Escolar Documentos

Profissional Documentos

Cultura Documentos

Bond and Sock Valuation

Enviado por

Rizky Ayu SeptianaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Bond and Sock Valuation

Enviado por

Rizky Ayu SeptianaDireitos autorais:

Formatos disponíveis

6-1

Bonds and Their Valuation

Key features of bonds Bond valuation Measuring yield Assessing risk

6-2

Key Features of a Bond 1. 2. Par value: Face amount; paid at maturity. Assume $1,000. Coupon interest rate: Stated interest rate. Multiply by par value to get dollars of interest. Generally fixed.

(More)

6-3

3. 4. 5.

Maturity: Years until bond must be repaid. Declines. Issue date: Date when bond was issued. Default risk: Risk that issuer will not make interest or principal payments.

6-4

How does adding a call provision affect a bond? Issuer can refund if rates decline. That helps the issuer but hurts the investor. Therefore, borrowers are willing to pay more, and lenders require more, on callable bonds. Most bonds have a deferred call and a declining call premium.

6-5

Financial Asset Valuation

0 r Value CF1 CF2 1 2 n

...

CFn

PV =

(1+ r )

CF1

(1 + r )

CF2

+ ... +

(1+ r )

CFn

6-6

The discount rate (ri) is the opportunity cost of capital, i.e., the rate that could be earned on alternative investments of equal risk. ri = r* + IP + LP + MRP + DRP for debt securities.

6-7

Whats the value of a 10-year, 10% coupon bond if rd = 10%?

0 10% V=? 100 100 1 2 10

...

100 + 1,000

VB =

$100

(1 + rd )

+ . . . +

$100

(1 + r d )

10

$1,000

(1 + r d )

10

= $90.91 + = $1,000.

. . . + $38.55 + $385.54

6-8

Suppose the bond was issued 20 years ago and now has 10 years to maturity. What would happen to its value over time if the required rate of return remained at 10%, or at 13%, or at 7%?

6-9 1,372 1,211

Bond Value ($)

rd = 7%.

1,000 837 775

30 25

rd = 10%.

rd = 13%.

20 15 10 5 0

Years remaining to Maturity

6 - 10

At maturity, the value of any bond must equal its par value. The value of a premium bond would decrease to $1,000. The value of a discount bond would increase to $1,000. A par bond stays at $1,000 if rd remains constant.

6 - 11

Whats yield to maturity?

YTM is the rate of return earned on a bond held to maturity. Also called promised yield.

6 - 12

Whats the YTM on a 10-year, 9% annual coupon, $1,000 par value bond that sells for $887?

0 rd=? 1 90

...

9 90

10 90 1,000

PV1 . . . PV10 PVM

887

Find rd that works!

6 - 13

Find rd

VB = INT

(1 + r d )

... + 1 + ... +

INT

(1 + r d )

(1 + r d )

90 887 = 1 + (1 + r d )

INPUTS OUTPUT 10 N

90 1,000 10 + 10 (1+ r d) (1 + r d)

-887 PV 90 PMT 1000 FV

I/YR 10.91

6 - 14

If coupon rate < rd, bond sells at a discount. If coupon rate = rd, bond sells at its par value. If coupon rate > rd, bond sells at a premium. If rd rises, price falls. Price = par at maturity.

6 - 15

Find YTM if price were $1,134.20.

INPUTS OUTPUT

10 N

I/YR 7.08

-1134.2 90 PV PMT

1000 FV

Sells at a premium. Because coupon = 9% > rd = 7.08%, bonds value > par.

6 - 16

Definitions Annual coupon pmt Current yield = Current price Change in price Capital gains yield = Beginning price Exp total Exp Exp cap = YTM = + return Curr yld gains yld

6 - 17

Find current yield and capital gains yield for a 9%, 10-year bond when the bond sells for $887 and YTM = 10.91%. $90 Current yield = $887 = 0.1015 = 10.15%.

6 - 18

YTM = Current yield + Capital gains yield. Cap gains yield = YTM - Current yield = 10.91% - 10.15% = 0.76%. Could also find values in Years 1 and 2, get difference, and divide by value in Year 1. Same answer.

