Escolar Documentos

Profissional Documentos

Cultura Documentos

Kuliah 3 - Islamic Bank

Enviado por

Musbri MohamedDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Kuliah 3 - Islamic Bank

Enviado por

Musbri MohamedDireitos autorais:

Formatos disponíveis

Kuliah 3 SHARIAH & LEGAL ISSUES IN ISLAMIC CONSUMER BANKING (SALE-BASED FINANCING)

Universiti Kebangsaan Malaysia Faculty of Law Pursuing PHD Program in Law P58462

Musbri Mohamed DIL; ADIL ( ITM ) MBL ( UKM ) 1

The elementary concepts of modern Islamic banking date back to the mid 1940s. Models for Islamic banking appeared in the mid-1950s, but comprehensive and detailed concepts for interest-free banking only appeared in the late 1960s. The political environment during that time almost all Muslim countries was hardly favorable for a change in the entire system of banking and finance. In fact, the first experiment in Islamic banking was set up undercover in Mit Ghamr, Egypt in 1963. The model for the experiment was the German Savings bank modified to comply with Islamic principles, i.e. it was barred from charging and paying interest. Nevertheless, the charter of the Bank did not refer to Shariah.

The second Islamic Conference of Foreign Ministers in 1973 adopted a document on the "Institution of an Islamic Bank, Economics and Islamic Doctrines". In 1974, the Islamic Development Bank (IDB) was established as a result of this conference. The member states of the OIC became members of the IDB. The IDB helped to establish a number of Islamic banks in various countries.

Beginning in 1974, several Islamic banks have been established which include: Dubai Islamic Bank in 1975, Faisal Islamic Bank of Sudan in 1977, Faisal Islamic Egyptian Bank and Islamic Bank of Jordan in 1978, Islamic Bank of Bahrain in 1979, the International Islamic Bank of Investment and Development, Luxembourg in 1980 and BIMB in 1983. Today, there are more than a hundred financial institutions which claim to be operating partially or fully on an interestfree basis in 34 countries.

Islamic banking has been adopted at the national level in Pakistan, Sudan, and Iran, and they have decided to Islamize the whole banking system. Iran enacted a new banking law in August 1983 requiring complete abolition of interest by March 1985 (M.N. Siddiqi 1988: 48). Sudan opted for a total change when a presidential decree was issued in 1984, directing all banks to stop dealing with interest. The Central Bank of Sudan, on 10 December 1984, directed all commercial banks to stop dealing with interest with immediate effect, and to negotiate conversion of existing deposit into investment deposits or any other kind of deposits in accordance with shariah. All outstanding interest bearing advances were either to be settled through repayment or they had to be converted into one of the Islamic modes of financing. Foreign transactions were to continue on the basis of interest till an alternative way as available.

Sale Based Financing BBA Murabahah Bay al-Inah Tawarruq Bay Salam Bay Istisna Sale and Lease Back

Leased Based Financing AITAB Operating Lease Ijarah Mausufah fi Zimmah Sale and Lease Back Deposit Services Wadiah Yad Damanah Murabahah Mudarabah NIDC Tawarruq

Credit/ Charge Card Bay al-Inah Tawarruq Ijarah Kafalah with Fee Cash Line Facility Bay al-Inah Tawwaruq

GENERAL PRINCIPLES IN BBA AND MURABAHAH Both contract are contract of sale and purchase (bay) Sale and purchase is a contract of exchange (aqd al-muawadah) The exchange is between the two counter values, i.e., goods and price Sale and purchase presupposes the transfer of ownership between the parties (regardless of any formal registration of transfer).

ESSENTIAL CONDITIONS FOR SALE CONTRACT (BBA & MURABAH) CONTRACTUAL EXPRESSION (Sighah) Offer Acceptance Clarity Consensus at idem CONTRACTING PARTIES(Aqidan) Offeror Offeree Of full contractual capacity (ahliyyah al-ada al-kamilah) Legal authority to contract As owner & in possession of asset Legal representative (agent, guardian etc)

10

SUBJECT MATTER (Mahall al-aqd) Goods/Asset Price/ consideration Something of value Ascertainable Legal

11

SPECIAL FEATURES FOR BBA & MURABAHAH BBA Final price should be contractually agreed and known to both parties Payments of price is deferred Time and mode of payment should be ascertained No need to state the cost price and amount of mark-up MURABAHAH It is a sale and purchase contract based on trust (bay alamanah) Full disclosure and transparency between the parties Cost and amount of mark-up are disclosed Payment of price can be spot or deferred, depending on the agreement between the parties (if deferred also a BBA)

