Escolar Documentos

Profissional Documentos

Cultura Documentos

TFW Manual PDF

Enviado por

Gustavo Lopes100%(1)100% acharam este documento útil (1 voto)

199 visualizações157 páginasTítulo original

TFW_Manual.pdf

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

100%(1)100% acharam este documento útil (1 voto)

199 visualizações157 páginasTFW Manual PDF

Enviado por

Gustavo LopesDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 157

www-.OliverVelez.co

er L. Velez

Your Trader for Life™

Trade For Wealth

Achieving Sustainable Prosperity with a

Global Market Approach

With Oliver L. Velez

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

AS Accomplishments

2009

International Ranked #1

Trader of the Year Trader’s Website by:

2 ; xk

OPTIMIZED INDICATORS

For SAP 500

nked #1... Again!

Ranked #1 WINNER

Trading Service by: Ist Annual

International

mes f=

Copyright 2010@ * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

First In Business Worldwide Rai

www.Olivervelez.com

er tVelez Oliver Velez Bestsellers

5 Int'l Best-Selling Books

written by Oliver Velez,

including Tools and Tactics

of the Master Day Trader,

one of the best selling

trading books of all-time.

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

erL.Velex Accessibility to Wealth

ce Trader for Life™

ea Mcbile

ext the word

MNKDup 918%" intyear = \Weairit

BAC up 138%* in 6 months to 99222

RIMM up 162% in 6 months Do itnow!

GCA up 132%* in 5 months

AAPL up 120%* in 7 months

DGP up 52% in 3 months it nia

TWITTER

"Using Oliver Velez’ Add and Reduce Method

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

RO EEO eee Cee ene ee hd

Phase |- Initiation

7-Day Master Equity & Forex

Programs which include full 2-day

seminars and 5-days of live trading.

Phase (t- Immersion iFundTraders Trade with our Money

Several weeks to several months of 7-Day Master Trader Program No Risk to You!

ongoing mentoring in a structured, ‘complte Catenin fr ating

simulated trading environment.

Phase Ill - Professional

Graduates start trading with $75,000

and mave up to trading as much as

$2,000,000.

‘The firm bears the losses.

Traders receive 80% to 95% of all 5 Wireless Mobile Trading - New

net profits. Trade anywhere on the go!

Phase IV - Master Trader

‘Trader becomes a colony leader of

other traders and gets a percentage Online Trading Reem - New

of their trading profits. Paseo

Copyright © 2010 * ifundTraders.com * 2576 Broadway, #158, NY, NY, 10025

Otter eter

"Your Trader for Life™

FX Trader Advancement

7-Day Master Forex Trader Program

Practice pL) $6,000 0.06 $25 $50 $20 20% 30

1) $10,000 on $50 $100 $60 30% 6

Training 2 | $30,000 02 $100 $200 $130 ‘0% oo

3) $50,000 03 5150 $300 5200 0% oo

Reminisce GL ee

4) $75,000 os $250 $500 $400 80% 0

Development 5) $100,000 o7 $350 $70 $700 0% 100

$150,000 412 $500 $1,000 $1,200 20% ‘100

7) $250,000 1s $800 $1,600 2,090 85% 100

Mastery 8 | $375,000 25 $1,250 $2,500 $3,250, 85% 100

9 | $550,000 36 $1,800 $3,600 $4,680 85% 130

10 | $800,000 5A $2,700 $5.40 $7,600 90% 0

Flite 11.) $1,350,000 ° $4,500 $9,000 ‘12,600 30% 0

12 | $2,000,000 “ $7,000 $14,000 $19,600 95% 40

Standard

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

Olmert.velez Equity Trader Advancement

wen OllverVelezion

7-Day Master Trader Program

Practice PL_——‘$5,000 50 $25 $50 $20 80%

1 |__ $10,000 100 $50 $100 $60 B05

Treining 2 | $30,000 200 $100 $200 80%

3 | $50,000 300 $150 $300 80%

feieien Uae ae, Lk, ta

$75,000 500 $250 $500 80%

$100,000 $350 $700 80%

$150,000 $500 $1,000 80%

85%

85%

$250,000 $800 $1,600

$375,000 "$1,250 $2,500

$550,000 $1,600 $3,600

$800,000 $2,700

$1,350,000 $4,500

$2,000,000 $7,000

www.OlivervVelez

er L. Velez

Your Trader for Life™

Section I

Understanding How All

Market’s Behave

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.

er L. Velez

Your Trader for Life™

The Three Major Wealth

Building Markets

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.OlivervVelez

er L. Velez

Your Trader for Life™

The Market’s Single Cycle

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.OlivervVelez

er L. Velez

Your Trader for Life™

The Market’s Three Trends

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.

er L. Velez

Your Trader for Life™

The Market’s Four Stages

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.OlivervVelez

er L. Velez

Your Trader for Life™

The Market’s Four

Transitions

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.

er L. Velez

Your Trader for Life™

Section II

The Wealth Building Tools

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.

er L. Velez

Your Trader for Life™

The Four Major Wealth

Time Frames

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

lige, L,Velex ‘The Wealth Time Frames

sew OliverVeletom,

‘60-minute Chart ~ This time frame: can be a powerful intra-day window allowing for the occasional early

‘entry opportunity for wealth traders. An ever reliance on this time frame can be troublesome, though, so the

‘wealth trader is advised to only take entries inthis time frame based on the most powerful of all events,

rnamely the Bull Twin Tower. As an exit time frame, itean also afford the wealth trader with earlier than

normal warning signs that it’s time to lighten up. Keep itn front of you at all times.

Daily Chart ~ This is the granddaddy of alltime frames for the wealth trader. It is used greater than 80% of

the time to act both on the buy and sell size. If| did not deploy an incremental buy and sell approach, the

‘weekly time frame would be the key one. Because I ease in and out of plays, the daily is by far the most

superior one of all II ad to pick one time frame to look a, the daily would be it All of the action bars and

events are to be taken on this key time frame.

‘Weekly Chart ~ This key time frame runs a close second to the Daily. Action bars and events that occur

here are-very powerful, and tend to warrant larger sized buys and sells. When studying or reviewing, the

‘wealth trader is advised to look at each stock or underlying instrument with the Daily and Weekly chart side

by side, If my approach was an “all in” style, versus an incremental one, the weekly would be the key one to

‘act on

Monthly Chart ~ This major time frame is used more as an analytical one versus an action based one. The

‘wealth trader is advised to occasionally review all stocks and other items through the eyes of the monthly

chart to assess where major support and resistance points are. Long-term prior highs and lows seen on this,

time frame can serve as lofty targets and provide the wealth trader of the inherent possibilities ina play. The

Tong.term trend in 2 stock is determined via the monthly time frame as well

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.

er L. Velez

Your Trader for Life™

The Four Major Wealth

Moving Averages

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

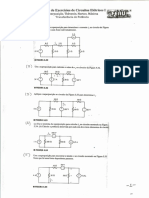

E,velex Your Actionable Sell Items

Bear Elenhant Topping Tall Bar"

Igniting Bear Elephant (1)

Clearing Bear Elephant (24) ae

“Can be groom ore

20ma Halt

Regular (2+)

Bear Twin (3+)

A

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

‘Bear Twin Tower U

Regular (2+) ll

Far Above 20ma (3+)

www.Olivervelez.com

QlwerLVelex Wealth Moving Averages

sew OliverVeletom,

20-period Moving Average (20ma) — This simple moving average is the number

one staple for wealth traders. No chart is ever looked at without the aid of the

20ma, It reveals a stock’ s directional bias, serves as a significant area of support

and resistance and tells the trader when a stock is overbought (far above) as well as

oversold (far below). significant areas of support and resistance are, There is an

alternative that can me used for wealth trading, however, and it is advised that the

trader experiment with it too - the 34-period moving average.

50-period Moving Average (50ma) ~ This major moving average is a very

popular one for the institutional crowd. It has a wide professional following and as

aresult is a very reliable indication of major support and resistance. The wealth

trader should know where the 50ma is at all times.

