Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter 2

Enviado por

Siti AishahDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chapter 2

Enviado por

Siti AishahDireitos autorais:

Formatos disponíveis

CHAPTER 2

TIME VALUE OF MONEY

Time Value Of Money

Basic Principle : A dollar received today is worth more

than a dollar received in the future.

• This is due to opportunity costs. The opportunity cost

of receiving $1 in the future is the interest we could

have earned if we had received the $1 sooner.

• This concept is so important in understanding

financial management (investment, stock & bond

valuation etc..)

SITI AISHAH BINTI KASSIM (FM2)

2

If we can measure this opportunity cost,

we can:

Translate $1 today into its equivalent in the future

(compounding) – Future Value

Today Future

?

Translate $1 in the future into its equivalent today

(discounting)- Present Value

Today Future

SITI AISHAH BINTI KASSIM (FM2)

3

Future Value (FV)

Compound interest occurs when interest paid

on the investment during the first period is added

to the principal; then, during the second period,

interest is earned on this new sum.

• Compounding is the process of determining the

Future Value (FV) of cash flow.

• The compounded amount (Future Value) is

equal to the beginning amount plus interest

earned.

SITI AISHAH BINTI KASSIM (FM2)

4

Future Value (FV)

For example : If we place RM 1000 in a savings

account paying 5% interest compounded annually.

How much will it be worth at the end of each year ?

RM 1000 5% 5% 5% 5% 5%

0 1 2 3 4 n..

• Year 1 = RM1000 (1.05) = RM1050.00

• Year 2 = RM1050.00 (1.05) = RM1102.50

• Year 3 = RM1102.50 (1.05) = RM1157.63

• Year 4 = RM1157.63 (1.05) = RM 1215.51

• etc……

SITI AISHAH BINTI KASSIM (FM2)

5

Future Value (FV)

Formula of Future Value (FV) :

FVn = PV (1+i)n or FVn = PV (FVIFi,n)

where;

FVn = the FV of the investment at the end of n year

n = the number of years

i = the annual interest rate

PV = original amount invested at beginning of the

first year

**(1+i) is also known as compounding factor.

SITI AISHAH BINTI KASSIM (FM2)

6

Future Value (FV)

For example : If we place RM1,000 in a savings

account paying 5% interest compounded annually.

How much will our account accrue in 4 years?

PV=RM1,000, i =5% & n=4 years.

a) FVn=PV (1+i)n b) FVn = PV (FVIFi,n)

FV4=1,000 (1+0.05)4 FV4 = PV (FVIF5%,4)

=1,000 (1.2155) =1,000 (1.2155)

=RM1,215.50 =RM1,215.50

SITI AISHAH BINTI KASSIM (FM2)

7

Example:

If Adam invests RM10,000 in a bank where it will earn 6% interest

compounded annually. How much will it be worth at the end of

a) 1 year and b) 5 years?

Compounded for 1 year

a) FV1= $10000 (1+0.06)1 b) FV1 = PV (FVIF6%,1)

= $10000 (1.06)1 = $10000 (1.0600)

= $10,600.00 = $10,600.00

Compounded for 5 year

a) FV5 = $10000 (1+0.06)5 b) FV5 = PV (FVIF6%,5)

= $10000 (1.06)5 = $10000 (1.3382)

= $13,380.00 = $13,382.00

SITI AISHAH BINTI KASSIM (FM2)

8

Compound Interest With Non-annual

Periods

Non-annual periods : not annual compounding but

occurs semiannually, quarterly, monthly…

If compounding semiannually :

FV = PV (1 + i/2)n x 2 or FVn = PV (FVIFi/2,nx2)

If compounding quarterly :

• FV = PV (1 + i/4)n x 4 or FVn = PV (FVIFi/4,nx4)

If compounding monthly :

• FV = PV (1 + i/12)n x 12 or FVn = PV (FVIFi/12,nx12)

SITI AISHAH BINTI KASSIM (FM2)

9

PRESENT VALUE (PV)

Present value is the current value of futures sum

Finding Present Values (PVs) is called discounting

We can calculate PV by using this equation :

• PV = FVn or PV = FVn (PVIFi,n)

(1+i )n

**[ 1/(1+i)n ] is also known as discounting factor.

SITI AISHAH BINTI KASSIM (FM2)

10

PRESENT VALUE (PV)

For example : What is the PV of $800 to be received

10 years from today if our discount rate is 10%.