12

OBSERVATIONS The Islamic banking practice in Malaysia tends to confine BBA to long term asset financing and Murabahah to short & medium term financing. This has nothing to do with any Islamic law requirement BBA in Islamic law is simply a method of repayment, i.e., deferred payment and thus, it applies to all kinds of sales where the payment is deferred whether on the basis of instalments or lump sum payment at the end of the tenor. BBA and Murabahah in practice; does the contract reflect BBA and Murabahah or some other contract? The transactions are more reflective of Bay al-Inah, rather than BBA or Murabahah Technically, bay al-Inah is also a form of sale and purchase contract But, it is different from normal BBA and Murabahah because it involves two subsequent sale and purchase contract, between two parties

13

SOME CONTROVERSIES ON BAY AL-INAH Transactions between two parties only, on the same asset. Gives rise to the assumption that the apparent sale and purchase transactions are fictitious. The assumption is : the parties are not interested in the transfer of ownership of the property, but in the transfer of cash between them to be paid at a later time, with a mark-up

14

OTHER OBSERVATIONS It is important to note that Murabahah, as a trust sale (amanah), requires more strict conditions compared to other normal or deferred payment sale. Therefore, this presentation will first examine issues peculiar to Murabah, and alter, issues which are common to BBA and Murabahah as sale contracts generally.

15

SHARIAH AND LEGAL ISSUES IN MURABAHAH Being an amanah sale, the seller is obliged to disclose the actual cost price or purchase price of the asset that is intended to be sold to the customer on the basis of Murabahah. The failure to disclose, or the disclosure of incorrect cost price will render the contract voidable. Following this principle, there are many other issues to be considered:+ Murabahah cannot be effect on an asset which cost price is not known or cannot be known due to the nature of the asset or the contract leading to the acquisition of that asset. Cost price includes insurance premium, transportation cost, import duty, etc. Mark-up formula could be in term of amount or in terms of percentage and this formula must be disclosed and agreed up-front. Some scholars (Hanafis) have required that the nature of contract in acquiring the asset must also be disclosed to the buyer under a Murabahah sale.

16

COMMON SHARIAH & LEGAL ISSUES FOR BBA/MURABAHAH Both BBA and Murabahah are always sale and purchase transactions. They are never intended to become financing instruments in the strict sense. Therefore, BBA and Murabahah must remain in their original nature and cannot be made analogous to any financial instrument to the extent that principles of sale and purchase embodied in them are put aside. Most of the Shariah and legal issues stem from misunderstanding of this fact. The issues are as follow: Terminology used: Payment vs repayment, sale vs loan, customer vs borrower, financier vs. Lender; What would be the correct term in BBA and Murabahah documentation? Misconceptions: it is just another form of financing, it is a fixed rate term loan, interest is substituted with margin of profit

17

Both BBA and Murabahah should result in transfer of ownership irrespective of whether the registration of the transfer is made or otherwise. Case study : BIMB v. Dato Nik Haji Mahmud Clause on Right to recall; is it lawful to insert clause allowing the bank or financier to recall the facility in the events of default? Clause on Cross default ; is it permissible to insert and practice this right in BBA and Murabahah transaction? Clause on consolidation and set off; this can be based on Islamic principle of al-muqasah. Incorporation of purpose of financing in the agreement Disclosure of the rate or formula of margin of profit Rebate clause i.e. Whether the bank/financier is allowed to incorporate this clause in the agreement Case study : Affin bank v. Zulkifli (2005) Note : rebate or ibra is a discretion of the bank/financier

18

Compensation clause i.e whether the bank/financier is allowed to insert the clause that is : in the case of default and delayed payment, the bank/financier is entitled to recover its actual loss from the customer? Right of the bank/financier to sell the receivable to a third party for liquidity purposes Right to repossess the asset in the case of non payment (e.g. BBA foe vehicle financing) Definition of an asset; tangible asset, intangible asst, right, etc. Definition of ownership to an asset; beneficial interest vs legal interest

19

Third party financing: (joint ownership single applicant) (single ownership joint applicant) Restructuring or rescheduling the facility Third party collateral Istisna (manufacturing contract) for house under construction? Beneficial ownership for house under construction? Novation agreement for BBA for houses under construction Solution in the case of non-completion of the house?

