Escolar Documentos

Profissional Documentos

Cultura Documentos

Legal Aspects For A Start Up

Enviado por

Mehul Mukati0 notas0% acharam este documento útil (0 voto)

526 visualizações43 páginasLegal aspects to be considered by an entrepreneur

Título original

Legal Aspects for a Start Up

Direitos autorais

© Attribution (BY)

Formatos disponíveis

PPTX, PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoLegal aspects to be considered by an entrepreneur

Direitos autorais:

Attribution (BY)

Formatos disponíveis

Baixe no formato PPTX, PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

526 visualizações43 páginasLegal Aspects For A Start Up

Enviado por

Mehul MukatiLegal aspects to be considered by an entrepreneur

Direitos autorais:

Attribution (BY)

Formatos disponíveis

Baixe no formato PPTX, PDF ou leia online no Scribd

Você está na página 1de 43

Legal Aspects for a Start Up

Presented by CA Mehul Mukati

for

ET Power Of Ideas Workshop

CIIE, IIM - Ahmedabad

Axia Advisory Services Pvt Ltd

Outline

2

• SSI vs MSME

• Choosing your vehicle

• Companies

• Taxation

• Other Legal aspects

Axia Advisory Services Pvt Ltd

3

SSI vs MSME

• SSI – Small Scale Industries

• MSME – Micro, Small and Medium Enterprises

– Certification / Registration

Type Service Manufacturing

Equipment Value P&M Value

Micro < Rs10 lakhs < Rs5 lakhs

Small < Rs2 crores < Rs5 crores

Medium < Rs5 crores <Rs10 crores

Axia Advisory Services Pvt Ltd

Entity Choice

4

• Service area or product development

• No of people – partners, employees, etc

• Time to test your service / prototype your

product

Axia Advisory Services Pvt Ltd

5

Formation

Proprietor Partnership LLP Company

Incorporation None Agreement / Incorporation MoA / AoA

Documentation Deed Agreement

Min Capital Least Minimal Rs500 Rs1 lakh

Personal Liability Unlimited Unlimited Limited Limited

Flexibility Very High High Medium Medium - Low*

Remuneration to Fully Flexible Partial Partial Partial Restriction

owners Restriction Restriction

Record Low Medium Medium High

Maintenance

Eff Tax Rates Slab 30.9% 30.9% 30.9% / 32.445%#

MAT NA NA MAT MAT

Eff MAT Rate 19.055% 19.055% / 20.01%#

* High degree of legal compliance / formalities

# surcharge applicable if revenues > Rs1 crore

Axia Advisory Services Pvt Ltd

6

In all forms of entity

• Need to maintain proper income and

expenditure records

• Obtain tax numbers:

– PAN / TAN / Service Tax / VAT / Sales Tax

• PAN / TAN / Service Tax process simplified

– Anyone can apply online and then send the

documents to the relevant office

OR

– Go to the nearest facilitation centre and submit

the form and documents

Axia Advisory Services Pvt Ltd

Partnership

7

• Proper agreement (deed)

– Capital share

– Profit share vs Loss share

– Duties, responsibilities, and authority

• Salary paid to partners deductible as expense

– Taxable in hands of individual

Axia Advisory Services Pvt Ltd

Limited Liability Partnership (LLP)

8

• Agreement Deed / Incorporation Agreement

(as previous)

• LLP Act, 2008

– Minimum 2 partners, at least 1 resident

– DPIN to be obtained

– audit subject to limits

– Annual Filings

• Statement of Accounts and Solvency to be filed within

six months from end of financial year

• Annual Return to be filed within 60 days of end of

financial year

Axia Advisory Services Pvt Ltd

Limited Liability Partnership (LLP)

9

• Exemptions from audit available

– Turnover

– Contribution

– But needs to be certified by designated partners

• Maximum Remuneration*

– Profit ≤ Rs3 lakhs Rs1.5 lakhs/90% of profit

– Profit > Rs3 lakhs 60% of incremental profit

* same as a traditional partnership firm

Axia Advisory Services Pvt Ltd

Private Limited Company

10

• All Directors need DIN

• Other mandatory provisions:

