Escolar Documentos

Profissional Documentos

Cultura Documentos

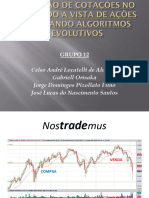

Definição Da Teoria Dow

Enviado por

Okarin SanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Definição Da Teoria Dow

Enviado por

Okarin SanDireitos autorais:

Formatos disponíveis

Traduzido para: Português Mostrar o original Opções ▼

EDUCAÇÃO NOTÍCIA SIMULADOR O TEU DINHEIROTraduzirCONSULTORES

esta página para Português

ACADEMIA Opções

Exchange Matching Engine

Matching Engine Technology

Advertisement

A estrutura personalizável oferece uma solução eficiente e econômica para novos participantes

connamara.com Saber Mais

ANÁLISE TÉCNICA CONCEITOS AVANÇADOS DE ANÁLISE TÉCNICA

Teoria Dow

Por ADAM HAYES Atualizado em 04 de junho de 2022

Revisados pela CHARLES POTTER

Fato verificado por SUZANNE KVILHAUG

Advertisement

Investopédia / Zoe Hansen

O que é a Teoria Dow?

A teoria Dow é uma teoria financeira que diz que o mercado está em uma

tendência ascendente se uma de suas médias (ou seja , industrial ou transporte

) avança acima de uma alta importante anterior e é acompanhada ou seguida

por um avanço semelhante na outra média. Por exemplo, se o Dow Jones

Industrial Average (DJIA) subir para uma alta intermediária, espera-se que o

Dow Jones Transportation Average (DJTA) siga o exemplo dentro de um período

de tempo razoável.

PRINCIPAIS CONCLUSÕES

A Teoria Dow é uma estrutura técnica que prevê que o mercado está

em tendência ascendente se uma de suas médias avançar acima de

uma alta importante anterior, acompanhada ou seguida por um

avanço semelhante na outra média.

A teoria baseia-se na noção de que o mercado desconta tudo de forma

consistente com a hipótese dos mercados eficientes.

Advertisement

Nesse paradigma, diferentes índices de mercado devem se confirmar

em termos de ação de preço e padrões de volume até que as

tendências se revertam.

CLICK

CLICK TO

TO PLAY

PLAY

1:36

O Dow Jones Industrial Average

Entendendo a Teoria Dow

A teoria Dow é uma abordagem de negociação desenvolvida por Charles H.

Dow que, com Edward Jones e Charles Bergstresser, fundou a Dow Jones &

Company, Inc. e desenvolveu o Dow Jones Industrial Average em 1896. A Dow

desenvolveu a teoria em uma série de editoriais no Wall Street Journal , que ele

co-fundou. [1]

Charles Dow died in 1902, and due to his death, he never published his

complete theory on the markets, but several followers and associates have

published works that have expanded on the editorials. Some of the most

important contributions to Dow theory include the following:

William P. Hamilton's The Stock Market Barometer (1922)

Robert Rhea's The Dow Theory (1932)

E. George Schaefer's How I Helped More Than 10,000 Investors to Profit in

Stocks (1960)

Richard Russell's The Dow Theory Today (1961)

Dow believed that the stock market as a whole was a reliable measure of overall

business conditions within the economy and that by analyzing the overall

market, one could accurately gauge those conditions and identify the direction

of major market trends and the likely direction of individual stocks.

The theory has undergone further developments in its 100-plus-year history,

including contributions by William Hamilton in the 1920s, Robert Rhea in the

1930s, and E. George Shaefer and Richard Russell in the 1960s. Aspects of the

theory have lost ground, for example, its emphasis on the transportation sector

—or railroads, in its original form—but Dow's approach still forms the core of

modern technical analysis.

Practice trading with virtual money

Find out what a hypothetical investment would be worth today.

SELECT A STOCK

TSLA AAPL NKE AMZN WMT

TESLA INC APPLE INC NIKE INC AMAZON… WALMAR…

SELECT INVESTMENT AMOUNT SELECT A PURCHASE DATE

$ 1000 5 years ago

CALCULATE

How the Dow Theory Works

There are six main components to the Dow theory.