6 - 19

Whats interest rate (or price) risk? Does a 1-year or 10-year 10% bond have more risk? Interest rate risk: Rising rd causes bonds price to fall. rd 1-year Change 10-year Change 5% 10% 15% $1,048 1,000 956 4.8% 4.4% $1,386 1,000 749 38.6% 25.1%

6 - 20

Value

1,500

10-year

1,000

1-year

500

0 0% 5% 10% 15%

rd

6 - 21

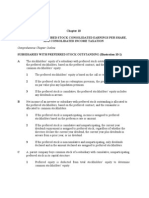

Bond Ratings Provide One Measure of Default Risk

Investment Grade Moodys Aaa S&P

AAA Aa A Baa

Junk Bonds

Ba B Caa C

AA

BBB

BB

CCC D

6 - 22

Stocks and Their Valuation

Features of common stock Determining common stock values

6 - 23

Common Stock: Owners, Directors, and Managers Represents ownership. Ownership implies control. Stockholders elect directors. Directors hire management. Since managers are agents of shareholders, their goal should be: Maximize stock price.

6 - 24

Whats classified stock? How might classified stock be used? Classified stock has special provisions. Could classify existing stock as founders shares, with voting rights but dividend restrictions. New shares might be called Class A shares, with voting restrictions but full dividend rights.

6 - 25

When is a stock sale an initial public offering (IPO)? A firm goes public through an IPO when the stock is first offered to the public. Prior to an IPO, shares are typically owned by the firms managers, key employees, and, in many situations, venture capital providers.

6 - 26

What is a seasoned equity offering (SEO)? A seasoned equity offering occurs when a company with public stock issues additional shares. After an IPO or SEO, the stock trades in the secondary market, such as the NYSE or Nasdaq.

6 - 27

Different Approaches for Valuing Common Stock Dividend growth model Using the multiples of comparable firms Free cash flow method

6 - 28

Stock Value = PV of Dividends

P0 = D1 D2 D3 D + + +. . . + 1 2 3 (1 +rs ) (1 +rs ) (1 +rs ) (1 +rs )

What is a constant growth stock? One whose dividends are expected to grow forever at a constant rate, g.

6 - 29

For a constant growth stock,

D1 = D 0 ( + g) 1 2 D 2 = D 0 ( + g) 1 t D t = D t ( + g) 1

1

If g is constant, then:

= D0 ( 1 + g ) = D1 P0 rs g rs g

6 - 30

D t = D 0 (1 + g)

0.25

Dt PVD t = (1 + r ) t

P0 = PVD t

If g > r, P0 = !

Years (t)

6 - 31

What happens if g > rs?

= D1 requires r > g . P0 s rs g

If rs< g, get negative stock price, which is nonsense. We cant use model unless (1) g < rs and (2) g is expected to be constant forever. Because g must be a longterm growth rate, it cannot be > rs.

6 - 32

Assume beta = 1.2, rRF = 7%, and RPM = 5%. What is the required rate of return on the firms stock? Use the SML to calculate rs: rs = rRF + (RPM)bFirm = 7% + (5%) (1.2) = 13%.

6 - 33

D0 was $2.00 and g is a constant 6%. Find the expected dividends for the next 3 years, and their PVs. rs = 13%. 0

g=6%

2 2.2472

3 2.3820

D0=2.00 2.12 1.8761 13% 1.7599 1.6508

6 - 34

Whats the stocks market value? D0 = 2.00, rs = 13%, g = 6%. Constant growth model:

= D0 ( 1 + g ) = D1 P0 rs g rs g

$2.12 $2.12 = = $30.29. 0.13 - 0.06 0.07

6 - 35

What is the stocks market value one year from now, ^ 1? P D1 will have been paid, so expected dividends are D2, D3, D4 and so on. D2 Thus,

P1 = rs - g

= $2.2427 = $32.10 0.07

6 - 36

Find the expected dividend yield and capital gains yield during the first year.

D1 $2.12 Dividend yield = = = 7.0%. P0 $30.29 ^ P1 - P0 $32.10 - $30.29 CG Yield = = P0 $30.29 = 6.0%.

6 - 37

Find the total return during the first year. Total return = Dividend yield + Capital gains yield. Total return = 7% + 6% = 13%. Total return = 13% = rs. For constant growth stock: Capital gains yield = 6% = g.

6 - 38

Rearrange model to rate of return form:

D1 D1 = P0 to r s = + g. rs g P0

Then, rs = $2.12/$30.29 + 0.06 = 0.07 + 0.06 = 13%.

6 - 39

What would P0 be if g = 0? The dividend stream would be a perpetuity. 0 r =13% s 1 2.00

^

2 2.00

3 2.00

PMT $2.00 P0 = = = $15.38. r 0.13

6 - 40

If we have supernormal growth of 30% for 3 years, then a long-run ^ ? r is constant g = 6%, what is P0 still 13%. Can no longer use constant growth model. However, growth becomes constant after 3 years.

