Escolar Documentos

Profissional Documentos

Cultura Documentos

E Banking

Enviado por

Mitesh ShahDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

E Banking

Enviado por

Mitesh ShahDireitos autorais:

Formatos disponíveis

5/4/12

5/4/12

CONTENT

What is E-banking? of E-banking & E-banking of the E-Banking and Risk of E-banking

Development RBI

Advantages

Disadvantages Precaution

of risk and security

Persecutions

5/4/12

What is E-banking?

Definition: The provision of banking service through electronic channels and the customer can access the data without time and geographical limitation.

5/4/12

Development of E-banking

1980s : - Rapid development of the Internet - TCP/IP system (communication system) - E-commerce

5/4/12

Development of E-banking

May 1995 : Wells Fargo - the first bank in the world to offer customer access to their accounts over the internet .

Allows

customer to see their accounts online

5/4/12

Development of E-banking

ICICI

was the first bank to initiate the Internet banking revolution in India as early as 1997 under the brand name 'Infinity'. Bank kicked off online banking way back in 1996 . But even for the Internet as a whole, 1996 to 1998 marked the adoption phase, while usage increased only in 1999-due to lower ISP online charges, increased PC penetration and a tech-friendly atmosphere.

ICICI

5/4/12

RBI & E-Banking

The

Reserve Bank of India constituted a working group on Internet Banking. The group divided the internet banking products in India into 3 types based on the levels of access granted. They are:i) Information Only System: ii) Electronic Information Transfer System: iii) Fully Electronic Transactional System:

5/4/12

Information

Only System: General purpose information like interest rates, branch location, bank products and their features, loan and deposit calculations are provided in the banks website. There exist facilities for downloading various types of application forms. The communication is normally done through e-mail. There is no interaction between the customer and bank's application system. No

5/4/12

Electronic

Information Transfer System: The system provides customer- specific information in the form of account balances, transaction details, and statement of accounts. The information is still largely of the 'read only' format. Identification and authentication of the customer is through password. The information is fetched from the bank's application system either in batch mode or off-line.

5/4/12

Fully

Electronic Transactional System: This system allows bidirectional capabilities. Transactions can be submitted by the customer for online update. This system requires high degree of security and control. In this environment, web server and application systems are linked over secure infrastructure. It comprises technology covering computerization, networking and security, inter-bank

different services provided under e-banking

ONLINE

5/4/12

BILL PAYMENT BOOKING

PERSONAL

HOME

PAGE

SHOPPING TICKET PRE

INVESTMENT SERVICES APPLICATIONS

PAID MOBILE RECHARGE WATCH

ONLINE PERSONAL

MARKET

UPDADATE

5/4/12

SERVICE PROVIDED BY sbi

LIC and other Self-account

insurance premium

payments, funds transfer across India. SBI Mutual funds Investments to PPF account,

Credit

Third party Remit Subscription

transfers in the payments, card dues same branch Deposit your taxes, New account Donations to your religious inspirations opening Donations to Red Cross and such other Demand Draft organisations

5/4/12

SERVICE PROVIDED BY icici

BILL PAYMENT CONVERT TO EMI FUND TRANSFER A/C TO CARD TRANSFER ACCOUNT INFORMATION PREPAID MOBILE RECHARGE SMART MONEY ORDER ACCOUNT TRANSFER SERVICE

REQUEST

5/4/12

Advantages of E-banking

v

Benefits for Banks Benefits for Small to Medium Businesses Benefits for Customers

5/4/12

Benefits for Banks

Larger customer coverage Reducing the costs of operations Promoting their services and products internationally Increasing the customer satisfaction and providing a personalized relationship with customers

5/4/12 Benefits for Small to Medium Businesses

To run its operations more effectively Lower cost than traditional financial management mechanisms

Benefits for Customers

5/4/12

Convenience - 24 hours a day, seven days a week Cost Reducing transfer fees Speed Faster circulation of assets

5/4/12

Benefits for Customers

Communication

-

communicate easily Environmental

Abolishing the uses of paper Others

- Offering one-stop-shop solutions

5/4/12

Disadvantages OF E-banking

A need for customer skill to deal with computers and browsers. E.g. Elderly, Housewives Inconvenient

Site change it will make the customer have some confusion or delay. Security Risk

5/4/12

Security Risk

Increasing

number of fraudulent bank websites

Fake

emails purporting to be sent from banks

Use

of Trojan Horse programs to capture user IDs and passwords

5/4/12

Fraudulent Bank Websites

A suspicious

bank website: www.sbionline.com Original bank website www.onlinesbi.com These website are believed to aim to trick persons into disclosing their sensitive personal information

