Escolar Documentos

Profissional Documentos

Cultura Documentos

09 - Paid To Mr. A Rs. 25,000 Through Cheque: Balance B/F Credit Purchase From B

Enviado por

Amir KashyTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

09 - Paid To Mr. A Rs. 25,000 Through Cheque: Balance B/F Credit Purchase From B

Enviado por

Amir KashyDireitos autorais:

Formatos disponíveis

Financial Accounting

Lecture 14

09 Paid to Mr. A Rs. 25,000 through cheque

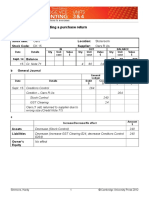

Mr. A Date Feb 01 Feb 10 Feb 17 No Narration

Balance B/F

Code 07 Cr. Rs. Bal. Dr/(Cr) 15,000 60,000 (15,000) (75,000) (50,000)

Dr. Rs.

06 Credit purchase from B 09 Paid to A 25,000

Bank Account

Date Feb 01 No Narration

Balance B/F

Code 02

130,000

Dr. Rs. 130,000

Cr. Rs. Bal. Dr/(Cr)

Feb 02

Feb 05 Feb 15 Feb 17

01 Cash deposited

03 Expenses payable paid 08 Fixed deposit placed 09 Paid to A

25,000

15,000 75,000 25,000

155,000

140,000 65,000 40,000

Financial Accounting

Lecture 14

10 Received cash from Mr. B. Rs. 75,000.

Mr. B

Date Feb 01 Feb 06 Feb 07 Feb 12 Feb 20 04 05 07 10 No. Narration

Balance B/F Cash received from B Discount given to B Credit sale to B Received from B

Code 09

Cr. Rs. 14,000 1,000 Bal. Dr/(Cr) 15,000 1,000 0 95,000 75,000 20,000 Code 01 Cr. Rs. 25,000 Bal. Dr/(Cr) 35,000 10,000 24,000

Dr. Rs. 15,000

95,000

Cash Account Date Feb 01 Feb 02 Feb 06 01 04 No. Narration

Balance B/F Cash deposited Cash received from B

Dr. Rs. 35,000 14,000

Feb 20

10

Received from B

75,000

99,000

Financial Accounting

Lecture 14

11 Salaries accrued Rs. 5,000.

Salaries Date Feb 01 Feb 28 11 No. Narration

Balance B/F Salaries Accrued

Code 10 Cr. Rs. Bal. Dr/(Cr) 5,000 10,000

Dr. Rs. 5,000 5,000

Expenses Accrued Date Feb 01 Feb 03 Feb 05 Feb 28 02 03 11 No. Narration

Balance B/F Expenses payable reduced Expenses payable paid Salaries Accrued

Code 12 Cr. Rs. Bal. Dr/(Cr) 20,000 (20,000) (15,000) 0 5,000 (5,000)

Dr. Rs.

5,000 15,000

Financial Accounting

Lecture 14

12 Expenses accrued Rs. 15,000.

Expense Account Date Feb 01 Feb 03 Feb 28 02 12 No. Narration

Balance B/F Expenses payable reduced Expenses accrued

Code 01 Cr. Rs. Bal. Dr/(Cr) 20,000 5,000 15,000 30,000 Code 12 Cr. Rs. 20,000 Bal. Dr/(Cr) (20,000) (15,000)

Dr. Rs. 20,000 15,000 Expenses Accrued

Date Feb 01 Feb 03

No.

Narration

Balance B/F

Dr. Rs.

02

Expenses payable reduced

5,000

Feb 05

Feb 28 Feb 28

03

11 12

Expenses payable paid

Salaries Accrued Expenses accrued

15,000

5,000 15,000

0

(5,000) (20,000)

Financial Accounting

Lecture 14

Trial Balance

Ali Traders Trial Balance As On February 28, 20-Title of Account Cash Account Bank Account Capital Account Furniture Account Vehicle Account Purchases Account Mr. A (Creditor) Code 01 02 03 04 05 06 07 15,000 50,000 120,000 50,000 Dr. Rs. 99,000 40,000 200,000 Cr. Rs.

Financial Accounting

Lecture 14

Ali Traders Trial Balance As On February 28, 20-Title of Account Sales Mr. B (Debtor) Salaries Expenses Expenses Payable Discount Fixed deposit Total Code 08 09 10 11 12 13 14 1,000 75,000 460,000 460,000 20,000 10,000 30,000 20,000 Dr. Rs. Cr. Rs. 190,000

Financial Accounting

Lecture 14

Items purchased for own use of the business are charged as

expense, e.g. tube lights, bulbs, stationery etc.

Items

purchased for the purpose of resale are treated as Purchases.