20

OTHER CONTENTIOUS ISSUES Selling something before taking possession of the asset convert the Murabahah and BBA into a mere financing instrument instead of actual buying and selling e.g. 1 : the judgement of the Shariah Supreme Court in Pakistan Order 83, Rules of High Court e.g. BIMB vs Adnan bin Omar

21

SHARIAH COMPLIANCE GOVERNANCE IN MALAYSIA BANKING STATUTES Specific Islamic Banking Laws requires Syariah compliance & mandate Syariah governance Sect. 2 IBA 1983 Islamic banking business means banking business whose aims and operations do not involve any element which is not approved by Religion of Islam Sect. 3 (5) IBA 1983 The Central Bank shall not recommend the grant of a licence unless.. The aims and operations of the banking business which it is desired to carry on will not involve any element which is not approved by the religion of Islam and That there is in the articles of association of the bank concerned, provision for the establishment of the Shariah Advisory Board, as may be approved by the Central Bank, to advise the bank on the operations of its banking business in order to ensure that they do not involve any element which is not approved by the Religion of Islam

22

Sect. 124 BAFIA 1989 Islamic Financial Business any financial business the aims and operation of which do not involve any element which is not approved by the Religion of Islam . COURTS JURISDICTION IN IF CASES Civil courts have jurisdiction Why? Although the term Islamic law in Para 1, List 11 of Ninth Schedule is wide, its application is limited to persons professing the religion of Islam. Only federal legislations on IBF no state legislations on IBF. Banking & Finance within List 1 (Federal List) of Ninth Schedule

23

MALAYSIAN LEGAL FRAMEWORK FOR IF : CONSTRAINS? Lack of Substantive Law Law & regulation are procedural not substantive . Substantive rules in IF derived from rulings from Shariah Boards/Committees . In Malaysia centralised Shariah Advisory rulings Judicial Issues . Jurisdiction civil courts . Judges & legal counsels are not trained in Shariah . Potential conflict with Shariah principles & philosophies courts decisions may not reflect Shariah principles, or may even contravene those principles . Lack of substantive law aggravate the problem

24

Other Legal issues Application of general laws to IF . General laws are not legislated to facilitate/ support IF . In the case of contradiction between general laws & Shariah no clear cut provision on which one will prevail

25

THE STAND OF THE COURT ON IF LITIGATION... Bank Kerjasama Rakyat Malaysia Berhad v Emcee Corporation Sdn Bhd, per Dato Abdul Hamid Mohamad: - as was mentioned at the beginning of this judgement the facility is an Islamic banking facility. But that does not mean that the law applicable in this application is different from the law that is applicable if the facility were given under conventional banking...The procedure is provided by the Code and the Rules of High Court 1980. The court adjudicating it is the High Court. So, it is the same law that is applicable, the same order that would be, if made, and the same principles that should be applied in deciding the application.

26

TRENDS IN CASE LAW Case law on Islamic banking in Malaysia had been mainly on BBA; and a few on Istisna BBA had been used right from the start of Islamic Banking in Malaysia e.g. BIMBs house financing since 1983 BBA is still the main contract for asset financing in Malaysia though some Islamic banks have started to use some other contract Istisna had been used by some Islamic banks to finance asset/s under construction A few later cases tend to question some basic features of BBA arrangement e.g. rebate vs unearned profit, validity of BBA?

27

ARAB-MALAYSIAN FINANCE BHD V TMAN IHSAN JAYA SDN BHD [2008] ARAB-MALAYSIAN FINANCE BHD V TMAN IHSAN JAYA SDN BHD [2008] The consolidated judgment of this case & 11 others in July 2008 had caused shock-waves in the industry All the 12 cases involve BBA contracts Main issue validity of BBA contract? Judge recognized a few variation of BBA, and gave the following verdicts according for each variation: There is no novation agreement BBA is not valid, just a loan transaction & bank can only recover principal sum profit portion is interest (riba) There is novation agreement BBA is valid, and: Can recover full outstanding sale price (if financing period has expired) If period has not expired, bank can recover a lesser sum i.e. outstanding sale price minus unearned profit

28

ISSUE : VALIDITY OF BBA? Validity of Islamic banking contract under s. 2 of IBA 1983 must it be approved by all recognised school of law? If a facility is to be offered as Islamic to Muslims generally, regardless of their madhab, then the test is no element not approved by the Religion of Islam under the interpretation of any of the recognised madhab. That it is acceptable in the Religion of Islam when it is not accepted by the other madhabs (per Wahab Patail at para 5) This conclusion is fallacious difference of views in matters subject to ijtihad is allowed Bay al-Inah is allowed by SAC of BNM and SC, though other Shariah boards may not approve the practice

29

ISSUE: FORM V SUBTANCE LEGAL TRICK (HILAH) Bearing this in mind it is not sufficient that the distinction between a sale and loan is maintained in form, but it must also be maintained in substance. It is the reality and not the form and labels that matter. (per Wahab Patail at para. 29) Is it wrong to use legal trick (hiyal) Two school of laws: ShafiI & Hanafi (e.g: al-Sarakshi) generally allow legal tricks as long as they are in line with Shariah principles & do not deny the rights of people or involve in wrongfulness Maliki & Hambali (e.g: Ibn Qayyim) generally disallow legal tricks. In fact, strongly against the practice consider them as fraud against God & Shariah.