5/4/12

Fake e-mails

Email

send from Fraudulent bank Verify the personal information Guide customer enter the fraud link Disclosing their ATM card numbers and their passwords

Viruses and Worms-Trojan Horse Program

5/4/12

When

we open some suspicious websites or email Trojan Horse Program will install our computer secretly Hidden in the computer When you access bank websites Capture our

5/4/12

Case From Newspaper

Dont

banks

use the hyperlink to login to the website of

Should

deeply check the postscript of the website

Observe

that is it have the encryption and compare the login account of encryption cert is equal to the bank.

5/4/12

Persecutions

For Bank:

Should

provide specific guidance to their customers

5/4/12

For Customers :

Should

not disclose their customer IDs (e.g., account numbers) or passwords to anyone else. change their passwords promptly log out from the service

Periodically Should Should

regularly check their account balances and statements to identify unusual transactions.

5/4/12

Do not access Corporate Cyber banking through public terminals. To safeguard your computer from any other hacker attack, install anti-virus and anti-spyware software on your computer and update it regularly.

5/4/12

THANK YOU

Você também pode gostar

- Customer Perception Towards Internet Banking PDFDocumento17 páginasCustomer Perception Towards Internet Banking PDFarpita waruleAinda não há avaliações

- Regional Rural Banks of India: Evolution, Performance and ManagementNo EverandRegional Rural Banks of India: Evolution, Performance and ManagementAinda não há avaliações

- Project On E-BankingDocumento58 páginasProject On E-BankingNirmal78% (55)

- E BankingDocumento28 páginasE BankingNeeraj Kumar0% (1)

- HDFC Online BankingDocumento24 páginasHDFC Online BankingAmardeep SinghAinda não há avaliações

- Executive Synopsis Internet BankingDocumento8 páginasExecutive Synopsis Internet BankingSweta PandeyAinda não há avaliações

- Internet Banking PDFDocumento19 páginasInternet Banking PDFJadhav NikitaAinda não há avaliações

- Internet BankingDocumento16 páginasInternet BankingArpita barikAinda não há avaliações

- Banking Services Online and OfflineDocumento39 páginasBanking Services Online and Offlineonkarskulkarni0% (1)

- Online BankingDocumento40 páginasOnline BankingIsmail HossainAinda não há avaliações

- Role of Technology in Banking Sector PDFDocumento2 páginasRole of Technology in Banking Sector PDFAbhishek AnandAinda não há avaliações

- Banking ProjectDocumento21 páginasBanking Projectjigna kelaAinda não há avaliações

- E Banking Consumer BehaviourDocumento116 páginasE Banking Consumer Behaviourrevahykrish93Ainda não há avaliações

- Recent Trends in BankingDocumento8 páginasRecent Trends in BankingNeha bansalAinda não há avaliações

- 4-Kyc NormsDocumento14 páginas4-Kyc Normsraghav4231Ainda não há avaliações

- Internet Banking IntroductionDocumento4 páginasInternet Banking Introductionaihjaaz a71% (7)

- Executive SummaryDocumento51 páginasExecutive SummaryDhawal TankAinda não há avaliações

- Customer Satisfaction With Regard To ATM ServicesDocumento75 páginasCustomer Satisfaction With Regard To ATM Servicesdinesh_v_0076945100% (2)

- E Banking ProjectDocumento59 páginasE Banking ProjectSurbhi Singhal0% (1)

- A Project On Internet BankingDocumento90 páginasA Project On Internet BankingSahana P RaoAinda não há avaliações

- Innovation in Indian Banking SectorDocumento20 páginasInnovation in Indian Banking Sectorshalu71% (24)

- Ranson Dantis Project Black Book TybmsDocumento87 páginasRanson Dantis Project Black Book Tybmsranson dantisAinda não há avaliações

- MJ Customer Satisfaction of BSNL ProductsDocumento97 páginasMJ Customer Satisfaction of BSNL ProductsMOHIT KASHYAP100% (1)

- E-Banking Services With Special Reference To SBI and ICICI: List of ContentDocumento60 páginasE-Banking Services With Special Reference To SBI and ICICI: List of ContentShahebazAinda não há avaliações

- Project On Online Banking Project On Online BankingDocumento24 páginasProject On Online Banking Project On Online BankingAxE GhostAinda não há avaliações

