Escolar Documentos

Profissional Documentos

Cultura Documentos

The Fed and Interest Rates

Enviado por

Jackie Raborar0 notas0% acharam este documento útil (0 voto)

14 visualizações26 páginasTítulo original

Lecture3.ppt

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PPT, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

14 visualizações26 páginasThe Fed and Interest Rates

Enviado por

Jackie RaborarDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

Você está na página 1de 26

CHAPTER 3

THE FED AND INTEREST RATES

Definition of the Monetary Base

Money Aggregates

M1—”Medium of Exchange”, Currency and

Checking Deposits.

M2– M1+ saving deposits, money market deposit

accounts, overnight repurchase agreements,

Eurodollars, small time deposits.

MZM – M2– small denomination time deposits +

institutional money market mutual funds.

M3 – M2+ institutional money market mutual

funds, large time deposits, and repurchase

agreements and Eurodollars > 1 day maturity

L – All liquid assets economy wide including U.S.

Treasury Bills maturing 1 year or less.

Copyright© 2003 John Wiley and Sons, Inc.

Objectives of Fed Monetary Policy

Full Employment

Frictional Unemployment

• The rate of unemployment created by job mobility

Structural Unemployment

• Created by immobile workers or poor job skills

(education)

“Natural Rate of Unemployment”

• The rate of unemployment generally tolerated by

governments

Copyright© 2003 John Wiley and Sons, Inc.

Objectives of Fed Monetary Policy

Economic Growth

Gross Domestic Product (GDP) per Capita

• The general measure of a countries wealth

The goal has been to have a steadily rising

level of real GDP (inflation adjusted)

• This has not been the case however, as inflation

has eaten away at GDP.

Copyright© 2003 John Wiley and Sons, Inc.

Objectives of Fed Monetary Policy

Price Stability

Goal has been to provide steady average

prices in the economy on average

Inflation

• Book Definition – a continuous rise in average

prices over time.

• Class Definition – An increase in the money supply

resulting in a general rise in average prices as the

purchasing power of the monetary unit falls due

to proliferation and the resulting loss in

purchasing power.

Copyright© 2003 John Wiley and Sons, Inc.

Objectives of Fed Monetary Policy

Interest Rate Stability

The goal is to provide a steady level of

interest rates reflective of market risk while

reducing interest rate volatility.

Economic/Financial Calculation is more

difficult with uncertainty regarding future

interest rates.

Copyright© 2003 John Wiley and Sons, Inc.

Objectives of Fed Monetary Policy

Financial System Stability

The Fed as Lender of Last Resort

• The Fed is to stand ready in the event of

catastrophic losses in the financial system

• The Fed would provide liquidity to increase public

confidence in the system

Copyright© 2003 John Wiley and Sons, Inc.

Objectives of Fed Monetary Policy

Foreign Exchange Stability

A primary goal of the Fed is to provide

stable purchasing power of the U.S. Dollar

relative to foreign currencies

This is expressed in stable exchange rates.

The Fed may seek to weaken the dollar

during economic downturns to increase

exports giving U.S. firms a boost in demand

Copyright© 2003 John Wiley and Sons, Inc.

Objectives of Fed Monetary Policy

Inconsistencies and Limitations

The Fed can not continually inflate the

money supply as this has serious domestic

and international consequences.

Remember inflation is not your friend

High inflation rates domestically make life

more expensive to live

Likewise, high inflation causes an

international asset drain as U.S. assets are

sent oversees to find more stability in other

markets

Copyright© 2003 John Wiley and Sons, Inc.

Objectives of Fed Monetary Policy

The Alternative (My personal view)

A hard money standard

Eliminating the Fed and tying the U.S. Dollar

to Gold and Silver

The afore mentioned goals thus would be

met

Large and Powerful Banks and Financial

Service firms would not profit as easily

through this system

Copyright© 2003 John Wiley and Sons, Inc.