PV = 800/(1.10)10

= $308.43

or

PV = $800 (PVIF 10%,10yrs)

= $800 (0.3855)

= $308.40

SITI AISHAH BINTI KASSIM (FM2)

11

Hint for single sum problems:

In every single sum future value and present

value problem, there are 4 variables: FV, PV, i,

and n

When doing problems, you will be given 3

of these variables and asked to solve for the

4th variable.

Keeping this in mind makes “time value”

problems much easier!

SITI AISHAH BINTI KASSIM (FM2)

12

PV with Multiple, Uneven Cash

Flows

For example: What is the PV of an investment that

yields $300 to be received in 2 years and $450 to be

received in 8 years if the discount rate is 5%?

PV = $300(PVIF5%,2) + $450(PVIF5%,8)

= $300(0.907) + $450(0.677)

= 272.10 + 304.65

= $576.75

SITI AISHAH BINTI KASSIM (FM2)

13

ANNUITY

An annuity is a series of equal payments for a

specified numbers of years.

100 100 100 100 100

0 1 2 3 4

There are 2 types of annuities*:

- ordinary annuity

- annuity due

*in finance, ordinary annuities are used much more frequently

than are annuities due

SITI AISHAH BINTI KASSIM (FM2)

14

Ordinary Annuity

Ordinary Annuity is an annuity which the payments

occur at the end of each period.

a) Present Value of Annuity (PVA)

Present Value of Annuity (PVA) can be calculated

by using these equations:

PVAn = PMT / (1+i)n or PVAn = PMT (PVIFAi,n)

For example: Find the PV of $500 received at the end

of each year of the next 3 years discounted back to

the present at 10%?

SITI AISHAH BINTI KASSIM (FM2)

15

Ordinary Annuity

Solutions:

a) PVA3 = (500/1.10)1 + (500/1.10)2 +

(500/1.10)3

= 454.55 + 413.22 + 375.66

= $ 1243.43

OR

b) PVA3 = 500 (PVIFA10%,3)

= 500 (2.487)

= $ 1243.50

SITI AISHAH BINTI KASSIM (FM2)

16

Ordinary Annuity

b) Future Value of Annuity (FVA)

Compound Annuity / Future Value of Annuity (FVA)

can be calculated by using these equations :

FVAn = PMT (1+ i)n or FVAn = PMT (FVIFAi,n)

For example : We are going to deposit $15,000 at the

end of each year for the next 5 years in a bank where

it will earn 9% interest. How much will we get at the

end of 5 years?

SITI AISHAH BINTI KASSIM (FM2)

17

Ordinary Annuity

Solutions:

a) At the end of 5 years, we will get…

FVA5 = 15000(1.09)4 + 15000(1.09)3 +15000(1.09)2

+ 15000(1.09)1 +15000

= 21173.72 +19425.44 + 17821.50 + 16350 +

15000

= $89,770.66

OR

b) By using FVIFA table

FVA5 = 15000 (FVIFA9%,5)

= 15000 (5.9847)

= $89,770.50

SITI AISHAH BINTI KASSIM (FM2)

18

Annuity Due

Annuity Due is an annuity in which the payments

occur at the beginning of each period.

a) Future Value of Annuity Due (FVAD)

FVADn = PMT (FVIFAi,n) (1+i)

b) Present Value of Annuity Due (PVAD)

PVADn = PMT (PVIFAi,n) (1+i)

SITI AISHAH BINTI KASSIM (FM2)

19

Annuity Due

For example (FVAD): We are going to deposit

$1,000 at the beginning of each year for the

next 5 years in a bank where it will earn 5%

interest. How much will we get at the end of 5

years?

FVADn = PMT (FVIFAi,n) (1+i)

= 1000 (5.526) (1 + 0.05)

= $5802.30

SITI AISHAH BINTI KASSIM (FM2)

20

Annuity Due

For example (PVAD) : Find the PV of $500

received at the beginning of each year of

the next 5 years discounted back to the

present at 6%?

PVADn = 500 (PVIFA6%,5) (1+0.06)

= 500 (4.212) (1 + 0.06)

= $2,232.36

SITI AISHAH BINTI KASSIM (FM2)

21

Amortized Loan

Amortized loan is a loan that paid off in equal

installments.

To determine the installment (payment) we can use

this formula :

PMT = Loans

PVIFAi,n

Each installment consists partly of interest and

partly of repayment of principal. This breakdown is

given in the amortization schedule.