- Growth and Development of Online BankingDocumento45 páginasGrowth and Development of Online BankingSwati SrivastavAinda não há avaliações

- Assainment of Online BankingDocumento21 páginasAssainment of Online BankingMOHAMMAD SAIFUL ISLAM100% (1)

- Seminar Report On BankingDocumento14 páginasSeminar Report On BankingMohan Rao100% (1)

- Consumer Behaviour On Mobile Banking - A Behavioural Reasoning TheoryDocumento12 páginasConsumer Behaviour On Mobile Banking - A Behavioural Reasoning Theory02Mmr 02Ainda não há avaliações

- Black Book ProjectDocumento23 páginasBlack Book ProjectAtharv KoyandeAinda não há avaliações

- e Banking ReportDocumento40 páginase Banking Reportleeshee351Ainda não há avaliações

- E - Banking in IndiaDocumento52 páginasE - Banking in IndiaYatriShah100% (1)

- Case Study: HDFC Banking SystemDocumento10 páginasCase Study: HDFC Banking SystemNagaraju busiAinda não há avaliações

- Technology in BankingDocumento98 páginasTechnology in BankingkarenAinda não há avaliações

- E Banking Report - Punjab National BankDocumento65 páginasE Banking Report - Punjab National BankParveen ChawlaAinda não há avaliações

- Radhika Growth of Banking SectorDocumento36 páginasRadhika Growth of Banking SectorPranav ViraAinda não há avaliações

- Comparative Study of The Public Sector Amp Private Sector BankDocumento73 páginasComparative Study of The Public Sector Amp Private Sector BanksumanAinda não há avaliações

- BCMHNEW - CC 6.1Ch - 612-1111-0025-17Documento27 páginasBCMHNEW - CC 6.1Ch - 612-1111-0025-17ruPAM DeyAinda não há avaliações

- Banking ProjectDocumento56 páginasBanking ProjectViki Sakpal100% (1)

- Retail BankingDocumento73 páginasRetail Bankingnatakhatnirmal33% (3)

- 13 Growth of e Banking Challenges and Opportunities in IndiaDocumento5 páginas13 Growth of e Banking Challenges and Opportunities in IndiaAyesha Asif100% (1)

- Arun Uco Bank Internship ReportDocumento66 páginasArun Uco Bank Internship ReportArun SudhakarAinda não há avaliações

- Anywhere Banking: BY, Rony Mathew YohannanDocumento14 páginasAnywhere Banking: BY, Rony Mathew YohannanNikhil Thomas AbrahamAinda não há avaliações

- Questionnaire On Youth Preferences Towards E BankingDocumento2 páginasQuestionnaire On Youth Preferences Towards E BankingArchit AgarwalAinda não há avaliações

- Digital Banking Project - BubunaDocumento20 páginasDigital Banking Project - BubunaRaghunath AgarwallaAinda não há avaliações

- Research ProposalDocumento3 páginasResearch ProposalAniket GangurdeAinda não há avaliações

- A B C D of E-BankingDocumento75 páginasA B C D of E-Bankinglove tannaAinda não há avaliações

- Electronic Payment SystemDocumento28 páginasElectronic Payment Systemnehapaspuleti4891100% (1)

- Internet Banking Report - FinalDocumento9 páginasInternet Banking Report - FinalImaad Ali Khan100% (2)

- Introduction of E CommerceDocumento2 páginasIntroduction of E CommerceAkanksha KadamAinda não há avaliações

- Retail Banking of Allahabad BankDocumento50 páginasRetail Banking of Allahabad Bankaru161112Ainda não há avaliações

- E-Banking: Presented by:-PARDEEP KUMAR MBA (Hons.) 2.1 ROLL NO. - 3045Documento20 páginasE-Banking: Presented by:-PARDEEP KUMAR MBA (Hons.) 2.1 ROLL NO. - 3045pardeepkayatAinda não há avaliações

- Presented By-Ranjeet Kumar YadavDocumento23 páginasPresented By-Ranjeet Kumar YadavKumar RanjeetAinda não há avaliações

- Presented By-J. ManoharDocumento23 páginasPresented By-J. ManoharJadhav NikitaAinda não há avaliações

- E BankingDocumento41 páginasE BankingRahul RockAinda não há avaliações

- What Is EDocumento6 páginasWhat Is EManjinder SinghAinda não há avaliações

- Presented By-Ranjeet Kumar YadavDocumento23 páginasPresented By-Ranjeet Kumar YadavSaify Shaik100% (1)