The Monetary Base and Changes

in the Money Supply

Reserves are a % of the total Liabilities of the

Bank

ie: Total Liabilities of $800 mil. w/ 10% reserve

requirement = $80 mil in required reserves

Excess Reserves

Those in excess of requirements imposed by the

Fed

Banks hold only minimal excess reserves as the

Fed pays no interest on excess reserves held at

the Fed

Copyright© 2003 John Wiley and Sons, Inc.

Impacts of Federal Reserve Policy

Expansionary monetary policy

Open market operations -- purchase securities --

increase bank excess reserves and the monetary

base.

Reserve requirements -- reduce reserve

requirements -- increase excess reserves and

increase the deposit expansion multiplier.

Discount rate -- reduce the rate -- reduce the cost

of borrowing reserves.

Expands the money supply; reduces interest rates.

Copyright© 2003 John Wiley and Sons, Inc.

Impacts of Federal Reserve Policy

(concluded)

Restrictive monetary policy

Open market operations -- sell securities, reduce

bank reserves and the monetary base.

Reserve requirements -- increase reserve

requirements, reduces excess reserves and the

deposit expansion multiplier.

Discount rate -- increase the discount rate and the

cost of borrowing reserve deficiencies.

Reduce the money supply or its growth rate;

increase interest rates.

Copyright© 2003 John Wiley and Sons, Inc.

Effects of Federal Reserve

Policy in the Financial System

Changes in the Money Supply

When the Fed either increases the monetary base

or reduces reserve requirements, banks’ excess

reserves increase.

Excess reserves are loaned out or invested.

Transaction deposits increase as loaned or

invested funds are deposited.

The money supply increases.

Copyright© 2003 John Wiley and Sons, Inc.

Effects of Policy Changes

Changes in Interest Rates

Expansion of the monetary base or reductions in

reserve requirements increase bank liquidity.

Federal Funds rate declines.

Price of other money market securities increase

(rates decline) as banks invest their liquidity.

Loan rates and other security rates decline with

continued increases in bank liquidity.

Monetary policy starts in the bank money market

and spreads to other financial institutions and

markets and to the real economy.

Copyright© 2003 John Wiley and Sons, Inc.

Effects of Policy Changes

Credit availability is increased with the

expansion of bank liquidity and reduced

interest rates.

Wealth Effects -- reduced interest rates

(increased security prices) increases the

wealth of individuals.

Increased wealth prompts increased spending.

Increased spending has a current income, Y,

impact and a multiplier effect in future income

periods.

Copyright© 2003 John Wiley and Sons, Inc.

Short-Run Effects of Monetary Policy

Monetary policy affects spending

Investment.

Consumption.

State and local government.

Effects of Monetary Policy on Changes

in Investment

Investment demand, traditionally, has been

sensitive to changes in interest rates.

Copyright© 2003 John Wiley and Sons, Inc.

Short-Run Effects of Monetary Policy

(continued)

Housing investment -- both credit

availability and mortgage rates have been

impacted severely by monetary policy.

Plant and equipment investment is related

to expected rates of return relative to the

cost of financing.

Planned inventory investment is sensitive

to the cost and availability of credit.

Copyright© 2003 John Wiley and Sons, Inc.

Short-Run Effects of Monetary Policy

(continued)

Consumption expenditures are affected

several ways:

Increased or decreased holdings of money

affect spending.

Credit availability and interest rate levels

affect the purchase of durable goods.

Changes in wealth affect spending in the

current period.

Copyright© 2003 John Wiley and Sons, Inc.

Short-Run Effects of Monetary Policy

(concluded)

Foreign trade is affected by monetary policy.

Increased interest rates increase the value of the

dollar relative to the other currencies.

Increased dollar exchange rates encourage

imports; discourage exports.

State and Local Government Expenditures

Monetary policy affects capital project

expenditures.

Higher interest rates limit expenditures.

Copyright© 2003 John Wiley and Sons, Inc.

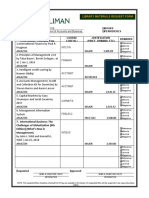

Changes in the Discount Rate

Copyright© 2003 John Wiley and Sons, Inc.