6 - 41

Nonconstant growth followed by constant growth:

0 r =13% s

g = 30%

1

g = 30%

2

g = 30%

3

g = 6%

4 4.6576

D0 = 2.00 2.3009 2.6470 3.0453 46.1135 54.1067 ^ = P0

2.603.38

4.394

= $4.6576 = $66.5371 P3 0.13 0.06

6 - 42

What is the expected dividend yield and capital gains yield at t = 0? At t = 4? At t = 0: $2.60 D1 Dividend yield = = = 4.8%. P0 $54.11 CG Yield = 13.0% - 4.8% = 8.2%.

(More)

6 - 43

During nonconstant growth, dividend yield and capital gains yield are not constant. If current growth is greater than g, current capital gains yield is greater than g. After t = 3, g = constant = 6%, so the t t = 4 capital gains gains yield = 6%. Because rs = 13%, the t = 4 dividend yield = 13% - 6% = 7%.

6 - 44

Is the stock price based on short-term growth? The current stock price is $54.11. The PV of dividends beyond year 3 is ^ discounted back to t = 0). $46.11 (P3 The percentage of stock price due to long-term dividends is: $46.11 = 85.2%. $54.11

6 - 45

Suppose g = 0 for t = 1 to 3, and then g is a constant 6%. What is ^ 0? P

0 1

g = 0%

rs=13% g = 0%

2

g = 0%

3

g = 6%

...

2.00 1.7699 1.5663 1.3861 20.9895 25.7118

2.00

2.00

2.12

= 2.12 = 30.2857 P3 0.07

6 - 46

What is dividend yield and capital gains yield at t = 0 and at t = 3? D1 2.00 = t = 0: P = $25.72 7.8%. 0 CGY = 13.0% - 7.8% = 5.2%. t = 3: Now have constant growth with g = capital gains yield = 6% and dividend yield = 7%.

6 - 47

Using the Stock Price Multiples to Estimate Stock Price

Analysts often use the P/E multiple (the price per share divided by the earnings per share) or the P/CF multiple (price per share divided by cash flow per share, which is the earnings per share plus the dividends per share) to value stocks. Example: Estimate the average P/E ratio of comparable firms. This is the P/E multiple. Multiply this average P/E ratio by the expected earnings of the company to estimate its stock price.

6 - 48

Using Entity Multiples

The entity value (V) is: the market value of equity (# shares of stock multiplied by the price per share) plus the value of debt. Pick a measure, such as EBITDA, Sales, Customers, Eyeballs, etc. Calculate the average entity ratio for a sample of comparable firms. For example, V/EBITDA V/Customers

6 - 49

Using Entity Multiples (Continued)

Find the entity value of the firm in question. For example, Multiply the firms sales by the V/Sales multiple. Multiply the firms # of customers by the V/Customers ratio The result is the total value of the firm. Subtract the firms debt to get the total value of equity. Divide by the number of shares to get the price per share.

6 - 50

Problems with Market Multiple Methods It is often hard to find comparable firms. The average ratio for the sample of comparable firms often has a wide range. For example, the average P/E ratio might be 20, but the range could be from 10 to 50. How do you know whether your firm should be compared to the low, average, or high performers?

6 - 51

Why are stock prices volatile?

D1 P = r g 0 s

rs = rRF + (RPM)bi could change. Inflation expectations Risk aversion Company risk g could change.

6 - 52

Stock value vs. changes in rs and g D1 = $2, rs = 10%, and g = 5%: P0 = D1 / (rs-g) = $2 / (0.10 - 0.05) = $40. What if rs or g change? g g g rs 9% 10% 11% 4% 40.00 33.33 28.57 5% 50.00 40.00 33.33 6% 66.67 50.00 40.00

6 - 53

In equilibrium, expected returns must equal required returns:

^

rs = D1/P0 + g = rs = rRF + (rM - rRF)b.

6 - 54

Why do stock prices change?

