Escolar Documentos

Profissional Documentos

Cultura Documentos

Modelo de Contrato de Empréstimo de Dinheiro para Pessoa Jurídica Juros

Enviado por

ScribdTranslationsTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Modelo de Contrato de Empréstimo de Dinheiro para Pessoa Jurídica Juros

Enviado por

ScribdTranslationsDireitos autorais:

Formatos disponíveis

CONTRATO PARTICULAR DE EMPRÉSTIMO DE DINHEIRO A PESSOA JURÍDICA COM

JUROS

Consistem em contrato de comodato de dinheiro com juros, que celebram por um lado como

CREDOR XXXXXXXXXXXXXX, identificado com DNI N° XXXXXXXXXXXXX, domiciliado em

XXXXXXXXXXXXXXXXXX, província de XXXXXXX, departamento de XXXXXXXXXXX; e da

outra parte como MUTUÁRIO XXXXXXXXXXXX, com domicílio legal em

XXXXXXXXXXXXXXXXXXXXXXXXX, com RUC N° XXXXXXXXXXXXXXXXX, devidamente

representada por XXXXXXXXXXXXXXXXXXXXX, identificada com DNI N°

XXXXXXXXXXXXXXXX, domiciliada em XXXXXXXXXXXXXXXXXXXXXXXX, celebram este

ato jurídico através do seguinte:

CLÁUSULAS

PRIMEIRO: OBJETO

O credor, concede como empréstimo de dinheiro em favor do Tomador

XXXXXXXXXXXXXXXXXXXX, a quantia de S/90.000,00 (Noventa Mil com 00/100 Soles),

que creditamos com o Boucher de depósito bancário em nome da empresa

XXXXXXXXXXXXXXXXXXXX

SEGUNDO: PRAZO E PAGAMENTO

O MUTUÁRIO compromete-se a devolver o montante total recebido acrescido dos juros

acordados de comum acordo, dentro de um prazo máximo e improrrogável, podendo ser

amortizado antecipadamente, caso contrário será feito da seguinte forma:

Pagamentos mensais de S/. 2384,50 soles, que começa a partir do momento de

efetuar o depósito bancário e subscrever este, e terá como vencimento o dia 30 de

cada mês e início da primeira parcela em 30 de maio de 2018.