200-period Moving Average (200ma) — This simple but major moving average is

the granddaddy of them all. It’s almost magical how often stocks and the overall

market obey this slow moving line. Of all the moving averages, this one has the

largest following, which makes it almost a self-fulfilling prophesy. It should always

be in view and given the utmost respect.

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www-.OliverVelez.co

er L. Velez

Your Trader for Life™

The Mighty MACD

Moving Average Convergence/ Divergence

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.

er L. Velez

Your Trader for Life™

How To Use Bollinger

Bands for Wealth

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.

er L. Velez

Your Trader for Life™

Section ITI

The Wealth Action Bars

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.OlivervVelez

er L. Velez

Your Trader for Life™

The Only Three Wealth

Bars That Count

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

AS The Three Power Bars

iverVelezom,

Bull Elephant Bull Tails

Of all bars, The Elephants are the most powerful

Bear Elephant Bear Tails

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

L. Velez

"Your Trader for Life™

wen OllverVelezon

Step 1:

Buy toward the end of the Bull

Bar's formation

Stop -——-

Bull Elephant

www.Olivervelez.com

Buy / Stop Method

Wealth Trading Tip:

With this. stop method, the Velez Trained

‘Wealth Trader only loses one bar

—

Buy

Step 2:

Place a hard stop 1 to 5 cents

below the Bull Bar's low if you

are using an all-in strategy. If

this buy Is a partial, your stop is

not placed until the final lot has.

been purchased.

Colored Non-Colored

Bottoming Tail Bottorning Tail

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

erLVelex Short / Stop Method

sew OliverVeletom,

Step 1: Wealth Trading Tip:

Sell toward the end of the Bear With this stop method, the Velez Trained

Bar's formation Wealth Trader only loses one bar

Step 2:

Place a hard stop 1 to 5 cents

above the Bear Bar's high if

you are using an all-in strategy.

If not, this stop is only to be

used once your last lot has

been sold short.

Colored Non-Colored

Bear Elephant ,

Topping Tail Topping Tail

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OlivervVelez

er L. Velez

Your Trader for Life™

The Elephant Bars

Knowing When The Major Institutions

are All In Unison

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

Bull Elephant Bar

VRSN - Verisign Inc. (NASDAQ) - Daily Candlestick Chart

WOp2s86, M2704, LlozeGT, Cleese Oh Var 1899900 Open interest mI SMA(e0) 25.50

Wealth Trading Tip:

‘The most potent Bull Elephant Bars are the first of

their kind as far as you can see to the left. In other

words, the further you have to go back in time to

see a bar that's similar, the more powerful itis.

Bull Elephant Bar ends the down trend and

+— “ignites a steady move back to the upside.

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Bull Elephant Bar

WOpt450, HAT, Lota v2, C383 GP VolS35050 Ml Openinierest mM SMA(20) 11.57

‘Wealth Trading Tip:

‘An important key is to look for sudden change. When a single

Elephant Bar stands out as being a rare breed compared to all or

most of the bars to the left of it, that its when it means the most.

‘Bull Elephant Bar

an 10 Fob Mar

Copyright 2010 © * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Bull Elephant Bars

OliverVelezom,

PLFE - Presidential Lite Corporation (NASDAQ) - Daily Candlestick Chart

TOG S2, HTT 7S, Lon TAG, CIT SS — GIVorS2400 ml Open terest mI SMA GO) 1093

Elephant Bars really stand out when a stock displays long periods of tiny bars. Take

note of the size of the average bar between each highlighted Bull Elephant below.

Clearing Bull Elephant ——» fy

|

400000)

200000)

al

Igniting Bull Elephant

Jos a.mepnan o. .2 ‘

‘Jan 10 Feb Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Bull Elephant Bars

OliverVelezom,

BOOT - Lacrosse Footwear Inc (NASDAQ) - Daily Candlestick Chart

TOp1832, HGS, Lovee, CHGIO ver 2126 Open Interest ml SMA(2O) 18.06

Don’t miss the Igniting Gap event which initiated the entire advance.

Mentally fill It in and you will see that the Bull Elephant in early March had

a big bow wrapped around it.

bty terra

Exhaustion Bull Elephant t T"

20ma

Clearing Bull Elephant ———> |]

Ht grt era alt al Hat

lL | Bull Elephant

Hie" Also, take special note of the higher lows.

190009]

0000] I

Pe pee er) ae

Feb 10 Mar Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

hi

5 lh in

é |

www.Olivervelez.com

QlwerLVelex Clearing Bull Elephant

sew OliverVeletom,

Hop8.01, HS23,lo7 64, C06 GVeLa0S2121 MOpeninierest _ m SMAGO).5a5

Exhaustion Gap—> | "

Wealth Trading Tip:

Notice how each Bull Elephant Igniting Bar clears a chunk of price data

to the left of it. These bars have the effect of wiping away or clearing all

the former junk, which makes way for smooth sailing to the upside.

Igniting Bull

Elephant —>

Dee 08 van 10 Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

erL.Velex Clearing Bull Elephant

KFN- Kkr Financial Corp. (NYSE)

Dop7.9, Five, loval, O50 Vel 19s2800 mM Open interest MW SOMA@O) G45

Wealth Trading Tip:

Notice how the best Bull Elephant Bars clear a good deal

of price data to the left of it.

Bull Elephant Bar.

+ o000000

soootcd J Liss

linens. GasbDiesssBoeten ya

Feb Mar

Dee 09 Jan 10

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

E,Velex Clearing Elephant Bar

"Your Trader for Life™

OliverVelezom,

MDF = Metrop Hith Ntwks (AMEX)

WOpS01, AiS.05, (ODO, S00 MVeL20ss4s Open interest a SMA(2O) 245

Elephant Bars are amongst the most powerful

footprints created by the big institutional players.

But they are not all created equal. Those which

ignite new moves while clearing a lot of price data

to the left are the absolute most powerful.

‘Stacked Profit-taking Elephant Bar—>

regard Clearing Elephant Bars to be “double

adds," meaning | tend to buy more on them.

aby clearing

‘This Elephant bar clears all

data to the left of it.

Hl] <—Bull Elephant Bar t

No Follow-thrdugh Bear Elephi Bottoming Tall Bar as “gift.”

jo Follow-through Bear Elephant

iB cneenlemalh oR eee

Dec 08 wan 10 Feb

Copyright 2010© * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

0

www.OliverVelez.com

QlwerL,Velex Clearing Bull Elephants

HOG - Harley Davidson (NYSE) - Daily Candlestick Chart

GOST 4, HISG.O2, Leal 76, CIS282 EI WareSG4000 ml Open interest SMA (20)/25.55

A Bull Elephant Bar is made more potent if it clears data to the left of it.

‘The more it clears, the more powerful and meaningful itis. Like all

good things, sometimes there are flukes. The clearing Bull Elephant

can't possibly be a fluke. It's as real as they come.

Clearing Bull Elephant >

Clearing Bull Elephant > At yyuotie

ant

1000000) 1

lesalla casiilles ee ee " ooafosenemesnsnel oan!

ob

Jan 10 Mar ‘Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

ectvelez Clearing Bull Elephant

BHI - Baker Hughes Intl (NY SE)

TOpS037, HEST.00, LoSO1S, CISO.89 CO VoLSSGN000 Open intereat SMA (20) 47.70

‘The Chinese have the Crouching Tiger.

We have the Clearing Bull. What power!

If it clears, | add to the position more heavily.

A

20ma Halt

Bull Elephant

oe

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

erL.Velex Clearing Bull Elephants

OliverVelezom,

MGIC - Magic Software Enterprises Ltd. (NASDAQ) - Daily Candlestick Chart

WOp310, HS, Le2s5, COG Ver t020900 Open interest “SMA QO; 2.08

When you know the footprints made by the big players,

its because clear how and when they act. The you

begin to see that their actions are repetitive and the

‘asnie aimnicakepery tiene: Exhaustion Bull Elephant —>

‘There is a Baby Bull Elephant and “gift” not

highlighted. Can you find it?

