Escolar Documentos

Profissional Documentos

Cultura Documentos

MA - Session 7

Enviado por

Ishaan KumarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

MA - Session 7

Enviado por

Ishaan KumarDireitos autorais:

Formatos disponíveis

CLEANLINESS IS NEXT TO GODLINESS

Duration: 60 mins

Slides: 12

LMT SCHOOL OF MANAGEMENT, THAPAR INSTITUTE OF

ENGINEERING & TECHNOLOGY

Masters of Business Administration

Course: Managerial Accounting

Faculty: Dr. Sonia Garg (Email: sonia.garg@thapar.edu)

Session 7: Marginal and Absorption Costing

Session Learning Objectives

• Identify what distinguishes marginal costing from

absorption costing

• Compute income under marginal and absorption

costing and explain the difference

• Differentiate throughput costing from marginal and

absorption costing

• Compute breakeven points for marginal and absorption

costing

Marginal and Absorption Costing

Marginal costing v/s Absorption

costing

• Marginal costing is a method of inventory costing in which only variable

manufacturing costs are included as inventoriable costs

• Absorption costing is a method of inventory costing in which all variable

manufacturing costs and all fixed manufacturing costs are included as

inventoriable costs

• Operating Income will differ between Absorption and Marginal Costing

• The amount of the difference represents the amount of Fixed Product

Costs capitalized as Inventory under Absorption costing, and expensed as

a period costs under Marginal Costing

Marginal and Absorption Costing

Example

April May

Beginning Inventory 0 150

Production 500 400

Sales 350 520

Variable Costs

Manufacturing costs per unit produced Rs. 1,00,000 Rs. 1,00,000

Operating costs per unit sold Rs. 30,000 Rs. 30,000

Fixed Costs

Manufacturing costs Rs. 2,00,00,000 Rs. 2,00,00,000

Operating costs Rs. 60,00,000 Rs. 60,00,000

The selling price is Rs. 2,40,000

Marginal and Absorption Costing

April May

Beginning Inventory 0 150

Solution Production

Goods available for

500

500

400

550

sale

Units sold 350 520

Marginal Costing Ending inventory 150 30

April May

Revenue 2,40,000*350 = 8,40,00,000 2,40,000*520 = 12,48,00,000

Costs:

Beginning Inventory 0 1,00,000*150 = 1,50,00,000

Variable manufacturing costs 1,00,000*500 = 5,00,00,000 1,00,000*400 = 4,00,00,000

Variable cost of goods available 5,00,00,000 5,50,00,000

for sale

Deduct Ending Inventory (1,00,000*150 = 1,50,00,000) (1,00,000*30 = 30,00,000)

Variable COGS 3,50,00,000 5,20,00,000

Variable operating costs 30,000*350 = 1,05,00,000 30,000*520 = 1,56,00,000

Fixed Manufacturing costs 2,00,00,000 2,00,00,000

Fixed operating costs 60,00,000 60,00,000

Marginal and Absorption Costing

Operating Income 1,25,00,000 3,12,00,000

April May

Fixed manufacturing costs 2,00,00,000 2,00,00,00

0

Absorption costing Units produced 500 400

Fixed manufacturing cost per unit 40,000 50,000

Variable manufacturing cost per unit 1,00,000 1,00,000

Total manufacturing cost per unit 1,40,000 1,50,000

April May

Revenue 2,40,000*350 = 8,40,00,000 2,40,000*520 = 12,48,00,000

Costs:

Beginning Inventory 0 2,10,00,000

Variable manufacturing costs 1,00,000*500 = 5,00,00,000 1,00,000*400 = 4,00,00,000

Fixed Manufacturing costs 2,00,00,000 2,00,00,000

Cost of goods available for sale 7,00,00,000 8,10,00,000

Deduct Ending Inventory (1,40,000*150 = 2,10,00,000) (1,50,000*30= 45,00,000)