1. The Market Discounts Everything

The Dow theory operates on the efficient markets hypothesis (EMH), which

states that asset prices incorporate all available information. In other words,

this approach is the antithesis of behavioral economics.

Earnings potential, competitive advantage, management competence—all of

these factors and more are priced into the market, even if not every individual

knows all or any of these details. In more strict readings of this theory, even

future events are discounted in the form of risk.

2. There Are Three Primary Kinds of Market Trends

Markets experience primary trends which last a year or more, such as a bull or

bear market. Within these broader trends, they experience secondary trends,

often working against the primary trend, such as a pullback within a bull

market or a rally within a bear market; these secondary trends last from three

weeks to three months. Finally, there are minor trends lasting less than three

weeks, which are largely noise.

3. Primary Trends Have Three Phases

A primary trend will pass through three phases, according to the Dow theory. In

a bull market, these are the accumulation phase, the public participation (or big

move) phase, and the excess phase. In a bear market, they are called the

distribution phase, the public participation phase, and the panic (or despair)

phase.

4. Indices Must Confirm Each Other

In order for a trend to be established, Dow postulated indices or market

averages must confirm each other. This means that the signals that occur on

one index must match or correspond with the signals on the other. If one index,

such as the Dow Jones Industrial Average, is confirming a new primary uptrend,

but another index remains in a primary downward trend, traders should not

assume that a new trend has begun.

Dow used the two indices that he and his partners invented, the Dow Jones

Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA), on

the assumption that if business conditions were, in fact, healthy, as a rise in the

DJIA might suggest, the railroads would be profiting from moving the freight

this business activity required. If asset prices were rising but the railroads were

suffering, the trend would likely not be sustainable. The converse also applies:

if railroads are profiting but the market is in a downturn, there is no clear trend.

5. Volume Must Confirm the Trend

Volume should increase if the price is moving in the direction of the primary

trend and decrease if it is moving against it. Low volume signals a weakness in

the trend. For example, in a bull market, the volume should increase as the

price is rising, and fall during secondary pullbacks. If in this example the volume

picks up during a pullback, it could be a sign that the trend is reversing as more

market participants turn bearish.

6. Trends Persist Until a Clear Reversal Occurs

Reversals in primary trends can be confused with secondary trends. It is

difficult to determine whether an upswing in a bear market is a reversal or a

short-lived rally to be followed by still lower lows, and the Dow theory

advocates caution, insisting that a possible reversal be confirmed.

Special Considerations

Here are some additional points to consider about Dow Theory.

Closing Prices and Line Ranges

Charles Dow relied solely on closing prices and was not concerned about the

intraday movements of the index. For a trend signal to be formed, the closing

price has to signal the trend, not an intraday price movement.

Another feature in Dow theory is the idea of line ranges, also referred to as

trading ranges in other areas of technical analysis. These periods of sideways

(or horizontal) price movements are seen as a period of consolidation, and

traders should wait for the price movement to break the trend line before

coming to a conclusion on which way the market is headed. For example, if the

price were to move above the line, it's likely that the market will trend up.

Signals and Identification of Trends

One difficult aspect of implementing Dow theory is the accurate identification

of trend reversals. Remember, a follower of Dow theory trades with the overall

direction of the market, so it is vital that they identify the points at which this

direction shifts.

One of the main techniques used to identify trend reversals in Dow theory is

peak-and-trough analysis. A peak is defined as the highest price of a market

movement, while a trough is seen as the lowest price of a market movement.

Note that Dow theory assumes that the market doesn't move in a straight line

but from highs (peaks) to lows (troughs), with the overall moves of the market

trending in a direction.

An upward trend in Dow theory is a series of successively higher peaks and

higher troughs. A downward trend is a series of successively lower peaks and

lower troughs.

The sixth tenet of Dow theory contends that a trend remains in effect until there

is a clear sign that the trend has reversed. Much like Newton's first law of

motion, an object in motion tends to move in a single direction until a force

disrupts that movement. Similarly, the market will continue to move in a

primary direction until a force, such as a change in business conditions, is

strong enough to change the direction of this primary move.

