Escolar Documentos

Profissional Documentos

Cultura Documentos

ATM1

Enviado por

Pankaj SehgalDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ATM1

Enviado por

Pankaj SehgalDireitos autorais:

Formatos disponíveis

SEMINAR REPORT ON ATM

Submitted By: MAYANK GUPTA Roll No. 2105198 B.TECH (8TH Sem.)

CONTENTS:INTRODUCTION NAMES HISTORY NETWORKING ATM CHARGES HARDWARE AND SOFTWARE RELIABILITY ATM CARD VS CREDIT CARD HOW ATM WORKS PARTS OF MACHINE SETTLEMENT FUNDS SECURITY TIPS FOR SAFE ATM USAGE NEW INNOVATIONS GLOSSARY

Introduction : AUTOMATIC TELLER MACHINE: An Automatic Teller Machine (ATM) is a machine permitting a Banks customers to make cash withdrawals and check their account at any time and without the need for a human teller. Many ATMs also allow people to deposit cash or cheques and transfer money between their bank accounts.

History:-

The world's first ATM was installed in Enfield Town in the London Borough of Enfield, London on June 27, 1967 by Barclays Bank. In modern ATMs, customers authenticate themselves by using a plastic card with a magnetic stripe, which encodes the customer's account number, and by entering a numeric passcode called a PIN (personal identification number), which in some cases may be changed using the machine. Typically, if the number is entered incorrectly several times in a row, most ATMs will retain the card as a security precaution to prevent an unauthorised user from working out the PIN by pure guesswork.

Networking:Most ATMs are connected to interbank networks, enabling people to withdraw money from machines not belonging to the bank where they have their account. (Deposits can only be made at machines belonging to the bank that has the account.) This is a convenience, especially for people who are travelling: it is possible to make withdrawals in places where one's bank has no branches, and even to withdraw local currency in a foreign country, often at a better exchange rate than would be available by changing cash.

ATM Charges:Many banks in the USA charge fees for the use of their ATMs by nondepositors, for withdrawals over the network by their own customers, or both; however, in the UK strong public reaction soon persuaded banks not to do this. There is also now a flourishing business in the United States of placing ATMs in grocery stores, malls, and other locations other than banks: some of these machines have signs advertising "low" fees.

Hardware and Software:ATMs contain secure cryptoprocessors, generally within an IBM PC compatible host computer in a secure enclosure. The security of the machine relies mostly on the integrity of the secure cryptoprocessor: the host software often runs on a commodity operating system.

ATM CARD VS CREDIT CARD:The card you use at the ATM is known as a debit card. When debit cards first appeared it was easy to tell them apart from credit cards. Debit cards didn't have a credit card company logo on them; instead, they usually just had your bank name, your account number and your name. Today debit cards look exactly like credit cards even carrying the same logos. Both types of cards can be swiped at the checkout counter , used to make purchases on the internet, or to pay for the fill-up at the gas pump. When you use your debit card to make a purchase, it's just like using cash. The account that is attached to your debit card, in most cases your checking account, is automatically debited when you use your debit card. The cost of your purchase is deducted from the funds you have in that account. On the other hand, when you use your credit card to make a purchase you are using someone's else's money, specifically the issuer of the credit card, usually a banking institution.

How Do ATMs Work?

An ATM is simply a data terminal with two input and four output devices. Like any other data terminal, the ATM has to connect to, and communicate through, a host processor. The host processor is analogous to an Internet service provider (ISP) in that it is the gateway through which all the various ATM networks become available to the cardholder (the person wanting the cash).

Parts of the Machine:You're probably one of the millions who has used an ATM. As you know, an ATM has two input devices: Card reader - The card reader captures the account information stored on the magnetic stripe on the back of an ATM/debit or credit card. The host processor uses this information to route the transaction to the cardholder's bank. Keypad - The keypad lets the cardholder tell the bank what kind of transaction is required (cash withdrawal, balance inquiry, etc.) and for what amount. Also, the bank requires the cardholder's personal identification number (PIN) for verification. Federal law requires that the PIN block be sent to the host processor in encrypted form.

And an ATM has four output devices:

Speaker - The speaker provides the cardholder with auditory feedback when a key is pressed. Display screen - The display screen prompts the cardholder through each step of the transaction process. Leasedline machines commonly use a monochrome or color CRT (cathode ray tube) display. Dial-up machines commonly use a monochrome or color LCD. Receipt printer - The receipt printer provides the cardholder with a paper receipt of the transaction. Cash dispenser - The heart of an ATM is the safe and cash-dispensing mechanism. The entire bottom portion of most small ATMs is a safe that contains the cash.

Settlement Funds:-

Settlement Funds:-

ATM Security:Early ATM security focused on making the ATMs invulnerable to physical attack; they were effectively safes with dispenser mechanisms. A number of attacks on ATMs resulted, with thieves attempting to steal entire ATMs by ram-raiding. Modern ATM physical security concentrates on denying the use of the money inside the machine to a thief, by means of techniques such as dye markers and smoke canisters. This change in emphasis has meant that ATMs are now frequently found free-standing in places like shops, rather than mounted into walls. Another trend in ATM security leverages the existing security of a retail establishment. In this scenario, the fortified cash dispenser is replaced with nothing more than a paper-tape printer. The customer requests a withdrawal from the machine, which dispenses no money, but merely prints a receipt. The customer then takes this receipt to a nearby sales clerk, who then exchanges it for cash from the till.

New Innovations:Several companies are advertising ATMs for the blind. These machines would be located at kiosks rather than bank drive-thrus. For several years, the keypads at ATMs were equipped with braille for the blind or visually impaired. New innovations in this technology will include machines that verbally prompt the customers for their card, their PIN and the type of transaction they would like to make.