COGS 4,90,00,000 7,65,00,000

Variable operating costs 30,000*350 = 1,05,00,000 30,000*520 = 1,56,00,000

Fixed operating costs 60,00,000 60,00,000

Operating Income 1,85,00,000 2,67,00,000

Marginal and Absorption Costing

Operating income difference

• Absorption costing operating income – Marginal

costing operating income = fixed manufacturing costs

in ending inventory – fixed manufacturing costs in

beginning inventory

• April:

1,85,00,000 – 1,25,00,000 = (40,000*150)-0

60,00,000 = 60,00,000

• May:

2,67,00,000 – 3,12,00,000 = (50,000*30) – (40,000*150)

-45,00,000 = -45,00,000

Marginal and Absorption Costing

How do changes in unit inventory cost

affect operating income

Marginal Costing Absorption Costing

Production = Sales Equal Equal

Production > Sales Lower Higher

Production < Sales Higher Lower

Marginal and Absorption Costing

Performance Issues and Absorption Costing

• Managers may seek to manipulate income by producing too many units

• Production beyond demand will increase the amount of inventory on hand

• This will result in more fixed costs being capitalized as inventory

• That will leave a smaller amount of fixed costs to be expensed during the

period

• Profit increases, and potentially so does a manger’s bonus

• REMEDY: base manager’s bonuses on profit calculated using Marginal Costing

Marginal and Absorption Costing

Other Issues

• Deciding to manufacture products that absorb the highest amount of fixed

costs, regardless of demand (“cherry-picking”)

• Accepting an order to increase production, even though another plant in

the same firm is better suited to handle that order

• Deferring maintenance

• REMEDIES

o Careful budgeting and inventory planning

o Incorporate an internal carrying charge for inventory

o Change (lengthen) the period used to evaluate performance

o Include nonfinancial as well as financial variables in the measures to evaluate

performance

Marginal and Absorption Costing

Extreme Variable Costing: Throughput

Costing

• Throughput costing (super-variable costing) is a method of

inventory costing in which only direct material costs are

included as inventory costs.

• All other product costs are treated as operating expenses

Marginal and Absorption Costing

Break even point

For Marginal costing: Break even point is unique

– Break even point (in units) = total fixed cost/contribution margin per

unit

– No. of units sold = (total fixed cost + target operating

income)/contribution margin per unit

For Absorption costing: Break even point is not unique

– No. of units sold =(total fixed cost + target operating income+ [fixed

manufacturing cost rate*(breakeven sales in units – units

produced)])/contribution margin per unit

– The term fixed manufacturing cost rate*(breakeven sales in units –

units produced) reduces the fixed costs that need to be recovered

when units produced are more than breakeven sales quantity

Marginal and Absorption Costing

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

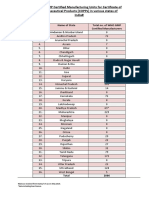

- List of API: Product Cas No. End Use (Category)Documento4 páginasList of API: Product Cas No. End Use (Category)Ishaan KumarAinda não há avaliações

- Farmplus New - 090122Documento18 páginasFarmplus New - 090122Ishaan KumarAinda não há avaliações

- Karnatic StockDocumento53 páginasKarnatic StockIshaan KumarAinda não há avaliações

- (Gkmojo) November 2021 File: Important Days of NovemberDocumento34 páginas(Gkmojo) November 2021 File: Important Days of NovemberIshaan KumarAinda não há avaliações

- Revenue Worksheet: Food and Beverage Sample WorksheetDocumento10 páginasRevenue Worksheet: Food and Beverage Sample WorksheetJose BarajasAinda não há avaliações

- Academic Session 2020-21 Grade V Chapter - 8 (The Frigid Zone) Back Exercise and Concept MapDocumento3 páginasAcademic Session 2020-21 Grade V Chapter - 8 (The Frigid Zone) Back Exercise and Concept MapIshaan KumarAinda não há avaliações

- Farm-Plus Pitch DeckDocumento19 páginasFarm-Plus Pitch DeckIshaan KumarAinda não há avaliações

- Business Analytics and Research Major ProjectDocumento17 páginasBusiness Analytics and Research Major ProjectIshaan KumarAinda não há avaliações