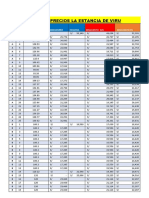

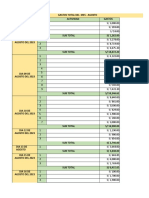

TABLA DE AMORTIZACION METODO FRANCES

Tasa anual/mensual 1.67%

Inicial(monto financiado) S/. 90,000

Periodos años/meses 60

MES QUE EMPIEZA A PAGAR LA PRIMERA CUOTA

periodos inicial b) interés c) amortizacion a) cuota d) final

0 S/. 90,000.0

1 S/. 90,000.0 S/. 1,500.0 -S/. 884.4 -S/. 2,384.5 S/. 89,115.6

2 S/. 89,115.6 S/. 1,485.3 -S/. 899.2 -S/. 2,384.5 S/. 88,216.4

3 S/. 88,216.4 S/. 1,470.3 -S/. 914.2 -S/. 2,384.5 S/. 87,302.2

4 S/. 87,302.2 S/. 1,455.1 -S/. 929.4 -S/. 2,384.5 S/. 86,372.8

5 S/. 86,372.8 S/. 1,439.6 -S/. 944.9 -S/. 2,384.5 S/. 85,427.9

6 S/. 85,427.9 S/. 1,423.8 -S/. 960.6 -S/. 2,384.5 S/. 84,467.3

7 S/. 84,467.3 S/. 1,407.8 -S/. 976.7 -S/. 2,384.5 S/. 83,490.6

8 S/. 83,490.6 S/. 1,391.5 -S/. 992.9 -S/. 2,384.5 S/. 82,497.7

9 S/. 82,497.7 S/. 1,375.0 -S/. 1,009.5 -S/. 2,384.5 S/. 81,488.2

10 S/. 81,488.2 S/. 1,358.2 -S/. 1,026.3 -S/. 2,384.5 S/. 80,461.9

11 S/. 80,461.9 S/. 1,341.1 -S/. 1,043.4 -S/. 2,384.5 S/. 79,418.5

12 S/. 79,418.5 S/. 1,323.7 -S/. 1,060.8 -S/. 2,384.5 S/. 78,357.7

13 S/. 78,357.7 S/. 1,306.0 -S/. 1,078.5 -S/. 2,384.5 S/. 77,279.2

14 S/. 77,279.2 S/. 1,288.0 -S/. 1,096.5 -S/. 2,384.5 S/. 76,182.7

15 S/. 76,182.7 S/. 1,269.7 -S/. 1,114.7 -S/. 2,384.5 S/. 75,068.0

16 S/. 75,068.0 S/. 1,251.2 -S/. 1,133.3 -S/. 2,384.5 S/. 73,934.7

17 S/. 73,934.7 S/. 1,232.3 -S/. 1,152.2 -S/. 2,384.5 S/. 72,782.5

18 S/. 72,782.5 S/. 1,213.1 -S/. 1,171.4 -S/. 2,384.5 S/. 71,611.1

19 S/. 71,611.1 S/. 1,193.5 -S/. 1,190.9 -S/. 2,384.5 S/. 70,420.2

20 S/. 70,420.2 S/. 1,173.7 -S/. 1,210.8 -S/. 2,384.5 S/. 69,209.4

21 S/. 69,209.4 S/. 1,153.5 -S/. 1,231.0 -S/. 2,384.5 S/. 67,978.4

22 S/. 67,978.4 S/. 1,133.0 -S/. 1,251.5 -S/. 2,384.5 S/. 66,727.0

23 S/. 66,727.0 S/. 1,112.1 -S/. 1,272.3 -S/. 2,384.5 S/. 65,454.6

24 S/. 65,454.6 S/. 1,090.9 -S/. 1,293.5 -S/. 2,384.5 S/. 64,161.1

25 S/. 64,161.1 S/. 1,069.4 -S/. 1,315.1 -S/. 2,384.5 S/. 62,846.0

26 S/. 62,846.0 S/. 1,047.5 -S/. 1,337.0 -S/. 2,384.5 S/. 61,509.0

27 S/. 61,509.0 S/. 1,025.2 -S/. 1,359.3 -S/. 2,384.5 S/. 60,149.7

28 S/. 60,149.7 S/. 1,002.5 -S/. 1,382.0 -S/. 2,384.5 S/. 58,767.7

29 S/. 58,767.7 S/. 979.5 -S/. 1,405.0 -S/. 2,384.5 S/. 57,362.7

30 S/. 57,362.7 S/. 956.1 -S/. 1,428.4 -S/. 2,384.5 S/. 55,934.3

31 S/. 55,934.3 S/. 932.3 -S/. 1,452.2 -S/. 2,384.5 S/. 54,482.1

32 S/. 54,482.1 S/. 908.1 -S/. 1,476.4 -S/. 2,384.5 S/. 53,005.7

33 S/. 53,005.7 S/. 883.4 -S/. 1,501.0 -S/. 2,384.5 S/. 51,504.7

34 S/. 51,504.7 S/. 858.4 -S/. 1,526.0 -S/. 2,384.5 S/. 49,978.7

35 S/. 49,978.7 S/. 833.0 -S/. 1,551.5 -S/. 2,384.5 S/. 48,427.2

36 S/. 48,427.2 S/. 807.1 -S/. 1,577.3 -S/. 2,384.5 S/. 46,849.8

37 S/. 46,849.8 S/. 780.8 -S/. 1,603.6 -S/. 2,384.5 S/. 45,246.2

38 S/. 45,246.2 S/. 754.1 -S/. 1,630.4 -S/. 2,384.5 S/. 43,615.9

39 S/. 43,615.9 S/. 726.9 -S/. 1,657.5 -S/. 2,384.5 S/. 41,958.3

40 S/. 41,958.3 S/. 699.3 -S/. 1,685.1 -S/. 2,384.5 S/. 40,273.2