30

BBA FINANCING WITH NOVATION ISSUES ? Novation ? Status under Sharah ? Amount recoverable full outstanding amount of selling price or lesser amount ? Issue of rebate on the unearned profit? Precedents : BIMB v Adnan Omar Affin Bank v Zulkifli

31

MURABAHA COMMODITY WITH TAWARRUQ FEATURES Some IFIs use murabahah contract with tawarruq arrangement to allow for cash financing without resorting to bay al-Inah Examples are some banks in Saudi Arabia, Kuwait and Bahrain However, this practice has also been criticized as being a mere hilah (legal trick) by some contemporary scholars e.g. The Majlis Majma al-Fiqh al-Islami in its 17th meeting Though in an earlier meeting, Majlis Majma al-Fiqh had approved tawarruq in principle (15th meeting) they consider tawarruq masrafi as not approved (17th meeting)

32

SPECIAL FEATURES FOR BAY AL-SALAM This contract is an exception to the general rule that the subject matter of the contract must exist at the time of the contract The contract is allowed only when there is reasonable certainty that the goods will be ready and available for delivery at the contractually agreed time (e.g clearing house) Payment of the price has to be made in advance at the time of the contract The amount and quantity of the goods ordered must be precisely determined at the time of the contract The time, place and mode of delivery must also be prescribed at the time of the contract All of these additional rules are to minimise the uncertainty involved in a salam contract

33

Salam contract is suitable for future/forward contracts in commodities, provided the parties are willing to pay the price upfront If both price and goods are deferred, this is not salam In Malaysia, SC allows the practice on the basis of bay al-istijrar (allowed by Ibn Abidin in Hanafi School) and /or bay bima yanqati bihi al-sir (allowed by Hanafi school of law) Note : both practice involve buying and selling now or continuously, without fixing the price yet, and the price is payable at the end of the period agreed according to market price then

34

SPECIAL FEATURES FOR BAY AL-ISTISNA This contract is also an exception to the general rule pertaining to the existence of the subject matter at the time of contract This contract involves manufacturable goods only (commodities that cannot be manufactured e.g fruits, grains etc are not suitable) Payment of the price is flexible need not be advanced at the time of contract only Proper description of the goods ordered should be made Time, place and mode of delivery of both the goods and price should be specified at the time of contract This contract is suitable to finance the purchase of property which is still under construction

35

ISTISNA IN PRACTICE: SOME LEGAL AND SHARIAH ISSUES Originally the istisna contract is not binding on neither party until the goods are made and accepted by the buyer (majority view in the Hanafi school) However, in contemporary Islamic banking, it is accepted that istisna is binding on both parties from the start (minority view in Hanafi school) As with other types of sale, parties in Istisna are free to fix the price as they wish, using e.g, cost-plus or mark up approach Payments for the price is flexible and can be delayed until delivery, or even beyond

36

However, to make matters easier, a schedule of progress payment may be agreed between the parties In contemporary practice, Islamic banks may employ istisna to finance manufacture and construction contract project financing Classical Islamic law also allows the manufacturing party in an istisna to sub-contract the manufacturing to a third party through a second istisna This arrangement is known as back-to-back istisna or parallel istisna This structure has been used by contemporary Islamic banks to finance the purchase of major manufactured goods such as ships and airplanes

37

The financing aspects of Al-Bay Bithaman Ajil (BBA) is very complex as it must represent the buying and selling activities (albay). As such, all the Shariah requirements to constitute a valid sale contract must be adhered to. In addition to that, it must also satisfy the civil aspects of a sale contract because Islamic banking matters fall under the jurisdiction of the civil court by virtue of the Federal Constitution and Civil Law Act 1956. To sum up, the practitioners of Islamic financing (bankers and lawyers) must be conversant with both legal systems as well as rules and procedure so as to avoid possibility of being challenged in the court of law of non-conformity or contradiction with Shariah and existing civil law and rules of procedure.

