QuotesNickKrAinda não há avaliações

- 52-Week High and Momentum InvestingDocumento32 páginas52-Week High and Momentum InvestingCandide17Ainda não há avaliações

- The Next Perfect Trade: A Magic Sword of NecessityNo EverandThe Next Perfect Trade: A Magic Sword of NecessityNota: 4.5 de 5 estrelas4.5/5 (3)

- Dragons and Bulls - Profitable Investment StrategiesDocumento147 páginasDragons and Bulls - Profitable Investment StrategiesAnonymous qtHTK6OAinda não há avaliações

- Chris ColeDocumento16 páginasChris ColeSultan Fehaid100% (1)

- Buffett - 50% ReturnsDocumento3 páginasBuffett - 50% ReturnsRon BourbondyAinda não há avaliações

- TapeReadingAndMarketTactics PDFDocumento134 páginasTapeReadingAndMarketTactics PDFNenugrAinda não há avaliações

- Buyers FancyFoodDocumento6 páginasBuyers FancyFoodvanAinda não há avaliações

- Reeducation PDFDocumento8 páginasReeducation PDFelija100% (1)

- 4th Summative Test Science 6Documento5 páginas4th Summative Test Science 6ANNALIZA FIECASAinda não há avaliações

- SRS documentation of Virtual Classroom System , SRS documentation of Personal Identity Management ,SRS documentation of EMentoring for women system , SRS Documentation of Employee Performance Management SRS Documentation of Online TicketingDocumento79 páginasSRS documentation of Virtual Classroom System , SRS documentation of Personal Identity Management ,SRS documentation of EMentoring for women system , SRS Documentation of Employee Performance Management SRS Documentation of Online Ticketingsaravanakumar1896% (26)

- My Notes (Eurodollar Master Notes From The Eurodollar Futures Book, by BurghardtDocumento59 páginasMy Notes (Eurodollar Master Notes From The Eurodollar Futures Book, by Burghardtlaozi222Ainda não há avaliações

- My Investment Journey: How I failed in stock trading and the lesson learnedNo EverandMy Investment Journey: How I failed in stock trading and the lesson learnedNota: 5 de 5 estrelas5/5 (1)

- Hall of Fame: Interview With David E. ShawDocumento4 páginasHall of Fame: Interview With David E. Shawskfs ksjdfAinda não há avaliações

- New Paradigm Risk Management ScribdDocumento7 páginasNew Paradigm Risk Management ScribdJudithAinda não há avaliações

- Market Timing Via Monthly and Holiday PatternsDocumento10 páginasMarket Timing Via Monthly and Holiday PatternsSteven KimAinda não há avaliações

- Dthe Great Investors, Their Methods and How We Evaluate Them - Wilmott Magazine ArticleDocumento6 páginasDthe Great Investors, Their Methods and How We Evaluate Them - Wilmott Magazine ArticleKelvin SumAinda não há avaliações

- Specialists Use of The Media by Richard NeyDocumento4 páginasSpecialists Use of The Media by Richard NeyaddqdaddqdAinda não há avaliações

- 50 Largest Hedge Funds in The WorldDocumento6 páginas50 Largest Hedge Funds in The Worldhttp://besthedgefund.blogspot.comAinda não há avaliações

- DiagonalsDocumento5 páginasDiagonalsLuis FerAinda não há avaliações

- WyckoffDocumento1 páginaWyckoffRatulAinda não há avaliações

- Make Your Family Rich: Why to Replace Retirement Planning with Succession PlanningNo EverandMake Your Family Rich: Why to Replace Retirement Planning with Succession PlanningAinda não há avaliações

- Abend CodesDocumento8 páginasAbend Codesapi-27095622100% (1)

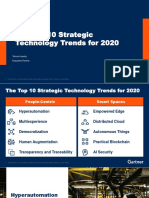

- The Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerDocumento31 páginasThe Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerCarlos Stuars Echeandia CastilloAinda não há avaliações

- Bargaining Power of SuppliersDocumento9 páginasBargaining Power of SuppliersPiyumi VitharanaAinda não há avaliações

- 2020 - Audcap1 - 2.3 RCCM - BunagDocumento1 página2020 - Audcap1 - 2.3 RCCM - BunagSherilyn BunagAinda não há avaliações

- DJDocumento907 páginasDJDeepak BhawsarAinda não há avaliações

- North American Countries ListDocumento4 páginasNorth American Countries ListApril WoodsAinda não há avaliações

- Surveying 2 Practical 3Documento15 páginasSurveying 2 Practical 3Huzefa AliAinda não há avaliações

- ACM JournalDocumento5 páginasACM JournalThesisAinda não há avaliações

- Module 3 Paired and Two Sample T TestDocumento18 páginasModule 3 Paired and Two Sample T TestLastica, Geralyn Mae F.Ainda não há avaliações

- MMH Dan StoringDocumento13 páginasMMH Dan Storingfilza100% (1)

- Edexcel A2 Biology 6BI06Documento7 páginasEdexcel A2 Biology 6BI06abhayAinda não há avaliações

- Expected OutcomesDocumento4 páginasExpected OutcomesPankaj MahantaAinda não há avaliações

- Microwave: Microwaves Are A Form ofDocumento9 páginasMicrowave: Microwaves Are A Form ofDhanmeet KaurAinda não há avaliações

- Lesson Plan 12 Climate ChangeDocumento5 páginasLesson Plan 12 Climate ChangeRey Bello MalicayAinda não há avaliações

- ĐỀ CƯƠNG ANH 9 - CK2 (23-24)Documento7 páginasĐỀ CƯƠNG ANH 9 - CK2 (23-24)thuyhagl2710Ainda não há avaliações

- Putri KartikaDocumento17 páginasPutri KartikaRamotSilabanAinda não há avaliações

- Divide Fractions by Fractions Lesson PlanDocumento12 páginasDivide Fractions by Fractions Lesson PlanEunice TrinidadAinda não há avaliações

- Operation Manual TempoLink 551986 enDocumento12 páginasOperation Manual TempoLink 551986 enBryan AndradeAinda não há avaliações

- Developmen of Chick EmbryoDocumento20 páginasDevelopmen of Chick Embryoabd6486733Ainda não há avaliações

- UTC awarded contracts with low competitionDocumento2 páginasUTC awarded contracts with low competitioncefuneslpezAinda não há avaliações

- Case Acron PharmaDocumento23 páginasCase Acron PharmanishanthAinda não há avaliações

- Chapter 1Documento2 páginasChapter 1Nor-man KusainAinda não há avaliações

- Monitoring Tool in ScienceDocumento10 páginasMonitoring Tool in ScienceCatherine RenanteAinda não há avaliações