Escolar Documentos

Profissional Documentos

Cultura Documentos

A Study On Factor Influencing The Market Prices

Enviado por

Neeru MahajanDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A Study On Factor Influencing The Market Prices

Enviado por

Neeru MahajanDireitos autorais:

Formatos disponíveis

Financial sector reforms were initiated as part of overall economic reforms in the country and wide ranging reforms

covering industry, trade, taxation, external sector, banking and financial markets have been carried out since mid 1991. A decade of economic and financial sector reforms has strengthened the fundamentals of the Indian economy and transformed the operating environment for banks and financial institutions in the country. The sustained and gradual pace of reforms has helped avoid any crisis and has actually fuelled growth. As pointed out in the RBI Annual Report 2001-02, GDP growth in the 10 years after reforms i.e. 1992-93 to 2001-02 averaged 6.0% against 5.8% recorded during 1980-81 to 1989-90 in the pre-reform period.

Banking Industry has grown faster than real economy, resulting in the ratio of assets of commercial banks to GDP increasing to 92.5 % by the end of March 2007. Price to book value ratio of Indian banks is second to china on world map. On one side Public sector banks are constituting 78% of total asset base in Industry, on the other hand Private sector banks are witnessing exponential growth due to state of art technology, ATMs network, mobile banking etc.

The financial crises highly affected in past years. Before the crisis erupted, the economies worldwide were characterized by booming stock and real estate market, ample liquidity, low interest rates and lesser volatility in financial markets. Presently, the economy of India is growing around 8-9%. The economy has also acknowledged booming stocks with some above average returns in the shares of banks. Thus, this study is intended to find the performance of the bank shares in this booming economy and test its efficiency with respect to the changes in the market conditions.

This study can be used by any investor who wants to invest in banking sector for short run he can excess the data and take decision. And this research also useful for financial institution. They can know the performance of banking sector from sep.2010 to feb.2011. This research also can be beneficial for government body. They can excess the return from the banking shares. This research also helpful for rating companies.

People prefer to invest in the banking sector? To study the performance of the banking share . To study the factor effecting on the price of banking shares.

Research Design:- The research design in this study is Descriptive. Descriptive research studies are those studies, which are concerned with describing the characteristics of a particular individual, or of a group. This study concerned with narration of facts and characteristics concerning individual bank shares as well as Bank Nifty Index as a whole.

Sampling unit:- All the Banks listed under Bank Nifty Index. Data collection technique:- Our research is based upon secondary data.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Ceat TyreDocumento26 páginasCeat TyreNeeru MahajanAinda não há avaliações

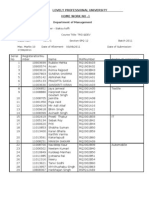

- LOVELY PROFESSIONAL UNIVERSITY HOMEWORK FINANCIAL MANAGEMENTDocumento1 páginaLOVELY PROFESSIONAL UNIVERSITY HOMEWORK FINANCIAL MANAGEMENTNeeru MahajanAinda não há avaliações

- Heritage and AgglomerationDocumento20 páginasHeritage and AgglomerationNeeru MahajanAinda não há avaliações

- Home Work No1Documento2 páginasHome Work No1Neeru MahajanAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Fundamental Equity Analysis - SPI Index - Swiss Performance Index Top 100 CompaniesDocumento205 páginasFundamental Equity Analysis - SPI Index - Swiss Performance Index Top 100 CompaniesQ.M.S Advisors LLC100% (1)

- IftaDocumento44 páginasIftapriyakedAinda não há avaliações

- Canadian dollar's forward rate should exhibit a premiumDocumento3 páginasCanadian dollar's forward rate should exhibit a premiumPhước NguyễnAinda não há avaliações

- Review of key capital asset pricing modelsDocumento12 páginasReview of key capital asset pricing modelsdaohoa8x100% (1)

- Marketing 3.0 From Products To Customers To The Human Spirit PDFDocumento3 páginasMarketing 3.0 From Products To Customers To The Human Spirit PDFArif KruytAinda não há avaliações