38

Legislations for Islamic Banking Business Although the Islamic Banking Act specifically governs the Islamic banking business, the provisions of the same may not be sufficiently exhaustive to cover all aspects. Thus, there are several legislations that we refer to in the conduct of Islamic banking business. These are: * * * * * * * * * * * * The Islamic Banking Act 1983 The Banking and Financial Institutions Act 1989 The Takaful Act 1984 The Companies Act 1965 The Securities Commission Act The Stamp Duty Act 1949 The National Land Code The Contracts Act 1950 The Real Property Gains Tax Act 1967 The Hire Purchase Act 1967 The Sale of Goods Act 1957 The Development Financial Institutions Act 2002

39

40

41

The key issue is understanding the proper application of the above mentioned legislations in the implementation of Islamic banking business and in resolving issues or disputes. For example, based on the statutory provisions, we have to be able to distinguish whether an Islamic banking product would be liable for ad valorem or minimal stamp duty; or whether certain aspects of a movable asset transacted under an Ijarah facility fall within the purview of the Hire Purchase Act 1967 or the Sale of Goods Act 1957. The main authority that carries out a supervisory and advisory role and at the same time ensures enforcement of rules and regulations under the BAFIA and IBA is Bank Negara Malaysia. Musbri Mohamed December 2011

42

Você também pode gostar

- 2009 Valuation Handbook A UBS GuideDocumento112 páginas2009 Valuation Handbook A UBS Guidealmasy99100% (4)

- Chase Bank StatementDocumento1 páginaChase Bank Statementruby calde0% (1)

- Raising Money – Legally: A Practical Guide to Raising CapitalNo EverandRaising Money – Legally: A Practical Guide to Raising CapitalNota: 4 de 5 estrelas4/5 (1)

- Account Statement For Account:0491000500000038: Branch DetailsDocumento3 páginasAccount Statement For Account:0491000500000038: Branch DetailsNIDHI SINGH100% (1)

- (1 Point) : True FalseDocumento18 páginas(1 Point) : True FalseElla DavisAinda não há avaliações

- Modes of Deployment of Fund by Islamic BanksDocumento30 páginasModes of Deployment of Fund by Islamic Banksvivekananda Roy100% (1)

- Ijarah Car FinancingDocumento20 páginasIjarah Car FinancingAminahAbdullahAinda não há avaliações

- The Role of Capital Market Intermediaries in The Dot-Com Crash of 2000Documento5 páginasThe Role of Capital Market Intermediaries in The Dot-Com Crash of 2000Prateek Jain100% (2)

- J Singh & Associates Chartered Accountants: Profile For Concurrent AuditDocumento28 páginasJ Singh & Associates Chartered Accountants: Profile For Concurrent AudittusharAinda não há avaliações

- Derivatives in Islamic FinanceDocumento35 páginasDerivatives in Islamic FinanceSana KhanAinda não há avaliações

- Issues in Bay InahDocumento10 páginasIssues in Bay InahShukri Omar AliAinda não há avaliações

- GlossaryDocumento29 páginasGlossaryMrudula GummuluriAinda não há avaliações

- Islamic Law of ContractDocumento24 páginasIslamic Law of ContractAbid RazaAinda não há avaliações

- Islamic Banking and Conventional BankingDocumento4 páginasIslamic Banking and Conventional BankingSajjad AliAinda não há avaliações

- Islamic Banking and Its Modes of FinancingDocumento5 páginasIslamic Banking and Its Modes of FinancingHasnain BhuttoAinda não há avaliações

- IB-Topic 05-Islamic Financial Modes and Financial Instruments-2Documento29 páginasIB-Topic 05-Islamic Financial Modes and Financial Instruments-2Mayra NiharAinda não há avaliações

- Arab-Malaysian Finance BHD V Taman Ihsan Jaya SDN BHD & Ors (Koperasi Seri Kota Bukit Cheraka BHD, Third Party)Documento30 páginasArab-Malaysian Finance BHD V Taman Ihsan Jaya SDN BHD & Ors (Koperasi Seri Kota Bukit Cheraka BHD, Third Party)Hadhirah AzharAinda não há avaliações

- Assignment On Islamic BankingDocumento8 páginasAssignment On Islamic BankingRimsha LatifAinda não há avaliações

- Glossary of Islamic Finance TermsDocumento4 páginasGlossary of Islamic Finance TermsElmelki AnasAinda não há avaliações

- DR Obi Paper Derivatives in Islamic Finance - An Overview - Bank Negara-24th June 05Documento35 páginasDR Obi Paper Derivatives in Islamic Finance - An Overview - Bank Negara-24th June 05SihamAinda não há avaliações