Financial Accounting

Lecture 14

Stock

Stock is the quantity of unutilized or unsold goods lying with

the organization.

Financial Accounting

Lecture 14

Types of Stock

In case of Trading Concern (an organization that does not

manufacture goods and but resells the purchased goods.) Stock in Trade (Finished goods) In case of Manufacturing Concern (an organization that purchases material and converts into a finished product by putting it through a process). Raw Material Stock Work in Process Finished Goods Stock

Financial Accounting

Lecture 14

Stock Account

Stock

Account is Debited with the Value of the Goods Purchased.

Stock account is Credited with the Purchase Price of the

Goods Sold / Issued for Production.

Stock

goods.

Account shows the cost / purchase value of unsold

10

Financial Accounting

Lecture 14

Purchase of Stock

Credit

Cash Account OR Supplier / Creditor Account

Debit

Stock Account

11

Financial Accounting

Lecture 14

Payment to Creditors

Debit Credit

Supplier / Creditor Account

Cash Account

12

Financial Accounting

Lecture 14

Sale of Goods

Credit Debit

Stock Account Cost of Goods Sold

13

Financial Accounting

Lecture 14

+ + =

Opening Stock Purchases Value / Cost of Goods Sold Closing Stock

14

Financial Accounting

Lecture 14

Cost of Goods Sold

Trading Concern

Purchase Price of the Goods Sold

Manufacturing Concern

+ + Cost of Raw Material Consumed Other Manufacturing Costs e.g. salaries of labour, cost of machinery

15

Financial Accounting

Lecture 14

Stock & Cost of Goods Sold In Manufacturing Conc.

Raw Material Stock Other Costs Accounts

Work in Process Account

Finished Goods Account

Cost of Goods Sold Account

16

Você também pode gostar

- Financial Accounting - MGT101 Power Point Slides Lecture 25Documento21 páginasFinancial Accounting - MGT101 Power Point Slides Lecture 25daood abdullah100% (1)

- Module 6 - Accounting Cycle 1 - Recording Business Transactions and Accounting For Service Entities - Part BDocumento29 páginasModule 6 - Accounting Cycle 1 - Recording Business Transactions and Accounting For Service Entities - Part BAbelAinda não há avaliações

- Financial Accounting - An Ice BreakerDocumento64 páginasFinancial Accounting - An Ice BreakerMohit DhawanAinda não há avaliações

- Implement Business Plan & RecordsDocumento101 páginasImplement Business Plan & RecordsParon MarAinda não há avaliações

- Accounts PGDMDocumento48 páginasAccounts PGDMMeghali BarmanAinda não há avaliações

- Textbook Answers AsDocumento37 páginasTextbook Answers AsHuGo Kwok40% (5)

- Journal EntriesDocumento55 páginasJournal Entriesmunna00016100% (1)

- Double Entry Book Keeping PDFDocumento3 páginasDouble Entry Book Keeping PDFAnonymous hHsNQCCAinda não há avaliações

- Study unit 5 online class slidesDocumento24 páginasStudy unit 5 online class slideszinesunduzaAinda não há avaliações

- Double Entry Accounting Exercise Workbook Bookkeeping Cases Free PDFDocumento139 páginasDouble Entry Accounting Exercise Workbook Bookkeeping Cases Free PDFayiahAinda não há avaliações

- Osborne Books Answer Sheet PDFDocumento37 páginasOsborne Books Answer Sheet PDFBarışEgeUysalAinda não há avaliações

- Principles of AccountancyDocumento24 páginasPrinciples of AccountancyAmandeep Singh SalujaAinda não há avaliações

- A Simple Start To Managing Your Business FinancesDocumento50 páginasA Simple Start To Managing Your Business FinancesJISHNUAinda não há avaliações

- Final Accounts PPT APTDocumento36 páginasFinal Accounts PPT APTGaurav gusai100% (1)

- Deeper Dive - 2014 1Documento7 páginasDeeper Dive - 2014 1shirazasadAinda não há avaliações

- Management and Financial AcctgDocumento10 páginasManagement and Financial AcctgVishnu RoyAinda não há avaliações

- Financial Accounti ng1: Transactions For The Month of January of A Small Finishing RetailerDocumento16 páginasFinancial Accounti ng1: Transactions For The Month of January of A Small Finishing RetailerYassin ElsafiAinda não há avaliações

- Assignment Front Sheet: BusinessDocumento13 páginasAssignment Front Sheet: BusinessHassan AsgharAinda não há avaliações

- Accounting Cycle Problems & SolutionsDocumento18 páginasAccounting Cycle Problems & Solutionsurandom101100% (4)