- Paper - 1 - MARK SCHEME and EXAMINER COMMENTS - SLDocumento44 páginasPaper - 1 - MARK SCHEME and EXAMINER COMMENTS - SLlarry wangAinda não há avaliações

- B.B.a. Sem-6 Structure & Syllabus-1Documento18 páginasB.B.a. Sem-6 Structure & Syllabus-1jalimchora886Ainda não há avaliações

- Update March 08Documento25 páginasUpdate March 08api-27370939100% (2)

- Trends Toward Globalization And Marketing ConceptsDocumento28 páginasTrends Toward Globalization And Marketing ConceptsUyên TốAinda não há avaliações

- Ion of ProspectingDocumento12 páginasIon of ProspectingPooja Subhash SakhareAinda não há avaliações

- L6 IBCSkm2Documento234 páginasL6 IBCSkm2Del Farai Balengu100% (1)

- AL Hisbah Islamic Economic (Nurhilmi 1932010)Documento9 páginasAL Hisbah Islamic Economic (Nurhilmi 1932010)NURHILMI KAMARUL HADZAAinda não há avaliações

- BJT Tugas 2 ADBI4201 Bahasa Inggris Niaga PDFDocumento3 páginasBJT Tugas 2 ADBI4201 Bahasa Inggris Niaga PDFSakazukiAinda não há avaliações

- Mutual Funds Sahi HaiDocumento24 páginasMutual Funds Sahi Haishiva1602Ainda não há avaliações

- Background & Theory of Relationship Marketing: Compiled by DR Rosaline FernandezDocumento26 páginasBackground & Theory of Relationship Marketing: Compiled by DR Rosaline FernandezOmar SanadAinda não há avaliações

- Present Values, The Objectives of The Firm, and Corporate GovernanceDocumento5 páginasPresent Values, The Objectives of The Firm, and Corporate GovernanceRamesh TiwariAinda não há avaliações

- MS3 Midterms 1Documento76 páginasMS3 Midterms 1ForkensteinAinda não há avaliações

- MAIN PPT Stock Exchange of India - pptmATDocumento42 páginasMAIN PPT Stock Exchange of India - pptmATAnkit Jain100% (1)

- Business Environment ProjectDocumento22 páginasBusiness Environment ProjectShreyaAinda não há avaliações

- Report of Amul IndiaDocumento11 páginasReport of Amul IndianehaAinda não há avaliações

- Notes - Market Failure-Ch 13Documento3 páginasNotes - Market Failure-Ch 13Rodney MonroeAinda não há avaliações

- Berman CH 08Documento28 páginasBerman CH 08Harpreet SharmaAinda não há avaliações

- Chapter 5 ATW 108 USM Tutorial SlidesDocumento21 páginasChapter 5 ATW 108 USM Tutorial Slidesraye brahmAinda não há avaliações

- JacintoDocumento7 páginasJacintoMary Grace Arellano SilvaAinda não há avaliações

- Innovation in China's Electronic Information Industry: Management ForumDocumento7 páginasInnovation in China's Electronic Information Industry: Management Forumshozaib91Ainda não há avaliações

- Bond Yields and Yield Calculations ExplainedDocumento17 páginasBond Yields and Yield Calculations ExplainedJESSICA ONGAinda não há avaliações

- Project-Baumol Sales Revenue Maximization ModelDocumento10 páginasProject-Baumol Sales Revenue Maximization ModelSanjana BhabalAinda não há avaliações

- Fibonacci Golden Zone StrategyAAADocumento34 páginasFibonacci Golden Zone StrategyAAAPs Christ Daniel Rocha MoralesAinda não há avaliações

- Apple Case SolutionDocumento5 páginasApple Case SolutionMarium RazaAinda não há avaliações

- Bulgari Hotel London - Creative BriefDocumento18 páginasBulgari Hotel London - Creative Briefje100% (1)