41 S/. 40,273.2 S/. 671.2 -S/. 1,713.2 -S/. 2,384.5 S/. 38,560.0

42 S/. 38,560.0 S/. 642.7 -S/. 1,741.8 -S/. 2,384.5 S/. 36,818.2

43 S/. 36,818.2 S/. 613.6 -S/. 1,770.8 -S/. 2,384.5 S/. 35,047.3

44 S/. 35,047.3 S/. 584.1 -S/. 1,800.3 -S/. 2,384.5 S/. 33,247.0

45 S/. 33,247.0 S/. 554.1 -S/. 1,830.3 -S/. 2,384.5 S/. 31,416.7

46 S/. 31,416.7 S/. 523.6 -S/. 1,860.8 -S/. 2,384.5 S/. 29,555.8

47 S/. 29,555.8 S/. 492.6 -S/. 1,891.9 -S/. 2,384.5 S/. 27,664.0

48 S/. 27,664.0 S/. 461.1 -S/. 1,923.4 -S/. 2,384.5 S/. 25,740.6

49 S/. 25,740.6 S/. 429.0 -S/. 1,955.5 -S/. 2,384.5 S/. 23,785.1

50 S/. 23,785.1 S/. 396.4 -S/. 1,988.0 -S/. 2,384.5 S/. 21,797.1

51 S/. 21,797.1 S/. 363.3 -S/. 2,021.2 -S/. 2,384.5 S/. 19,775.9

52 S/. 19,775.9 S/. 329.6 -S/. 2,054.9 -S/. 2,384.5 S/. 17,721.0

53 S/. 17,721.0 S/. 295.4 -S/. 2,089.1 -S/. 2,384.5 S/. 15,631.9

54 S/. 15,631.9 S/. 260.5 -S/. 2,123.9 -S/. 2,384.5 S/. 13,508.0

55 S/. 13,508.0 S/. 225.1 -S/. 2,159.3 -S/. 2,384.5 S/. 11,348.7

56 S/. 11,348.7 S/. 189.1 -S/. 2,195.3 -S/. 2,384.5 S/. 9,153.3

57 S/. 9,153.3 S/. 152.6 -S/. 2,231.9 -S/. 2,384.5 S/. 6,921.4

58 S/. 6,921.4 S/. 115.4 -S/. 2,269.1 -S/. 2,384.5 S/. 4,652.3

59 S/. 4,652.3 S/. 77.5 -S/. 2,306.9 -S/. 2,384.5 S/. 2,345.4

60 S/. 2,345.4 S/. 39.1 -S/. 2,345.4 -S/. 2,384.5 S/. 0.0

TERCEIRO:

O mutuário declara que de fato recebeu a quantia em dinheiro de S/90.000,00

(Noventa Mil com 00/100 Soles), comprometendo-se a pagar no prazo fixado.

QUARTO: JUROS

O mutuário é obrigado a pagar os juros sobre os saldos devedores com uma

taxa anual fixa de 20% que é distribuída na tabela de amortização pelo método

francês

QUINTO: RESOLUÇÃO DE LITÍGIOS

Qualquer questão que surja entre as partes quanto à interpretação ou

execução deste acordo será submetida à arbitragem em equidade, de acordo

com as regras que regem esse tipo de procedimento.

SEXTO: CONSENTIMENTO

Ambas as partes apontam e asseguram que na celebração do mesmo não

houve erro, fraude de nulidade ou anulabilidade que pudesse invalidar o

conteúdo do mesmo.

OIT abril 27, 2018

Agiota Mutuário

Você também pode gostar

- Chapa de Aço Tabela NumeraçãoDocumento1 páginaChapa de Aço Tabela NumeraçãoGustavoAinda não há avaliações

- Manual Técnico Caldeiraria e Tubulação Petrobras REPLANDocumento21 páginasManual Técnico Caldeiraria e Tubulação Petrobras REPLANMichael Gomes Gomes100% (1)

- A Efetividade Do Direito Fundamental Social À SaúdeNo EverandA Efetividade Do Direito Fundamental Social À SaúdeAinda não há avaliações

- Tabela de ChapasDocumento1 páginaTabela de ChapasCosta VagnerAinda não há avaliações

- Relatorio Acionamento Bandeiras TarifáriasDocumento12 páginasRelatorio Acionamento Bandeiras Tarifáriasgpamaster-1Ainda não há avaliações

- Tabela de Chapas TenaxDocumento1 páginaTabela de Chapas TenaxRafael SalgadoAinda não há avaliações

- Tab Chapas Aco CarbonoDocumento1 páginaTab Chapas Aco CarbononelsoncamposAinda não há avaliações