- Greenpanel Wood Floors BrochureDocumento22 páginasGreenpanel Wood Floors BrochureIshaan KumarAinda não há avaliações

- Farm-Plus: "The Helping Hand"Documento10 páginasFarm-Plus: "The Helping Hand"Ishaan KumarAinda não há avaliações

- Ishaan Kumar: Professional SummaryDocumento2 páginasIshaan Kumar: Professional SummaryIshaan KumarAinda não há avaliações

- Walia Niwas, Near Auckland Hotel, Shimla - 171001 +91-9459765797 Info@amplifywealth - inDocumento1 páginaWalia Niwas, Near Auckland Hotel, Shimla - 171001 +91-9459765797 Info@amplifywealth - inIshaan KumarAinda não há avaliações

- List Who GMPDocumento126 páginasList Who GMPAnonymous 3LiDeGpOc100% (1)

- List of Biotech Companies in Mumbai PDFDocumento17 páginasList of Biotech Companies in Mumbai PDFaniket100% (1)

- GLP CertificateDocumento2 páginasGLP CertificateIshaan KumarAinda não há avaliações

- Apteka - Participants - Profile1Documento26 páginasApteka - Participants - Profile1Gurukrushna PatnaikAinda não há avaliações

- Greenpanel Wood Floors BrochureDocumento22 páginasGreenpanel Wood Floors BrochureIshaan KumarAinda não há avaliações

- Coa UspDocumento1 páginaCoa UspIshaan KumarAinda não há avaliações

- GLP CertificateDocumento2 páginasGLP CertificateIshaan KumarAinda não há avaliações

- Divyanish RTTDocumento7 páginasDivyanish RTTIshaan KumarAinda não há avaliações

- Project Report: Financial and Investment Planning in Reference To Mutual Funds IndustryDocumento27 páginasProject Report: Financial and Investment Planning in Reference To Mutual Funds IndustryIshaan KumarAinda não há avaliações

- Facilities LISTDocumento22 páginasFacilities LISTIshaan KumarAinda não há avaliações

- Application Form GD200074477Documento3 páginasApplication Form GD200074477Ishaan KumarAinda não há avaliações

- Smt. Krishna Rani: in The Everlasting Memory ofDocumento1 páginaSmt. Krishna Rani: in The Everlasting Memory ofIshaan KumarAinda não há avaliações

- Name: Aman Arya: Client Information Ideal Benchmarks, If AnyDocumento4 páginasName: Aman Arya: Client Information Ideal Benchmarks, If AnyIshaan KumarAinda não há avaliações

- Test Report: Test Results Biol. Ref. Result For Sars-Cov-2 (Covid-19) Negative CT Value of Orf1Ab Gene (If Positive)Documento2 páginasTest Report: Test Results Biol. Ref. Result For Sars-Cov-2 (Covid-19) Negative CT Value of Orf1Ab Gene (If Positive)Ishaan KumarAinda não há avaliações

- Collage On Cyber CrimeDocumento1 páginaCollage On Cyber CrimeIshaan KumarAinda não há avaliações

- Financial and Investment Planning in Reference To Mutual Funds IndustryDocumento18 páginasFinancial and Investment Planning in Reference To Mutual Funds IndustryIshaan KumarAinda não há avaliações

- Financial and Investment Planning in Reference To Mutual Funds IndustryDocumento16 páginasFinancial and Investment Planning in Reference To Mutual Funds IndustryIshaan KumarAinda não há avaliações

- Collage On HTML BY-Aashreya 10 Alpha: Hyper Text Markup LanguageDocumento1 páginaCollage On HTML BY-Aashreya 10 Alpha: Hyper Text Markup LanguageIshaan KumarAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Soal AkunDocumento3 páginasSoal AkunOther EmailAinda não há avaliações

- Solder Wire Making PlantDocumento24 páginasSolder Wire Making Plantbirukbrook2Ainda não há avaliações

- Ratio Analysis of TCS (KIIT School of Management)Documento28 páginasRatio Analysis of TCS (KIIT School of Management)ShivamKumar83% (18)