Reversals

A reversal in the primary trend is signaled when the market is unable to create

another successive peak and trough in the direction of the primary trend. For an

uptrend, a reversal would be signaled by an inability to reach a new high

followed by the inability to reach a higher low. In this situation, the market has

gone from a period of successively higher highs and lows to successively lower

highs and lows, which are the components of a downward primary trend.

The reversal of a downward primary trend occurs when the market no longer

falls to lower lows and highs. This happens when the market establishes a peak

that is higher than the previous peak, followed by a trough that is higher than

the previous trough, which are the components of an upward trend.

Compete Risk Free with $100,000 in Virtual

Cash

Put your trading skills to the test with our FREE Stock Simulator. Compete with

thousands of Investopedia traders and trade your way to the top! Submit trades

in a virtual environment before you start risking your own money. Practice

trading strategies so that when you're ready to enter the real market, you've

had the practice you need. Try our Stock Simulator today >>

ARTICLE SOURCES

Compare Accounts

Advertiser Disclosure

PROVIDER

NAME

DESCRIPTION

PART OF

Guide to Technical Analysis

CURRENTLY READING UP NEXT

How to Use the Dow Support and Resistance Support (Support Level) Resistance (Resistance

Theory to Analyze the Basics Definition Level)

Market

2 of 55 3 of 55 4 of 55 5 of 55

Related Terms

What Is the Head and Shoulders Pattern?

A head and shoulders pattern is an indicator that appears on a chart as a set of three

peaks or troughs, with the center peak or trough representing the head. more

Theoretical Dow Jones Index

The theoretical Dow Jones Index is a method of calculating the Dow Jones index that

assumes all index components hit their high or low at the same time during the day.

more

Bull Market Definition

A bull market is a financial market in which prices are rising or are expected to rise. more Partner Links

Negocie na XM com spreads baixos, sem

Bear Market Guide: Definition, Phases, Examples & How to comissão e proteção de saldo negativo.

Invest During One

Assine nossos boletins diários

A bear market occurs when prices in the market fall by 20% or more. more

Ouça o podcast da Investopedia Express no

Relative Strength Index (RSI) Indicator Explained With Spotify

Formula Aprenda a negociar ações investindo $ 100.000

The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude dólares virtuais...

of recent price changes to analyze overbought or oversold conditions. more

Dow Jones Transportation Average (DJTA)

The Dow Jones Transportation Average is a price-weighted average of 20 transportation

stocks traded in the United States. more

Related Articles

Histórico de STRATEGY & EDUCATION

preços do Bitcoin What Charts Should Crypto Investors Use?

Charles Dow RICH & POWERFUL

Who Was Charles Dow?

TECHNICAL ANALYSIS BASIC EDUCATION

Introduction to Stock Chart Patterns

TECHNICAL ANALYSIS

The Pioneers of Technical Analysis

TECHNICAL ANALYSIS BASIC EDUCATION

Making Money the Wyckoff Way

STOCK TRADING STRATEGY & EDUCATION

Profiting in Bear and Bull Markets

About Us Terms of Use Dictionary

Editorial Policy Advertise News

Privacy Policy Contact Us Careers

CONFIANÇA

California Privacy

Notice

# A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

Investopedia is part of the Dotdash Meredith publishing family. We've updated our Privacy Policy, which will go in to effect on September 1, 2022. Review

our Privacy Policy

Você também pode gostar

- 5 - Manual de Análise Técnica - Marcos Abe PDFDocumento69 páginas5 - Manual de Análise Técnica - Marcos Abe PDFEverton Nogueira50% (2)

- Disciplina 2 - Contabilidade e Análise de Demonstrações Financeiras PDFDocumento82 páginasDisciplina 2 - Contabilidade e Análise de Demonstrações Financeiras PDFElias XavierAinda não há avaliações

- Micro IV - p1 - Conceitos Básicos (Aula 1)Documento51 páginasMicro IV - p1 - Conceitos Básicos (Aula 1)LuanCndidoAinda não há avaliações

- Gestão Dos Riscos - Carlos Alberto Correa Salles JuniorDocumento73 páginasGestão Dos Riscos - Carlos Alberto Correa Salles JuniorFábio AlmeidaAinda não há avaliações