GLOSSARY:Secure Cryptoprocessor : A secure cryptoprocessor is a dedicated computer for carrying out cryptographic operations,embedded in a packaging with multiple physical security measures,which give it a degree of tamper resistance. The purpose of secure cryptoprocessor is to act as a keystone of a security subsystem,eliminating the need to protect the rest of the sub-system with physical security measures. Modem : The word "modem", a portmanteau word constructed from "modulator" and "demodulator", refers to a device that modulates an analog "carrier" signal (such as sound), to encode digital information, and that also demodulates such a carrier signal to decode the transmitted information. The goal is to produce a signal that can be transmitted easily and decoded to reproduce the original digital data. Primarily used to communicate via telephone lines, modems can be used over any means of transmitting analog signals, from driven diodes to radio.

THANKS

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- User Manual VAG-Prog 2012Documento26 páginasUser Manual VAG-Prog 2012spetiAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- EMV v4.1 Book 4 Other InterfacesDocumento161 páginasEMV v4.1 Book 4 Other InterfaceskeerthukanthAinda não há avaliações

- BAI GIANG 75T English For TourismDocumento35 páginasBAI GIANG 75T English For TourismRose DNAinda não há avaliações

- Account Statement From 5 Apr 2023 To 5 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento8 páginasAccount Statement From 5 Apr 2023 To 5 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAman guptaAinda não há avaliações

- Toktok Wallet: Secure Cashless TransactionsDocumento11 páginasToktok Wallet: Secure Cashless TransactionsShella MatrizAinda não há avaliações

- Mobile Banking FormDocumento2 páginasMobile Banking FormSanjiv GuptaAinda não há avaliações

- Protection of Information Systems: © The Institute of Chartered Accountants of IndiaDocumento28 páginasProtection of Information Systems: © The Institute of Chartered Accountants of Indiajonnajon92-1Ainda não há avaliações

- Adigrat University College of Business and Economics Department of Marketing ManagementDocumento38 páginasAdigrat University College of Business and Economics Department of Marketing ManagementAmir sabirAinda não há avaliações

- Computer Studies HandoutDocumento150 páginasComputer Studies HandoutEdzai Nyasha TarupiwaAinda não há avaliações

- Final Test: 1.sarah Likes Teaching English When ..Documento10 páginasFinal Test: 1.sarah Likes Teaching English When ..Kerry KoNepeAinda não há avaliações

- Facility Commander WNX 7 7 AE Specification RevA2Documento29 páginasFacility Commander WNX 7 7 AE Specification RevA2WERMERMAinda não há avaliações

- Sony Xperia XA1 Plus - Schematic DiagarmDocumento115 páginasSony Xperia XA1 Plus - Schematic DiagarmĐỗ Đình HòaAinda não há avaliações

- Se Lab FilwDocumento8 páginasSe Lab FilwNilendra Prasad KukretiAinda não há avaliações

- Security PlaybookDocumento96 páginasSecurity PlaybookRafa EgeaAinda não há avaliações

- Study of Awareness and Perception About Credit CardsDocumento67 páginasStudy of Awareness and Perception About Credit Cardsnidhirastogi95Ainda não há avaliações

- Ss90-Installation GuideDocumento87 páginasSs90-Installation Guidealoysobeck1988Ainda não há avaliações

- Sufyan Yahya PayBillDocumento2 páginasSufyan Yahya PayBillSuvLeviAinda não há avaliações

- Electronic Code Lock With User Defined Password Using 8051Documento21 páginasElectronic Code Lock With User Defined Password Using 8051Devanshu Kumar100% (1)

- Zo 0 G NX CR FYCZg HC HDocumento2 páginasZo 0 G NX CR FYCZg HC HJayant SalviAinda não há avaliações

- Janata Bank Limited: Tender ScheduleDocumento25 páginasJanata Bank Limited: Tender ScheduleNazmul Haque SadinAinda não há avaliações

- Un75-CGSP Before You Start GuideDocumento6 páginasUn75-CGSP Before You Start GuideSchoolAinda não há avaliações

- Change of Company or Directors ProceduresDocumento16 páginasChange of Company or Directors ProceduresneliuswAinda não há avaliações

- Conductivity MeterDocumento150 páginasConductivity MeterAbhishek BanerjeeAinda não há avaliações

- Case Study On Customer Satisfaction HSBCDocumento20 páginasCase Study On Customer Satisfaction HSBCgaurav260589Ainda não há avaliações

- 30 Arduino™ Projects For The Evil Genius - Department of Control (PDFDrive)Documento37 páginas30 Arduino™ Projects For The Evil Genius - Department of Control (PDFDrive)eAinda não há avaliações

- Digitalization Improves Banking ServicesDocumento76 páginasDigitalization Improves Banking ServicesNikhil KapoorAinda não há avaliações

- Atm Error Codes-1Documento4 páginasAtm Error Codes-1Karthi DeviAinda não há avaliações

- Chap 1 & 2 & 3Documento189 páginasChap 1 & 2 & 3Yash BolarAinda não há avaliações

- Yc Vy BCM LB VTGJ O6 MDocumento5 páginasYc Vy BCM LB VTGJ O6 MAbhi saxenaAinda não há avaliações

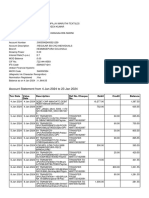

- Account Statement From 4 Jan 2024 To 23 Jan 2024: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento4 páginasAccount Statement From 4 Jan 2024 To 23 Jan 2024: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancerangaswamy8194Ainda não há avaliações