- Quiz Accounting For VHWO Ver. 7Documento9 páginasQuiz Accounting For VHWO Ver. 7Becky GonzagaAinda não há avaliações

- Cost Concepts and Behaviors-EEP-lec5Documento25 páginasCost Concepts and Behaviors-EEP-lec5Ramendra KumarAinda não há avaliações

- Sample Financial PlanDocumento12 páginasSample Financial PlanSneha KhuranaAinda não há avaliações

- Differential AnalysisDocumento9 páginasDifferential AnalysisGilner PomarAinda não há avaliações

- Advanced Bond ConceptsDocumento32 páginasAdvanced Bond ConceptsJohn SmithAinda não há avaliações

- Mas Test BankDocumento23 páginasMas Test BankFrancine Holler100% (1)

- Consolidated Financial StatementsDocumento29 páginasConsolidated Financial StatementsPramad BhattacharjeeAinda não há avaliações

- Mitchell Regional Habitat For Humanity-Mitchell Habitat Audit Report 06-30-2020Documento17 páginasMitchell Regional Habitat For Humanity-Mitchell Habitat Audit Report 06-30-2020api-308302326Ainda não há avaliações

- Business Plan & Pitching Workshop: Peter Farrell Cup Entrepreneurial ChallengeDocumento53 páginasBusiness Plan & Pitching Workshop: Peter Farrell Cup Entrepreneurial ChallengealfinaAinda não há avaliações

- Answers To Question - Bank - SFMDocumento320 páginasAnswers To Question - Bank - SFMKeerthana SureshAinda não há avaliações

- IAS 39 Detailed SummaryDocumento18 páginasIAS 39 Detailed Summarywesternwound82Ainda não há avaliações

- NPV and XIRR Calculator Excel TemplateDocumento7 páginasNPV and XIRR Calculator Excel TemplateAJIT KUMAR PATRAAinda não há avaliações

- Accounting For Shareholders Equity KINGDocumento11 páginasAccounting For Shareholders Equity KINGAlexis KingAinda não há avaliações

- Comparative Financial Statement AnalysisDocumento3 páginasComparative Financial Statement Analysispriya100% (1)

- Accounting Level 3: LCCI International QualificationsDocumento17 páginasAccounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (4)

- CAIIB - ABM - CASE StudyDocumento68 páginasCAIIB - ABM - CASE StudyKirankumarAinda não há avaliações

- Free Cash FlowDocumento8 páginasFree Cash FlowSisila Agusti AnggrainiAinda não há avaliações

- BUS20269 Financial Management Final ExamDocumento7 páginasBUS20269 Financial Management Final Examshiyingyang98Ainda não há avaliações

- ADBL Level 4 Account TopicsDocumento20 páginasADBL Level 4 Account TopicsCrEaTiVe MiNdAinda não há avaliações

- CH 3Documento10 páginasCH 3Mohammed mostafaAinda não há avaliações

- Financial Modelling FundamentalsDocumento44 páginasFinancial Modelling FundamentalsNguyen Binh MinhAinda não há avaliações

- Accounting Standard - 22Documento25 páginasAccounting Standard - 22themeditator100% (1)

- Financial Reporting Strathmore University Notes and Revision KitDocumento551 páginasFinancial Reporting Strathmore University Notes and Revision KitLazarus AmaniAinda não há avaliações

- Chapter 15 Q&PDocumento49 páginasChapter 15 Q&PPramod KumawatAinda não há avaliações

- Dividend and Retention Policy: By: Pooja Narwani Pratik Lalani Razaali Vakil Richa Shah Riddhi SalotDocumento45 páginasDividend and Retention Policy: By: Pooja Narwani Pratik Lalani Razaali Vakil Richa Shah Riddhi SalotGirimallika BoraAinda não há avaliações

- Akuntansi KeuanganDocumento20 páginasAkuntansi KeuanganCenxi TVAinda não há avaliações

- Chart of AccountDocumento13 páginasChart of AccountHarso SurosoAinda não há avaliações