- Brizolismo - João Trajano Sento-Sé PDFDocumento365 páginasBrizolismo - João Trajano Sento-Sé PDFFernando NogueiraAinda não há avaliações

- Teoria de Dow - O Que É e Como Aplicar Na Análise TécnicaDocumento10 páginasTeoria de Dow - O Que É e Como Aplicar Na Análise TécnicaJames M. Oliveira PreacherAinda não há avaliações

- Analise Tecnica I - Profº Cleber RochaDocumento128 páginasAnalise Tecnica I - Profº Cleber RochaCaio Fernando RaymundoAinda não há avaliações

- Análise Técnica para IniciantesDocumento40 páginasAnálise Técnica para IniciantesWalter ZaniboniAinda não há avaliações

- Guia de Análise TécnicaDocumento48 páginasGuia de Análise TécnicaFilipe MachadoAinda não há avaliações

- Compreendendo A Teoria Da DowDocumento4 páginasCompreendendo A Teoria Da Dowfayfer santanaAinda não há avaliações

- Re SumosDocumento11 páginasRe SumosFilipa LinchoAinda não há avaliações

- ANÁLISE TÉCNICA - Intermediário - Teoria DowDocumento4 páginasANÁLISE TÉCNICA - Intermediário - Teoria DowAlan PedreiraAinda não há avaliações

- Teorias de Desenvolvimento RegionalDocumento28 páginasTeorias de Desenvolvimento RegionalAlice SoaresAinda não há avaliações

- Teoria Dos JogosDocumento2 páginasTeoria Dos JogosStefani Deoli PaulinoAinda não há avaliações

- 2011s2 mc906 Seminario 12Documento25 páginas2011s2 mc906 Seminario 12bbarrosobhAinda não há avaliações

- Estrategia EmpresarialDocumento57 páginasEstrategia Empresarialvanderson maestriAinda não há avaliações

- Apresentação MargareteDocumento42 páginasApresentação MargareteLucak SilvaAinda não há avaliações

- O Trader QuânticoDocumento59 páginasO Trader QuânticoThiago Rodrigues100% (1)

- Almanaque Mensal de AgostoDocumento128 páginasAlmanaque Mensal de AgostoÁlef Freire serraAinda não há avaliações

- Teoria Do Produtor ProdutorDocumento76 páginasTeoria Do Produtor ProdutorGerame Da SilvaAinda não há avaliações

- Ebook Análise Técnica A Precisão Dos Gráficos v1.0 CDocumento31 páginasEbook Análise Técnica A Precisão Dos Gráficos v1.0 CJean Carlos Viana100% (1)

- Economia Industrial - Slides (2018) - 20.01.2018Documento110 páginasEconomia Industrial - Slides (2018) - 20.01.2018Thee MendesAinda não há avaliações

- Estratégia EmpresarialDocumento203 páginasEstratégia EmpresarialJamyly Da S. RodriguesAinda não há avaliações

- Tese MarcoDocumento77 páginasTese MarcoGabriel SantosAinda não há avaliações

- Economia Política ClássicaDocumento2 páginasEconomia Política ClássicaScribdTranslationsAinda não há avaliações

- CoasefirmaDocumento21 páginasCoasefirmaJuan Carlos Sertori de OliveiraAinda não há avaliações

- Ebook Volume Financeiro Diogo PrestesDocumento26 páginasEbook Volume Financeiro Diogo PrestesLessandra Correa100% (1)

- Microeconoma Teoria Do Produtor: Arlindo Alegre Donário Ricardo Borges Dos SantosDocumento76 páginasMicroeconoma Teoria Do Produtor: Arlindo Alegre Donário Ricardo Borges Dos SantosOsvaldo SalazarAinda não há avaliações

- Investindo Na Bolsa Utilizando o Método CAN SLIMDocumento9 páginasInvestindo Na Bolsa Utilizando o Método CAN SLIMBelfegor MelatoninAinda não há avaliações

- MD Disrupt MSSDocumento192 páginasMD Disrupt MSSrenan silvaAinda não há avaliações