SITI AISHAH BINTI KASSIM (FM2)

22

Amortized Loan

For example: Daniel wants to accumulate

RM75,000 by the end of five (5) years. Assume

that the fund will earn an interest at 9.5%

compounded annually.

PMT = $75000/ PVIFA9.5%,5

= $10000 / 6.0446

= $ 12,407.73

SITI AISHAH BINTI KASSIM (FM2)

23

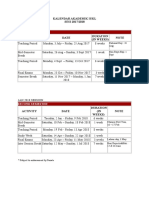

Loan Amortization Schedule

Beginning Annual Interest Accumulated

Year Balance Deposit Generated Amount

(1) (2) (3) (1)+(2)+(3)=(4)

1 0 12,407.73 0 12,407.73

2 12,407.73 12,407.73 1,178.74 25,994.20

3 25,994.20 12,407.73 2,469.45 40,871.38

4 40,871.38 12,407.73 3,882.78 57,161.89

5 57,161.89 12,407.73 5,430.38 75,000

SITI AISHAH BINTI KASSIM (FM2)

24

Perpetuity

Perpetuity is an annuity that continues forever.

The equation representing the present value of

annuity:

PV = PP

i

where,

PV= PV of the perpetuity

PP= Constant dollar amount provided by perpetuity

i = interest rate

25 SITI AISHAH BINTI KASSIM (FM2)

THE END

SITI AISHAH BINTI KASSIM (FM2)

26

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Academic Calendar IUKL Jul 2017 & Jan 2018Documento1 páginaAcademic Calendar IUKL Jul 2017 & Jan 2018Siti AishahAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Presentation RubricDocumento2 páginasPresentation RubricSiti AishahAinda não há avaliações

- Teamwork (Peer Review) A131: 1 Never 2 Rarely 3 Usually 4 Always MarksDocumento1 páginaTeamwork (Peer Review) A131: 1 Never 2 Rarely 3 Usually 4 Always MarksSiti AishahAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Animasi Apr 2019Documento14 páginasAnimasi Apr 2019Siti AishahAinda não há avaliações

- Chapter 4Documento30 páginasChapter 4Siti AishahAinda não há avaliações

- Chapter 1 (Intro)Documento18 páginasChapter 1 (Intro)Siti AishahAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Tutorial 3: Bpme2023 Creativity and Innovation Act-Uum SEM1 2016/2017Documento2 páginasTutorial 3: Bpme2023 Creativity and Innovation Act-Uum SEM1 2016/2017Siti AishahAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Creativity & Developing The Business Ideas: Developing New Products & Services Topic 7Documento28 páginasCreativity & Developing The Business Ideas: Developing New Products & Services Topic 7Siti AishahAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Organizational Leadership & Individual Towards Creativity.: Topic 8Documento39 páginasOrganizational Leadership & Individual Towards Creativity.: Topic 8Siti Aishah100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Exploiting Networks: Topic 10Documento15 páginasExploiting Networks: Topic 10Siti AishahAinda não há avaliações

- Exercise Chapter 6Documento3 páginasExercise Chapter 6Siti AishahAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Tutorial 1: Fill in The BlankDocumento2 páginasTutorial 1: Fill in The BlankSiti AishahAinda não há avaliações

- Sources of Innovation: Topic 6Documento36 páginasSources of Innovation: Topic 6Siti AishahAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- THE Concept of Creativity: Topic 1Documento25 páginasTHE Concept of Creativity: Topic 1Siti AishahAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Myths of Creativity & Innovation: Topic 5Documento9 páginasThe Myths of Creativity & Innovation: Topic 5Siti AishahAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- FCFChap004 - Financial Forecasting and PlanningDocumento37 páginasFCFChap004 - Financial Forecasting and PlanningSiti AishahAinda não há avaliações

- Group Assignment A171Documento2 páginasGroup Assignment A171Siti AishahAinda não há avaliações

- Chapter 13Documento54 páginasChapter 13Siti AishahAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Tutorial 1Documento1 páginaTutorial 1Siti AishahAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Tutorial Topic 7Documento3 páginasTutorial Topic 7Siti AishahAinda não há avaliações

- Exercise Cash FlowDocumento5 páginasExercise Cash FlowSiti AishahAinda não há avaliações

- Amortization vs. Depreciation - What's The Difference - InvestopediaDocumento4 páginasAmortization vs. Depreciation - What's The Difference - InvestopediaBob KaneAinda não há avaliações