- Flanges Anexo BDocumento19 páginasFlanges Anexo BJirehmaq MáquinasAinda não há avaliações

- Chapas INOXDocumento2 páginasChapas INOXalexgcavichiolliAinda não há avaliações

- NMF-4350 - REV02 - Tabela de TorqueDocumento17 páginasNMF-4350 - REV02 - Tabela de Torquerviana2engenhariaAinda não há avaliações

- Torque Parafusos - NMF-4350 - REV02Documento17 páginasTorque Parafusos - NMF-4350 - REV02Thiago GoulartAinda não há avaliações

- Planilha LOASDocumento486 páginasPlanilha LOASЖоэл КейросAinda não há avaliações

- Volume Anexo 3.a Estudos GeotecnicosDocumento96 páginasVolume Anexo 3.a Estudos GeotecnicosRodrigo LeanzaAinda não há avaliações

- Master Data FinanzasDocumento21 páginasMaster Data FinanzasNAYELY CASTREJONAinda não há avaliações

- Site - PREVISAO - DE - SAFRA CANA DE ACUCAR NOV 2023Documento33 páginasSite - PREVISAO - DE - SAFRA CANA DE ACUCAR NOV 2023John WolterAinda não há avaliações

- Ciser - FixaçãoDocumento216 páginasCiser - Fixaçãogabrielgca34Ainda não há avaliações

- Produccion Real y ProgramadaDocumento5 páginasProduccion Real y ProgramadaJonaiker Pillaca LeónAinda não há avaliações

- Produccion Real y ProgramadaDocumento5 páginasProduccion Real y ProgramadaJose HuaytallaAinda não há avaliações

- 00.548-22-Eco-048 - Memorial DrenagemDocumento9 páginas00.548-22-Eco-048 - Memorial DrenagemsratransportesvipAinda não há avaliações

- Htcms Media PDF Tabela-De-Precos BR Fixadores-Para-Construcao-Civil PDFDocumento46 páginasHtcms Media PDF Tabela-De-Precos BR Fixadores-Para-Construcao-Civil PDFalanasantos0% (1)

- Tabelas - Conab - Safra - 23 - 24Documento2 páginasTabelas - Conab - Safra - 23 - 24Cléberson SantosAinda não há avaliações

- Carta Concessao BeneficioDocumento6 páginasCarta Concessao Beneficiogiovannathais7Ainda não há avaliações

- Lista de Precios La EstanciaDocumento24 páginasLista de Precios La Estanciajose luis carranza leyvaAinda não há avaliações

- Tubo Espessura Mínima PetrobrásDocumento3 páginasTubo Espessura Mínima PetrobrásLaercio CanhaAinda não há avaliações

- Alvenius Tabela Geral Tubos PDFDocumento1 páginaAlvenius Tabela Geral Tubos PDFrafaelcoser50% (2)

- Tabela Tubos VerolaDocumento1 páginaTabela Tubos VerolaPaulo BaldiniAinda não há avaliações

- Fio CobreDocumento2 páginasFio CobreaminotepAinda não há avaliações

- Cálculo 0000364-77.2013.8.05.0235 NovoDocumento17 páginasCálculo 0000364-77.2013.8.05.0235 NovofabianossantanaAinda não há avaliações

- Futebol Combinados - Semana-8Documento3 páginasFutebol Combinados - Semana-8Eurico SetecoAinda não há avaliações

- WEG-w22 - Pagina 35Documento1 páginaWEG-w22 - Pagina 35Rafael FusinattoAinda não há avaliações

- Tubo Patente PDFDocumento1 páginaTubo Patente PDFCarlos Firmo Baptista Dos SantosAinda não há avaliações

- Catalogo UnipecasDocumento30 páginasCatalogo UnipecasJorge Luiz Jesus Dos Santos SantosAinda não há avaliações

- Marcio Noronha Revista TimingDocumento30 páginasMarcio Noronha Revista TimingacioliRCAinda não há avaliações

- Carta Concessao Beneficio PDFDocumento6 páginasCarta Concessao Beneficio PDFSILVANDA LIMAAinda não há avaliações

- RV021022Documento20 páginasRV021022Felipe CassianoAinda não há avaliações

- DotaçãoDocumento3 páginasDotaçãosintegra.spedAinda não há avaliações

- RV250922Documento22 páginasRV250922Valter MoreiraAinda não há avaliações

- Declaracao BeneficioDocumento6 páginasDeclaracao BeneficiojulianeAinda não há avaliações