- AnOverviewOfShariahContractPractice PDFDocumento27 páginasAnOverviewOfShariahContractPractice PDFKuo Hsiung ChongAinda não há avaliações

- Islamic Banking System - EditedDocumento5 páginasIslamic Banking System - EditedLubaba RazaAinda não há avaliações

- Basic Concepts of Islamic FinanceDocumento5 páginasBasic Concepts of Islamic FinanceSaifullahMakenAinda não há avaliações

- Islamic Hire-Purchase - IjarahDocumento28 páginasIslamic Hire-Purchase - IjarahAmine ElghaziAinda não há avaliações

- Vol 4-2..anas Zarqa..Istisna Financing... DPDocumento8 páginasVol 4-2..anas Zarqa..Istisna Financing... DPAdielah HassimAinda não há avaliações

- Mudharabah 2Documento4 páginasMudharabah 2Hairizal HarunAinda não há avaliações

- The Islamic Bonds Market Possibilities and ChallengesDocumento18 páginasThe Islamic Bonds Market Possibilities and Challengeshoch94Ainda não há avaliações

- Islamic Civil Law Q AttemptDocumento4 páginasIslamic Civil Law Q AttemptTF Plays VAinda não há avaliações

- History of Islamic Banking in PakistanDocumento26 páginasHistory of Islamic Banking in Pakistanaamir mumtaz81% (16)

- Islamic Bank Concepts GlossaryDocumento27 páginasIslamic Bank Concepts GlossarybnmjgcAinda não há avaliações

- Principle of Islamic FinanceDocumento6 páginasPrinciple of Islamic FinanceumbreenAinda não há avaliações

- Principles of MuamalatDocumento46 páginasPrinciples of Muamalatal-hakim100% (1)

- Islamic Private Debt SecuritiesDocumento6 páginasIslamic Private Debt SecuritiesMuhammad Shahrul NazwinAinda não há avaliações

- Wix Shariah and Legal Issues On Islamic Financial Products1Documento30 páginasWix Shariah and Legal Issues On Islamic Financial Products1Nur IzzatiAinda não há avaliações

- What Is Islamic BankingDocumento5 páginasWhat Is Islamic BankingUmar yuguda MuhammadAinda não há avaliações

- Philosophy of Islamic Banking and FinanceDocumento9 páginasPhilosophy of Islamic Banking and FinanceNabeela ShahAinda não há avaliações

- Islamic Banking Myths and FactsDocumento12 páginasIslamic Banking Myths and Factsthexplorer008Ainda não há avaliações

- IBF BY DaniDocumento14 páginasIBF BY DaniDaniyal AwanAinda não há avaliações

- Quiz 4 SolvedDocumento10 páginasQuiz 4 SolvedAsad AliAinda não há avaliações

- Rameen Khan 5B.Documento18 páginasRameen Khan 5B.Umair FarooquiAinda não há avaliações

- Modes of Islamic Finance AssignmentDocumento4 páginasModes of Islamic Finance AssignmentSohaib AsifAinda não há avaliações

- Islamic Finance CombinedDocumento28 páginasIslamic Finance CombinedCh Aamir SohailAinda não há avaliações

- Islamic Banking ProductDocumento3 páginasIslamic Banking Productput3_waniegurlAinda não há avaliações

- Assignment IIDocumento47 páginasAssignment IIapi-19984025Ainda não há avaliações

- Products and Services Offered by Islamic Banks.Documento6 páginasProducts and Services Offered by Islamic Banks.Jaffer J. KesowaniAinda não há avaliações

- Murabahah in Islamic BankingDocumento8 páginasMurabahah in Islamic BankingKhairulIzwan50% (2)

- Final Test Deposit - MurabahahDocumento13 páginasFinal Test Deposit - MurabahahNor SyahidahAinda não há avaliações

- Concept of Various Islamic Modes of Financing: 2.1.1 Mudarabah As A Mode of FinanceDocumento3 páginasConcept of Various Islamic Modes of Financing: 2.1.1 Mudarabah As A Mode of FinancehudaAinda não há avaliações

- Fiqh-ul-Mauamlat: Islamic Banking and FinanceDocumento4 páginasFiqh-ul-Mauamlat: Islamic Banking and Financehaiqa malikAinda não há avaliações

- Tutorial 5 & 6 - LatestDocumento8 páginasTutorial 5 & 6 - LatestTham AnnAinda não há avaliações

- Islamic Banking AssignmentDocumento7 páginasIslamic Banking AssignmentFarjad AliAinda não há avaliações