D1 P0 = ri g

^

ri = rRF + (rM - rRF )bi could change. Inflation expectations Risk aversion Company risk g could change.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Midterm or Pre Final Exam in Bus Com Trimex Pup CampusesDocumento8 páginasMidterm or Pre Final Exam in Bus Com Trimex Pup CampusesmahilomferAinda não há avaliações

- Revenue Recognition - Long-Term Construction Contracts (Part 2)Documento6 páginasRevenue Recognition - Long-Term Construction Contracts (Part 2)CaliAinda não há avaliações

- E Corporate Manager June 2022 - FINALDocumento90 páginasE Corporate Manager June 2022 - FINALlegal shuruAinda não há avaliações

- Financial Accounting and Reporting - 9th PDFDocumento496 páginasFinancial Accounting and Reporting - 9th PDFmikiyo90% (10)

- L8-Valuations and Capital Budgeting For The LeveredDocumento25 páginasL8-Valuations and Capital Budgeting For The LeveredtyraAinda não há avaliações

- Batik Malaysia Gallery Budgeted Income StatementDocumento6 páginasBatik Malaysia Gallery Budgeted Income StatementkiwiweeAinda não há avaliações

- MTP 1 Suggested Answers AADocumento9 páginasMTP 1 Suggested Answers AAYash RankaAinda não há avaliações

- Aswath CDocumento2 páginasAswath CSonai DasAinda não há avaliações

- Short Questions FMDocumento21 páginasShort Questions FMsultanrana100% (1)

- Lesson 4 Working CapitalDocumento13 páginasLesson 4 Working CapitalNicki Lyn Dela CruzAinda não há avaliações

- Corporate AccountingDocumento11 páginasCorporate AccountingDhruv GargAinda não há avaliações

- Case 1-1 CGDocumento5 páginasCase 1-1 CGCreativea holicAinda não há avaliações

- Corporate Finance: Short-Term Finance and PlanningDocumento25 páginasCorporate Finance: Short-Term Finance and PlanningIBn RefatAinda não há avaliações

- Series Seed Term Sheet (v2)Documento2 páginasSeries Seed Term Sheet (v2)zazenAinda não há avaliações

- Subsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationDocumento16 páginasSubsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationAnzas Rustamaji PratamaAinda não há avaliações

- Qualifying Exam - 1Documento5 páginasQualifying Exam - 1Eleazer Ego-oganAinda não há avaliações

- BBA SYLLABUS Sem-5 18-21Documento24 páginasBBA SYLLABUS Sem-5 18-21SagarAinda não há avaliações

- Auditing Equity and Debt SecuritiesDocumento5 páginasAuditing Equity and Debt SecuritiesElisha Batalla80% (5)

- HOBA - General Procedures-DLSAUDocumento25 páginasHOBA - General Procedures-DLSAUJasmine LimAinda não há avaliações

- CHP 11Documento41 páginasCHP 11SUBA NANTINI A/P M.SUBRAMANIAMAinda não há avaliações

- Solved The Statement of Cash Flows For The Year Ended DecemberDocumento1 páginaSolved The Statement of Cash Flows For The Year Ended DecemberAnbu jaromiaAinda não há avaliações

- 11.1. Practice Exercise - Cumberland Inc - BlankDocumento5 páginas11.1. Practice Exercise - Cumberland Inc - Blank155- Salsabila GadingAinda não há avaliações

- Nedap half-yearly figures press release highlights 10% revenue growthDocumento14 páginasNedap half-yearly figures press release highlights 10% revenue growthjasper laarmansAinda não há avaliações

- Module-1 Chapter 3: Overview of Accounting Standards Module-2 Chapter 4: Financial Statements of Companies Module-3 Accounting PronouncementsDocumento7 páginasModule-1 Chapter 3: Overview of Accounting Standards Module-2 Chapter 4: Financial Statements of Companies Module-3 Accounting PronouncementsMS editzzAinda não há avaliações

- Afar Quizzer On Consolidation (Ifrs 10)Documento9 páginasAfar Quizzer On Consolidation (Ifrs 10)john paul100% (1)

- Problems 1st PartDocumento17 páginasProblems 1st PartValentin JallaisAinda não há avaliações

- 03 Bulavin AgrogenerationDocumento19 páginas03 Bulavin AgrogenerationМикола АкімовAinda não há avaliações

- Capital Budgeting Techniques - pp13Documento53 páginasCapital Budgeting Techniques - pp13Micheal WorthAinda não há avaliações

- CH 14 Practice MCQ - S Financial Management by BrighamDocumento63 páginasCH 14 Practice MCQ - S Financial Management by BrighamShahmir Ali100% (1)

- National College of Business and Arts: Fairview, Quezon CityDocumento4 páginasNational College of Business and Arts: Fairview, Quezon CityLouise MchaleAinda não há avaliações