Change in Money Supply and

Interest Rates and the Economy

Copyright© 2003 John Wiley and Sons, Inc.

Long-Run Effects of Monetary Policy

Expectations are affected by current,

short-run monetary policy actions.

High money growth to stimulate the

economy may increase interest rates

(interest rate effects).

Market expects inflation from near-term

policy action.

Investors sell long-term bonds, prices fall,

and interest rates increase.

Copyright© 2003 John Wiley and Sons, Inc.

Long-Run Effects of Monetary Policy

(concluded)

Expected inflation may cause increased

spending and borrowing and increased

interest rates.

Pay back lower value debts.

Buy before the price goes up psychology.

May move the economy to inflationary income

levels.

Cost increases (interest and labor) faster than

price increases will cause reductions in investment

spending.

Copyright© 2003 John Wiley and Sons, Inc.

Practical Considerations in Monetary

Policy

Expectations may nullify intent of policy.

Time lags in implementing monetary

policy reduce its effectiveness.

Political pressures influence Federal

Reserve policy.

Copyright© 2003 John Wiley and Sons, Inc.

Complications in Implementing Policy

The Velocity of Money

The rate money changes hands in the

economy

V= Y/M or M x V = Y

• V= Velocity

• M= Money Supply

• Y= GDP

Copyright© 2003 John Wiley and Sons, Inc.

Você também pode gostar

- Conduct of Monetary Policy: Tools, Goals, Strategy, and TacticsDocumento30 páginasConduct of Monetary Policy: Tools, Goals, Strategy, and TacticsNaheed SakhiAinda não há avaliações

- Lecture-3 Determination of Interest RatesDocumento31 páginasLecture-3 Determination of Interest RatesZamir StanekzaiAinda não há avaliações

- Felicia Irene - Week 5Documento27 páginasFelicia Irene - Week 5felicia ireneAinda não há avaliações

- ch11 Lecture and Textbook NotesDocumento11 páginasch11 Lecture and Textbook Notes47fwhvhc6kAinda não há avaliações

- HW 3Documento4 páginasHW 3Marino NhokAinda não há avaliações

- Dwnload Full Financial Institutions and Markets International 10th Edition Madura Solutions Manual PDFDocumento8 páginasDwnload Full Financial Institutions and Markets International 10th Edition Madura Solutions Manual PDFbinayobtialc100% (11)

- MiluDocumento3 páginasMiluTú NguyễnAinda não há avaliações

- Monetary Policy: How The Global Financial Crisis 2007 Was A Result of Loose Monetary Policy in The USDocumento11 páginasMonetary Policy: How The Global Financial Crisis 2007 Was A Result of Loose Monetary Policy in The USMortigou Richmond Oliver LabundaAinda não há avaliações

- Chap 2 - noteDocumento6 páginasChap 2 - notePeo PaoAinda não há avaliações

- Monetary PolicyDocumento31 páginasMonetary Policyapi-3748231100% (1)

- Determinants of Interest Rates ExplainedDocumento4 páginasDeterminants of Interest Rates ExplainedJunvy AbordoAinda não há avaliações

- Chapter 2Documento9 páginasChapter 2api-25939187Ainda não há avaliações

- Effects of Inflation:: Inflation and Interest RateDocumento10 páginasEffects of Inflation:: Inflation and Interest RatesangramlifeAinda não há avaliações

- AccOrg ReportDocumento4 páginasAccOrg ReportJohn Miguel GordoveAinda não há avaliações

- Determinants of Interest RatesDocumento9 páginasDeterminants of Interest RatesxxpinkywitchxxAinda não há avaliações

- Impact of Fed Rate Hike: On Emerging EconomiesDocumento11 páginasImpact of Fed Rate Hike: On Emerging EconomiesPrateek TaoriAinda não há avaliações

- Monetary Policy Meaning, Types, and ToolsDocumento1 páginaMonetary Policy Meaning, Types, and ToolsShareen MalikAinda não há avaliações