- Islamic FinanceDocumento26 páginasIslamic FinanceAGBA NJI THOMASAinda não há avaliações

- Skrip Isb547Documento3 páginasSkrip Isb547HANA' HASSAN HALMIAinda não há avaliações

- 3239-Article Text-5093-1-10-20200115Documento5 páginas3239-Article Text-5093-1-10-20200115shafiqah hasanAinda não há avaliações

- Shirkah Partnership by Shoayb JoosubDocumento20 páginasShirkah Partnership by Shoayb JoosubRidhwan-ulHaqueAinda não há avaliações

- 03 MudharabahDocumento6 páginas03 MudharabahJinebh HanifahAinda não há avaliações

- Haroon Slide FileDocumento5 páginasHaroon Slide FileHaroon AfzalAinda não há avaliações

- An Introduction To Islamic FinanceDocumento14 páginasAn Introduction To Islamic FinanceThargistAinda não há avaliações

- TO Islamic Banking: Naina Jagesha Roll No - 22 Prof-In-Charge-Rashmi MamDocumento12 páginasTO Islamic Banking: Naina Jagesha Roll No - 22 Prof-In-Charge-Rashmi Mamnaina_jageshaAinda não há avaliações

- INDIVIDUAL QUIZ BFM 4273 Islamic Trade Finance PDFDocumento3 páginasINDIVIDUAL QUIZ BFM 4273 Islamic Trade Finance PDFNORSARINA SIRI BIBFAinda não há avaliações

- Khiyar Aib Dalam Ba'i Al-MurabahahDocumento9 páginasKhiyar Aib Dalam Ba'i Al-MurabahahmasterridAinda não há avaliações

- The Uses and Misuses of Commodity Murabaha Islamic Economic PerspectiveDocumento10 páginasThe Uses and Misuses of Commodity Murabaha Islamic Economic PerspectiveTayyab ShereAinda não há avaliações

- Islamic Business ContractsDocumento15 páginasIslamic Business Contracts_*_+~~>Ainda não há avaliações

- Introduction To International Trade Law Note 7 of 13 NotesDocumento16 páginasIntroduction To International Trade Law Note 7 of 13 NotesMusbri MohamedAinda não há avaliações

- According To Article 3 of The Federal ConstitutionDocumento33 páginasAccording To Article 3 of The Federal ConstitutionMusbri MohamedAinda não há avaliações

- Introduction To Company Law Note 6 of 7 Notes: Merger & TakeoverDocumento22 páginasIntroduction To Company Law Note 6 of 7 Notes: Merger & TakeoverMusbri MohamedAinda não há avaliações

- Introduction To International Trade Law Note 7 of 13 NotesDocumento16 páginasIntroduction To International Trade Law Note 7 of 13 NotesMusbri MohamedAinda não há avaliações

- Pembangunan Ummah Islam Global: Universiti Kebangsaan Malaysia Fakulti Undang-UndangDocumento21 páginasPembangunan Ummah Islam Global: Universiti Kebangsaan Malaysia Fakulti Undang-UndangMusbri MohamedAinda não há avaliações

- Itl 5Documento21 páginasItl 5Musbri MohamedAinda não há avaliações

- Company Law 5Documento27 páginasCompany Law 5Musbri MohamedAinda não há avaliações

- Separation of Powers: Universiti Kebangsaan Malaysia Faculty of LawDocumento32 páginasSeparation of Powers: Universiti Kebangsaan Malaysia Faculty of LawMusbri MohamedAinda não há avaliações

- Build The World EconomyDocumento35 páginasBuild The World EconomyMusbri MohamedAinda não há avaliações

- Asia and The World EconomyDocumento32 páginasAsia and The World EconomyMusbri MohamedAinda não há avaliações

- Only Man and A WomanDocumento21 páginasOnly Man and A WomanMusbri MohamedAinda não há avaliações

- Company Law 4Documento21 páginasCompany Law 4Musbri MohamedAinda não há avaliações

- Introduction To Company Law Note 3 of 7 Notes: Directors Duties and LiabilitiesDocumento30 páginasIntroduction To Company Law Note 3 of 7 Notes: Directors Duties and LiabilitiesMusbri MohamedAinda não há avaliações

- Trademark: Law Made Simple Intellectual Property Law Note 4 0f 7 NotesDocumento30 páginasTrademark: Law Made Simple Intellectual Property Law Note 4 0f 7 NotesMusbri Mohamed100% (1)