Clearing Bull Elephant ———»

i Lad fa,,if 41 egltg tenet HET

Clearing Bull Elephant ———>

‘to0000

0 al

Dec 09 van 10 Feb

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er Velex Marching Bull Elephants

OliverVelezom,

BANR - Banner Corporation (NASDAQ) - Daily Candlestick Chart

WOp571, HiG.17, lo587, C587 OD VelG20500 Open Interest BY SMA(2O} 405

‘The footprints of the big institutions can easily be missed if the decide to tip-toe

In, versus pile in. The “tip-toe” mode will created a series of smaller solid green

bars. When viewed individually that are not all the meaningful, but when you

‘stack them as if they are a single bar sliced in parts, their actions are vividly

revealed.

Note how each Marching Bull Elephant Bar clears a good deal of data to the left.

Stacked Bull»

bul

Marching Bull» oa

aay

What would the astute Wealth Trader be doing today?

We. omen ote cme temes tee

Jan 10 Feb War

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

erL.Velex Marching Bull Elephant

OliverVelezom,

WNC « Wabash Nat! Cp (NYSE) - Daily Candlestick Chart

Dopey Oe, HT 76, Loos, Chas El veraveso0 wl Openntest mi SMA@ONSaS

Don’t allow the big institutions to sneak

past with with their chopped up footprints.

Stack to reveal their true moves.

4000009]

2000000]

0

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Marching Elephants

OliverVelezom,

BPI - Bridgepoint Edueatio (NYSE) - Daily Candlestick Chart

Tr Opza55, Hid. 14, LowsGr, Cease GlVor4se700 Open interest MSNA (eo) 1.04

‘The Numbered Events

1- Staked Bear Elephant

2- Stacked Bull Elephant/Bull Twin

3~ Stacked Bear ElephantiGift

4- Stacked Bull Elephant/Clearing

5 - Stacked Bull Elephant/Bull Twin

§ - Stacked Bull ElephantiRBI

4

2000000

1090000

0

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Bear Elephant Bar

sew OliverVeletom,

SANM - Sanmina-Sci Corporation (NASDAQ) - Daily Candlestick Chart

Op 5, HiN788, Lo:TeS4, Ohi6.S7 — GVor2220000 ml Open interest ml SMA(2O} 17.11

SANM's powerful uptrend is likely over for a while. This is

evidenced by the emergence of the biggest Bear Elephant Bar i’ een

in quite a while. In fact, there is no bear bar close to its equal.

Bull Elephant —>

‘The astute Wealth Trader would look to exit

ail longs. The more aggressive traders

would attempt an early short using options.

10000000

ssona0no| j

al : a-nosalbeasnall at

Dec 09 Jan 10 Feb

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Bear Elephant Bar

sew OliverVeletom,

‘ONP - Orient Paper Inc. (AMEX) - Daily Candlestick Chart

WOp90e, HOOF, LloSO1, claie GIVerSiI400 mM Openintesst mI SMAC@O; O77

forms well above the 20ma, making it

even more deadly.

Biggest Bear Elephant Bar in all the

past price data. What's more, this bar

Marching Bull Elephant

At:

I é Bear Elephant with GBI ——+

00000

: stool done

Dec 09 ‘Jan 10 Feb Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OlivervVelez

er L. Velez

Your Trader for Life™

Igniting vs. Exhaustion

Identifying the Start and the Finish

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

ec tVelez Two Types of Elephants

There are two types of Elephant Bars:

Igniting and Exhaustion

Igniting Elephant Bars change the direction of the current

trend. In other words, they ignite a brand new move.

Exhaustion Elephant Bars continue or exasperate an

already well established trend. Said another way, rather

than change, they actually continue the current color.

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Igniting Bull Elephant

sew OliverVeletom,

CLAT - Clarient Inc. (NASDAQ) - Daily Candlestick Chart

(i Op274, HI2HS, Loess, CEES OVoIS2SG00 ml Open inierest a SMA(@OV AT

Wealth Trading Tip:

After an extended decline, the appearance of an above

average green bar formation marks the initial footprint

of the bulls. This igniting sign marks a shift in the the

balance of power from the sellers, back to the buyers. i

tHe

CLRT, an official Trade for Wealth +— Bull Elephant Igniting Bar

play Went on to higher prices.

4000000)

2000000

ol

van 10 Feb Mar ‘Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Igniting Bull Elephant

OliverVelezom,

CKSW - Clicksoftware Technologies Ltd. (NASDAQ) - Daily Candlestick Chart

TW OpHGS, F724, LOBES, C722 EIVoLaae100 ml Open hterest mE SMAG2ON7.AT

panes, per

Igniting Bull Elephant

Bottoming fe Bar

igniting Bull Elephant

Igniting Bull Elephant Bars abruptly change the

‘stocks direction and behavior for the better.

Jan 10

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Igniting Bull Elephant

sew OliverVeletom,

THOR - Thoratec Corporation (NASDAQ)

ta00000,

so00000

0

TD OpS0.6%, HIG2.04, los06o, HSSbT Ver i7ass00 ml Open inlerest SMA @O)-28SS

Exhaustion Bull ~ |

Marching Bull Elephant—>

De

aft

Dec 09 Jan 10

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

erL.Velex Exhaustion Bull Elephant

sew OliverVeletom,

PUDA - Puda Coal New (AMEX)

Dopee2s HGS, Lowe, BS CIVoraveis00 mM Openinierest mM SMA@ONe4S

Wealth Trading Tip:

Exhaustion Bull Elephant Bars typically establish the end of a

period of strength. In other words, they are topping events. They Exhaustion __,

usually form after a series of other green bars, take place far Elephant Bar

above the 20ma and they tend to occur on very heavy volume.

yn

2000000) 450

a

|< Bull Elephant °

5.00

Jan 10 War

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

erL.Velex Exhaustion Bull Elephant

sew OliverVeletom

IDT - Idt Corp Cl B New (NYSE) - Daily Candlestick Chart

iD OpG4, TSO, LoGST, CSO Civoreadi00 ml Open interest SNAG SDB

Wealth Trading Tip:

Exhaustion Bull Elephant Bars typically establish the end of a

period of strength for at least a time. in other words, they are

topping/pausing events. They usually form after a series of other

green bars; they take place far above the 20ma and they tend to

‘cour an very heavy volume,

if co

00000) Heavy Volume—————+

ot a sonal

Dec 09 fan 10 Feb Mar

Copyright 2010© * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

Marching Bull Elephant ee

| ees

www.Olivervelez.com

Exhaustion Bull Bar

Dop2er, Was, lowee, C260 Vol Seses21 ll Openinterest Mm SMA(@oy 223

Bear Elephant Bar follows

a Bull Exhaustion Bar

Bull Exhaustion Bar ends the up move-——> |

itl

Marching Bull Elephant —> ”

van 10 Feb Bar

Copyright 2010 © * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.c

er L. Velez

Your Trader for Life™

The Tail Bars

Identifying A Change in the Balance of Power

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

fer E Velex Bottoming Tail Bar

sew OliverVeletom,

EWH10 - E-Mini S&P Midcap (GBLX)

TH On 758.90, Hi77010, La 7SO.G0, Ci768S0 EIVaraos') ml Open Inferest Gg 07300 mr SMA(@0). 75060

Wealth Trading Tip:

Location is an important key. The further below

the 20ma a Bottoming Tail Bar forms, the greater

the odds that it will produce the final low.

Bottoming Tail Bar

well below the 20ma ———*

sonmssesmMicettiys iMac

Jan 10 Feb Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Bottoming Tail Bar

sew OliverVeletom,

CVS - Cvs Caremark Cp (NYSE) - Daily Candlestick Chart

W pss 16 FIGS 2s, L0:34S3, C1S4SS — EAVOL TEIS7S00 ml Open Interest’ wl SWAG) SABE

Wealth Trading Tip:

Location is an important key. The further below

the 20ma a Bottoming Tail Bar forms, the greater

the odds that it will produce the final low.

Colored Bottoming Tail Bar

<— Bottoming Tail Bar rar below the 20ma

‘

alan) sniatsstnentte tlt stern ststttroteceeee reel

Jan 10 Feb Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Bottoming Tail Bar

sew OliverVeletom,

‘WMB - Williams Cos (NYSE) - Daily Candlestick Chart

(W 0p:22.68, Hi2290, Lo2222, 12253 GIVol 555000 Open inevest Bl SMAC@O)22.57

Wealth Trading Tip:

Note how far below the 20ma the wf Topping Tail Bar above 20ma

{ i ( A

Bottoming Tail Bar formed.