- Eficiencia de Mercado - 230516 - 194739Documento14 páginasEficiencia de Mercado - 230516 - 194739Florinda SopiteAinda não há avaliações

- 158236-Texto Do Artigo-350518-1-10-20190523Documento24 páginas158236-Texto Do Artigo-350518-1-10-20190523Alzira AnesioAinda não há avaliações

- Prova de Pesquisa OperacionalDocumento5 páginasProva de Pesquisa OperacionalJose Luciano da SilvaAinda não há avaliações

- Daytrade e Swing TradeDocumento50 páginasDaytrade e Swing TradeaugustocgnAinda não há avaliações

- ECONOMIA ApostilaDocumento40 páginasECONOMIA ApostilaandrefaccindasilvaAinda não há avaliações

- Aula 1 - ESTGDocumento21 páginasAula 1 - ESTGFabrizio Falabella GribelAinda não há avaliações

- Internacional Iza Ç ÃoDocumento14 páginasInternacional Iza Ç ÃoMAP Social MediaAinda não há avaliações

- UntitledDocumento31 páginasUntitledGabriel ReisAinda não há avaliações

- Pensamento EconômicoDocumento58 páginasPensamento EconômicoEder RobertoAinda não há avaliações

- Livro DPP PlataformaDocumento182 páginasLivro DPP PlataformaIsabella NunesAinda não há avaliações

- Aula 01Documento15 páginasAula 01Djalma AlmeidaAinda não há avaliações

- Analise Tecnica 1.ppsxDocumento22 páginasAnalise Tecnica 1.ppsxJoãoMarcosAinda não há avaliações

- 1.estratégia EmpresarialDocumento10 páginas1.estratégia EmpresarialwsrlimpAinda não há avaliações

- 01 Gestão de Segurança PrivadaDocumento22 páginas01 Gestão de Segurança PrivadaLeo FreittasAinda não há avaliações

- 3.equilíbrio GeralDocumento30 páginas3.equilíbrio GeralSérgio LuizAinda não há avaliações

- MKT para Produtos de Alta TecnologiaDocumento11 páginasMKT para Produtos de Alta TecnologiararisobralAinda não há avaliações

- Atividade - 3 - !!Documento12 páginasAtividade - 3 - !!DIENNE FERREIRAAinda não há avaliações

- TEXTO OligopóliosDocumento7 páginasTEXTO OligopóliosJonathas Felipe100% (1)

- As Três Escolas de AnáliseDocumento4 páginasAs Três Escolas de AnáliseTrading FullAinda não há avaliações

- Porter RevisitadoDocumento24 páginasPorter RevisitadoKleber LealAinda não há avaliações

- A Nova Economia Institucional Revisit AdaDocumento34 páginasA Nova Economia Institucional Revisit AdaJeprange3593Ainda não há avaliações

- 2270-Texto Do Artigo-6146-1-10-20220308Documento9 páginas2270-Texto Do Artigo-6146-1-10-20220308leticiaAinda não há avaliações

- Aula 1 - B 2 Apostila Economia39-43Documento5 páginasAula 1 - B 2 Apostila Economia39-43Eber Kennedy Cassimiro OliveiraAinda não há avaliações

- Modelos de Decisão e Teorias Aplicadas A ContabilidadeDocumento25 páginasModelos de Decisão e Teorias Aplicadas A ContabilidadeKenia CarvalhoAinda não há avaliações

- 15-The Innovation Equation PTDocumento15 páginas15-The Innovation Equation PTmargaridaAinda não há avaliações

- Formacao de Traders - Modulo 1Documento56 páginasFormacao de Traders - Modulo 1augustocgnAinda não há avaliações

- Aula 08 - Planejamento Estratégico - Prof . Eliane MeiraDocumento22 páginasAula 08 - Planejamento Estratégico - Prof . Eliane MeiraMariha DavidAinda não há avaliações

- Economia e MercadosDocumento154 páginasEconomia e MercadosQuirono CabralAinda não há avaliações

- Nick Srnicek - Valor, Renda e Capitalismo de PlataformaDocumento12 páginasNick Srnicek - Valor, Renda e Capitalismo de PlataformalabpjrAinda não há avaliações