– Quarterly board meetings

– Intimation to Registrar of Companies

– Audit

• More Legal Requirements

Axia Advisory Services Pvt Ltd

11

Annual Filing – RoC

• Balance Sheet

• Profit and Loss Statement

• Annual Return

• Compliance Certificate

– If capital between Rs10 lakhs and Rs2 crore

Axia Advisory Services Pvt Ltd

12

Other Filings – RoC

• Mortgage

• Cost Audit Report, if applicable

• Increase in Authorised / Paid Up Capital

• Change in Directors, if any

Axia Advisory Services Pvt Ltd

13

Companies Act

• Board Meetings

– At least one each quarter

– No maximum limit

– Whole-time / promoter directors no sitting fees

– Can be held anywhere and at any time

• Registers to be maintained

• Audit requirement

– Audit fees cannot be % based

– Auditor can claim reimbursement of expenses

Axia Advisory Services Pvt Ltd

14

Companies Act

• Annual Return to be filed within 60 days of

General Meeting

• Can accept deposit only from Director /

Member / Relative

• AGM to be held within max 15 months

• On working day and during working hours

• Appointment of Statutory Auditor

• Change in Directors

Axia Advisory Services Pvt Ltd

15

Companies Act

• Can issue DVR shares

– Cool off period 3 profitable years

• Specific format of P&L / Balance Sheet

Axia Advisory Services Pvt Ltd

16

Companies Act – No Worry On

• Audit Committee

• Directors rotation / retirement

• Ceiling on managerial remuneration

• Time-limit for managing director

Axia Advisory Services Pvt Ltd

17

Dividends

• To be deposited in separate bank account

within 5 days and paid within 30 days

• Prerequisites

– Provision for depreciation

– Transfer to general reserve

– No default in redemption of preference shares

• Need to pay DDT @ 16.22%

• Not Taxable in the hands of recipient

Axia Advisory Services Pvt Ltd

18

Income Tax – Due Dates

• Advance Tax payments

– Calculated on the estimated profit for the year

• 15th June 15% ---

• 15th Sept 45% 30%

• 15th Dec 75% 60%

• 15th Mar 100% 100%

• Annual Returns to be filed

– Audited / Partner of such firm 31st Oct

– All others 31st July

– Ensure loss returns are filed in time

Axia Advisory Services Pvt Ltd

19

Income Tax - Requirements

• Maintain Books of Accounts for 8 years

• Form of entity does not matter

• Audit Limits based on revenues

– Business > Rs60 lakhs (Rs40 lakhs)

– Profession > Rs15 lakhs (Rs10 lakhs)

– Mandatory for companies irrespective of revenue

• Statutory Dues / Taxes can be claimed only if

paid within respective due dates

Remember: advantageous if bills are generated in name of entity

Axia Advisory Services Pvt Ltd

20

Income Tax – Expenses Claim

• Depreciation on WDV : vehicle, computers &

peripherals, mobile

– 30 September vs 31 March

– Can be carried forward indefinitely

• Service Tax/Sales Tax/VAT Input

– Availability of set-off

• Rentals

– Receiver can claim flat maintenance cost of 30% of

rentals: no bills are needed

• Income tax applicable only on balance amount

Axia Advisory Services Pvt Ltd

21

Income Tax – Expenses Claim

• Other Company Expenses

– can vary from puja expenses in the office,

newspapers, office materials, water, electricity,

telecom, security, etc.

– Claimed by the company and not by the directors

– Proper bills will be needed in company name

• Salaries & Reimbursements

– Employees

– Directors / Promoters

Axia Advisory Services Pvt Ltd

22

Income Tax –Salary Payments

• Optimum Salary: Rs3.30 lakhs / year

– New tax slab limit Rs. 1.8 Lakh

– 80C benefits Rs1.1 Lakh

– Medical insurance Rs15,000/Rs35,000?

– Others: medical, conveyance, children education

– If above 60 / 80 yrs Rs4.15 / 6.15 lakhs

• Other Direct Payments to Directors

– Rentals

– Consultation Fee

– Commissions 1% / 3% of Net Profits

Axia Advisory Services Pvt Ltd

23

Income Tax – Deductions

• Sec 80HHC – Export of Goods

– Export of goods / merchandise

– Certificate issued by Export House / Trading House

• Sec 80HHE – Software / Tech Services Export

– Buyer / Auditor certificate

• Common to above

– Payment in Convertible Foreign Currency

– Proportionate to Total Revenue / Profits

Axia Advisory Services Pvt Ltd

24

Income Tax – TDS

• Onus on payer to deduct TDS

• TDS to be deducted on all bills / payments

• TDS to be deposited each quarter / month

• PAN not quoted = higher TDS

Axia Advisory Services Pvt Ltd

25

Income Tax – TDS

Head Exempt Upto When Deposit Cert Due

Due

Salary Min Slab Payment 7th of Form 16 on

next / before 31

month May

Interest Rs5,000 p.a. Payment 7th of Form 16A,

Contractor Rs30,000 / / Credit next 31 Jul, 31

contract OR month Oct, 31 Jan,

Rs75,000 p.a. 31 May

Commission Rs10,000 p.a.