These bars make for great all in

bars or beefed up options ma

Non-Colored Bottoming Tai

+ Bar well below the 20ma

400000001

20000000

#aysincentenlll piatDt teres netetseeecnsentacectes

Dee 09 Jan 10 Feb War

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Bottoming Tail Bar

sew OliverVeletom,

PAM10 - Palladium (NYMEX)

0p:462.50, Hi:480.00, Lo:460.05, C1476.70 Ch Vol 2216 W Open Interest: 21,343.00 BN SMA (20): 433.44

Wealth Trading Tip:

Location is an important key. The further below 72.70)

the 20ma a Bottoming Tail Bar forms, the greater i 3470.00

the odds that it will produce the final low. 460100

f ee

Prior highs serve as a key location of support f h fi 08:

as well. See dotted line.

430100

420.00

410.00

Prior Highs Support Area 400.00

“¢__Bottoming Tail Bar 2°7.°°

‘well below the 20ma 738.00

a7a.00

360.00

950,00

340.00

390.00

320.00

ye

ts i

Dee 09 Jan 10 Feb Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.com

Bottoming Tail Bars

EP - El Paso Corporation (NYSE)

Op.11 40, i114, Lot 30, Ch 43 G)Vol6918200 ml Openinterest SMA G@0) 1045,

Bear Elephant far above 20ma— > |

t

if il

an 10

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Bottoming Tail Bar

Dis - Walt Disney-Disney C (NYSE)

Ti 0p:32.79, HiS5.22, LoS275, 019922 Ver 18905099 Open interest BN SMA (ZO). 30.98

3350

=

3250

Igniting Gap/RB| ————» aa2.00

3180

3100

3050

Anny , =

oil Bottoming Tall Bar—> 29.00

Far below the 20ma es

40000000 28.00

20000000 | 7 - 2750

MilaM eeemnomtaantnl ins E MeN ops ooeM Mums oMen MoO tea Ay oEMne flee ot on tal

Deco

ull

Jan 10 Feb ar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Bottoming Tail Bar

OliverVelezom,

AMP - Ameriprise Financial (NYSE)

Tr OpAT 59, Hi43.00, lod? §8, C4250 ClVolG86100 lM Open interest Wl SMA(20). 0068

Exhaustion Bull Elephant ——» |

Baby Bear Twin well above 20-ma > i

Bottoming Tall Bar +

so00000

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

GEO! - Georesources Inc. (NASDAQ)

2000000]

taq0000)

0

www.Olivervelez.com

Bottoming Tail Bar

TH opia14, Hia.82, Lo409, Ohta es

Igniting Baby Bull

Tivol 62237 ml Open interest “SMA QO) TSE

Bottoming Tail Bar

W/20-ma Halt

Dec 09

‘Jan 10 Feb War

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.com

Bottoming Tail Bar

BUCY = Bucyrus International Inc. (NASDAQ)

Ti Op a5.55, HIGE.TT, LoWSOT, CLOTS Var 1107027 ml Open Interest SMA(@0), 6007

Putting It All Together

|<—— Baby Bear Elephant well above 20-ma

Ah

t 4

é "

‘i cal

Igniting Gaps

yet

wenn

*f

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

E,Velex Topping Tail Bar

"Your Trader for Life™

sew OliverVeletom,

PFE - Pfizer Inc (NY SE) - Daily Candlestick Chart

MOpI7.80, HrI7S0, Loe, Chee! GVO 11aes8605 mOpen hierest mM SMAC@Oy 17.41

Wealth Trading Tip:

Topping Tail well above the 20ma—> Location is an important key. The further

above the 20ma a Topping Tail Bar forms,

the greater the odds that it will produce

the final top for a while.

Dec 09 ~~ dan 10 Feb

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Topping Tail Bar

sew OliverVeletom,

‘OLCB - Ohio Legacy Corporation (NASDAQ) - Dally Candlestick Chart

Wop20s, Hens, Low 80, ChV69 IVorTS800 ll Open Interest OMA(O) aot

Wealth Trading Tip:

Location is an important key. The further abave

the 20ma a Topping Tail Bar forms, the greater the

‘odds that it will produce the final top for a while.

10000}

50000

al

Dee 09 Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Topping Tail Bar

sew OliverVeletom,

PCBC - Pacitic Capital Bancorp (NASDAQ) - Daily Candlestick Chart

Woe216, Ha, loys, Chive BVaraea000 Open Interest SMACGO) 138

Wealth Trading Tip:

Location is an important key. The further above |=§ >

the 20ma a Topping Tail Bar forms, the greater the

‘dds that it will produce the final top for a while.

+—Bottoming Tail Bar

20000000

‘on0000]

vl

its

Dee 09° lan 10 War

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.

er L. Velez

Your Trader for Life™

Section IV

The Wealth Action Events

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

er L. Velez

Your Trader for Life™

The Twin Tower

Event

The Most Powerful Event of All

Copyright 2010@ * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

er tVelez Bull Twin Tower Set-up

The Criteria:

1) Solid (Red) Bear Elephant Bar totiowed ty

2) Solid (Green) Bull Elephant Bar

3) Bull Elephant must trade above the

high of the Bear Elephant Bar (or at

least the red part of the bar)

The Twin Tower is a simple but

very powerful two-bar set-up.

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Bull Twin Tower Entry

1) Buy gbove the high of the Bear Elephant Bar

1-Buy Here

2) Stop below the lowest low of

the two Twin Bars.

Stop Here

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.com

AS Bull Twin Tower

AUDGEP - Australian/British Pound (FOREX)

TOpOS9S1, HD6038, 10105960, CIOSSST SMA (20) 0.5705

Wealth Trading Tip: i,

‘The most powerful Market Event is the Bull Twin Tower Set-up. Nothing

compares to the power generated by this simple two bar occurrence. It is worthy

of heavier buy participation. For the aggressive it is an excellent “all-in” event.

ff Pt / oma

i

el a Bull Twin Tower

Dec 09 van 10 Feb Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.com

AS Bull Twin Tower

A. Agilent Tech Inc (NYSE)

TH ops285, Aids2s, Loses CISa16 CVO Ss0400 mM Open init SMA (20) S085

Wealth Trading Tip:

‘The most powerful Market Event is the Bull Twin Tower Set-up. Nothing

‘compares to the power generated by this simple two bar occurrence. It is

worthy of stepping up your buy amount.

e

ty th

Bull Twin Tower» +—Bottoming Tail Bar

soi H 0 Bo esunal oe oe no nD no ODNOOD Hie EE Hen uname e Nl

Dec 09 at 10 Feb war

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez Bull Twin Tower

sew OliverVeletom,

CAG - Conagra Food Inc (NY SE)

‘o000000]

son009|

0

TW 0p24.96, HIS 29, le24eS, Sea AVR AG2TS00 Ml Open interest SMA @O)-2a.1T

Wealth Trading Tip:

The essence of the Bull Twin Tower's

power lies in the "no follow-through"

concept. The fact that a strong showing t

by the bears in the first bar of this pattern f

can't be followed through on means the

bears are weak, spent and easily

‘overcome by the bulls. Power Stack»

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez Bull Twin Tower

OliverVelezom,

CTN10 - Cotton #2 (ICEUS) - Daily Candlestick Chart

Ti Op70.63, HIGO6S, [o7962, CrSDSO ClVerSM060 ml Open interest: 160,06500 ml SMA (en) 6188

Bear Twin Tower —>| ir

t

|~———Bear Elephant Bull Twin Tower

|<—Bull Twin Tower Set-up

#90000

200000

6 :

van 10 Feb War Apr

Copyright 2010© * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez Bull Twin Tower

OliverVelezom,

DVA - Davita Inc (NYSE) - Daily Candlestick Chart

4000000]

2000009]

0

Ti Ope445, Hige.'S, Loetes, Cleoe Varts08000 ml Oneninierest MW SMA(@O) 58

Bull Twin Towers are by far the most powerful

action event | look/wait for. When they occur, they

are worthy of heavier participation than normal.