- Upto Day 10Documento25 páginasUpto Day 10Abhijeet DashAinda não há avaliações

- LCCI First Level Revision NotesDocumento20 páginasLCCI First Level Revision NotesLinda Martin100% (2)

- Chap 004Documento45 páginasChap 004Yuti XianAinda não há avaliações

- Accounting Concepts and Principles ExplainedDocumento16 páginasAccounting Concepts and Principles ExplainedKristine Lei Del MundoAinda não há avaliações

- The Accounting Cycle ExplainedDocumento61 páginasThe Accounting Cycle ExplainedHottie-Hot SoniAinda não há avaliações

- Australian School of BusinessDocumento12 páginasAustralian School of BusinessMaria Luisa Laniado IllingworthAinda não há avaliações

- Adjustments for Bad Debts and DiscountsDocumento24 páginasAdjustments for Bad Debts and DiscountsMuhammad Adib100% (2)

- Accounting Equation Assets Liabilities + CapitalDocumento19 páginasAccounting Equation Assets Liabilities + CapitalMayank KumarAinda não há avaliações

- Manage Receivables and Calculate Allowance for Doubtful AccountsDocumento5 páginasManage Receivables and Calculate Allowance for Doubtful AccountsJamaica MarjadasAinda não há avaliações

- FABM 2 Lesson 6 CFSDocumento28 páginasFABM 2 Lesson 6 CFSKia MorenoAinda não há avaliações

- Osborne Books Answer Document AS AccountingDocumento37 páginasOsborne Books Answer Document AS AccountingAaron33% (3)

- Mba025 Set1 Set2 520929319Documento16 páginasMba025 Set1 Set2 520929319tejas2111Ainda não há avaliações

- JournalizingDocumento27 páginasJournalizingMelody LiwanagAinda não há avaliações

- Accounts Notes RevisionDocumento47 páginasAccounts Notes RevisionSamson SammieAinda não há avaliações

- MGT101 - Financial Accounting - UnSolved - MID Term Paper - 02Documento7 páginasMGT101 - Financial Accounting - UnSolved - MID Term Paper - 02osamaAinda não há avaliações

- Business Accounting: Emba Lecture 3Documento12 páginasBusiness Accounting: Emba Lecture 3udhaskhanAinda não há avaliações

- Simple Start PresentationDocumento53 páginasSimple Start PresentationCheltine RatinoffAinda não há avaliações

- Rules in Debit and CreditDocumento17 páginasRules in Debit and CreditWenibet SilvanoAinda não há avaliações

- MB0041Documento26 páginasMB0041Saurav KumarAinda não há avaliações

- Acc34 Ch13ExerciseSolutionsDocumento17 páginasAcc34 Ch13ExerciseSolutionsAnonymous HSWUQRbAinda não há avaliações

- AFM Module 1Documento30 páginasAFM Module 1Saloni AggarwalAinda não há avaliações

- Accounts Project FileDocumento23 páginasAccounts Project Filebetu813784% (25)

- Prepared by:-CA Priyanka SatarkarDocumento31 páginasPrepared by:-CA Priyanka Satarkarnick1425Ainda não há avaliações

- Week 5 - Sept 26-30 - AcctgDocumento13 páginasWeek 5 - Sept 26-30 - Acctgmaria teresa aparreAinda não há avaliações

- NUS ACC1002X Lecture 2 Accounting Cycle (I) - RecordingDocumento29 páginasNUS ACC1002X Lecture 2 Accounting Cycle (I) - Recordingchestervale1Ainda não há avaliações

- QN 1 - Final Accounts: One ApproachDocumento42 páginasQN 1 - Final Accounts: One ApproachAbhijeet PatilAinda não há avaliações

- CH 4 Acc106Documento36 páginasCH 4 Acc106Mas Ayu0% (1)

- Understanding ledgers and trial balancesDocumento33 páginasUnderstanding ledgers and trial balancesGokul KumarAinda não há avaliações

- Understanding ReceivablesDocumento8 páginasUnderstanding ReceivablesKian BarredoAinda não há avaliações

- Cash Flow TutorialDocumento6 páginasCash Flow TutorialEric Chambers100% (1)

- Laundry - System Analysis and Design - (Excel Linking)Documento10 páginasLaundry - System Analysis and Design - (Excel Linking)JO SAAinda não há avaliações

- Record Transactions in Journals & Cash BookDocumento20 páginasRecord Transactions in Journals & Cash BookSubodh Saxena100% (1)

- Homework QuestionsDocumento17 páginasHomework QuestionsAAinda não há avaliações

- Statement of Cash FlowsDocumento36 páginasStatement of Cash FlowsLoida Yare Laurito100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionAinda não há avaliações