- Ft2 Cash To Receivables Key FinalDocumento49 páginasFt2 Cash To Receivables Key Finalkmarissee100% (1)

- Customer Request FormDocumento1 páginaCustomer Request Formrautakshay279Ainda não há avaliações

- Barclays Bank PLC Annual Report 2008Documento159 páginasBarclays Bank PLC Annual Report 2008Kay ChenAinda não há avaliações

- Canada Email Wire 2023Documento15 páginasCanada Email Wire 2023Mac AppleAinda não há avaliações

- The Impact of E Banking On The Use of Banking Services and Customers SatisfactionDocumento4 páginasThe Impact of E Banking On The Use of Banking Services and Customers SatisfactionEditor IJTSRDAinda não há avaliações

- TD Bank StatementDocumento1 páginaTD Bank StatementBaba d100% (2)

- Payment Notification: Capitec B AnkDocumento1 páginaPayment Notification: Capitec B AnkJarrod AnthonyAinda não há avaliações

- KNPS Loan Form 0921 PDFDocumento2 páginasKNPS Loan Form 0921 PDFcollins gatobu100% (3)

- Cash and Cash Equivalents Mock TestDocumento3 páginasCash and Cash Equivalents Mock Testwednesday addamsAinda não há avaliações

- Banking CompanyDocumento5 páginasBanking CompanyPragathi PraAinda não há avaliações

- Top 1000 World Banks 2014Documento8 páginasTop 1000 World Banks 2014Phương Anh TrầnAinda não há avaliações

- He Legal Status of Online Currencies ARE Itcoins The Future: Rhys Bollen 2013 1Documento38 páginasHe Legal Status of Online Currencies ARE Itcoins The Future: Rhys Bollen 2013 1prabin ghimireAinda não há avaliações

- OpTransactionHistory16 06 2018Documento1 páginaOpTransactionHistory16 06 2018Shivam BhadouriaAinda não há avaliações

- Contract Account FormatDocumento3 páginasContract Account FormatVishakh Nag100% (1)

- Core Banking Systems by Vendor Country - Nationality (A To L)Documento4 páginasCore Banking Systems by Vendor Country - Nationality (A To L)dahoune4728Ainda não há avaliações

- Daftar RefundDocumento4 páginasDaftar RefundTarry CesmoyAinda não há avaliações

- Statement of Fees 04 May 2023Documento4 páginasStatement of Fees 04 May 2023wendyclaridg75Ainda não há avaliações

- Pay Later StatementDocumento2 páginasPay Later StatementDharma RajAinda não há avaliações

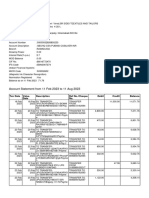

- Account Statement From 11 Feb 2023 To 11 Aug 2023Documento8 páginasAccount Statement From 11 Feb 2023 To 11 Aug 2023vinodbommadeniAinda não há avaliações

- Turning India Into A Cashless Economy The Challenges To OvercomeDocumento19 páginasTurning India Into A Cashless Economy The Challenges To OvercomeAkshay SwamiAinda não há avaliações

- Anggo Toyota Application FormDocumento1 páginaAnggo Toyota Application FormTempwell company Naga BranchAinda não há avaliações

- MSB ATM GuidanceDocumento3 páginasMSB ATM GuidanceJay CaplanAinda não há avaliações

- Manual of Regulations For Banks Vol 1Documento577 páginasManual of Regulations For Banks Vol 1Neneng KunaAinda não há avaliações

- Baking CH 2Documento5 páginasBaking CH 2Endalkachew BefirdeAinda não há avaliações

- Time Value of MoneyDocumento40 páginasTime Value of MoneyAhmedmughalAinda não há avaliações

- Chapter 1 Monetary Policy IntroductionDocumento53 páginasChapter 1 Monetary Policy IntroductionBrian Ferndale Sanchez GarciaAinda não há avaliações

- Case StudyDocumento4 páginasCase Studyrujean romy p guisandoAinda não há avaliações

- How To Price Swaps in Your Head An Interest Rate Swap & Asset Swap PrimerDocumento96 páginasHow To Price Swaps in Your Head An Interest Rate Swap & Asset Swap Primerswinki3Ainda não há avaliações

- Fee DetailsDocumento8 páginasFee DetailsArchana BakshAinda não há avaliações

- Dangila Branch CustomerDocumento2 páginasDangila Branch CustomerdagnayeAinda não há avaliações