- Sss Salary Loan QuizDocumento4 páginasSss Salary Loan QuizMeireen AnnAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Consumer Mathematics: Borrowing: Loans and Loan RepaymentDocumento22 páginasConsumer Mathematics: Borrowing: Loans and Loan RepaymentAlthea Noelfei QuisaganAinda não há avaliações

- Rolling Forecast TemplateDocumento4 páginasRolling Forecast TemplatebenaikodonAinda não há avaliações

- Bonds Payable - ExplanationDocumento37 páginasBonds Payable - ExplanationRuby Dela CruzAinda não há avaliações

- Toa Cpa ReviewDocumento10 páginasToa Cpa ReviewKim ZamoraAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- SSS Member Loan Application FormDocumento2 páginasSSS Member Loan Application FormJr Sam90% (49)

- Contract To SellDocumento5 páginasContract To SellvicentemariscalAinda não há avaliações

- Chapter 11&12 QuestionsDocumento8 páginasChapter 11&12 QuestionsMya B. Walker100% (1)

- Gin BilogDocumento14 páginasGin BilogHans Pierre AlfonsoAinda não há avaliações

- 5 3 NotesDocumento7 páginas5 3 Notesapi-301176378Ainda não há avaliações

- RJR Nabisco Harshavardhan 2015PGP254Documento18 páginasRJR Nabisco Harshavardhan 2015PGP254Harsha Vardhan100% (1)

- Financial Accounting and Reporting: Multiple ChoiceDocumento54 páginasFinancial Accounting and Reporting: Multiple ChoiceLouiseAinda não há avaliações

- MPPA (Financial Statement Analysis)Documento36 páginasMPPA (Financial Statement Analysis)Sufian TanAinda não há avaliações

- Problem 7-1: 1. Origination Fee Received From The Borrower Direct Origination CostDocumento4 páginasProblem 7-1: 1. Origination Fee Received From The Borrower Direct Origination CostSarah Joy Piamonte EstradaAinda não há avaliações

- ABanca Cuentas Consolidadas 1s 2019 enDocumento75 páginasABanca Cuentas Consolidadas 1s 2019 enMiguel RamosAinda não há avaliações

- Mortgage Calculator Excel TemplateDocumento13 páginasMortgage Calculator Excel TemplateHamid MansouriAinda não há avaliações

- Sol. Man. - Chapter 7 Leases Part 1Documento12 páginasSol. Man. - Chapter 7 Leases Part 1Miguel Amihan100% (1)

- Branch Audit Cut-Off Date - Loans Audit Objectives and Procedures A. Audit ObjectiveDocumento25 páginasBranch Audit Cut-Off Date - Loans Audit Objectives and Procedures A. Audit ObjectiveRolando VasquezAinda não há avaliações

- Ch12 Intangible AssetsDocumento28 páginasCh12 Intangible AssetsBabi Dimaano Navarez0% (1)

- Bonds PayableDocumento34 páginasBonds PayableArgem Jay PorioAinda não há avaliações

- Eastland Center - Loan Prop DetailDocumento10 páginasEastland Center - Loan Prop DetailClickon DetroitAinda não há avaliações

- EW00467 Annual Report 2018Documento148 páginasEW00467 Annual Report 2018rehan7777Ainda não há avaliações

- 10 Amortization GenmathDocumento41 páginas10 Amortization GenmathMac FerdsAinda não há avaliações

- Mathematics of Investment - Mr. NogralesDocumento55 páginasMathematics of Investment - Mr. NogralesatlasAinda não há avaliações

- ACC 211 SIM Week 6 7Documento40 páginasACC 211 SIM Week 6 7Threcia Rota50% (2)

- PAG IBIG Housing LoanDocumento38 páginasPAG IBIG Housing LoanKrisha Jean ManzanoAinda não há avaliações

- Are Present Obligation of An Entity: As A Result of Past EventsDocumento14 páginasAre Present Obligation of An Entity: As A Result of Past EventsMARY ACOSTAAinda não há avaliações

- Chapter 4 Intermediate Accounting Vol 2Documento17 páginasChapter 4 Intermediate Accounting Vol 2Amber Lavarias BernabeAinda não há avaliações

- Chapter 32 - Multiple ChoiceDocumento2 páginasChapter 32 - Multiple ChoiceLorraineMartinAinda não há avaliações