- Contabilidad de Costos Iii S4Documento1 páginaContabilidad de Costos Iii S4Jesús Anderson Perez VeraAinda não há avaliações

- Carta Concessao BeneficioDocumento6 páginasCarta Concessao BeneficioCamilaAinda não há avaliações

- Tubos de Troca Termica - Trocador - B111 BWG 16Documento3 páginasTubos de Troca Termica - Trocador - B111 BWG 16WIGO WAIOAinda não há avaliações

- Catalogo Técnico de Limitações - Rev04 - 07.05.2018Documento70 páginasCatalogo Técnico de Limitações - Rev04 - 07.05.2018Carlos OliviAinda não há avaliações

- Catalogo Técnico de Limitações Rev04 04.02.2020Documento70 páginasCatalogo Técnico de Limitações Rev04 04.02.2020Cleber Gomes CardosoAinda não há avaliações

- Tarugo de Ferro FundidoDocumento2 páginasTarugo de Ferro FundidoPedro PrachedesAinda não há avaliações

- Alimentos Balanceados 2Documento3 páginasAlimentos Balanceados 2Juan Carlos Luque QqueccañaAinda não há avaliações

- Fixadores LataoDocumento6 páginasFixadores LataoadrianoAinda não há avaliações

- Reunião 25 JANDocumento2 páginasReunião 25 JANelisabete.pinheiroAinda não há avaliações

- Torque ParafusosDocumento1 páginaTorque ParafusoshmscunhaAinda não há avaliações

- Gastos Administrativos SeptiembreDocumento6 páginasGastos Administrativos SeptiembreMillerAinda não há avaliações

- Evolucao e Composicao CUB Projeto Padrao Fevereiro de 2024 1Documento1 páginaEvolucao e Composicao CUB Projeto Padrao Fevereiro de 2024 1flm799Ainda não há avaliações

- RV240722Documento21 páginasRV240722Julio ViniciusAinda não há avaliações

- Revista TimingDocumento30 páginasRevista TimingProfessor Adilson MarquesAinda não há avaliações

- Aa Relatório de Manutenção Preventiva - ItpDocumento32 páginasAa Relatório de Manutenção Preventiva - ItpScribdTranslationsAinda não há avaliações

- Exame DD124 2Documento7 páginasExame DD124 2ScribdTranslationsAinda não há avaliações

- Atividade 2 - Ciclo CelularDocumento3 páginasAtividade 2 - Ciclo CelularScribdTranslationsAinda não há avaliações

- Estagnação EspiritualDocumento3 páginasEstagnação EspiritualScribdTranslationsAinda não há avaliações

- IG2 SHAHID REHAN20191202-3236-11ekn05Documento23 páginasIG2 SHAHID REHAN20191202-3236-11ekn05ScribdTranslationsAinda não há avaliações

- Caso 4 Perguntas ASICSDocumento1 páginaCaso 4 Perguntas ASICSScribdTranslationsAinda não há avaliações

- Mapa Conceitual T8.2Documento2 páginasMapa Conceitual T8.2ScribdTranslationsAinda não há avaliações

- Exame Final - Administração Financeira - Grupo N°11 - CópiaDocumento10 páginasExame Final - Administração Financeira - Grupo N°11 - CópiaScribdTranslationsAinda não há avaliações

- The Air Liquide Airgas Merger Case AnalysisDocumento15 páginasThe Air Liquide Airgas Merger Case AnalysisScribdTranslationsAinda não há avaliações

- Importância Da Liderança Na Ciência RegulatóriaDocumento18 páginasImportância Da Liderança Na Ciência RegulatóriaScribdTranslationsAinda não há avaliações

- Explicação Das Camadas de RedeDocumento4 páginasExplicação Das Camadas de RedeScribdTranslationsAinda não há avaliações

- Programa Do Exame Rpas RESOLVIDO - WordDocumento9 páginasPrograma Do Exame Rpas RESOLVIDO - WordScribdTranslationsAinda não há avaliações

- Questionário de Estresse Do ProfessorDocumento2 páginasQuestionário de Estresse Do ProfessorScribdTranslationsAinda não há avaliações