- 1 - Monetary - Fiscal PolicyDocumento41 páginas1 - Monetary - Fiscal PolicyAditya NugrohoAinda não há avaliações

- Federal Reserve Rates in This Covid-19 PeriodDocumento26 páginasFederal Reserve Rates in This Covid-19 PeriodMacharia NgunjiriAinda não há avaliações

- Sine Curve: Managerial Economics, 2eDocumento14 páginasSine Curve: Managerial Economics, 2ePrateek KhandelwalAinda não há avaliações

- Chapter 2Documento9 páginasChapter 2api-25939187Ainda não há avaliações

- Why Monetary Policy MattersDocumento2 páginasWhy Monetary Policy MattersKatieYoungAinda não há avaliações

- Banking OperationDocumento5 páginasBanking OperationenobbeAinda não há avaliações

- 4.2.4. Interest Rate DeterminationDocumento21 páginas4.2.4. Interest Rate DeterminationGuy WilkinsonAinda não há avaliações

- Differences between prime rate, discount rate and federal funds rateDocumento4 páginasDifferences between prime rate, discount rate and federal funds rateTeffi Boyer MontoyaAinda não há avaliações

- Key Concepts: Money Supply, Banks, and Monetary PolicyDocumento43 páginasKey Concepts: Money Supply, Banks, and Monetary PolicyKc NgAinda não há avaliações

- Chapter 2Documento9 páginasChapter 2api-25939187Ainda não há avaliações

- Financial MarketsDocumento6 páginasFinancial MarketsRudella LizardoAinda não há avaliações

- FM 603 Unit 1Documento10 páginasFM 603 Unit 1Ritik SinghAinda não há avaliações

- Lecture 7 PDFDocumento44 páginasLecture 7 PDFAmna NoorAinda não há avaliações

- Introduction To Monetary PolicyDocumento21 páginasIntroduction To Monetary PolicyHisham JawharAinda não há avaliações

- Solution Manual For Financial Markets and Institutions 12th Edition by Madura ISBN 1337099740 9781337099745Documento36 páginasSolution Manual For Financial Markets and Institutions 12th Edition by Madura ISBN 1337099740 9781337099745caseywestfmjcgodkzr100% (17)

- Monetary PolicyDocumento18 páginasMonetary Policyandrew.collananAinda não há avaliações

- NullDocumento22 páginasNullapi-28191758100% (1)

- DeflationDocumento4 páginasDeflationnadekaramit9122Ainda não há avaliações

- Tools of Monetary Policy: Open - Market Operations Discount Rate Reserve RequirementsDocumento15 páginasTools of Monetary Policy: Open - Market Operations Discount Rate Reserve RequirementsAngelica BeltranAinda não há avaliações

- Chapter 4 Interest RatesDocumento31 páginasChapter 4 Interest RatesnoorabogamiAinda não há avaliações

- Singapore Property Weekly Issue 208Documento17 páginasSingapore Property Weekly Issue 208Propwise.sgAinda não há avaliações

- Financial Forces in International BusinessDocumento5 páginasFinancial Forces in International BusinessPutry AgustinaaAinda não há avaliações

- CH04 - The Level of Interest RatesDocumento14 páginasCH04 - The Level of Interest RatesAya FahmyAinda não há avaliações

- Bond Valuation - Interest RatesDocumento3 páginasBond Valuation - Interest RatesPrincess ArasherAinda não há avaliações

- Interest Rates and Bond Valuation Chapter 6Documento29 páginasInterest Rates and Bond Valuation Chapter 6Mariana MuñozAinda não há avaliações

- Central Bank Controls Money Supply Through Monetary Policy ToolsDocumento3 páginasCentral Bank Controls Money Supply Through Monetary Policy Toolsyurineo losisAinda não há avaliações

- Part II Interest Rates and TVM (Revised For 2e)Documento68 páginasPart II Interest Rates and TVM (Revised For 2e)Harun MusaAinda não há avaliações