Professional Rs30,000 p.a.

Axia Advisory Services Pvt Ltd

26

Service Tax

• Wide range of services covered, including

most common – consultancy, advisory, etc.

– Exception: Export, if receipts in foreign currency

• Applicable if revenue ≥ Rs10 lakhs

– Based on providers’ revenue

– Need to register

• once revenue crosses Rs9 lakhs in previous year

• Within 30 days

• Set-off available – now a grey area

• Effective Rate = 10.3%

Axia Advisory Services Pvt Ltd

27

Service Tax Procedure

• Apply to Superintendent of Central Excise

– Single Registration for all services

– PAN mandatory for ST registration

• Need to issue bill / invoice within 14 days of

completion of service

– Signed and numbered

– Details / description of service provided

• Service tax amount to be shown separately

– Name & Address of provider / receiver of service

• ePayment mandatory if ST ≥ Rs.10 lakhs

Axia Advisory Services Pvt Ltd

28

Service Tax

• Payment

– 5/6th of quarter end (ex Mar) Individual / Firms

– 5/6th of month (ex Mar) Others

• Returns: Half Yearly – 25th Oct / 25th Apr

• ST applicable on full bill value

– Including TDS deducted

Axia Advisory Services Pvt Ltd

29

Excise Duty

• Excise Duty

– Only manufacturers

– Payment by 5th / 6th of next month / quarter

• SSI Quarterly; others each month

– Returns

• SSI 10th after end of quarter; others 10th of next month

Axia Advisory Services Pvt Ltd

30

RBI / FEMA

• RBI Regulations / FEMA

– Imports: Equipment

– Exports: Software / Services

Axia Advisory Services Pvt Ltd

31

Provident Fund (PF)

• Mandatory if

– ≥ 20 employees and

– Salary ≤ Rs6,500/month

• Exceptions

– Company PF Trust

– “excluded” employee

• Deductions

– 12% of Basic + DA

– Matching contribution by employers

Axia Advisory Services Pvt Ltd

32

Shops & Establishments Act

• Mandatory in all cases (except if it is a factory)

• Fees depends on number of employees

Axia Advisory Services Pvt Ltd

33

ESIC

• Mandatory if

– Manufacturing using power ≥ 10 employees

– Others ≥ 20 employees

– Salary ≤ Rs15,000 / month

Axia Advisory Services Pvt Ltd

34

Professional Tax

• State subject

– Maharashtra, Karnataka, West Bengal, Andhra

Pradesh, Gujarat, Tamil Nadu, Madhya Pradesh

In Maharashtra

• Mandatory in all cases

• Amount depends on Salary

Axia Advisory Services Pvt Ltd

35

Things to Remember

• Always issue a Bill / Invoice

– Name & Address: both provider and receiver

– Serial Number

– PAN / TAN number

– Service Tax Registration Number

– Description of service / goods: each class

separately

– TDS / Service Tax / Education Cess / Higher

Secondary Education Cess separately shown

Axia Advisory Services Pvt Ltd

36

Private Company Sweat Equity

• Only of class of shares already issued

• Special Resolution passed in General Meeting

• Resolution to specify

– number of shares

– consideration, if any

– class / classes of directors / employees to whom

such equity shares are to be issued

• Company should be at least 1 year old

• To be at a fair price calculated by an

independent valuer

Axia Advisory Services Pvt Ltd

Thank You

CA Mehul Mukati

Axia Advisory Services Pvt Ltd

Axia Advisory Services Pvt Ltd

38

DIN Process

• Only eForms with scanned documents

• eForm can be submitted by person, if he/she

has valid DSC

• eForm can be digitally signed by CA / CS as

proof of having verified documents

– If so done, DIN will be approved immediately

Axia Advisory Services Pvt Ltd

39

Normal Procedure (1/2)