- Sessão Meu Nome É Especial e ÚnicoDocumento2 páginasSessão Meu Nome É Especial e ÚnicoScribdTranslationsAinda não há avaliações

- Ferramentas de Simulação PC3 para Tomada de DecisãoDocumento9 páginasFerramentas de Simulação PC3 para Tomada de DecisãoScribdTranslationsAinda não há avaliações

- Calculadora de AndaimeDocumento14 páginasCalculadora de AndaimeScribdTranslationsAinda não há avaliações

- M2 - TI - Habilidades para Comunicação Oral e Escrita PDFDocumento5 páginasM2 - TI - Habilidades para Comunicação Oral e Escrita PDFScribdTranslationsAinda não há avaliações

- Avaliação de Desempenho Da Coca ColaDocumento1 páginaAvaliação de Desempenho Da Coca ColaScribdTranslations100% (1)

- Perguntas de Revisão de Enfermagem GeriátricaDocumento32 páginasPerguntas de Revisão de Enfermagem GeriátricaScribdTranslationsAinda não há avaliações

- Workshop 13 Situações Requisitos HSEQDocumento15 páginasWorkshop 13 Situações Requisitos HSEQScribdTranslationsAinda não há avaliações

- Prática EXCELDocumento10 páginasPrática EXCELScribdTranslationsAinda não há avaliações

- Design Humano - 384 LinhasDocumento7 páginasDesign Humano - 384 LinhasScribdTranslationsAinda não há avaliações

- Plano de Negócios de ApostasDocumento15 páginasPlano de Negócios de ApostasScribdTranslationsAinda não há avaliações

- Matriz de Risco em Safari Fotográfico AfricanoDocumento15 páginasMatriz de Risco em Safari Fotográfico AfricanoScribdTranslationsAinda não há avaliações

- Exercícios P2-28 e P2-29A ContabilidadeDocumento15 páginasExercícios P2-28 e P2-29A ContabilidadeScribdTranslationsAinda não há avaliações

- WorldcomDocumento6 páginasWorldcomScribdTranslationsAinda não há avaliações

- Furuno FMD ECDIS PDFDocumento13 páginasFuruno FMD ECDIS PDFScribdTranslationsAinda não há avaliações

- Rosário para Refrigerar A Criança DeusDocumento19 páginasRosário para Refrigerar A Criança DeusScribdTranslationsAinda não há avaliações

- Rosário para Elevar A Criança DeusDocumento18 páginasRosário para Elevar A Criança DeusScribdTranslationsAinda não há avaliações

- Exemplo de Carta de Nomeação e Endosso de Um PCO para CredenciamentoDocumento2 páginasExemplo de Carta de Nomeação e Endosso de Um PCO para CredenciamentoScribdTranslationsAinda não há avaliações

- Avaliação 3A - NOVA - EMDocumento6 páginasAvaliação 3A - NOVA - EMgggggggggggggAinda não há avaliações

- Cartas de Opção de SindicalizaçãoDocumento142 páginasCartas de Opção de SindicalizaçãoTiago NunesAinda não há avaliações

- Análise Financeira - Gestao de TesourariaDocumento5 páginasAnálise Financeira - Gestao de TesourariaMarta MarquesAinda não há avaliações

- As Tendências de Consumismo Da Sociedade Brasileira Contemporânea No Mundo GlobalizadoDocumento36 páginasAs Tendências de Consumismo Da Sociedade Brasileira Contemporânea No Mundo GlobalizadoSergio JuniorAinda não há avaliações

- Pacotes Com Outros Periodos Fidelizacao e Outros PrecosDocumento10 páginasPacotes Com Outros Periodos Fidelizacao e Outros PrecosKeverton MatheusAinda não há avaliações

- Aula 2 - Comunicação EmpresarialDocumento68 páginasAula 2 - Comunicação EmpresarialPaulo Roberto Bangemann100% (1)

- UFCD 0607 - PPT - Instituições BancáriasDocumento14 páginasUFCD 0607 - PPT - Instituições BancáriasMarilia PascoaAinda não há avaliações

- Revista EmbalagemMarca 020 - Março 2001Documento38 páginasRevista EmbalagemMarca 020 - Março 2001EmbalagemMarca100% (2)