|<——Bull Twin Tower

+ Stacked Bull

van 10 War ‘Apr

Copyright 2010 © * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez Bull Twin Tower

OliverVelezom,

IGGE - Internet Capital Group Inc. (NASDAQ) - Daily Candlestick Chart

TOpS56, HSS, 1OSS6, CHS CIVorS4s700 ml Oneninterest mI eMA(@O) 820

All key stocks, commodities, currencies enjoy their

share of Bull Twin Set-ups. While It's nice to search

for them, all one need do is be patient enough and

they will actually come to you. When they do, you

must be intent on making them count, Exhaustion Bull Elephant —>|

qe

‘Stacked Bear and Bull elephants formed a Bull Twin Tower f"* ra

| i

La BT

Bull Twin Tower at the rising 20ma_

‘so00000) Bull Twin Tower

‘van 10 Feb) War Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Baby Bull Twin Tower

OliverVelezom,

FCH - Felcor Lodging Tr (NYSE) - Daily Candlestick Chart

T0670, HI7SS, Lov AG, CI7BS — CAVONTT23600 Open Witerest SMA @0)5.64

‘The goal of every Wealth Trader should be to enter or buy every Bull

‘Twin Tower set-up that materializes in the wealth plays of their

choice. They don't have to be looked for. They simply have to

happen to your stocks. And they will. Ever stock gets their share of

‘Twin Tower Set-ups.

‘Stacked Bull Elephant which cleared al the data to the left. _t

aft

‘ oe

batt hal * Baby Bull Twin off the 20ma

so0000

Del

Feb Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

ec tVelez Bear Twin Tower Set-up

The Criteria:

1) Solid (Green) Bull Elephant Bar toiowea sy

2) Solid (Red) Bear Elephant Bar

3) Bear Elephant must trade below the

low of the Bull Elephant Bar (or at

least the green part of the bar)

The Twin Tower is a simple but

very powerful two-bar set-up.

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er tVelez Bear Twin Tower Entry

Stop Here — *

1) Sell below the low of the Bull Elephant Bar |

a Dette

2) Stop above the highest high of the

‘two Twin Bars.

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www-.OliverVelez.co

er L. Velez

Your Trader for Life™

The 20ma Halt Event

The Start of a Major Turn

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

ES 20-ma Halt

EWM - MSC! Malaysia Index (AMEX) - Daily Candlestick Chart

TH Op12.00, Hit2.08, lo:t1.88, C4208 Ver 1150800 ll Open Inlerect SMA GO) Tad

Wealth Trading Tip:

‘When a stock moves above the 20ma for the first time in a while (see #2), what if

it does on the pullback to retest the 20ma determines if that initial showing of

‘strength is real or not. If the retest of the 20ma is successful (see #3), meaning

‘the 20ma halts the pullback, the stock is headed higher. If the 20ma does not

hold (see circle), the initial move must be considered a fake.

rr

+2) Move above 20ma

Jal.

apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

20-ma Halt

SPY - SPDR S&P 500 (AMEX) - Daily Candlestick Chart

Op: 10.42, HT92S, Lo 18.28, CTO IVa 10364004 Open Interest SMA (20) 116.50

Wealth Trading Tip:

After a 20ma Halt (#3), the trader must expect much higher prices to come.

wath

t

2) Above 20ma ri

3) 20ma Halt

— acttll lly ullalnda til says HOON

van 10 Par ‘Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Halt

sew OliverVeletom,

EWW - MSCI Mexico Investable Mkt Idx (AMEX) - Daily Candlestick Chart

Ti OpS438, HIGHS, LOS43, CISH7S _ CIVOLaR21100 ml Open interest mI SMA@O) 52.36

Wealth Trading Tip:

After a 20ma Halt (#3), the trader must expect much higher prices to come.

1) Below the 20ma———>| 3) 20ma Halt

so00000

van 10 Feb

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.com

ES 20-ma Halt

DOV - Dover Cp (NYSE) - Daily Candlestick Chart

TOpAa7a1, Ha? 67, Lo7.17, ClA76S ClVer 1646400 ml Open interest SMA @O)4670,

Circle one shows a bear 20ma Halt

Circle two shows a bull 20ma Halt

4000000] Is this another?

2000000) ri i i, tall i

; vo cnoonbus 000) MoM atl slid tasted fot seneondostalgtlinarts

rr b War

Jan 10 Fel ‘Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.com

ES 20-MA Halt

CAP - Cal International | (NYSE)

Wop 7s AIT 74 loll a, CTS Gverai000 “Wl Open Interest “SMA Oy a.34

The 20-ma Halt (see circle) was the key that th

e 20-ma Halt (see circle) was the key that the

trouble experienced by the recent breakdownwas —peseeideringontnis bar?

over and new highs were clase at hand, pan

Bull Elephant

Marching Bear Elephant —> /<—Marching Bull Elephant 2

Twin Tower

sl

7.00

Pa he Peer err pee TT ae sesluifabal san - Minsitialh 650

Feb Mar

Dec 08) Jan 10

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

L. Velez

"Your Trader for Life™

OliverVelezom,

COL - Rockwell Collins Inc (NYSE)

20-Ma Halt

1 Op:60.00, Hi60 39, LoS 67, CrenD4

20-ma Halt Note:

‘The 20-ma Halt is the beacon light the appears

“after” a period of trouble. It's formation

signifies that the worse is over and there are

better times ahead for the stock.

so00000

2000000

Boo o bo typeeBes tut)

vor 1ess000

jj

Bear Elephant—» |

ae

W Open interest SMA (G0) S838

Doji Bars well above

the 20-ma are strong

sell signals. Strong

“sells” can involve

selling the stock, a

covered ITM call, with

or without a “leg.”

20-ma Toe wa

Bull Elephant

!

0

Dec 09 van 10

Copyright 2010 * OliverVelez.com * The

Feb Mar

Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Halt

OliverVelezom,

DOV - Dover Cp (NYSE)

Th Opa656, HIN? O7, LOM 58, CL47G2 CVor1S02400 ll Open interest mI SMA(@O} 44.27

DOV gets well above the 20-ma after a

single color power run. It Is no surprise

that the subsequent move down was en

severe enough to break the 20-ma and run

into trouble for a while. One the stock got

back above the 20-ma, then successfully

tested it, new highs were expected to

abound. I's not always a enough that a

stock gets above Its 20-ma. The “halt”

event after is what locks In its strength.

te

20-ma Halt

skin

jaical :

2000000) Han L teal

d neotH nN ines tnnostuseM oes ye otentHi0 NINE aDoNM/SNaDNMislonll/

Dec 09 Jan 10 Feb

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Halt

OliverVelezom,

Wopas0, Has, (es2e, C437 Ver a4100 ml Open ievest sm SMAQGOy 420

+— Amajor Topping Tall well above the 20-ma not surprisingly led to a severe drop.

‘Only after the 20-ma Halt could the Wealth Trader know the stock was fully mended.

Clearing Bull Elephant Bar —> ,

20-ma Halt wi |

Bottoming Tall

<+——Bottoming Tail Bar inside a “gift.”

_ Bull Elephants

ede. se ces

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

erLVelex Igniting Bull Elephant

OliverVelezom,

CBOU - Caribou Cotte Company Inc. (NASDAQ) - Daily Candlestick Chart

Dop8s, Has les 7e, 192s Gver7I702 Open iniewest GP SMA(@Oy Baa

bars. They often lead to exponetial gains.