- Vantagens comparativas: Porque é que a especialização é a chave para o sucessoNo EverandVantagens comparativas: Porque é que a especialização é a chave para o sucessoAinda não há avaliações

- Axiomas De A Até ZNo EverandAxiomas De A Até ZAinda não há avaliações

- Tutorial Documentao Editais 2023Documento30 páginasTutorial Documentao Editais 2023Okarin SanAinda não há avaliações

- Plano de Curso GCET716 2022.2 01Documento1 páginaPlano de Curso GCET716 2022.2 01Okarin SanAinda não há avaliações

- ESTACAO FORRO .LanguagetoolDocumento2 páginasESTACAO FORRO .LanguagetoolOkarin SanAinda não há avaliações

- Estacao ForroDocumento2 páginasEstacao ForroOkarin SanAinda não há avaliações

- ESTACAO FORRO .LanguagetoolDocumento2 páginasESTACAO FORRO .LanguagetoolOkarin SanAinda não há avaliações

- Cap 4 Cap 5 AvilaDocumento31 páginasCap 4 Cap 5 AvilaOkarin SanAinda não há avaliações

- EC1 - Exercícios Com Cálculos 1 - Revisão Da TentativaDocumento1 páginaEC1 - Exercícios Com Cálculos 1 - Revisão Da TentativaOkarin SanAinda não há avaliações

- Prova 1 - Prof. Edwin - T01 - Revisão Da TentativaDocumento1 páginaProva 1 - Prof. Edwin - T01 - Revisão Da TentativaOkarin SanAinda não há avaliações

- QUIZ-03 - Revisão Da TentativaDocumento1 páginaQUIZ-03 - Revisão Da TentativaOkarin SanAinda não há avaliações

- QUIZ-02 - Revisão Da Tentativa2Documento1 páginaQUIZ-02 - Revisão Da Tentativa2Okarin San50% (2)

- Gráfico ExemploDocumento1 páginaGráfico ExemploOkarin SanAinda não há avaliações

- Lista 3Documento2 páginasLista 3Okarin SanAinda não há avaliações

- Lista 5Documento2 páginasLista 5Okarin SanAinda não há avaliações

- Aprender É Sancofa - GratuitoDocumento1 páginaAprender É Sancofa - GratuitoOkarin SanAinda não há avaliações

- AFROFUTURISMO Joãovictorneves 2019112480Documento2 páginasAFROFUTURISMO Joãovictorneves 2019112480Okarin SanAinda não há avaliações

- Lista 4Documento2 páginasLista 4Okarin SanAinda não há avaliações

- Atividade Sítense Fisica3 2019112480Documento7 páginasAtividade Sítense Fisica3 2019112480Okarin SanAinda não há avaliações

- Economia Colaborativa e AfroempreendorismoDocumento25 páginasEconomia Colaborativa e AfroempreendorismoLeidiane MacambiraAinda não há avaliações

- 005 Programa Institucional REIT EDITAL N 225 2022Documento2 páginas005 Programa Institucional REIT EDITAL N 225 2022Okarin SanAinda não há avaliações

- A Leitura Na Disciplina de História: Contribuições para Se Pensar A Prática de EnsinoDocumento14 páginasA Leitura Na Disciplina de História: Contribuições para Se Pensar A Prática de EnsinoRafael costaAinda não há avaliações

- Almeida-Filho Modelagem Covid-19 Estudos Avançados 2020Documento22 páginasAlmeida-Filho Modelagem Covid-19 Estudos Avançados 2020Naomar Almeida-FilhoAinda não há avaliações

- Miller, D. 2013. Treco, Troços e Coisas - Estudos Antropológicos Sobre A Cultura Material.Documento7 páginasMiller, D. 2013. Treco, Troços e Coisas - Estudos Antropológicos Sobre A Cultura Material.Jaqueline SousaAinda não há avaliações

- Capitulo01 f008Documento21 páginasCapitulo01 f008Isabela SilvaAinda não há avaliações

- As Organizações CorretoDocumento41 páginasAs Organizações CorretoIury MatheusAinda não há avaliações