- Monetary PolicyDocumento8 páginasMonetary PolicyHarsha KhianiAinda não há avaliações

- Global Financial CrisisDocumento12 páginasGlobal Financial Crisisprabinachudal2017Ainda não há avaliações

- Monetary Policy Thesis TopicsDocumento6 páginasMonetary Policy Thesis Topicsalisonreedphoenix100% (2)

- Fed Rate Hike Impact on Vietnam EconomyDocumento2 páginasFed Rate Hike Impact on Vietnam EconomyEli LiAinda não há avaliações

- Impact of Rising Interest Rates On Equity MarketsDocumento9 páginasImpact of Rising Interest Rates On Equity MarketsDeepak DharmavaramAinda não há avaliações

- Lesson 2 - The Financial Management EnvironmentDocumento24 páginasLesson 2 - The Financial Management EnvironmentHafiz HishamAinda não há avaliações

- Factors Influencing Exchange RatesDocumento2 páginasFactors Influencing Exchange RatesPravin Kumar PAinda não há avaliações

- The Definition of EconomicsDocumento12 páginasThe Definition of EconomicsKyeung Ah Cynthia LeeAinda não há avaliações

- Monetary Policy Toolkit for Global CrisesDocumento54 páginasMonetary Policy Toolkit for Global CrisesPrachi SinghiAinda não há avaliações

- Understanding The Federal Reserve Balance SheetDocumento4 páginasUnderstanding The Federal Reserve Balance Sheetjimmyboy111Ainda não há avaliações

- Monetary Policy PDFDocumento7 páginasMonetary Policy PDFDaniel SozonovAinda não há avaliações

- InflationDocumento6 páginasInflationasmiAinda não há avaliações

- S02 - CH 2 - Determinants of Interest Rate PDFDocumento79 páginasS02 - CH 2 - Determinants of Interest Rate PDFYasser TulbaAinda não há avaliações

- Emad A Zikry VAAM Opportunities in Non Dollar 2Documento4 páginasEmad A Zikry VAAM Opportunities in Non Dollar 2Emad-A-ZikryAinda não há avaliações

- Summary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionNo EverandSummary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionAinda não há avaliações

- The Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsNo EverandThe Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsAinda não há avaliações

- Proposed Questions For SOP No 3Documento6 páginasProposed Questions For SOP No 3Jackie RaborarAinda não há avaliações

- Excel Shortcut For MacDocumento2 páginasExcel Shortcut For MacLarry LiankoAinda não há avaliações

- Financial Analysis GlossaryDocumento6 páginasFinancial Analysis GlossarySergio OlarteAinda não há avaliações

- Books Periodicals: Library Materials Request FormDocumento2 páginasBooks Periodicals: Library Materials Request FormJackie RaborarAinda não há avaliações

- Books Periodicals: Library Materials Request FormDocumento2 páginasBooks Periodicals: Library Materials Request FormJackie RaborarAinda não há avaliações

- Partnership Law SyllabusDocumento3 páginasPartnership Law SyllabusJackie RaborarAinda não há avaliações

- Title List For GVRL 2018Documento1.449 páginasTitle List For GVRL 2018Jackie RaborarAinda não há avaliações

- Books Periodicals: Library Materials Request FormDocumento2 páginasBooks Periodicals: Library Materials Request FormJackie RaborarAinda não há avaliações

- Requested Books-9Documento2 páginasRequested Books-9Jackie RaborarAinda não há avaliações

- Requested Books-9Documento2 páginasRequested Books-9Jackie RaborarAinda não há avaliações

- Books Periodicals Description Course CODE (S) / Justification (Price, Demand, Etc) RemarksDocumento2 páginasBooks Periodicals Description Course CODE (S) / Justification (Price, Demand, Etc) RemarksJackie RaborarAinda não há avaliações

- Auditing Problems, CPA Reviewer by Roque, Gerardo: Books PeriodicalsDocumento2 páginasAuditing Problems, CPA Reviewer by Roque, Gerardo: Books PeriodicalsJackie RaborarAinda não há avaliações