Igniting bars that clear a good deal of prior price data to ft

the left should be played heavier than other elephant 4 y

pul

i uae tial hy Igniting Bull Elephant

i 4,8

aseeeel Bottoming Tail ay

200000)

a satUnberessststatasatecatenatalttalt les senersteatnal

r

Feb 10 ‘Apr May

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.com

ES 20-Ma Halt

VICR - Vicor Corporation (NASDAQ) - Daily Candlestick Chart

Tr opi289, HiG45, Lovaee, ciia.28 MVoress200 Wm Openinierest mM SMA(2O) 1061

Not necessarily a sell bar because the start of

the Bull Elephant bar was close to the 20m: 7

Marching Bull Elephant

Mou,

Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Halt

OliverVelezom,

RAVN- Raven Industries Inc. (NASDAQ) - Dally Candlestick Chart

WORSAG7, HGE.OG, LOG2G7, COREA EVarTGS063 ml Open Interest ml SMA(@O) S201

Not Necessarily a sell bar >

Why?

t

[pf rs z0ma aa otprosuce mun. Naing 0%

tno Fottow-through Bear elephant was actualy bullish,

Mar ‘Ap

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Halt

OliverVelezom,

ANF - Abercrombie & Fitch (NYSE)

TH Opa1 58, Hi42.40, Lot 30, C4298 War 7106400 lm Open interest SMA(20). 35.48,

1 - This Bear Elephant formed with a gap ignites the initial decine,

2-This Bottoming Tall bar halts the intial decline.

3- This Baby Bull Elephant that clears data to the left, while breaking

above the 20ma potentially causes the Wealth Trader to buy back in. q

4- This Bear Elephant that clears data to the left ignites a renewed

Us downward spiral

5- This 20ma Halt tells the trader the damage has been mended.

ANF is as wild as the teenagers It caters to. But

often it's the wild ones that offer the greatest

20000000} Profit potential. The benefit of the incremental

buy is evident here. Js it not?

teen a a

ii wi " ws

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Halt

OliverVelezom,

DV - Devry Inc (NYSE)

TD OpS5.27, HEE HE, [oG522,r66.79 OVerSi600 ml Onen interest GSMA @D).6195

Igniting Gaps should mentally be filled in by the Wealth trader.

This “filling” in will provide a clearer Indication of what the gap means.

Igniting Gap——_>

20-ma Halt

t

[<— Bottoming Tail Bar See follow-up Chart

so00000)

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Halt as a Gift

OliverVelezom,

DV - Devry Inc (NYSE)

Tp a5.27, HiG6.88, LoeSa2, C679 OVerSi1600 Wl Open interest

Now it’s very clear that the gap was really nothing more than a

Igniting Bull Elephant that cleared all data to the left, making the.

‘subsequent 20-ma Halt a “gift” scenario. And as we now know,

“Halts” often lead to new highs, which means they are worthy of

heavier additions.

Clearing Bull Elephant —»

so00000)

SMA @OY6T SS

New High —» J

t

20-ma Halt as a “gift.”

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Drift

OliverVelezom

EQR - Equity Residental (NYSE) - Daily Candlestick Chart

Marchi

Elephant

12000009]

000009]

BD Opa0.07, Hi#T 00, Los9.95, C4158 GVVErSEH700 El Open interest BSMA(20):39.25)

Wealth Trading Tip:

Strong stocks rest one of two ways. They either dip

or they drift. If the drift holds at the 20ma, much

higher prices are to be expected.

ng Bull

—

a

‘Jan 10: Mar ‘Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-Ma Drift

sew OliverVeletom,

DDT - Dillards Cap 7.5 (NYSE) - Daily Candlestick Chart

Wop2217, Hi22.70, 1o:22.10, C2a70 Ver SG000 ‘i Oaen terest SMA(@Oy 21.06

‘Successful retests of the 20-ma don't always Involve a decline,

‘They sometimes happen in the form of a sideways “drift”. A

Clearing Bull Elephant Bar typically ignites the renewed advance.

Clearing Bull Bar >

er)

soan0|

° Jan 10

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er de Vel 20-ma Power Plays

OliverVelezom,

DAL - Doral Financial (NYSE) - Dally Candlestick Chart

WOpSs AGO, Lobes, S87 Cvoreste00 ml Openinterest ml SMAC2Oy 45a

‘The Wealth Trader must be sure to add to every power

event that forms at a rising 20-ma. They often offer great

“put-back-on opportunities after some lots/shares have

been taken off on prior advances.

Clearing Bull Twin Tower ignites the ce my

Hitt

Bull Twin Tower at rising 20-ma

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.c

er L. Velez

Your Trader for Life™

20-MA Power Run

The Move That Can Change Your life

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

er I Velez 20-ma Power Move

sew OliverVeletom,

ENDP - Endo Pharmaceuticals Holdings In (NASDAQ) - Daily Candlestick Chart

WOp2804, H2aaS, Le2e77, Caa0l mI SMA@O}eSsS

Once a bottom is complete, and an advance finally gets going, it will i

usually spend a period in what | call a 20-ma Power Move. This is the

strongest part of the up move and some stocks have multiple power

moves before the next major down cycle begins. eo 00

20.00

Bull Twin pees

it 2300

Mel in

i 21.00

Het a

Bottoming Tal bar

2000

0000000

aula HAM EaD tans t00ctapsatstats eallitustadhusllls A

May 10 Jun ‘Aug,

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20ma Power Trend

OliverVelezom,

ABR - Arbor Realty Tr (NYSE) - Daily Candlestick Chart

TOn40, His29, LODO, Chae iver stae20 Ml Open interest mI SMACzONaae

‘The bull signs of institutional buying were all over the place. Pay special

attention to the Bull Twin Tower that formed via a stocked Elephant Bar.

Bull Elephant Break

Bull Twin Tower Stack

t Gift

Bottoming Tail Bar at 20ma

eooa00

s00000 . 1 1

4 i J anal fits ales ann nf BDTE

Feb Mar ‘Ape

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Power Run

OliverVelezom,

DLX - Deluxe Gp (NYSE) - Daily Candlestick Chart,

WORT9S6, Hi20.37, LoT8B8, CLIGST — GAVELGOWSOO Open Wilerest mI SMA (@Oy 19.01

Circles show Bull Twin Tower Set-ups at or near the rising 20-ma.

When a wealth play enters into a “power run”

phase, all the hard work of building and

Hates " methodically accumulating is pald off in a life

‘changing way. All Biue Chip wealth plays

eventually have their share of power runs.

2000009]

taq0000| rT

pblnee.ogtMEetomsONON lop. see pete boats usenetecesolinssnuny la Oy

Dec 08 ‘Jan 10 Feb Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

HUSA

e00009)

so0000)

a

www.Olivervelez.com

er I Velez 20-Ma Power Run

sew OliverVeletom,

= Houston American Energy Corpora (NASDAQ) - Daily Candlestick Chart

Wopi15.89, Hi1S.99, LorSa0, chTseo CG Verasi200 Wl Open interest mi SMA(@oy 1333

Dec 09 Jan 10

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Power Run

OliverVelezom,

JLL - Jones Lang Lasalle (NYSE) - Daily Candlestick Chart

Ti 0p:75.86, Hi77.46, L730, CL774a —VarSee400 Wl Open interest SMA (2071.63

‘The Nature of 20-ma Power Runs

20-ma Power Runs are often marked by thelr advances (tops) never getting too

extended or over done above the 20ma. Each advance is steady and controlled

and many of the bars that make up each advance are uneventful by themselves. a

ire when ou sing the bars together that they mae up something spec, OH

Clearing Bull ine

ee Twin Tower

2200000}! no flow-through Bear thease bar was neutralized by the clearing Bull Elephant Bar

00000 ee || ’

Slivansats osencntesuntnssoHs. oF aHll Many Bessette cesotaseecesessncas lt

Tar apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Power Run

OliverVelezom,

ASH- Ashland Inc [New] (NYSE) - Daily Candlestick Chart

WOpSO47, HiG0.22, Lose.77, CIBD22 Von 1489300 ml Open interest SMA 0) S444

Its important that the Wealth Trader not sell during 20-ma Power Runs, unless they

begin to separate greatly from the 20-ma and begin to get ahead of themselves. ————»,

‘Only now can the Wealth Trader consider lightening his load.