- Contrato Psicológico e Comportamento Organizacional - Maria José Chambel, 2012Documento18 páginasContrato Psicológico e Comportamento Organizacional - Maria José Chambel, 2012jpmcf0% (1)

- Eqt11 Questao Aula 6Documento2 páginasEqt11 Questao Aula 6Mónica MatosAinda não há avaliações

- Demetrius Nichele Macei: O Princípio Da Verdade Material No Processo TributárioDocumento188 páginasDemetrius Nichele Macei: O Princípio Da Verdade Material No Processo TributárioChico de MoraesAinda não há avaliações

- LIVRO LEONTIEV Alexei N. Os Princípiois Do Desenvolvimento Mental e o Problema Do Atraso MentalDocumento39 páginasLIVRO LEONTIEV Alexei N. Os Princípiois Do Desenvolvimento Mental e o Problema Do Atraso MentalSimone FernandesAinda não há avaliações

- Psicologia VocacionalDocumento29 páginasPsicologia VocacionalTania Marcos100% (1)

- Trabalho de Didactica GeralDocumento11 páginasTrabalho de Didactica GeralIssenguel AntónioAinda não há avaliações

- Modelo de ResenhaDocumento4 páginasModelo de Resenhaapi-3728326100% (1)

- Revista Pergunte e Responderemos - ANO III - No. 026 - FEVEREIRO DE 1960Documento46 páginasRevista Pergunte e Responderemos - ANO III - No. 026 - FEVEREIRO DE 1960Apostolado Veritatis Splendor100% (1)

- Emil Durkhein PDFDocumento9 páginasEmil Durkhein PDFMárcio Stelvio Miranda da SilvaAinda não há avaliações

- Problemas Dos Diferentes Enfoques Teóricos: Zetético e DogmáticoDocumento7 páginasProblemas Dos Diferentes Enfoques Teóricos: Zetético e DogmáticoPamela SantiagoAinda não há avaliações

- Espacialidades e Temporalidades Na Dinâmica Das Formações Urbanas PDFDocumento18 páginasEspacialidades e Temporalidades Na Dinâmica Das Formações Urbanas PDFCarlos David CHAinda não há avaliações

- Como Fazer PesquisaDocumento20 páginasComo Fazer PesquisaStrelinha BraAinda não há avaliações

- Etnopesquisa CriticaDocumento22 páginasEtnopesquisa CriticaLeo Soares100% (1)

- Vecossi, Cristiano Egger PDFDocumento181 páginasVecossi, Cristiano Egger PDFleandromenegoloAinda não há avaliações

- Livro Grupo PesqDocumento164 páginasLivro Grupo PesqXisto Souza JúniorAinda não há avaliações

- 2017 - Albasini, Fátima RicardoDocumento93 páginas2017 - Albasini, Fátima RicardoSantos Setimane MuadiaAinda não há avaliações

- EVOLUÇÃO BIOLÓGICA COMO EIXO Integrador...Documento12 páginasEVOLUÇÃO BIOLÓGICA COMO EIXO Integrador...Hugo Martins da CostaAinda não há avaliações

- Leitura e Produção de Textos II - Apostila PDFDocumento30 páginasLeitura e Produção de Textos II - Apostila PDFFernanda Araújo BonfimAinda não há avaliações

- Thibes AlgebraLinear e MecanicaQuantica PDFDocumento21 páginasThibes AlgebraLinear e MecanicaQuantica PDFLelecu LeoAinda não há avaliações

- Popper - Kuhn - Sebenta de Apoio e AtividadesDocumento35 páginasPopper - Kuhn - Sebenta de Apoio e AtividadesInês TeixeiraAinda não há avaliações

- Suporte FamiliarDocumento14 páginasSuporte FamiliarBacchus Wine100% (1)

- Manual de Resenhas Indicativas Tematicas UnlockedDocumento17 páginasManual de Resenhas Indicativas Tematicas UnlockedPetiscos PokeAinda não há avaliações

- A Práxis Profissional Relação Teórico-Prática.Documento10 páginasA Práxis Profissional Relação Teórico-Prática.Sadraque De Oliveira AmorimAinda não há avaliações