- Concept & Nature Of: ManagementDocumento49 páginasConcept & Nature Of: ManagementJackie RaborarAinda não há avaliações

- Books Periodicals: Date: April 1, 2019 Department: Department of Accounts and BusinessDocumento1 páginaBooks Periodicals: Date: April 1, 2019 Department: Department of Accounts and BusinessJackie RaborarAinda não há avaliações

- Books Periodicals Description Publisher, Etc.) Course CODE (S) / Subject Justification (Price, Demand, Etc) RemarksDocumento2 páginasBooks Periodicals Description Publisher, Etc.) Course CODE (S) / Subject Justification (Price, Demand, Etc) RemarksJackie RaborarAinda não há avaliações

- Organizational Communication: Managers' #1 ChallengeDocumento7 páginasOrganizational Communication: Managers' #1 ChallengeJackie RaborarAinda não há avaliações

- Books Periodicals: 6. Treasury Management (New Edition) 2018 AMAZONDocumento2 páginasBooks Periodicals: 6. Treasury Management (New Edition) 2018 AMAZONJackie RaborarAinda não há avaliações

- International Business Competing in The Global Marketplace PDFDocumento2 páginasInternational Business Competing in The Global Marketplace PDFJackie Raborar13% (31)

- Leader TypesDocumento25 páginasLeader Typesdaywalker100% (2)

- Management Concept, Nature and ImportanceDocumento26 páginasManagement Concept, Nature and ImportanceJackie RaborarAinda não há avaliações

- Course Code Course Title Units / Type: FO-ACAD-QAO-001/29JANUARY2020/REV.0 Page 1 of 8Documento8 páginasCourse Code Course Title Units / Type: FO-ACAD-QAO-001/29JANUARY2020/REV.0 Page 1 of 8Jackie RaborarAinda não há avaliações

- University of Dhaka: Assignment On: Function, Role and Skill of A Manager Principles of Management Course Code: 102Documento11 páginasUniversity of Dhaka: Assignment On: Function, Role and Skill of A Manager Principles of Management Course Code: 102Tyco MacAinda não há avaliações

- Course Code Course Title Units / Type: FO-ACAD-QAO-001/29JANUARY2020/REV.0 Page 1 of 8Documento8 páginasCourse Code Course Title Units / Type: FO-ACAD-QAO-001/29JANUARY2020/REV.0 Page 1 of 8Jackie RaborarAinda não há avaliações

- 7b - Leadership & MotivationDocumento92 páginas7b - Leadership & MotivationJackie RaborarAinda não há avaliações

- Managerial Control FunctionsDocumento27 páginasManagerial Control FunctionsKaustubh TiwaryAinda não há avaliações

- Strategic Financial ManagementDocumento1 páginaStrategic Financial ManagementJackie RaborarAinda não há avaliações

- LEADINGDocumento18 páginasLEADINGJackie RaborarAinda não há avaliações

- Bizcon: Special ThanksDocumento2 páginasBizcon: Special ThanksJackie RaborarAinda não há avaliações

- Leadership and MotivationDocumento24 páginasLeadership and MotivationJackie RaborarAinda não há avaliações

- Monetary Policy Midterm ExamDocumento1 páginaMonetary Policy Midterm ExamJackie RaborarAinda não há avaliações

- Growth of Money Market in IndiaDocumento6 páginasGrowth of Money Market in IndiaAbhijit JadhavAinda não há avaliações

- GLEC Gyan Kosh PDFDocumento39 páginasGLEC Gyan Kosh PDFMihir VoraAinda não há avaliações

- Manage-Working Capital Management of Paper Mills-K MadhaviDocumento10 páginasManage-Working Capital Management of Paper Mills-K MadhaviImpact JournalsAinda não há avaliações

- Chapter 5Documento30 páginasChapter 5Jyoti Prakash BarikAinda não há avaliações