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersNo EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersNota: 2 de 5 estrelas2/5 (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Accounting Survival Guide: An Introduction to Accounting for BeginnersNo EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersAinda não há avaliações

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthAinda não há avaliações

- CDDocumento2 páginasCDGautam PraveenAinda não há avaliações

- Nifty FactsheetDocumento2 páginasNifty FactsheetTudou patelAinda não há avaliações

- Financial Evaluation Report With SampleDocumento12 páginasFinancial Evaluation Report With SamplemaidangphapAinda não há avaliações

- Chapter 09 Testbank QuestionsDocumento23 páginasChapter 09 Testbank QuestionsFami Famz100% (2)

- Harmonic Trend Patterns Cheat SheetDocumento3 páginasHarmonic Trend Patterns Cheat SheetSharma comp100% (2)

- IFC Sustainable Investment in Sub-Saharan AfricaDocumento98 páginasIFC Sustainable Investment in Sub-Saharan AfricaIFC Sustainability100% (1)

- Yale Endowment Generates $2.29 Billion Gain in FY2013Documento24 páginasYale Endowment Generates $2.29 Billion Gain in FY2013alainvaloisAinda não há avaliações

- A Project ProposalDocumento10 páginasA Project ProposalRam PandeyAinda não há avaliações

- Multiple Choice Problems: 0 X, 1 1 X, 2 2 Y, 1 Y, 2Documento7 páginasMultiple Choice Problems: 0 X, 1 1 X, 2 2 Y, 1 Y, 2roBinAinda não há avaliações

- UNWTO Tourism Highlights 2018 EditionDocumento20 páginasUNWTO Tourism Highlights 2018 EditionTatianaAinda não há avaliações

- Pivot BossDocumento97 páginasPivot BossTarkeshwar Mahato100% (7)

- Profit and LossDocumento11 páginasProfit and LossAsif AhmedAinda não há avaliações

- Daily Trading Stance - 2010-01-11Documento3 páginasDaily Trading Stance - 2010-01-11Trading FloorAinda não há avaliações

- Free Numerical Reasoning Test QuestionsDocumento16 páginasFree Numerical Reasoning Test QuestionsautojunkAinda não há avaliações

- Basic Documents and Transactions Related To Banks DepositsDocumento3 páginasBasic Documents and Transactions Related To Banks DepositsAngelica Omilla50% (2)

- Review Class For Final Exam 2016, For Moodle, With SolutionDocumento17 páginasReview Class For Final Exam 2016, For Moodle, With SolutionMaxAinda não há avaliações

- Chapter 20 Non-Current Assets Acquisition and DepreciationDocumento6 páginasChapter 20 Non-Current Assets Acquisition and DepreciationDasun LakshithAinda não há avaliações

- 4 5949794731742463536 PDFDocumento22 páginas4 5949794731742463536 PDFAnastasia Nikoláyevna100% (2)

- 17 Proven Currency Trading Strategies-Pages-250-255Documento6 páginas17 Proven Currency Trading Strategies-Pages-250-255quan lyhongAinda não há avaliações

- Jea YuDocumento35 páginasJea YuvsampierAinda não há avaliações

- The Wyckoff Method ExplainedDocumento14 páginasThe Wyckoff Method ExplainedPro tube100% (2)

- Apache Case Study Analysis of Risk Management TechniquesDocumento14 páginasApache Case Study Analysis of Risk Management TechniquesSreenandan NambiarAinda não há avaliações

- CBSE Class 12 Accountancy Question Paper 2015 (Outside Delhi Set 1) With Answers (Compartment)Documento64 páginasCBSE Class 12 Accountancy Question Paper 2015 (Outside Delhi Set 1) With Answers (Compartment)Arpit GaurAinda não há avaliações

- Literature ReviewDocumento27 páginasLiterature ReviewkalaswamiAinda não há avaliações

- Positive Afformations For Abundnace and MoneyDocumento3 páginasPositive Afformations For Abundnace and Moneyamazingdivinegrace0% (1)

- 118.2 - Illustrative Examples - IFRS15 Part 1Documento3 páginas118.2 - Illustrative Examples - IFRS15 Part 1Ian De DiosAinda não há avaliações

- How Successful Are Family Businesses? and What Are The Keys To Success?Documento18 páginasHow Successful Are Family Businesses? and What Are The Keys To Success?Oxana ConstantinovaAinda não há avaliações

- Financial MarketsDocumento7 páginasFinancial MarketsLeo Andrei BarredoAinda não há avaliações

- Parametric VaR Calculation Method ExplainedDocumento6 páginasParametric VaR Calculation Method Explainedselozok1Ainda não há avaliações