• Obtain DSC / DIN

• File for approval of proposed name to ROC

• Get MoA & AoA vetted by ROC and printed

• Apply for stamping of the MoA & AoA

• Obtain CoI from RoC

• Open Bank Account

• Obtain a company seal

• Obtain PAN / TAN

• Value Added Tax (VAT) / Sales Tax / Service Tax

Axia Advisory Services Pvt Ltd

40

Normal Procedure (2/2)

• Register under

– Shops and Establishment Act

– Profession Tax

– Employees' Provident Fund Organization (EPFO)

– ESIC (medical insurance)

– Factories Act

• Filing for Government Approval before

RBI/FIPB for Foreigners and NRI's

Axia Advisory Services Pvt Ltd

41

How to e-File Documents

• Company representative

– Upload e-Forms on MCA21 portal through the

‘Annual Filing Process’ link

• Prepare e-Form and submit on CD to

Temporary Facilitation Offices (10-12 cities

only) / Registrar’s Front Offices (RFO).

• Prepare e-Form and submit through Certified

Filing Centers

• Either the director who has DSC or practicing

CA / CS can file on behalf of the Company

Axia Advisory Services Pvt Ltd

42

Private Company Sweat Equity

• Procedure

– IP / know-how / value addition valued by valuer;

– Valuer to justify valuation in report;

– Company to send valuation report to shareholders

– Treated as managerial remuneration, if:

• Sweat equity shares issued to director / manager;

• Issued for non-cash without resulting in an asset

Axia Advisory Services Pvt Ltd

43

Private Company Sweat Equity

• Taxation: Not a Perquisite, if

– Plan / Scheme as per SEBI Guidelines

• For both unlisted and listed companies

• Person holding >10% equity ineligible

– Copy of Plan / Scheme submitted to CIT

• Submission only, no approval required

– Conditions of Plan / Scheme have not changed

• Regulatory Compliance

– Within 30 days of allotment

Axia Advisory Services Pvt Ltd

Você também pode gostar

- Listing On SME ExchangesDocumento25 páginasListing On SME ExchangesMehul MukatiAinda não há avaliações

- CERC Renewable Energy Tariff Regulations - 2009-09-25Documento10 páginasCERC Renewable Energy Tariff Regulations - 2009-09-25Mehul MukatiAinda não há avaliações

- Strategy - 2010-07-14Documento109 páginasStrategy - 2010-07-14Mehul MukatiAinda não há avaliações

- Oil & Gas Deregulation - 160210Documento8 páginasOil & Gas Deregulation - 160210Mehul MukatiAinda não há avaliações

- CERC Renewable Energy Tariff Regulations - 2009-09-25Documento10 páginasCERC Renewable Energy Tariff Regulations - 2009-09-25Mehul MukatiAinda não há avaliações

- Thematic - Power Sector - 2009-01-21 - CERC Tariff Norms For 2009-14Documento3 páginasThematic - Power Sector - 2009-01-21 - CERC Tariff Norms For 2009-14Mehul MukatiAinda não há avaliações

- Thematic - Power Sector - 2009-08-26 - Rainfall and Hydro PowerDocumento5 páginasThematic - Power Sector - 2009-08-26 - Rainfall and Hydro PowerMehul MukatiAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Research On Motivation TheoriesDocumento15 páginasResearch On Motivation TheoriesNayeem Md SakibAinda não há avaliações

- ERAS DR - TESAR SP - AnDocumento26 páginasERAS DR - TESAR SP - AnAhmad Rifai R AAinda não há avaliações

- 1.4 Market FailureDocumento42 páginas1.4 Market FailureRuban PaulAinda não há avaliações

- My Study Plan Guide For AmcDocumento7 páginasMy Study Plan Guide For Amc0d&H 8Ainda não há avaliações

- C11984569 Signed OfferLetterDocumento10 páginasC11984569 Signed OfferLetterSiriAinda não há avaliações

- A-Plus Beyond Critical Shield & A-Plus Beyond Early Critical ShieldDocumento21 páginasA-Plus Beyond Critical Shield & A-Plus Beyond Early Critical ShieldGenevieve KohAinda não há avaliações