- Financial Statement Analysis of Janata Bank Limited: Internship Report OnDocumento39 páginasFinancial Statement Analysis of Janata Bank Limited: Internship Report OnFahimAinda não há avaliações

- Monetary Policy of India: CRR and SLRDocumento3 páginasMonetary Policy of India: CRR and SLRAditi VatsaAinda não há avaliações

- Question and Answer - 33Documento30 páginasQuestion and Answer - 33acc-expertAinda não há avaliações

- MCQsDocumento140 páginasMCQsHAssan AftabAinda não há avaliações

- Tutorialch5 MoneyfederalreserveDocumento75 páginasTutorialch5 MoneyfederalreserveRashid AyubiAinda não há avaliações

- All Chapters in Finmar TextDocumento133 páginasAll Chapters in Finmar TextShr BnAinda não há avaliações

- BFB4133 Financial Markets and Institutions Course NotesDocumento101 páginasBFB4133 Financial Markets and Institutions Course NotesMakisha NishaAinda não há avaliações

- Mock Test 19 Paper 1 - EngDocumento12 páginasMock Test 19 Paper 1 - Enghiu chingAinda não há avaliações

- CRR & SLR and Computation - PPTX BVB 204Documento20 páginasCRR & SLR and Computation - PPTX BVB 204679shrishti SinghAinda não há avaliações

- ch04 5eDocumento32 páginasch04 5eAulia Thalita SadaAinda não há avaliações

- Quiz Bee Questions (Semis and Finals)Documento4 páginasQuiz Bee Questions (Semis and Finals)John Vincent PardillaAinda não há avaliações

- Impact of Interest Rates On Stock Market in IndiaDocumento76 páginasImpact of Interest Rates On Stock Market in Indiakiran100% (1)

- Fin 426 Uitm Chapter 2Documento60 páginasFin 426 Uitm Chapter 2izwanAinda não há avaliações

- Tools for Monetary Policy Chapter Explains the Federal Reserve's Use of Open Market Operations, Reserve Requirements and MoreDocumento40 páginasTools for Monetary Policy Chapter Explains the Federal Reserve's Use of Open Market Operations, Reserve Requirements and MoreLộc TrầnAinda não há avaliações

- Banking Sector Reforms in IndiaDocumento8 páginasBanking Sector Reforms in IndiaAnand KumarAinda não há avaliações

- Chapter-5 - Money and BankingDocumento3 páginasChapter-5 - Money and BankingramanAinda não há avaliações

- .S.3 Commerce - 1630400614000Documento74 páginas.S.3 Commerce - 1630400614000Ssonko EdrineAinda não há avaliações

- Balance Sheet of Coal IndiaDocumento28 páginasBalance Sheet of Coal IndiaShankari MaharajanAinda não há avaliações

- MODULE 12 Central Banking and Monetary SystemDocumento51 páginasMODULE 12 Central Banking and Monetary SystemNashebah A. BatuganAinda não há avaliações

- FM 3 Prelim ReviewerDocumento9 páginasFM 3 Prelim ReviewerMicca Mae RafaelAinda não há avaliações

- Pec2143 AssignmentDocumento9 páginasPec2143 AssignmentARIANEE BINTI AHMAD SAINI (BG)Ainda não há avaliações

- UOB Economic PlaybookDocumento16 páginasUOB Economic PlaybookMas WarisAinda não há avaliações

- Class Xii Economics Mcqs (Case Study Based Questions, Ar, Additonal Questions)Documento74 páginasClass Xii Economics Mcqs (Case Study Based Questions, Ar, Additonal Questions)omsharma53643Ainda não há avaliações

- Chapter No.53psDocumento5 páginasChapter No.53psKamal SinghAinda não há avaliações

- Macroeconomics Adel LauretoDocumento66 páginasMacroeconomics Adel Lauretomercy5sacrizAinda não há avaliações

- Crux of Indian Economy For IAS Prelims 2017 PDFDocumento258 páginasCrux of Indian Economy For IAS Prelims 2017 PDFSandeep InAinda não há avaliações