Marching Bull Elephant clears data to the left» wy cee rane @. Zama

ey

pes

‘4000000}

2000000) a | ; :

pltaalln: iON Dentonec tl pnlatalaes Helse B Dn gt8igl Pane Foal alae

van 10 Fob Mar Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Power Run

OliverVelezom,

ICGE - Internet Capital Group Inc. (NASDAG) - Daily Candlestick Chart

Ope, HOSS, Lease, ChO.7S ClvalS45700 Open Interest WN SMA (GON 828

Exhaustion Bull Elephant Bar followed by an Exhaustion

Gap. Both are sellable/profit-taking events. —>

Marching Bull Elephant

forms a marching Bull

‘Twin Tower

|

Bull Twin Tower at 20-ma

so00000 Bull Twin Tower

20-ma Halt

Jan 10 Feb ar ‘Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Power Run

OliverVelezom,

PNC- P NC Fin Svcs Gr (NYSE) - Dally Candlestick Chart

TH Opn4 26, HiG4.80, LoO3.48, Chose) OVar4959000 ml Open interest ml SMA(20). 60,18

‘The Wealth Trader will always add to a play if it forms a Bull Elephant or

Bottoming Tail bar at or near a rising 20-ma within a Power Trend

ull Elephant at 20ma_|

‘qo00000|

so000000|

a

an 10 “Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

E Velez 20-ma Power Trend

"Your Trader for Life™

OliverVelezom,

LTD - Limited Brands Inc (NYSE) - Daily Candlestick Chart

Ti Opi26.56, HIZE.G?, Lo@EG6, CLOEGE GVerSTarGoo mi Open interest SMA GO). 257

‘The Sneaky 20-ma Power Move

‘The z0-ma Power Tad cat be ure oneal deo the uneventful way

in which it advances. Note how each bar Is rather small and almost

meaningless by itself. It's only dynamic after the fact or after you string

many bars tagether. This is the most profitable period of a stock's cycle,

Fa ayaa pa ocmesen en poate accuren nee he

ri An tig preva oepa renee it apa se ‘

Ofthe smal nature ofthe bers. RBs (Red Bar's Ignored) bocome the only 5 ft"

tactic by which the Wealth Trader can add In the midst of these tight

advances.

2onn0000

ta00000 ss ‘i call testaxast ds sallestesssstbguatle

° van 10 Feb ‘Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velez 20-ma Power Trend

OliverVelezom,

TSN - Tyson Foods Inc Cl A (NYSE) - Dally Candlestick Chart

WOPIGSG, HISTO, LolSas, GNGG7 EWareToo200 ml Open interest SMA (201554

Adding Within a Tiaht Power Trend

Adding during a tight 20-ma Power Trend becomes difficult

because of the uneventful nature of most of the bars.

Adding on baby Bull Elephant Bars and all subtle RBIs Is

the only way to maximize the benefits of these periods.

oa

oat

al

‘The Hiding Bull Elephant»

Marching Bull Elephant —» pn

Mar Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.c

er L. Velez

Your Trader for Life™

Igniting Gaps

When the Institutions Get Surprised

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

fer E Velex Igniting Gaps

sew OliverVeletom,

CREE - Cree Inc. (NASDAQ) - Daily Candlestick Chart

TD Op76.72, HITE.IS, LovSO4, OVENS BWaraa4aTO0 ml Open interest SMA (20). 72.55,

Without filling in Igniting Gaps, some “double up”

plays may be entirely missed. See follow-up chart.

20000000]

ro000000)

al as

Jan 10 ‘Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Igniting Gaps

OliverVelezom,

CREE - Cree Inc. (NASDAQ) - Daily Candlestick Chart

TH OpIE.72, HITE.IS, LevSO4, OVENS BWaraa4aT00 ml Open interest SMA (20). 72.55,

With the gaps filled in, it becomes clear how power the subsequent

‘add events are. As gifts, they warrant heavier play.

Clearing Bull Elephant >

Igniting Bull Elephant

20000000]

ro000000)

al Baus:

Jan 10 Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

fer E Velex Bear Igniting Gap

OliverVelezom,

OSG - Overseas Shiphdlg (NYSE) - Daily Candlestick Chart

WOpAa 1, HAS S8, loMDB8, Ch4v0S GVO T203600 Open Interest ml SMA (2D) 48.05,

Bull Elephant begins well above 20-ma, making the

MY

sh

next day's gap that much more bearish.

2000000) |

ceesifbat sal ab seen sKnae Bt bieet intl onl, suv ovllony

Jan 10 Feb Mar Apr ay

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

f.vekz Your Actionable Buy Items

OliverVelez.

‘Bottoming Tall Bar*

Near 20ma (1)

Clearing Bull Elephant (2+) Fae

@0ma Halt

Regular (2+)

Bull Twin (3+)

Regular (2+)

— a nad

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.

er L. Velez

Your Trader for Life™

Velez Opportunity Report

Plays That Rocked and the Reasons Why

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

er Velez Pacer Int’l (PACR)

wen OllverVelezon

W 0p 599, F607, lo583, C1586 GIVol 292500 ml Open Interest Mm SMA (20) 6.29

Velez Opportunity Buy

van 10 Feb

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

er I Velex Live Cattle

wen OllverVelezion

WH 0p:99.250, Hi39.500, 1998.975, CISR175 GIVol42973 Ml Open Interest: 358664000 mI SMAG2O) BB547

191.00¢

100.00¢

is

98.000

97.000

96.000

95.000

94.000

93.000

92.000

91.000

90.000

89.000

86.000

87.000

86.000

85.000

84.000

Velez opportunity Buys

Spenet BEER spe pee peed cce ce epe epee tense eRe oop teoe

Jan 10 Feb Mar ‘Apr

Copyright 2010© * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

JDS Uniphase (JDSU)

1 0p:13.10, Hi13.53, Lo12.98,C11332 Vol 9813900 Open Interest. «= SMA (20 11.74

Wealth Trading Tip:

The Incremental Buy Approach is better than the All-in Buy Approach. It

not only allows one to layer several smaller buys over a wider price range,

jitincreases the odds of not missing moves due to shallow pullbacks.

jet

nes

ps DeesusatotesBecast Dua tesusterecostnselalt atta nat

Jan 10 Feb

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

QlmerL,Velex Prospect Capital (PSEC)

Oveeletom

Op 1217, Hi1216,Lo17 85, Ch203 Voles9900 Open interest mI SMA(@0) 12.14

V + Velez Opportunity Buy

Velez Opportunity Buy ——————>

5

LenseogMMne tanstecenssneassbasttcafsaBSoDotosentnscosnset-sssenctel tay

‘dan 10 Feb Mar

‘Apr

Copyright 2010 © * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Silver Trust (SLV)

sew OliverVeletom,

DOpA7 73, H790, Lol773, C777 “Vor 7861400 Ml Openinterest — M SMA(20y 1686

| tlt

Velez Opportunity Buy ___]

‘Jan 10 “APE

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OlivervVelez

er L. Velez

Your Trader for Life™

Section V

Portfolio Management

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.OliverVelez.c

er L. Velez

Your Trader for Life™

Dividing Your Wealth

How to Apportion Your Money

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

liner, L. Velez ‘Trade for Wealth Lot System

sew OliverVeletom,

The first goal of every Wealth Trader is to determine how they are going to divide their wealth account up. The

choice will have a bearing on what equals one single lot, for purposes of easing into and out of wealth positions.

‘There are primarily two main portfolio sizes for Wealth Traders to choose from, which in turn have a direct bearing

‘on what a single lot Is. They appear below.

5x 10 Position Portfolio System - in this basic system, the wealth trader divides his total

‘account by 5 to get the total amount to be allocated to each position. That amount is then divided by 10 to get the

amount that equates to a single lot. Once the single lot number is known, adding and reducing becomes uniform

and very easy.

Example: $100,000/5 = $20,000 per wealth position. $20,000/10 = $2,000 per single lot.

10 x 10 Position Portfolio System - in this basic system, the wealth trader divides his total

‘account by 10 to get the total amount to be allocated to each position. That amount is then divided by 10 to get the

‘amount that equates to a single lot. Once the single lot number is known, adding and reducing becomes uniform

and very easy.

Example: $100,000/10 = $10,000 per wealth position. $10,000/10 = $1,000 per single lot.