- Introduction To Company Law Note 1 of 7 NotesDocumento30 páginasIntroduction To Company Law Note 1 of 7 NotesMusbri Mohamed100% (1)

- Introduction To International Trade Law Note 3 of 13 Notes: Dispute SettlementDocumento40 páginasIntroduction To International Trade Law Note 3 of 13 Notes: Dispute SettlementMusbri MohamedAinda não há avaliações

- Islam and Environment: Universiti Kebangsaan Malaysia Faculty of LawDocumento30 páginasIslam and Environment: Universiti Kebangsaan Malaysia Faculty of LawMusbri MohamedAinda não há avaliações

- Investing in Chapter 11 Stocks: Trading, Value, and PerformanceDocumento28 páginasInvesting in Chapter 11 Stocks: Trading, Value, and PerformancexiyaxoAinda não há avaliações

- Money and Banking ObjectiveDocumento5 páginasMoney and Banking Objectivebhivanshu mukhijaAinda não há avaliações

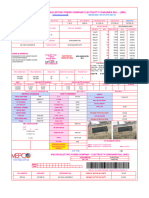

- MEPCO ONLINE BILL BankDocumento1 páginaMEPCO ONLINE BILL Bankahmadjutt19823Ainda não há avaliações

- Methods of Price Level AccountingDocumento17 páginasMethods of Price Level AccountingKuladeepa KrAinda não há avaliações

- Mutual Fund Report Jun-19Documento45 páginasMutual Fund Report Jun-19muddasir1980Ainda não há avaliações

- Amal Mobaraki - 441212274 - Case StudyDocumento18 páginasAmal Mobaraki - 441212274 - Case StudyAmal MobarakiAinda não há avaliações

- Fabozzi Ch15 BMAS 7thedDocumento42 páginasFabozzi Ch15 BMAS 7thedAbby PalomoAinda não há avaliações

- Chapter 29 PDFDocumento11 páginasChapter 29 PDFSangeetha Menon100% (1)

- Jadual Peperiksaan Akhir Semester I Sesi 2023/2024 Universiti Sultan Azlan Shah (DRAF)Documento53 páginasJadual Peperiksaan Akhir Semester I Sesi 2023/2024 Universiti Sultan Azlan Shah (DRAF)WajdiAinda não há avaliações

- Analysis of Section 139 A IT Act 1961Documento13 páginasAnalysis of Section 139 A IT Act 1961padam jainAinda não há avaliações

- Chapter 15 HW SolutionDocumento5 páginasChapter 15 HW SolutionZarifah FasihahAinda não há avaliações

- Financial Modelling Complete Internal Test 4Documento6 páginasFinancial Modelling Complete Internal Test 4vaibhav100% (1)

- Credit Risk ManagementDocumento17 páginasCredit Risk Managementarefayne wodajoAinda não há avaliações

- Suggested December 2022 CAP III Group IDocumento67 páginasSuggested December 2022 CAP III Group Isubash pandeyAinda não há avaliações

- Vertical Balance Sheet Particulars RsDocumento2 páginasVertical Balance Sheet Particulars Rsamit2201Ainda não há avaliações

- Bishal ThesisDocumento64 páginasBishal ThesisMiLan KhAdka100% (1)

- Merchant Request Letter Direct Debit Mandate FormDocumento1 páginaMerchant Request Letter Direct Debit Mandate FormStena NadishaniAinda não há avaliações

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocumento14 páginasThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureShaikh AmjadAinda não há avaliações

- Unit 7 Equity Financing (HH)Documento35 páginasUnit 7 Equity Financing (HH)Nikhila SanapalaAinda não há avaliações

- Last Minute Revision LMR SfmpraveencomDocumento14 páginasLast Minute Revision LMR SfmpraveencomjesurajajosephAinda não há avaliações

- Market Research and Product Development: Citi Global Consumer BankDocumento4 páginasMarket Research and Product Development: Citi Global Consumer BankAnil Kumar ShahAinda não há avaliações

- Receivables Management: "Any Fool Can Lend Money, But It TakesDocumento37 páginasReceivables Management: "Any Fool Can Lend Money, But It Takesjai262418Ainda não há avaliações

- Fundamentals of Financial Management Concise Edition 9Th Edition Brigham Test Bank Full Chapter PDFDocumento66 páginasFundamentals of Financial Management Concise Edition 9Th Edition Brigham Test Bank Full Chapter PDFJustinDuartepaej100% (11)

- Shopping Vocabulary, Expressions and PhrasesDocumento2 páginasShopping Vocabulary, Expressions and PhrasesicghtnAinda não há avaliações