- Live #097 - Como Eu Lançaria Meu Produto Na Internet Se Tivesse Só 2 Mil Reais de CaixaDocumento8 páginasLive #097 - Como Eu Lançaria Meu Produto Na Internet Se Tivesse Só 2 Mil Reais de CaixaBitencourt100% (1)

- Passo A Passo de Zero Ao MilhãoDocumento11 páginasPasso A Passo de Zero Ao Milhãodix editsAinda não há avaliações

- Plano de Ação Social - EmpreededorismoDocumento1 páginaPlano de Ação Social - EmpreededorismoMaira De Lisboa Veras FerreiraAinda não há avaliações

- FICHA CADASTRAL Da J AtualizadaDocumento5 páginasFICHA CADASTRAL Da J AtualizadaDrop Aromas FragranciasAinda não há avaliações

- Edição Suplementar 1372Documento363 páginasEdição Suplementar 1372Leonardo GomesAinda não há avaliações

- 10 Tendências de Design Gráfico Que Você Precisa Conhecer para o Instagram em 2023Documento21 páginas10 Tendências de Design Gráfico Que Você Precisa Conhecer para o Instagram em 2023João Marcus NascimentoAinda não há avaliações

- Prova de Rodrigo Ferreira Santos de EPODocumento4 páginasProva de Rodrigo Ferreira Santos de EPORodrigo FerreiraAinda não há avaliações

- Trabalho Metodologia Científica AVA2Documento16 páginasTrabalho Metodologia Científica AVA2Alexandre RodriguesAinda não há avaliações

- Modelo Contrato Social 2021Documento2 páginasModelo Contrato Social 2021Mendigo Do FrozenAinda não há avaliações

- Aula - Etapa 3 Do PE - Definição Da EstratégiaDocumento56 páginasAula - Etapa 3 Do PE - Definição Da EstratégiaZIANA PATRÍCIA MENDES CARDOSOAinda não há avaliações

- TQ203 Higiene e Segurança Do TrabalhoDocumento3 páginasTQ203 Higiene e Segurança Do TrabalhoNascimento JgaAinda não há avaliações

- Plano de Crescimento para Agências Digitais - Natanael OliveiraDocumento1 páginaPlano de Crescimento para Agências Digitais - Natanael OliveiraJean MarquesAinda não há avaliações

- Wallet 2.0Documento52 páginasWallet 2.0Almeida JuniorAinda não há avaliações

- Exercício Avaliativo - Módulo 1 - Revisão Da TentativaDocumento2 páginasExercício Avaliativo - Módulo 1 - Revisão Da TentativaLuana santos100% (1)

- Senar - Agricultura de Precisão Na Distribuição de Corretivos e FertilizantesDocumento115 páginasSenar - Agricultura de Precisão Na Distribuição de Corretivos e FertilizantesHenrique LehrbachAinda não há avaliações

- TegmaDocumento8 páginasTegmaVitória FernandesAinda não há avaliações

- EmpreendedorismoDocumento9 páginasEmpreendedorismoMesias julio ChamutotaAinda não há avaliações

- GESTÃO DE STOCKS - EXERCÍCIOSIO 2 MAEG - Cap.3 - 10-11Documento4 páginasGESTÃO DE STOCKS - EXERCÍCIOSIO 2 MAEG - Cap.3 - 10-11AiramOirógergOtnebAinda não há avaliações

- N2 - Pos0468 - Aspectos Tributários Na Cadeia de SuprimentosDocumento8 páginasN2 - Pos0468 - Aspectos Tributários Na Cadeia de SuprimentosRogério MeloAinda não há avaliações

- Formas de Extinção Do Contrato de TrabalhoDocumento4 páginasFormas de Extinção Do Contrato de TrabalhoJoaquim Jaime JoséAinda não há avaliações

- Texto de Apoio II. - Regimes de FabricoDocumento15 páginasTexto de Apoio II. - Regimes de FabricoManuel Alberto TieAinda não há avaliações

- Ava 2 - Comportamento OrganizacionalDocumento4 páginasAva 2 - Comportamento OrganizacionalJennifer KindleinAinda não há avaliações

- Deixe de ser pobre: Os segredos para você sair da pindaíba e conquistar sua independência financeiraNo EverandDeixe de ser pobre: Os segredos para você sair da pindaíba e conquistar sua independência financeiraNota: 4 de 5 estrelas4/5 (4)