Special Note:

While a system that allows for fewer bullets wil! beef up the single lot size (ex. 5x5 or 10x 8), Ifind that this

requires a level of selectivity with one’s actions that is so extreme, most traders won't be disciplined enough to pull

it off. Running out of bullets is the number one cardinal sin, which requires that you be absolutely sure that the

action event you're playing Is worthy of spending one. Your capital is the most precious possession you have In

‘this game and it should be guarded with your life. It ls however more acceptable to reduce the number of positions,

if'a higher lot size Is a must. Example: 6 x 10. But I would not drop below 5, the absolute minimum.

www.Olivervelez.com

liner, L. Velez ‘Trade for Wealth Lot System

STotal Positions 10 Total Lots per Position

5x10

The two most popular

= Wealth Portfolio Systems

10 Total Positions 10 Total Lots per Position

10 x 10

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.

er L. Velez

Your Trader for Life™

Guidelines for Building

Wealth

Rules NOT Set in Stone

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

QlimerLVelex Wealth Portfolio Guidelines

Nem

‘There are several portfolio guidelines that I believe should be utilized in the lifelong search for global wealth. They

appear below.

41-Never lose more than 15% of your entire portfolio on any given play. Example: $100,000 x

15% = $15,000. While this number might seem very large by traditional standards, itis a very rare occurrence for this,

to happen, because of the incremental entry and exit and add and reduce methods my wealth system deploys. A stock

can actually decline by as much as 65% and still not come close to hitting the max dollar stop of $15,000 based on the

example used.

. i is i |. This also may seem heretical based on other

market approaches, but keep | mind that your true position is not fully established until your entire 10 lot position is

fully vested. Only then, can or should you draw a line in the sand, since are now at the mercy of the market,

Remember, once you have no more lots/bullets, you longer possess the ability to adjust your average price.

3.- After 6 lots are deployed, become extra selective with your actions. Choose one or maybe

two of the most potent actions you've been taught. Example: Bull Tower Set-ups and Clearing Elephant Bars.

4- Be sure to reduce on all exhaustion moves. White larger portfolios can utilize a 20 and 30 lot

system, this Is the part of my wealth approach that allows the wealth trader to keep the limited 10 lot system running.

The general guideline is to reduce by @ minimum of 1/3. 1/2 to 2/3 is more then norm.

This guideline allows the trader to go beyond the 10 lot amount. That Is

why itis a guideline and not a hard rule, The trader must ensure that only when a stock has become truly special

should this be done.

Copyright 2010 © * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

‘There are several portfolio guidelines that I belleve should be utilized in the lifelong search for global wealth. They

appear below.

dormant positions notin play at the moment This Is another legitimate excuse to go beyond the 10 ot

‘guideline, but the wealth trader must be disciplined and absolutely certain that the stock's time to turn has truly come.

This also may seem heretical based on other market

approaches, but keep | mind that your true position is not fully established until your entire 10 lot position is fully

vested. Only then, can or should you draw a line in the sand, since are now at the mercy of the market. Remember,

‘once you have no more lots/bullets, you longer possess the ability to adjust your average price

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.c

er L. Velez

Your Trader for Life™

Four Wealth Quizzes

Testing your Opportunity Spotting Skills

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

L. Velez

"Your Trader for Life™

sew OliverVeletom,

www.Olivervelez.com

Action Bar Quiz

1H 0p 50.96, HiST.17, 1049.83, C5055

Velez Quiz Answers:

Tail Bar

Baby Bull Elephant

Tail Bar

Baby Bull Elephant

Bull Elephant

Baby Bull

Tail Bar

Bull Elephant

wil aint eet beet

vol39940 Ml Open interest SMA(20). 44.95

‘The below are what | call “action bars.” They serve as the

footprints of institutions that should ignite entries on our part.

‘These large behemoths wish their attempts to quietly

accumulate a stock could go undetected. But they can’t hide

from us. Not with me pointing the way. Peek-a-bor

Did you get all the answers correct?

Oct 09 Nov

Jan 10 Feb Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

1 0p 50.98, HiST.17, LoMa83, CIS0.SS

www.Olivervelez.com

AS Action Bar Quiz

Velez Quiz Answers:

pitas

Vol G9340 Ml Open Interest SMA (20). 44.06

The below are what | call ‘action bars." They serve as the

footprints of institutions that should ignite entries on our part.

‘These large behemoths wish their attempts to quietly

accumulate a stock could go undetected. But they can't hide

from us. Not with me pointing the way. Peek-a-boo. | see you!

Did you get all the answers correct?

abetjasesasr thst iit gill

Oct 09

Nov Dec van 10, Feb ‘Mar

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

E.Velez Wealth Trade Quiz

"Your Trader for Life™

OliverVelezom,

GBC! - Glacier Bancorp Inc. (NASDAQ) - Daily Candlestick Chart

WOpIG.OS, HNI.76, LoTeSS, CheG2 E1Vel7e4S00 ml Open inferest

TH SMA (0) 15.54

What Bar Ignited the entire advance?.

What Ended the advance in Late Jan?.

What was the first buy-back bar after the top in Jan?.

Atthe rising 20-ma, which bar did you buy?

What did you do near the end of today?

eee

Note that my wealth moves would have turned a $3 rally into a $5

rally, Increasing the potential 22% return to a $37% return.

000009]

000009] ;

a J

Feb Mar Apr

van 10

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.com

AS Wealth Quiz

CNW - Con-Way Inc (NYSE) - Daily Candlestick Chart

WOpSS7S, Hiar.os, Lows.2s, S720 Ver i46rs00 ml Open interest MW MA(@0) G59

Name the Numbered Events

1.

2-

3-

4.

5.

6-

Ts

8.

Jan 10 ‘Apr

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.c

A Wealth Appendix

Recommended Readings

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

Yahoo! Finance

BE

CONFIDENT

cela Kd

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

er I Velez BarChart.com

sew OliverVeletom,

@©barchart - zsrs00

Cs to

ieee!

al

G3 Ford bullish on Japan with new bathed insect be

Asian investments

Copyright 2010 © * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

Moody's May Downgrade

Hungary after IMF Breakdown

Boighet Minors Gain

pax cinest A ora ‘Our current agreements

with Time Warner Cable

‘will expire on

September 2:

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

German data brighten climate for stocks «Markets »

Stressed? Not so much S/S rumen sn cen

Nesdag 2248

Converts non-believers

"Bonnie" forces halt

looking fuzzy

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

EARNINGS.COM

(NE reared |) ieee i

SU Setlumnberaee (22 2010 Serurberget Earnings Confrence Cal e00aM

er Suatem. ne, {22.2010 der Svat ne. Eaminge Contrance Cal 0040

edorakte Corporation 22040 MkDana Samaraton Eamage Reloass| pee

‘Sctumbersae 222010 sovumaerger Eaming Relomte 22uui600.aM

‘he ceuw till comsaniag 22010 The ¥cGrew Hi Compares Exrings Release A 2UDMO

23. JUL 2010 Tosay's Highighied Spa

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

velex WealthTradeSecurities.Com

Olizer L.

Pd yours

Why Wealth Trade? Contact Us

Professional-Level Trading Tools

Full-Featured. Fast. Powerful. y

WealthTrade-

Fg55 PER, |

Copyright 2010 © * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.OliverVelez.com

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.com

FreeStockCharts.com

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.com

Copyright 2010 * OliverVelez.com * The Velez Opportunity Report * (866) 634-6095

www.Olivervelez.

er L. Velez

Your Trader for Life™

Marching Elephant Bars

Knowing When The Major Institutions

Are Trying to Hide

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.OlivervVelez

er L. Velez

Your Trader for Life™

Baby Elephant Bars

Knowing When The Major Institutions

Are Just Beginning to Act

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.OlivervVelez

er L. Velez

Your Trader for Life™

My Add and Reduce Method™

When to Get Heavy and When to Get Light

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.OlivervVelez

er L. Velez

Your Trader for Life™

Your Absolute Stop Rule

When to Call It Quits On a Play

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.Olivervelez.

er L. Velez

Your Trader for Life™

Section VI

Hedging & Income

Strategies

Copyright 2010 © * OliverVelez.com * 15 East Putnam Ave, Suite 504, Greenwich, CT 06830

www.OliverVelez.c

er L. Velez

Your Trader for Life™

Dividends

The Wealth Trader’s Extra Bonus