- "Residential Childcare Facilities: Better Services For Namibia's Vulnerable Children" - Pact End-Of-Project ReportDocumento7 páginas"Residential Childcare Facilities: Better Services For Namibia's Vulnerable Children" - Pact End-Of-Project ReportNathan Wilkinson100% (1)

- PDI Quality Manual Rev 4 - 1.0 Table of ContentsDocumento1 páginaPDI Quality Manual Rev 4 - 1.0 Table of ContentslouieAinda não há avaliações

- MBBS Final Part-I (Winter Session) Time Table (Jan 2023)Documento1 páginaMBBS Final Part-I (Winter Session) Time Table (Jan 2023)crystal mindAinda não há avaliações

- Is411 8Documento1 páginaIs411 8amoghimiAinda não há avaliações

- Properties of X-Rays and Gamma RaysDocumento13 páginasProperties of X-Rays and Gamma RaysjishnusajiAinda não há avaliações

- Forensic Science Project Group B5518Documento5 páginasForensic Science Project Group B5518Anchit JassalAinda não há avaliações

- Apraxia of Speech and Grammatical Language Impairment in Children With Autism Procedural Deficit HypothesisDocumento6 páginasApraxia of Speech and Grammatical Language Impairment in Children With Autism Procedural Deficit HypothesisEditor IJTSRDAinda não há avaliações

- Police Constable - GK MCQsDocumento56 páginasPolice Constable - GK MCQsSk Abdur RahmanAinda não há avaliações

- 4th QUARTER EXAMINATION IN TLE 8Documento3 páginas4th QUARTER EXAMINATION IN TLE 8judy ann sottoAinda não há avaliações

- Mini-Pitch Session Exceptionalities and InclusionDocumento18 páginasMini-Pitch Session Exceptionalities and Inclusionapi-486583325Ainda não há avaliações

- HVDC Vs HVAC TransmissionDocumento2 páginasHVDC Vs HVAC TransmissionBilal SahiAinda não há avaliações

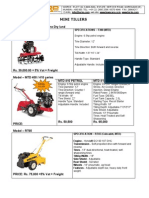

- Optimize soil preparation with a versatile mini tillerDocumento2 páginasOptimize soil preparation with a versatile mini tillerRickson Viahul Rayan C100% (1)

- Comparison Between China and Sri-Lanka GDPDocumento6 páginasComparison Between China and Sri-Lanka GDPcracking khalifAinda não há avaliações

- Betriebsanleitung Operating Instructions GLOBALlift R ATE V01R00 EN 2Documento14 páginasBetriebsanleitung Operating Instructions GLOBALlift R ATE V01R00 EN 2Alexandru RizescuAinda não há avaliações

- Airtel's Africa Growth: Surviving CompetitionDocumento9 páginasAirtel's Africa Growth: Surviving CompetitionSagar RiazAinda não há avaliações

- Annotated Bibliography For Elder AbuseDocumento6 páginasAnnotated Bibliography For Elder Abuseapi-302577490Ainda não há avaliações

- 2 - Electrical Energy Audit PDFDocumento10 páginas2 - Electrical Energy Audit PDFPrachi BhaveAinda não há avaliações

- Magnum 3416 SC: Product InformationDocumento2 páginasMagnum 3416 SC: Product InformationDridi BadredineAinda não há avaliações

- Safety Toolbox Project ProposalDocumento33 páginasSafety Toolbox Project ProposalShaffizi Boboy100% (1)

- Study To Assess The Effectiveness of Planned Teaching Programme Regarding Knowledge of Traffic Rules Among Higher Secondary Students 15 18 Years in Selected Schools of DehradunDocumento14 páginasStudy To Assess The Effectiveness of Planned Teaching Programme Regarding Knowledge of Traffic Rules Among Higher Secondary Students 15 18 Years in Selected Schools of DehradunEditor IJTSRDAinda não há avaliações

- Rockaway Times 11-21-19Documento44 páginasRockaway Times 11-21-19Peter MahonAinda não há avaliações

- Palm Avenue ApartmentsDocumento6 páginasPalm Avenue Apartmentsassistant_sccAinda não há avaliações

- Catalogo Presentacion Johnial UltimoDocumento10 páginasCatalogo Presentacion Johnial UltimoEmerson BermudezAinda não há avaliações

- Silver Chloride Dissolution in ARDocumento5 páginasSilver Chloride Dissolution in ARAFLAC ............Ainda não há avaliações