- Finanças Organizadas, Mentes Tranquilas: A organização precede a prosperidadeNo EverandFinanças Organizadas, Mentes Tranquilas: A organização precede a prosperidadeNota: 4.5 de 5 estrelas4.5/5 (17)

- A psicologia financeira: lições atemporais sobre fortuna, ganância e felicidadeNo EverandA psicologia financeira: lições atemporais sobre fortuna, ganância e felicidadeNota: 4.5 de 5 estrelas4.5/5 (21)

- Deixe de ser pobre: Os segredos para você sair da pindaíba e conquistar sua independência financeiraNo EverandDeixe de ser pobre: Os segredos para você sair da pindaíba e conquistar sua independência financeiraNota: 4.5 de 5 estrelas4.5/5 (5)

- Gerenciamento monetário para leigos e iniciantesNo EverandGerenciamento monetário para leigos e iniciantesNota: 3 de 5 estrelas3/5 (1)

- Gestão em Unidades de Alimentação e Nutrição da Teoria à PráticaNo EverandGestão em Unidades de Alimentação e Nutrição da Teoria à PráticaNota: 4 de 5 estrelas4/5 (7)

- Guia Definitivo Para Dominar o Bitcoin e as CriptomoedasNo EverandGuia Definitivo Para Dominar o Bitcoin e as CriptomoedasNota: 4 de 5 estrelas4/5 (5)

- Como se Tornar um Corretor de Imóveis Bem-SucedidoNo EverandComo se Tornar um Corretor de Imóveis Bem-SucedidoNota: 5 de 5 estrelas5/5 (1)

- Marketing Digital na Prática: Como criar do zero uma estratégia de marketing digital para promover negócios ou produtosNo EverandMarketing Digital na Prática: Como criar do zero uma estratégia de marketing digital para promover negócios ou produtosNota: 4.5 de 5 estrelas4.5/5 (19)

- Demonstrações Contábeis E Análise De BalançosNo EverandDemonstrações Contábeis E Análise De BalançosAinda não há avaliações

- Agência Enxuta: Como montar uma agência de marketing digital e ganhar dinheiro com o seu conhecimentoNo EverandAgência Enxuta: Como montar uma agência de marketing digital e ganhar dinheiro com o seu conhecimentoNota: 4 de 5 estrelas4/5 (4)

- Liderança: Guia De Gestão Para Ser Excepcional Em Influencia, Comunicação E Tomada De DecisãoNo EverandLiderança: Guia De Gestão Para Ser Excepcional Em Influencia, Comunicação E Tomada De DecisãoAinda não há avaliações

- Análise técnica de uma forma simples: Como construir e interpretar gráficos de análise técnica para melhorar a sua actividade comercial onlineNo EverandAnálise técnica de uma forma simples: Como construir e interpretar gráficos de análise técnica para melhorar a sua actividade comercial onlineNota: 4 de 5 estrelas4/5 (4)

- IoT: Como Usar a "Internet Das Coisas" Para Alavancar Seus NegóciosNo EverandIoT: Como Usar a "Internet Das Coisas" Para Alavancar Seus NegóciosNota: 4 de 5 estrelas4/5 (2)

- Como Vender Valor: O revolucionário sistema Venda+Valor para resolver os problemas dos clientes e vencerNo EverandComo Vender Valor: O revolucionário sistema Venda+Valor para resolver os problemas dos clientes e vencerNota: 3 de 5 estrelas3/5 (2)

- Desvendando O Metodo De Taufic Darhal Para Mega SenaNo EverandDesvendando O Metodo De Taufic Darhal Para Mega SenaNota: 4.5 de 5 estrelas4.5/5 (3)

- 10 Maneiras de organizar a sua vida financeiraNo Everand10 Maneiras de organizar a sua vida financeiraNota: 4.5 de 5 estrelas4.5/5 (20)

- Gatilhos mentais: O guia completo com estratégias de negócios e comunicações provadas para você aplicarNo EverandGatilhos mentais: O guia completo com estratégias de negócios e comunicações provadas para você aplicarNota: 4 de 5 estrelas4/5 (107)

- Consultoria Especializada e Estratégias De Trade De ForexNo EverandConsultoria Especializada e Estratégias De Trade De ForexAinda não há avaliações